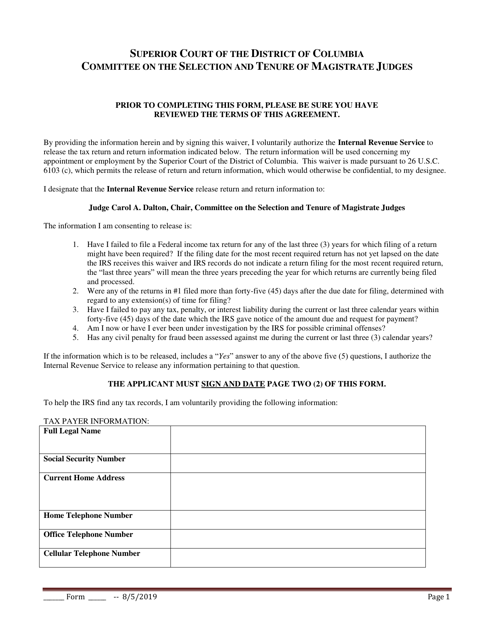

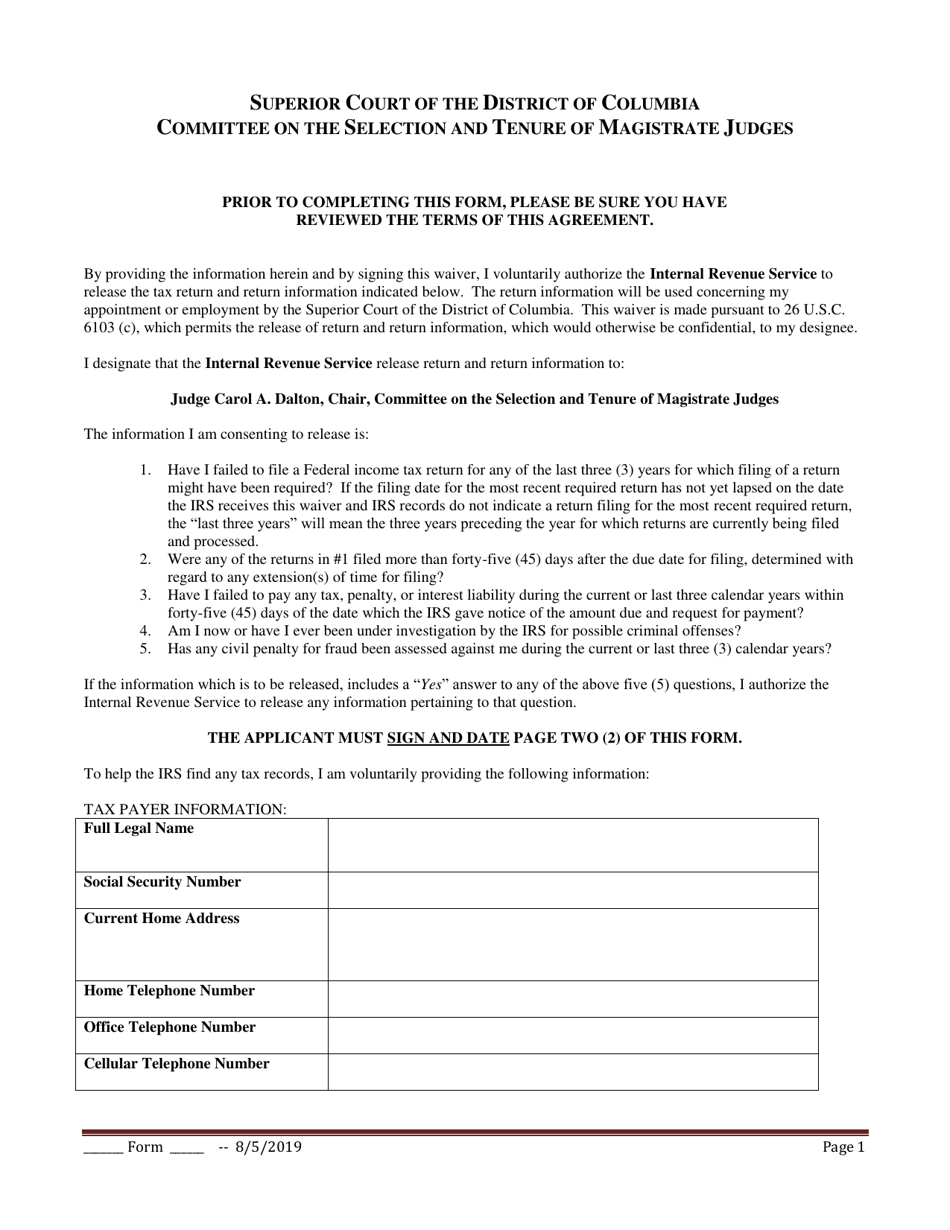

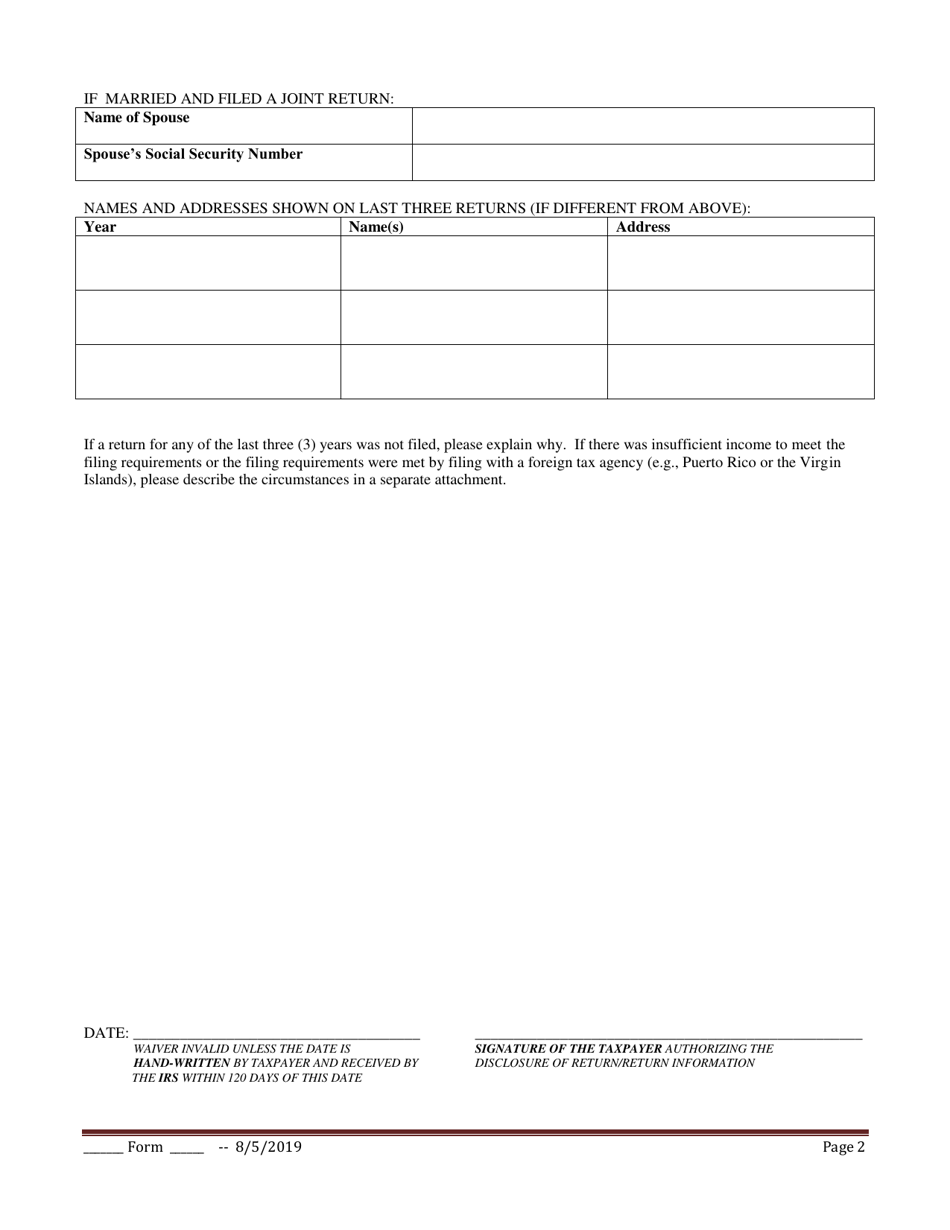

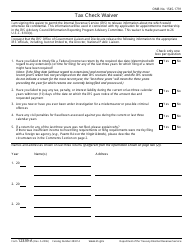

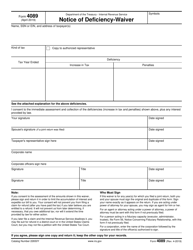

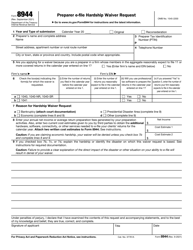

IRS Tax Waiver Form - Washington, D.C.

IRS Tax Waiver Form is a legal document that was released by the District of Columbia Courts - a government authority operating within Washington, D.C..

FAQ

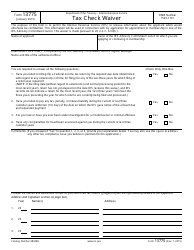

Q: What is an IRS tax waiver form?

A: An IRS tax waiver form is a document that requests the waiver or reduction of taxes owed to the Internal Revenue Service.

Q: Why would someone need an IRS tax waiver form?

A: Someone may need an IRS tax waiver form if they are unable to pay their taxes in full or if they believe they qualify for a reduction or waiver of their tax liability.

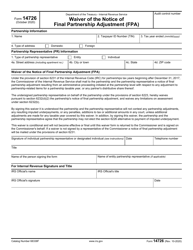

Q: What is the specific tax waiver form for Washington, D.C. residents?

A: The specific tax waiver form for Washington, D.C. residents is the IRS Form 656-W.

Q: What are the requirements to qualify for a tax waiver in Washington, D.C.?

A: The requirements to qualify for a tax waiver in Washington, D.C. may vary depending on the specific circumstances. It is best to consult with a tax professional or the IRS for more information.

Form Details:

- Released on August 5, 2019;

- The latest edition currently provided by the District of Columbia Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the District of Columbia Courts.