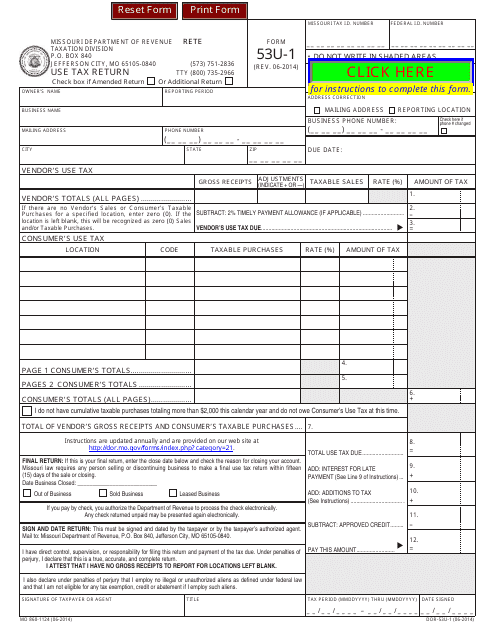

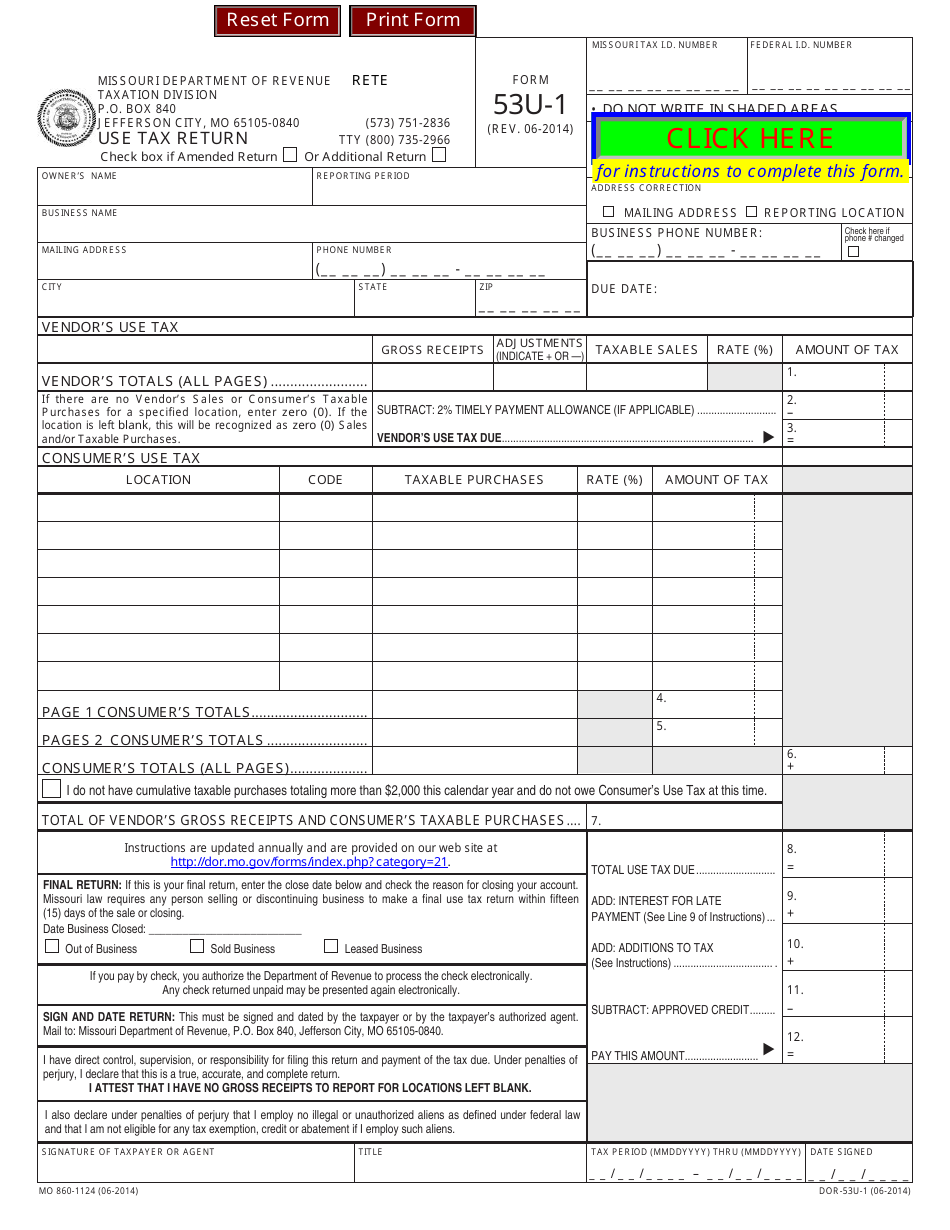

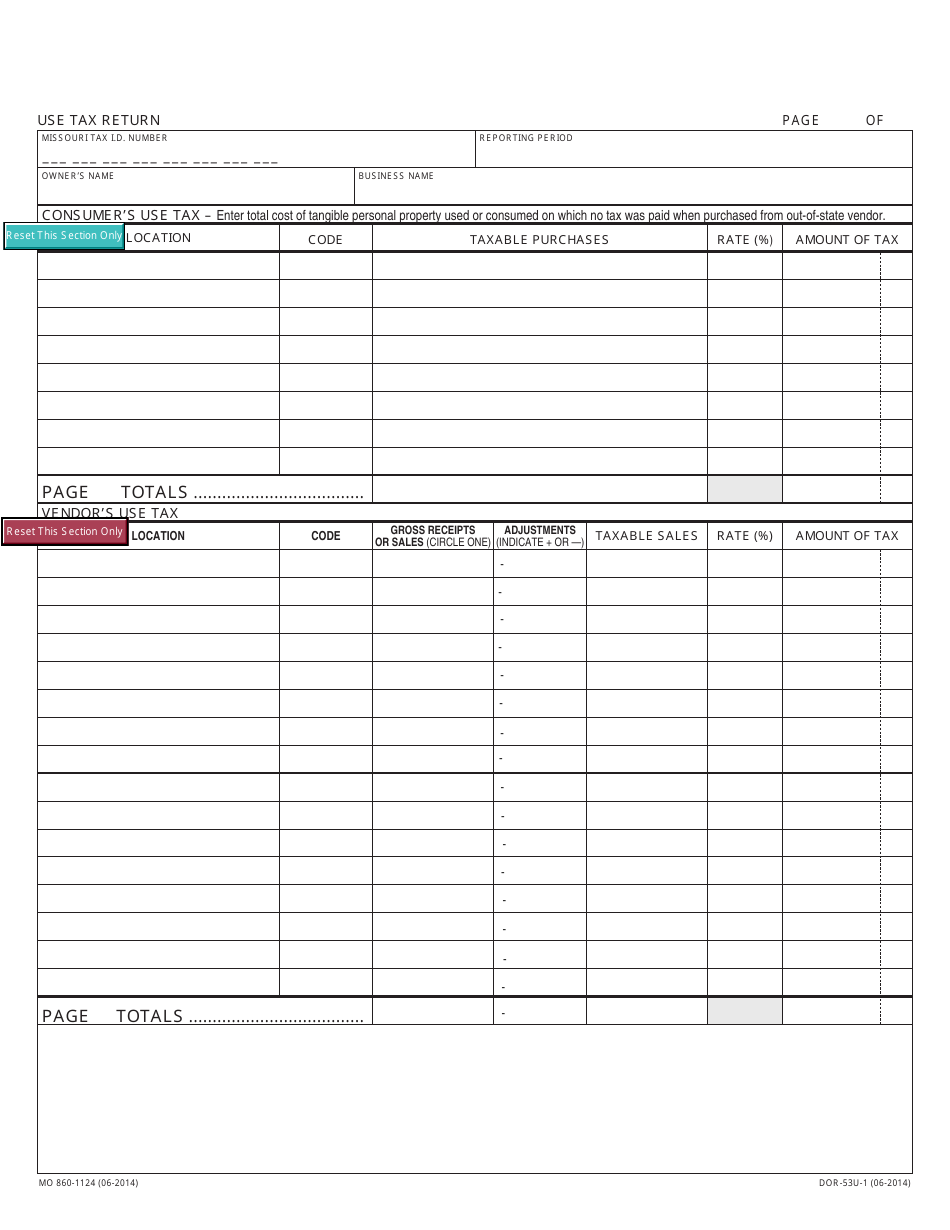

Form 53u-1 Use Tax Return - Missouri

What Is Form 53u-1?

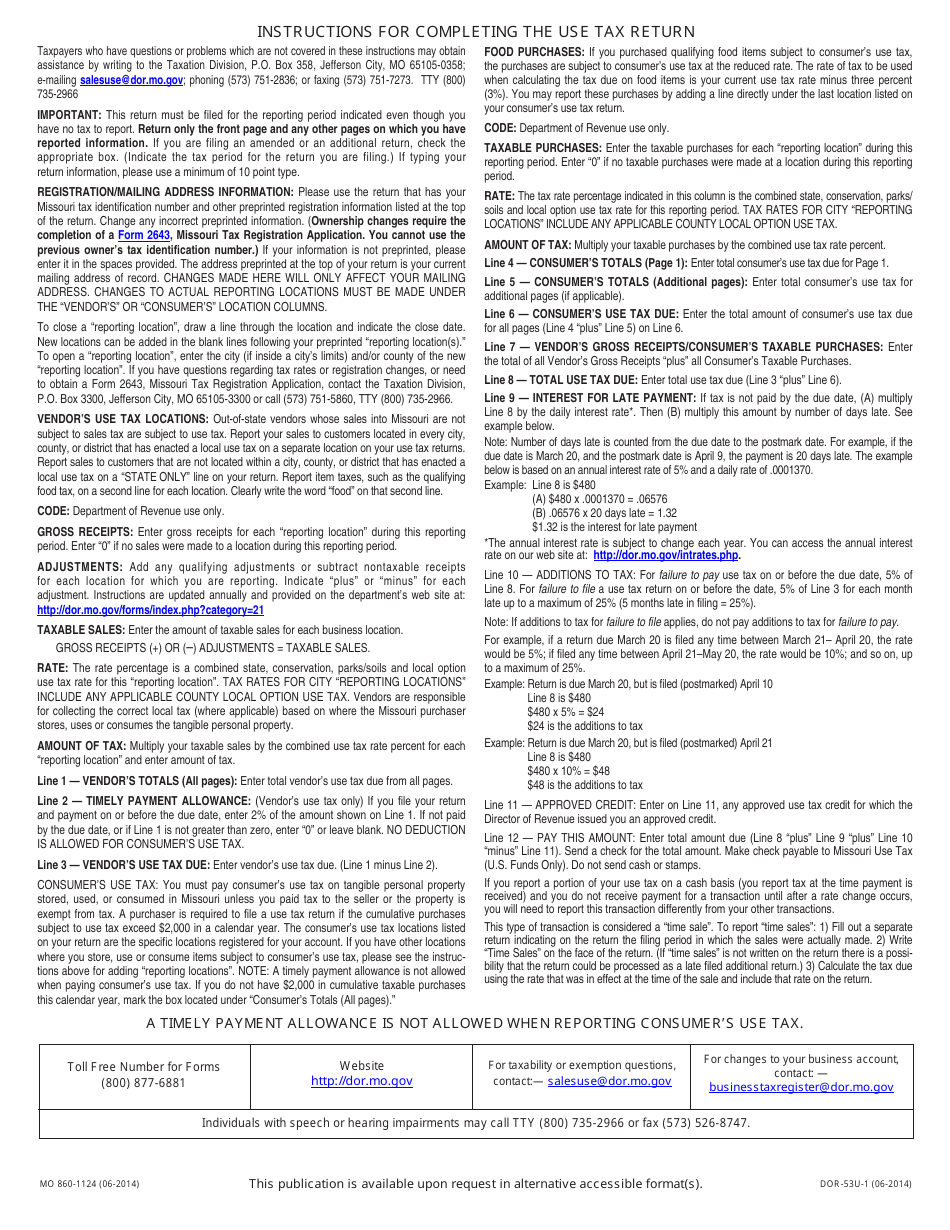

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 53u-1?

A: Form 53u-1 is the Use Tax Return form in Missouri.

Q: What is the Use Tax?

A: Use Tax is a form of taxation on goods or services that are purchased from out-of-state retailers and are used, consumed, or stored in Missouri.

Q: Who needs to file Form 53u-1?

A: Any individual or business in Missouri who has purchased taxable items or services from out-of-state retailers and owes use tax.

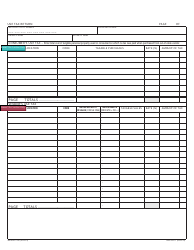

Q: What information is required on Form 53u-1?

A: The form requires you to provide details about the purchases made, the vendors, and the amount of use tax owed.

Q: When is the deadline to file Form 53u-1?

A: The form is due on or before the 20th day of the month following the end of each calendar quarter.

Q: What if I don't file Form 53u-1?

A: Failure to file Form 53u-1 or pay the required use tax can result in penalties and interest.

Q: Is Form 53u-1 specific to Missouri?

A: Yes, Form 53u-1 is specific to the state of Missouri and is used to report use tax owed in that state.

Q: Can I amend a filed Form 53u-1?

A: Yes, if you need to make changes to a previously filed Form 53u-1, you can file an amended form.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 53u-1 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.