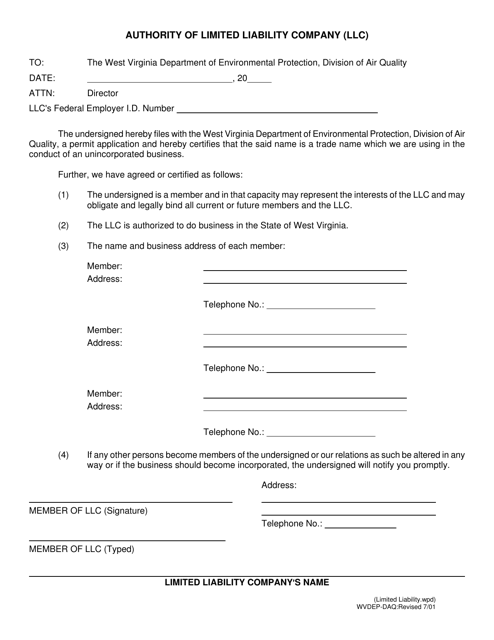

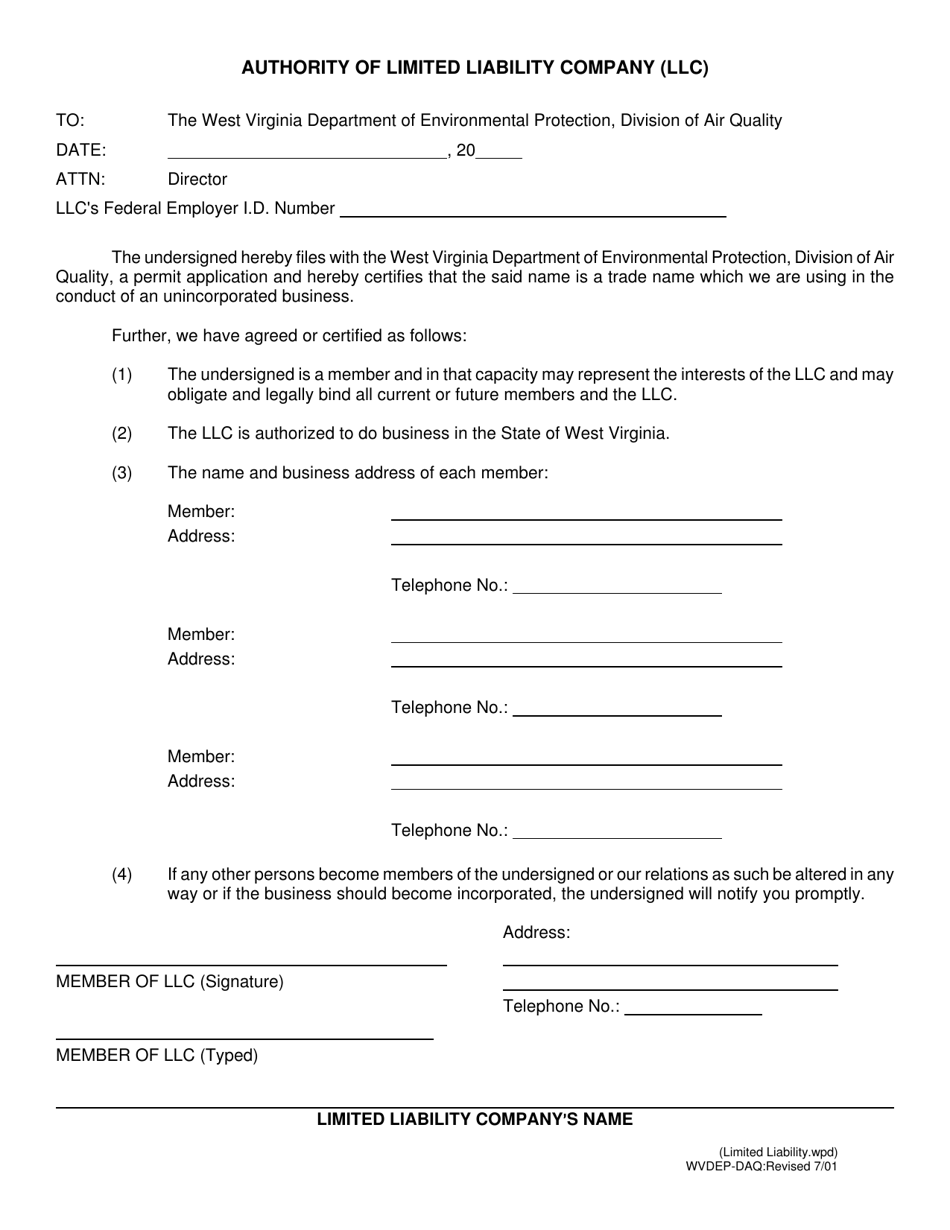

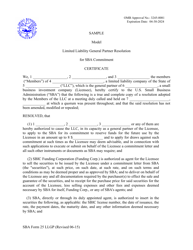

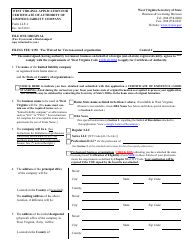

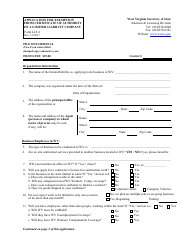

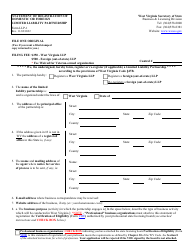

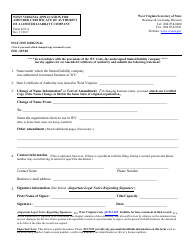

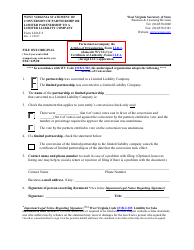

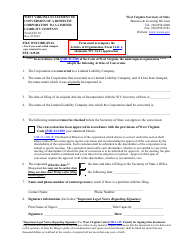

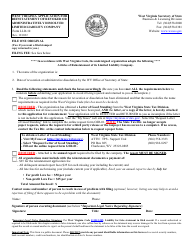

Authority of Limited Liability Company (LLC) - West Virginia

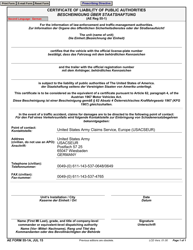

Authority of Limited Liability Company (LLC) is a legal document that was released by the West Virginia Department of Environmental Protection - a government authority operating within West Virginia.

FAQ

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a type of business entity that offers liability protection to its owners.

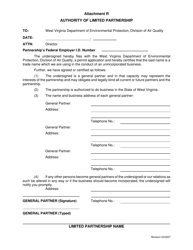

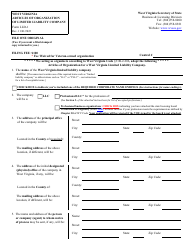

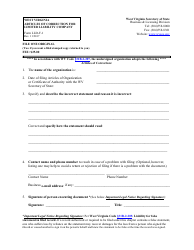

Q: How do you form an LLC in West Virginia?

A: To form an LLC in West Virginia, you need to file Articles of Organization with the Secretary of State's office.

Q: What is the liability protection offered by an LLC?

A: LLC owners, also known as members, are generally not personally liable for the company's debts or liabilities.

Q: Can a single person form an LLC in West Virginia?

A: Yes, a single person can form an LLC in West Virginia. This is known as a single-member LLC.

Q: What are the key advantages of forming an LLC?

A: LLCs offer limited liability protection, flexible management structure, and pass-through taxation.

Q: What is pass-through taxation for an LLC?

A: Pass-through taxation means that the profits and losses of the LLC are passed through to the individual members and reported on their personal tax returns.

Q: What are the ongoing requirements for an LLC in West Virginia?

A: LLCs in West Virginia are required to file an annual report and pay the associated fee.

Q: Can an LLC have multiple owners?

A: Yes, an LLC can have multiple owners, known as members. The ownership shares can be divided among the members according to their agreement.

Q: What is the difference between an LLC and a corporation?

A: LLCs offer more flexibility in terms of management and taxation compared to corporations. Additionally, LLCs do not issue stock.

Q: Can an LLC be managed by its members?

A: Yes, an LLC can be managed by its members. This is known as member-managed LLC.

Form Details:

- Released on July 1, 2001;

- The latest edition currently provided by the West Virginia Department of Environmental Protection;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Department of Environmental Protection.