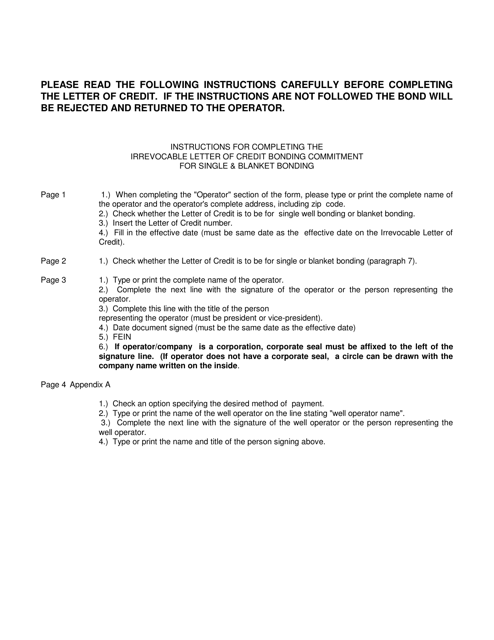

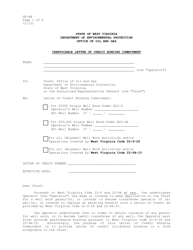

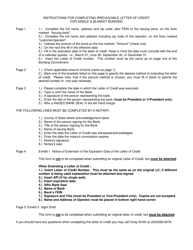

Instructions for Form OP-8B Irrevocable Letter of Credit Bonding Commitment - West Virginia

This document contains official instructions for Form OP-8B , Irrevocable Letter of Credit Bonding Commitment - a form released and collected by the West Virginia Department of Environmental Protection. An up-to-date fillable Form OP-8B is available for download through this link.

FAQ

Q: What is Form OP-8B?

A: Form OP-8B is an Irrevocable Letter of Credit Bonding Commitment.

Q: What is the purpose of Form OP-8B?

A: Form OP-8B is used to provide a bonding commitment for the payment of severance taxes in West Virginia.

Q: What is an Irrevocable Letter of Credit?

A: An Irrevocable Letter of Credit is a guarantee of payment issued by a bank.

Q: What are severance taxes?

A: Severance taxes are taxes imposed on the extraction of natural resources, such as coal or oil.

Q: Who needs to submit Form OP-8B?

A: Anyone who is required to pay severance taxes in West Virginia and wants to provide a bonding commitment instead of paying the taxes upfront.

Q: How long is the bonding commitment valid?

A: The bonding commitment is valid for one year and must be renewed annually.

Q: What happens if the taxpayer fails to pay the severance taxes?

A: If the taxpayer fails to pay the severance taxes, the state can draw on the funds from the Irrevocable Letter of Credit.

Q: Is there a fee for submitting Form OP-8B?

A: Yes, there is a fee for the issuance and renewal of the Irrevocable Letter of Credit.

Q: Can I use any bank for the Irrevocable Letter of Credit?

A: No, the bank must be authorized by the West Virginia State Tax Commissioner to issue the Irrevocable Letter of Credit.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia Department of Environmental Protection.