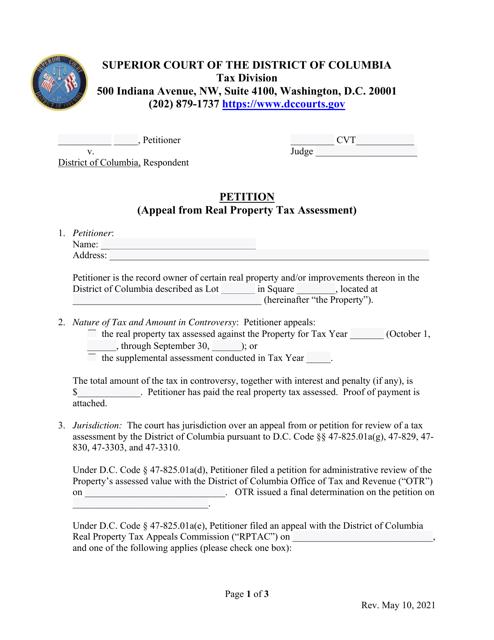

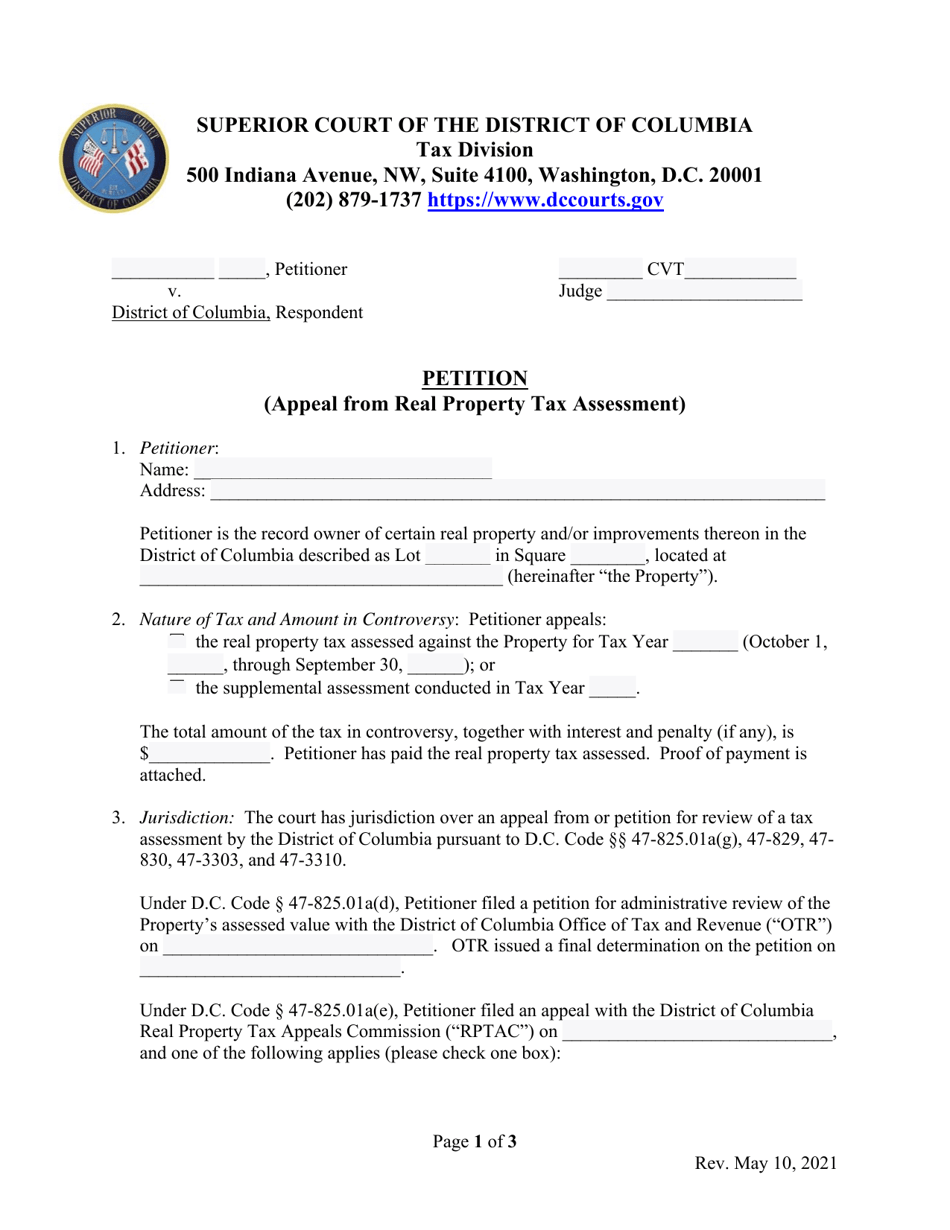

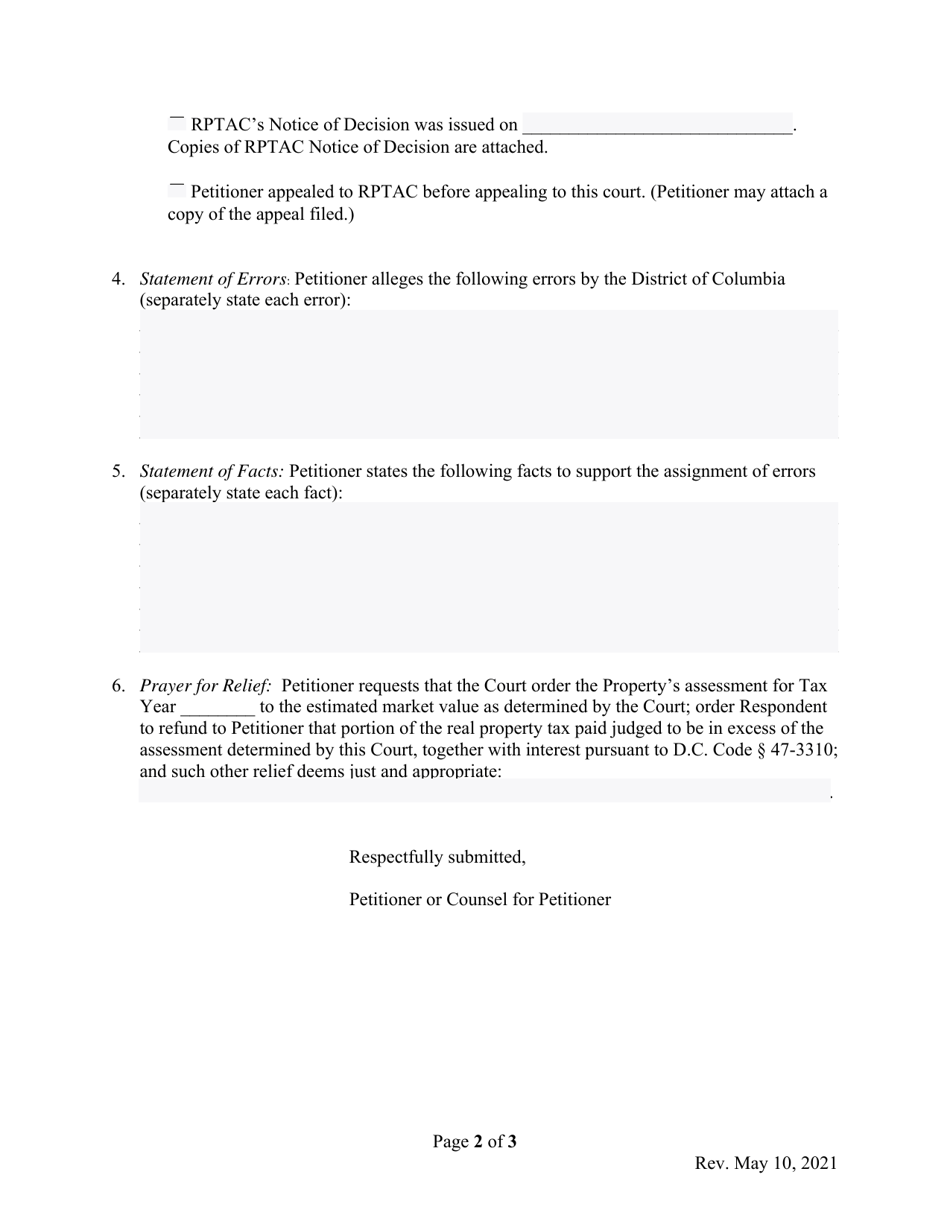

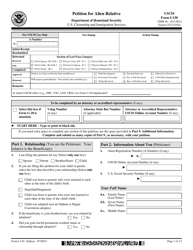

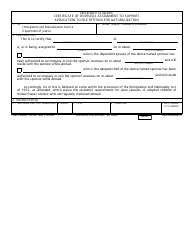

Petition (Appeal From Real Property Tax Assessment) - Washington, D.C.

Petition (Appeal From Real Property Tax Assessment) is a legal document that was released by the District of Columbia Courts - a government authority operating within Washington, D.C..

FAQ

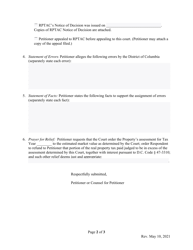

Q: What is a Petition (Appeal From Real Property Tax Assessment)?

A: A Petition (Appeal From Real Property Tax Assessment) is a formal request to challenge the assessment of your property's tax value in Washington, D.C.

Q: Why would someone file a Petition (Appeal From Real Property Tax Assessment)?

A: Someone would file a Petition (Appeal From Real Property Tax Assessment) if they believe their property's tax value has been assessed incorrectly and want to challenge it.

Q: How can I file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.?

A: To file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C., you need to complete the necessary forms provided by the local tax authority and submit them within the designated timeframe.

Q: Is there a deadline to file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.?

A: Yes, there is a specific deadline to file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C. It is usually within a certain number of days from the date of the property tax assessment notice.

Q: What happens after I file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.?

A: After you file a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C., your case will be reviewed by the appropriate authorities, and you may be provided with a hearing to present your evidence and arguments.

Q: Can I hire a representative to help me with my Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.?

A: Yes, you can hire a representative, such as a lawyer or property tax consultant, to assist you with your Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.

Q: What are the possible outcomes of a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C.?

A: The possible outcomes of a Petition (Appeal From Real Property Tax Assessment) in Washington, D.C. include having your property's tax value adjusted, receiving a refund for any overpayment, or having your petition denied if the authorities determine the assessment was accurate.

Form Details:

- Released on May 10, 2021;

- The latest edition currently provided by the District of Columbia Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the District of Columbia Courts.