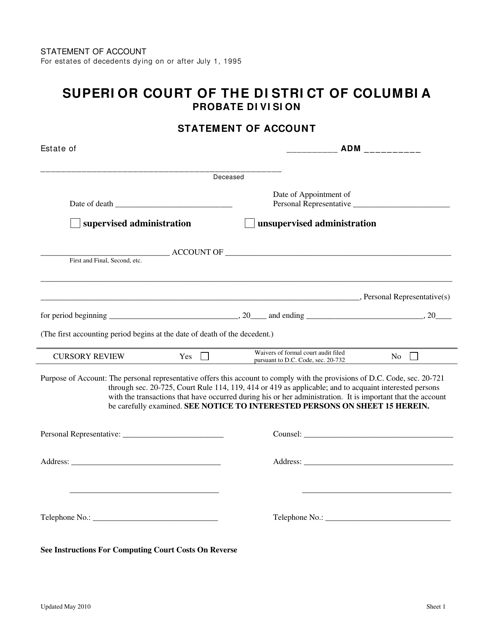

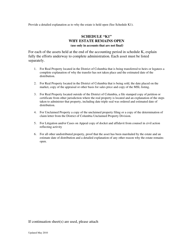

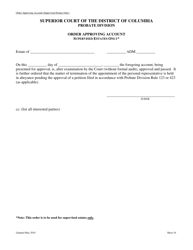

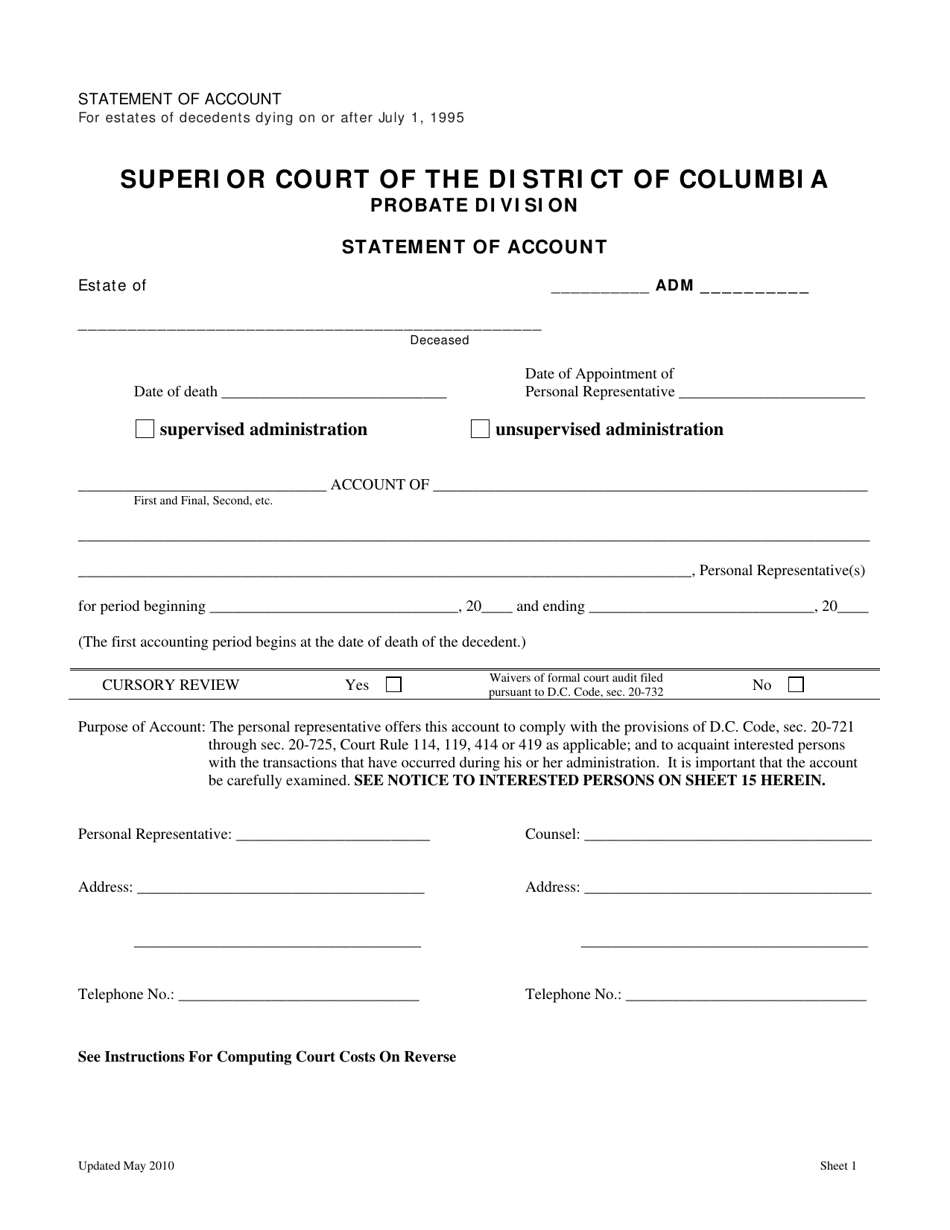

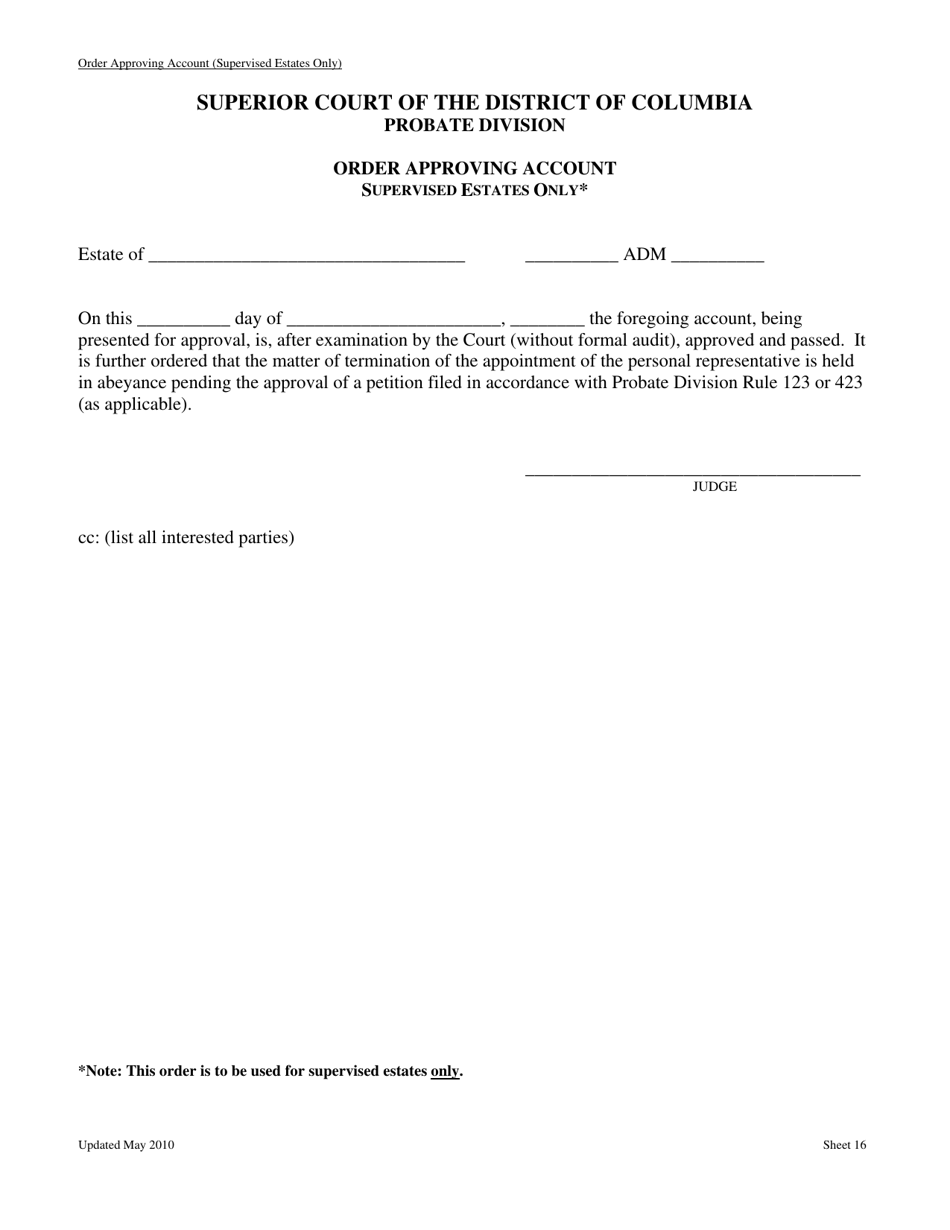

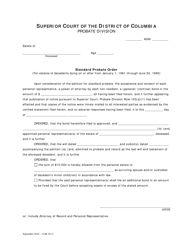

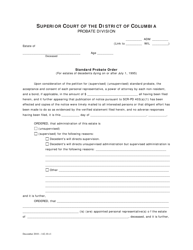

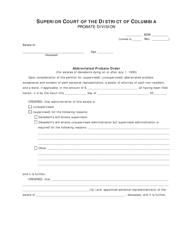

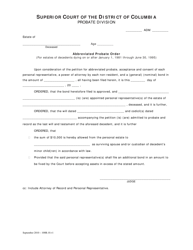

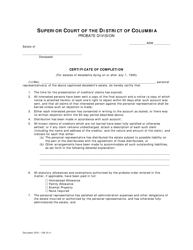

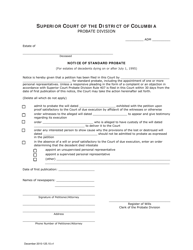

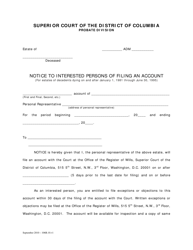

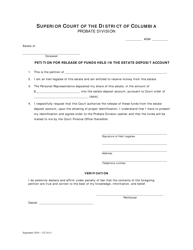

Statement of Account for Estates of Decedents Dying on or After July 1, 1995 - Washington, D.C.

Statement of Account for Estates of Decedents Dying on or After July 1, 1995 is a legal document that was released by the District of Columbia Courts - a government authority operating within Washington, D.C..

FAQ

Q: What is a Statement of Account for Estates of Decedents?

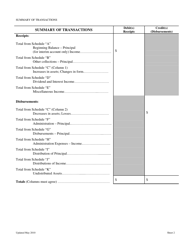

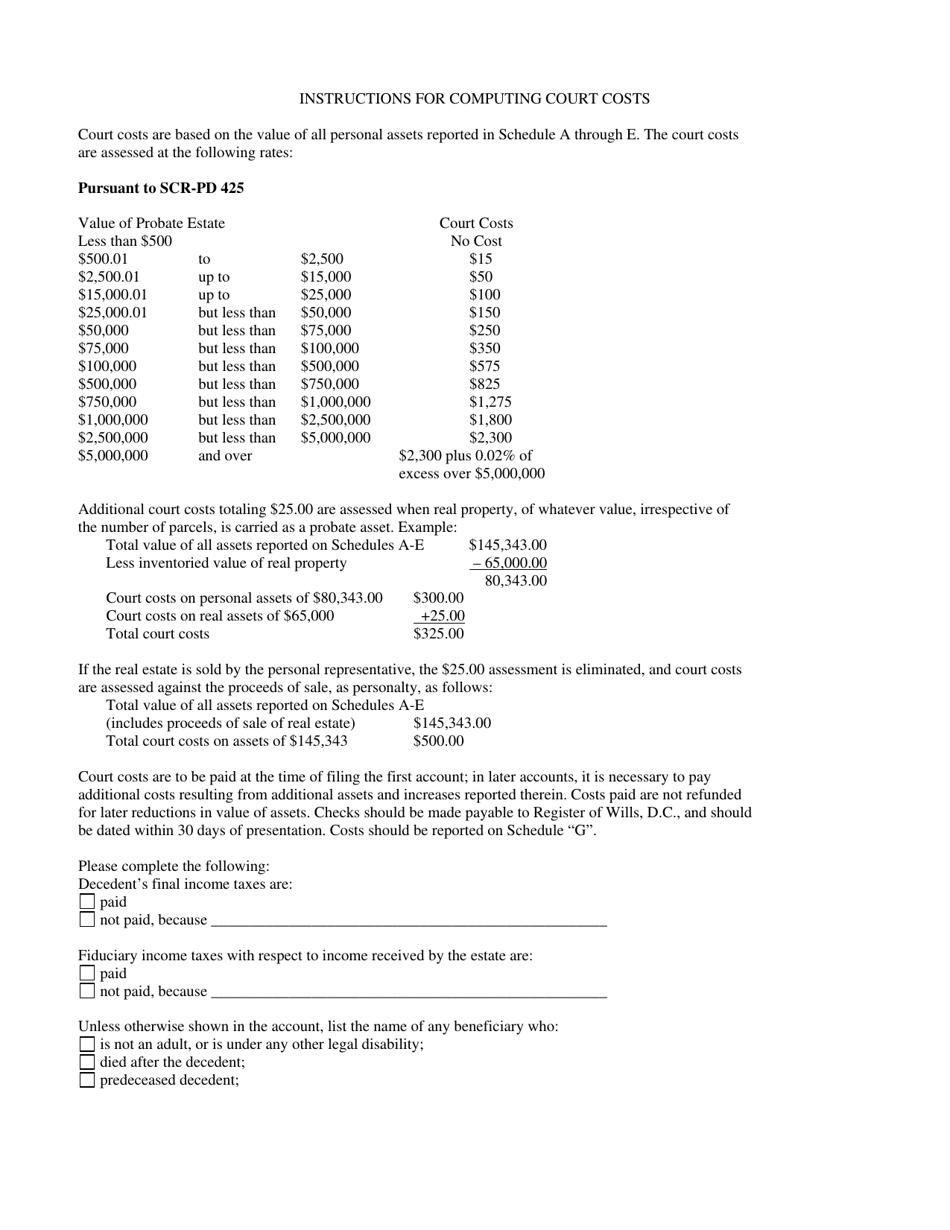

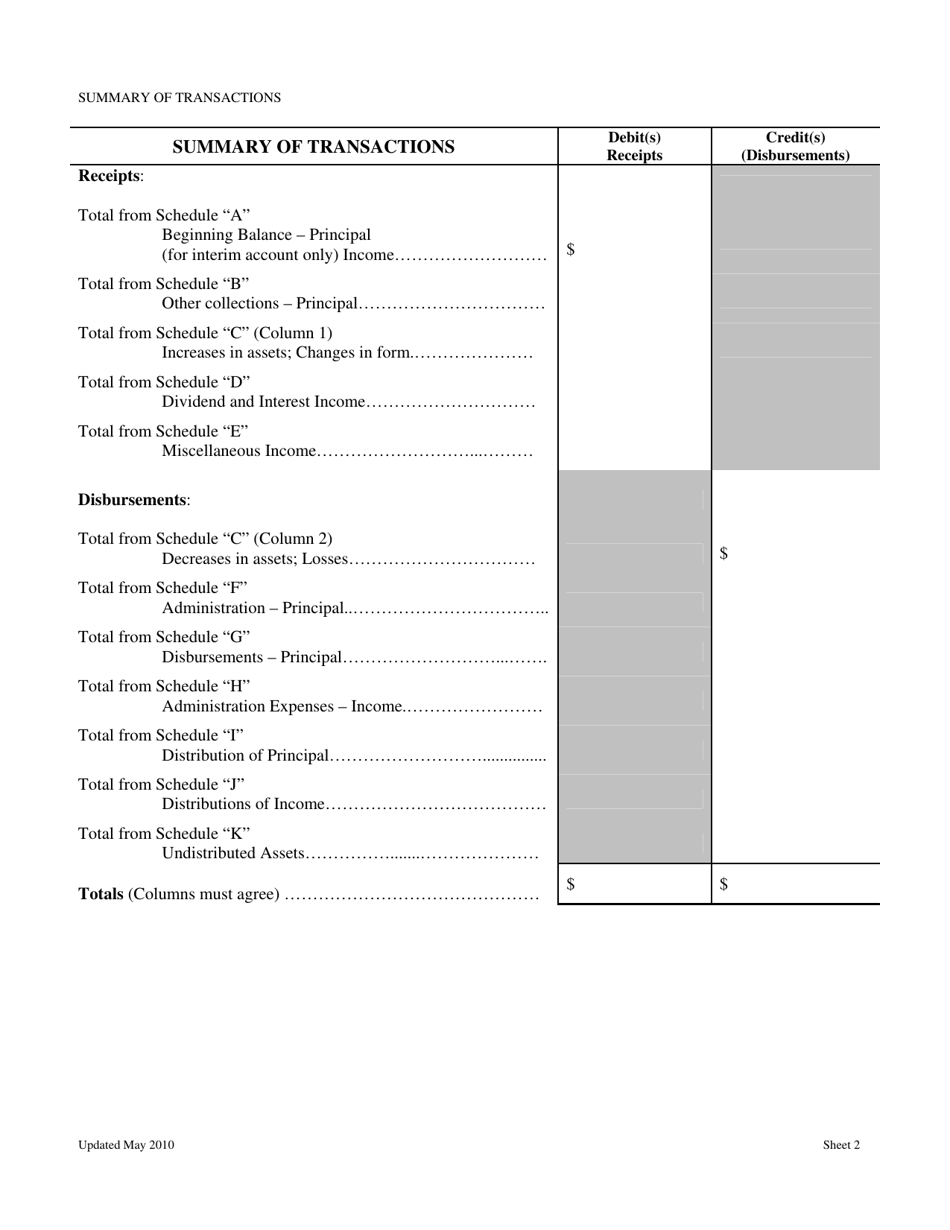

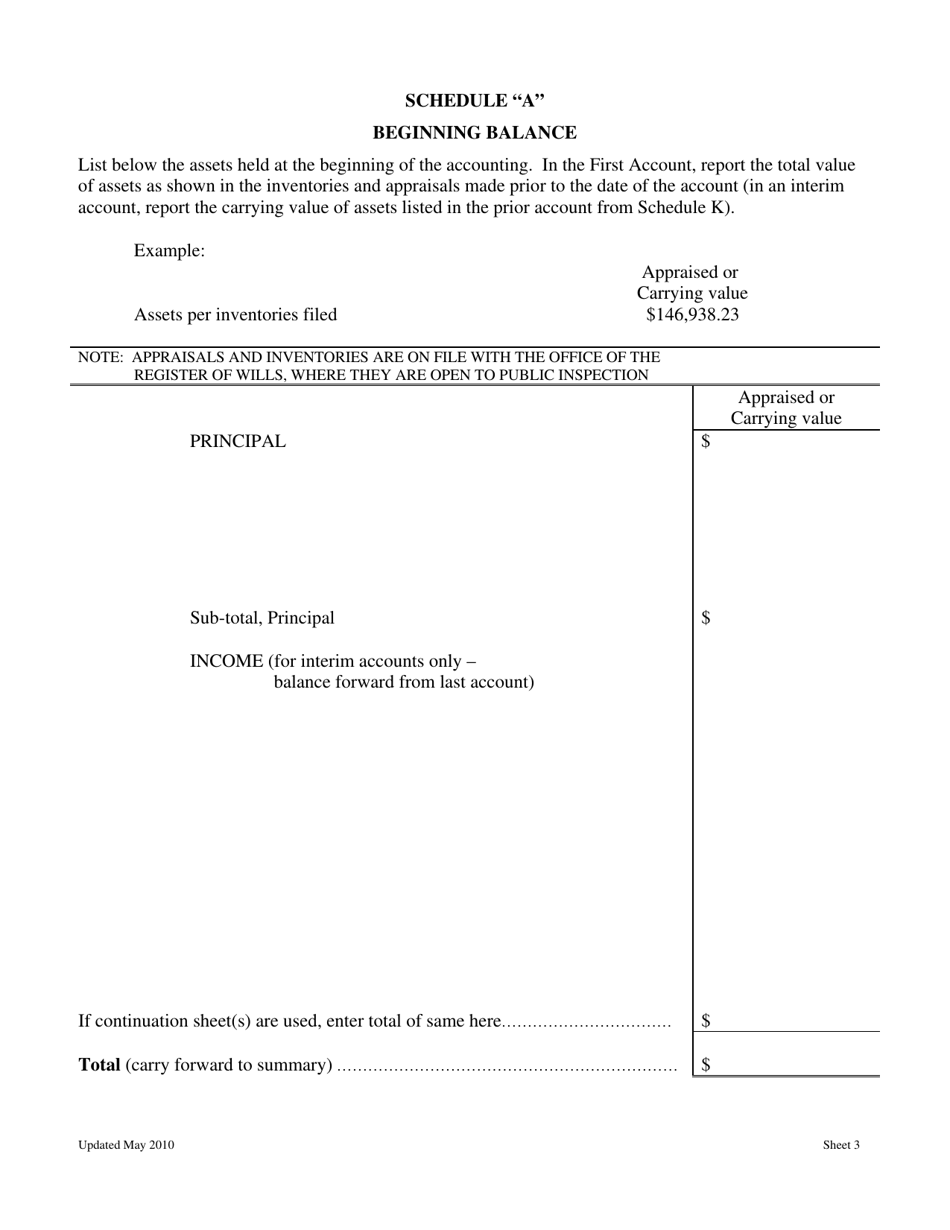

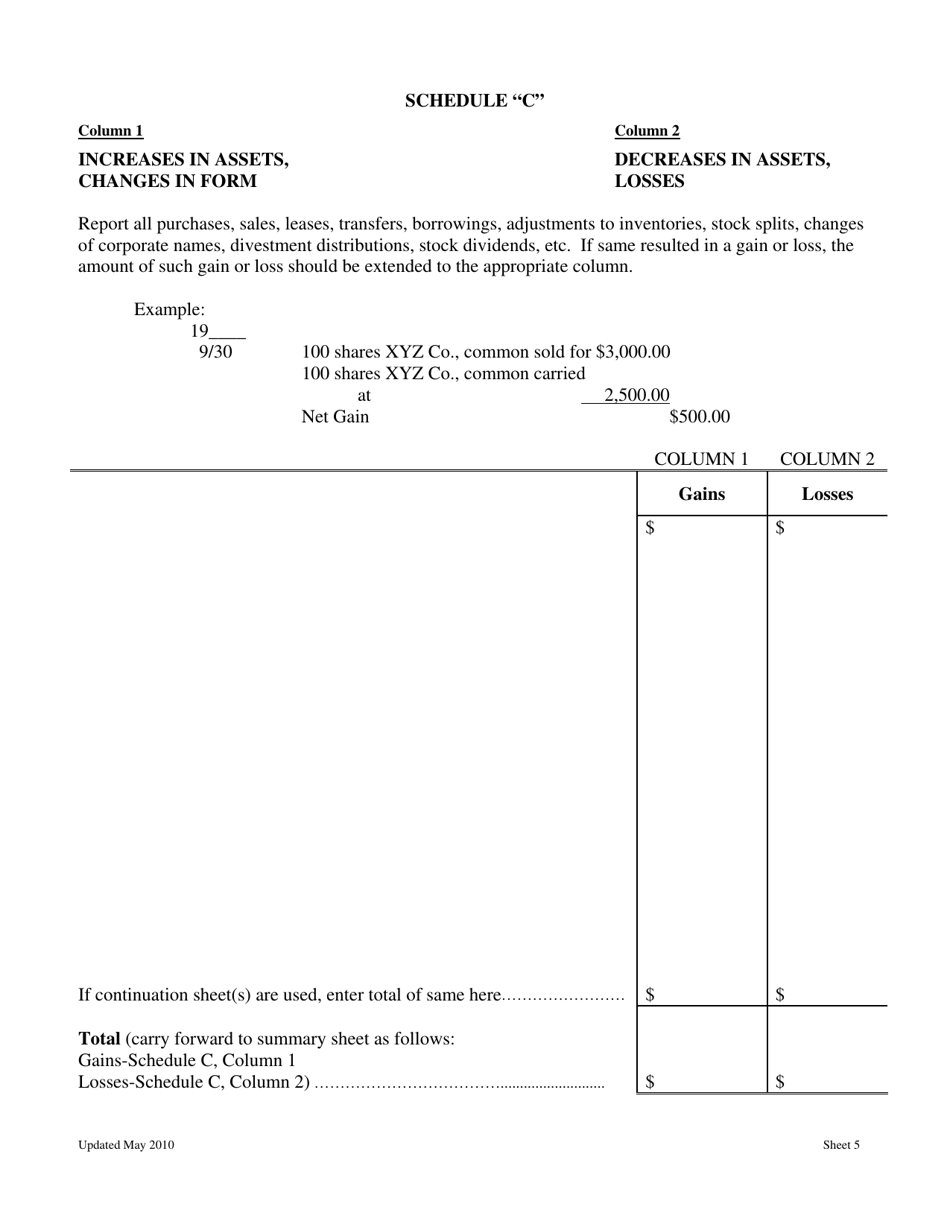

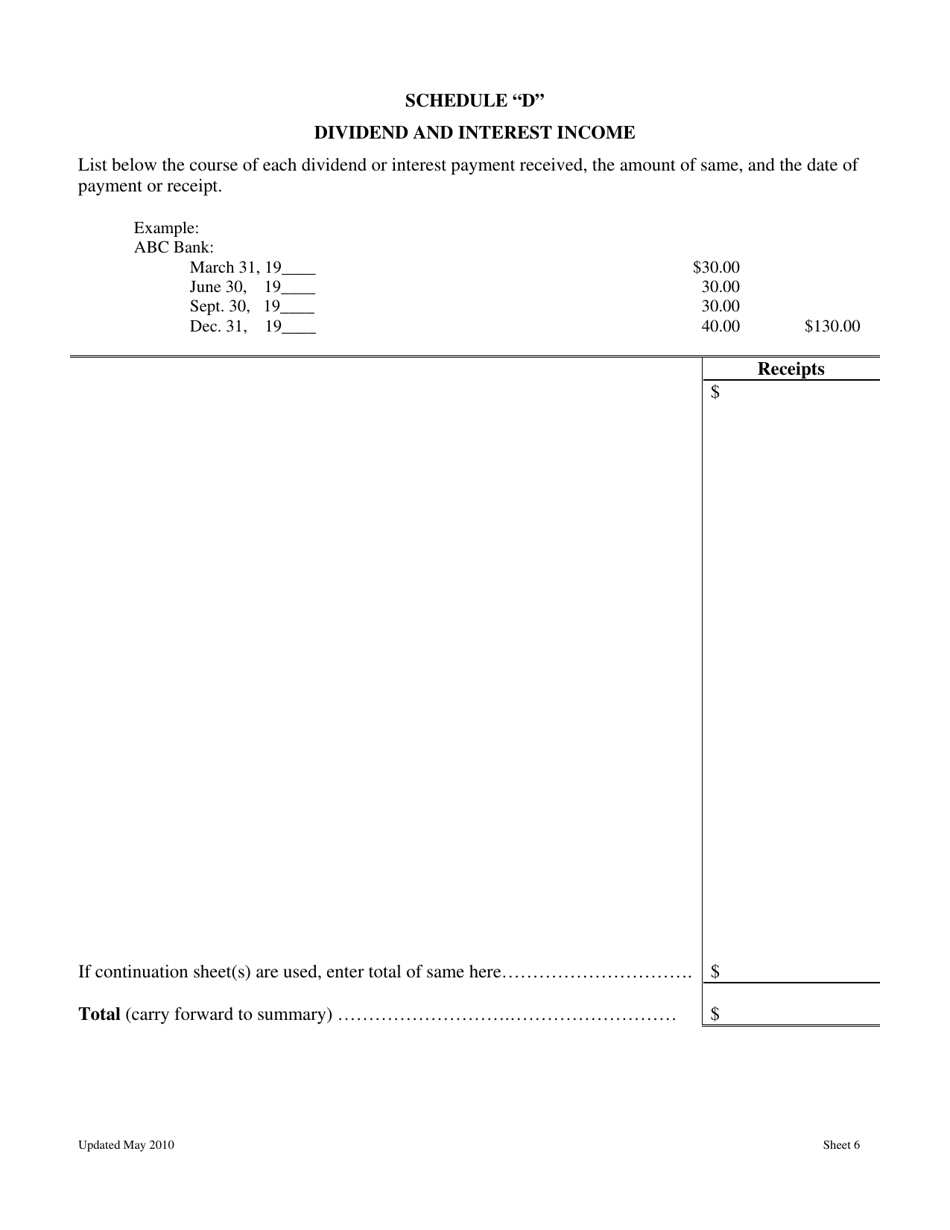

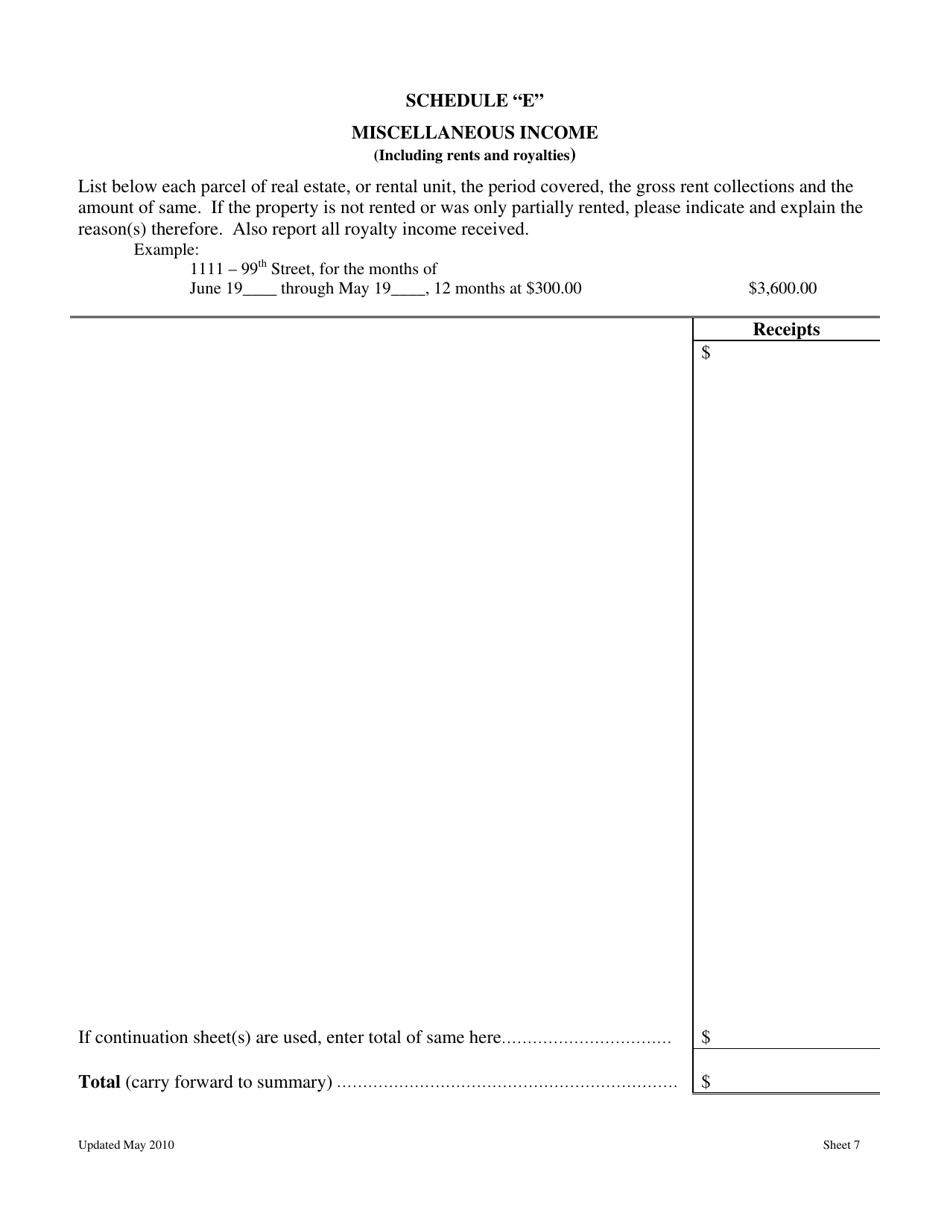

A: A Statement of Account for Estates of Decedents is a financial document that provides a summary of the assets, liabilities, and transactions related to the estate of a person who has passed away.

Q: When did the requirement for a Statement of Account for Estates of Decedents begin in Washington, D.C.?

A: The requirement for a Statement of Account for Estates of Decedents began on July 1, 1995.

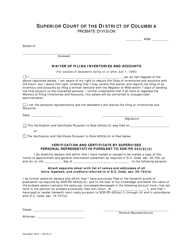

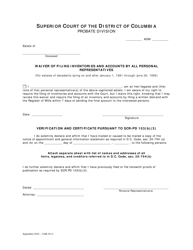

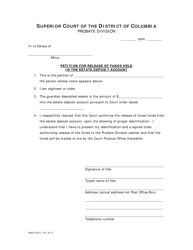

Q: Who needs to file a Statement of Account for Estates of Decedents?

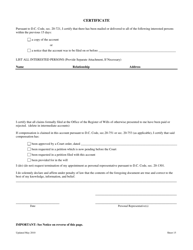

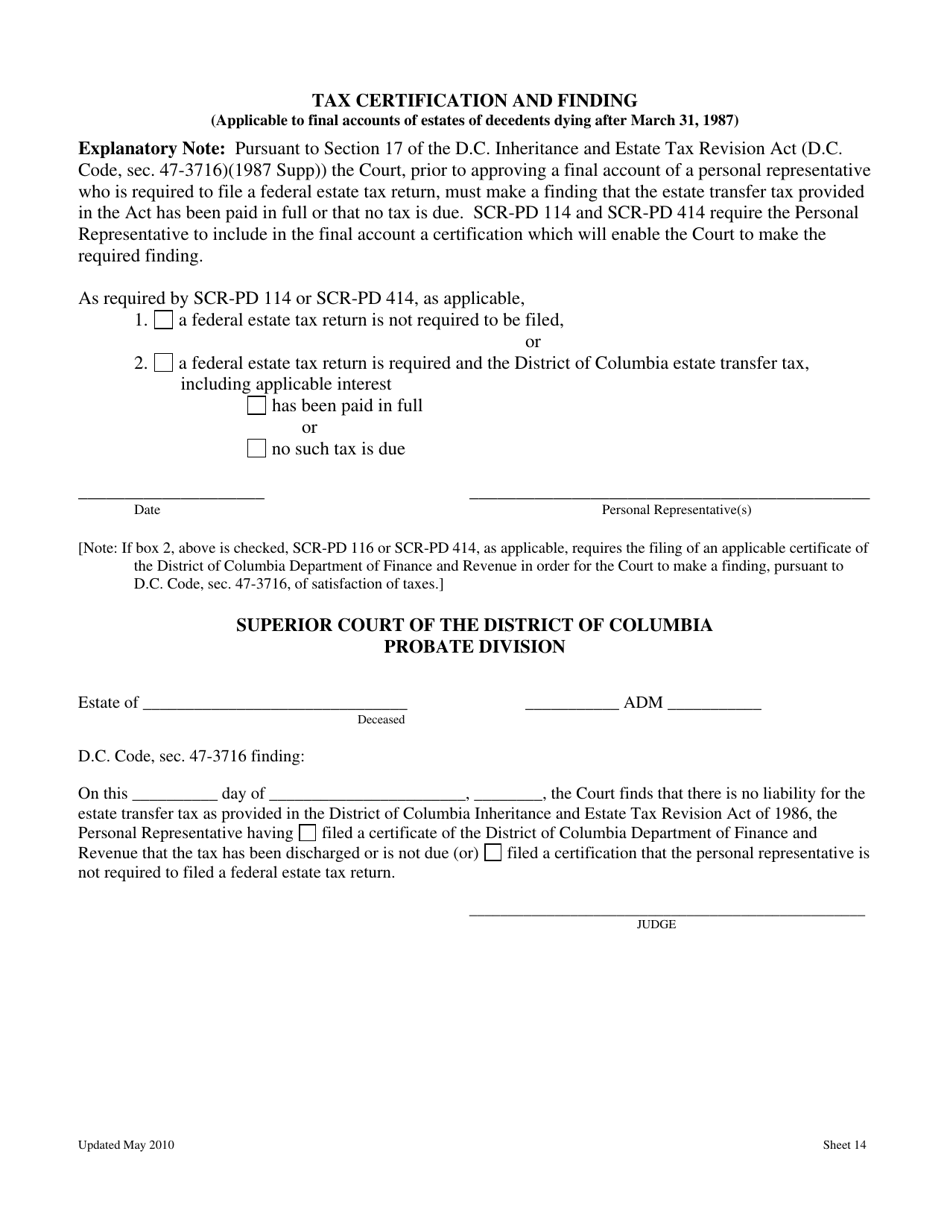

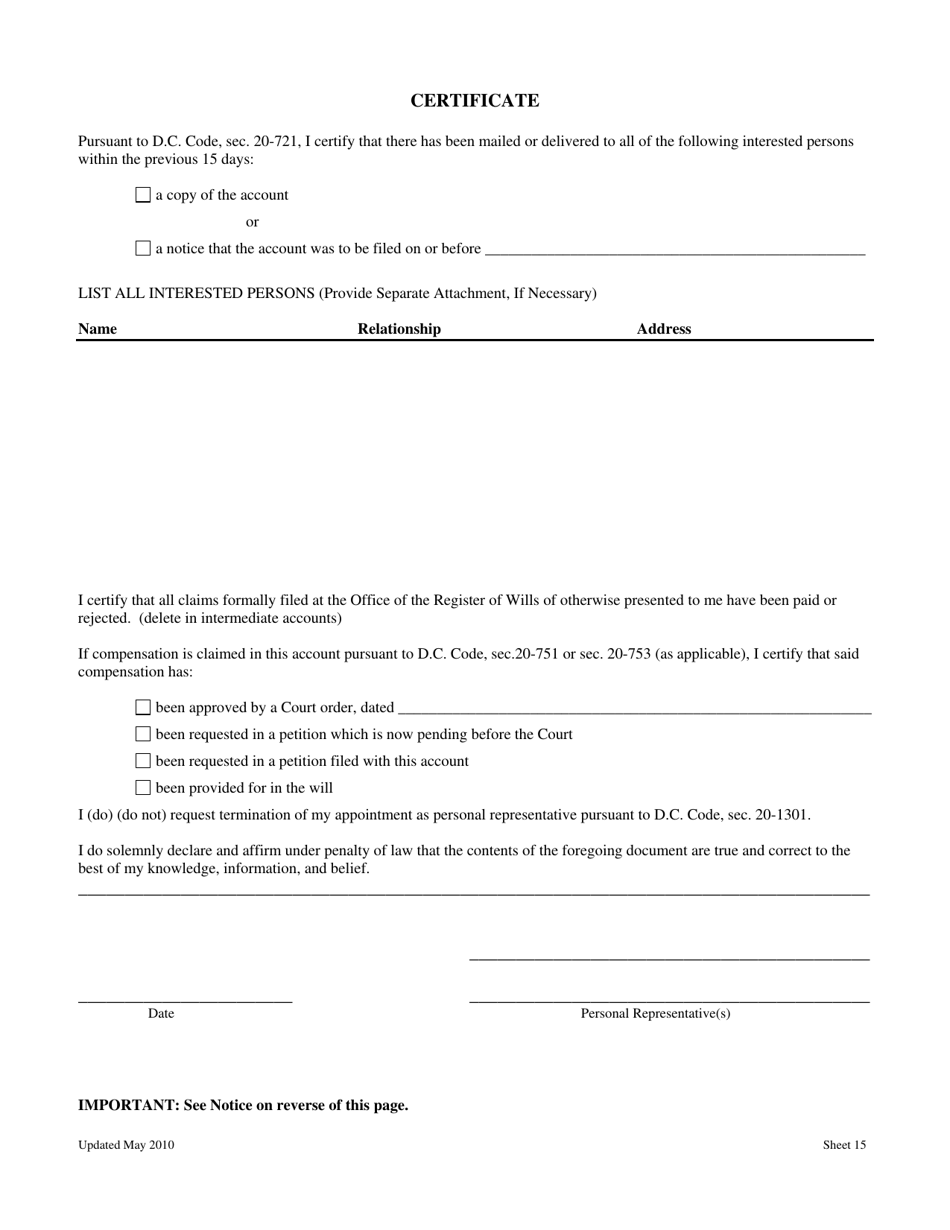

A: The personal representative or executor of the estate needs to file a Statement of Account for Estates of Decedents.

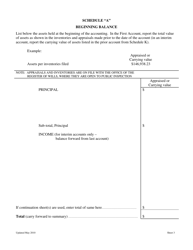

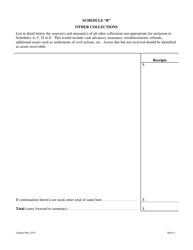

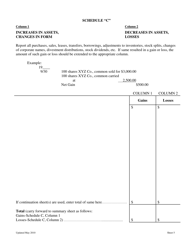

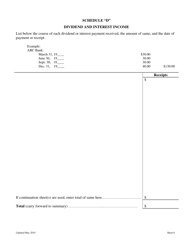

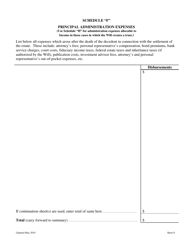

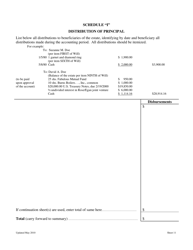

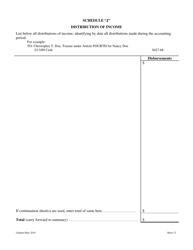

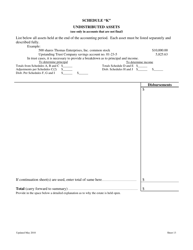

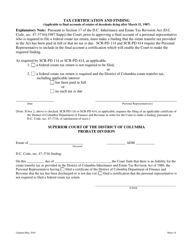

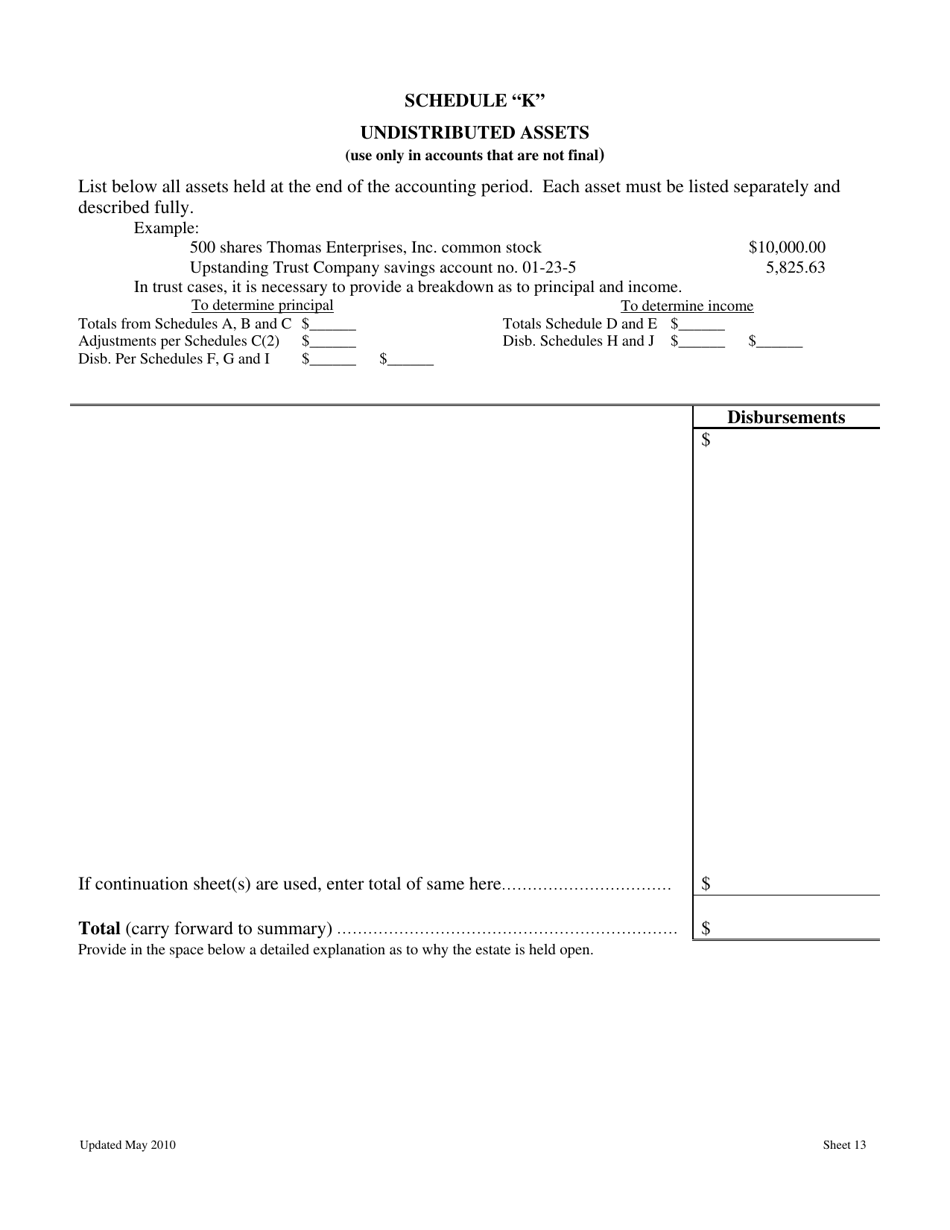

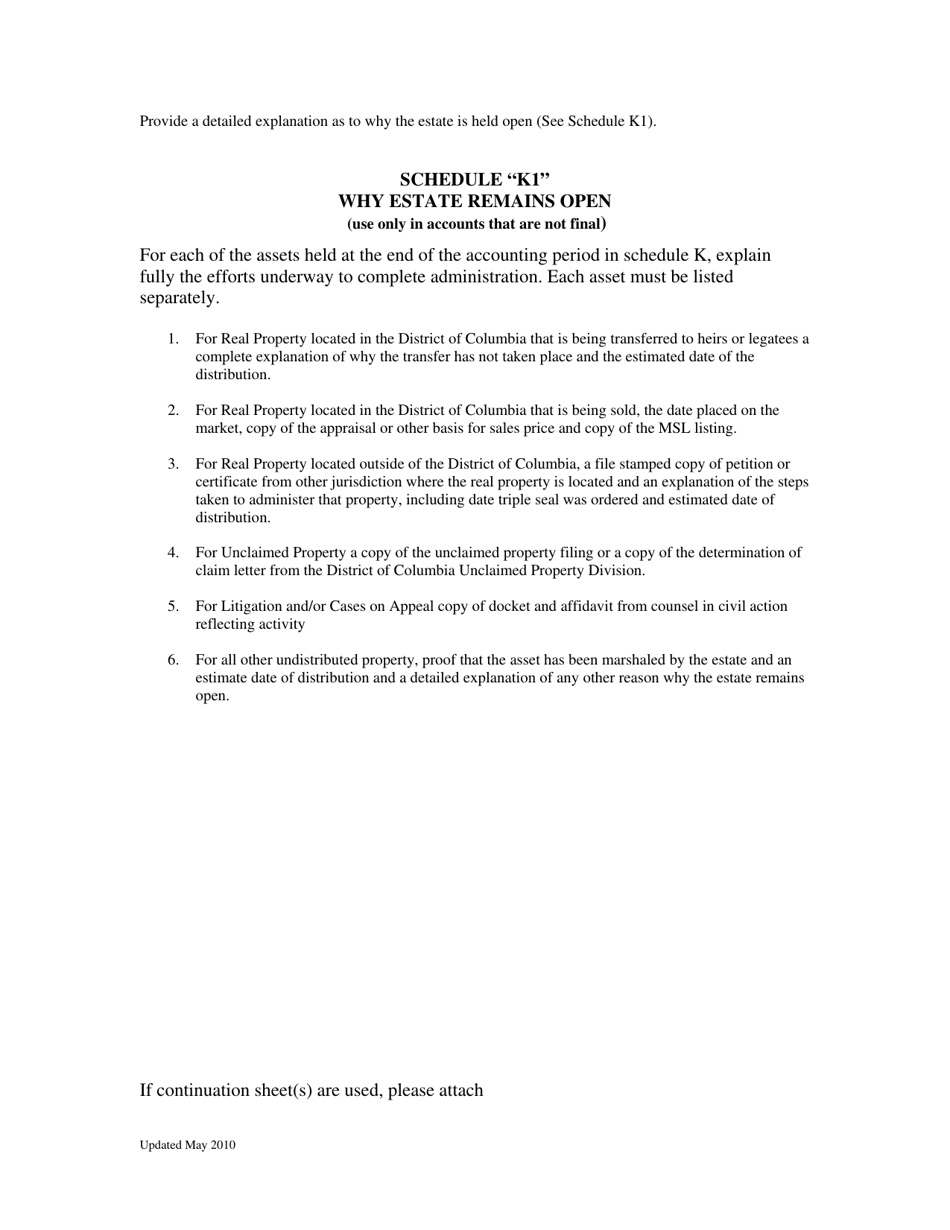

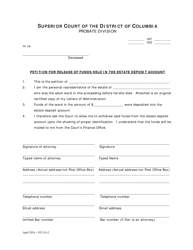

Q: What information is included in a Statement of Account for Estates of Decedents?

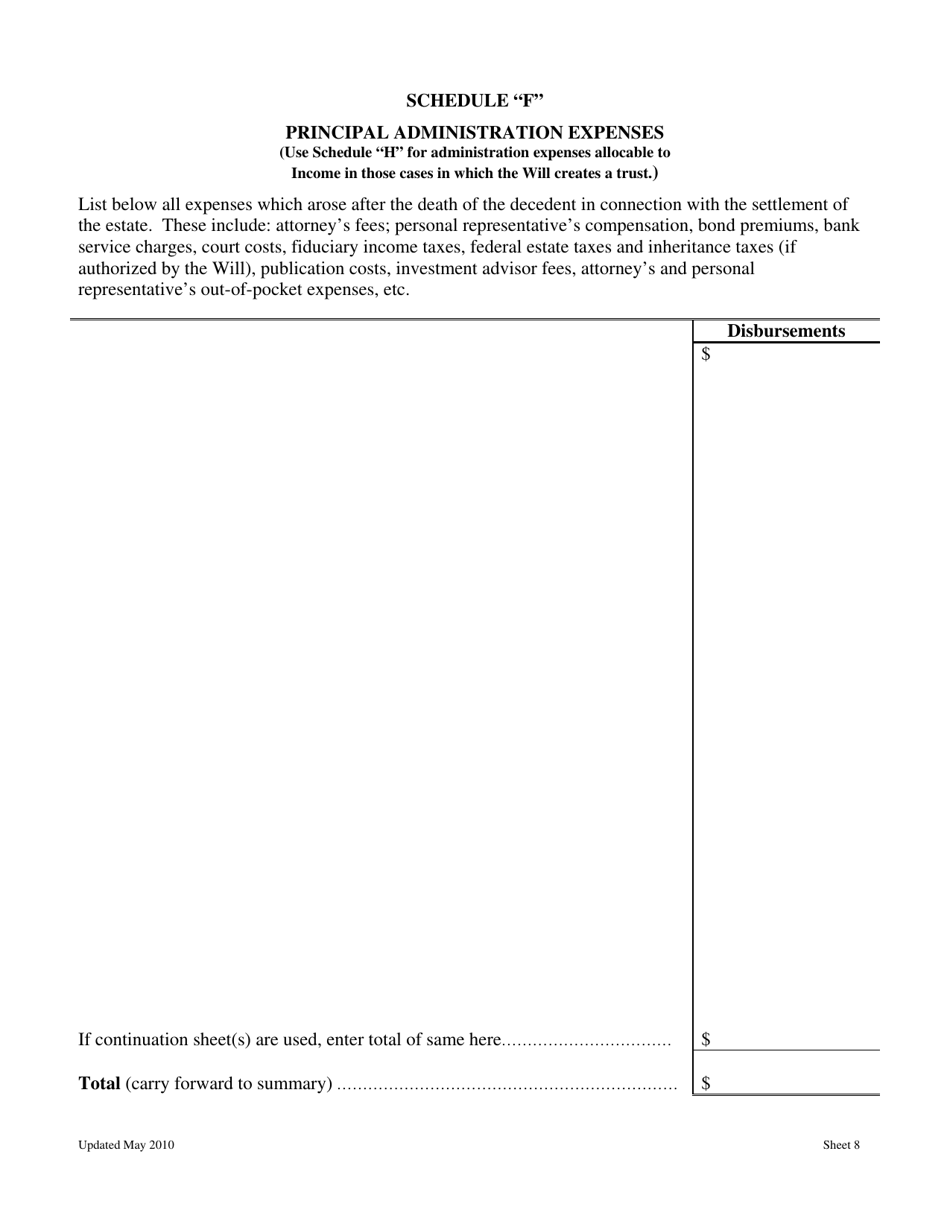

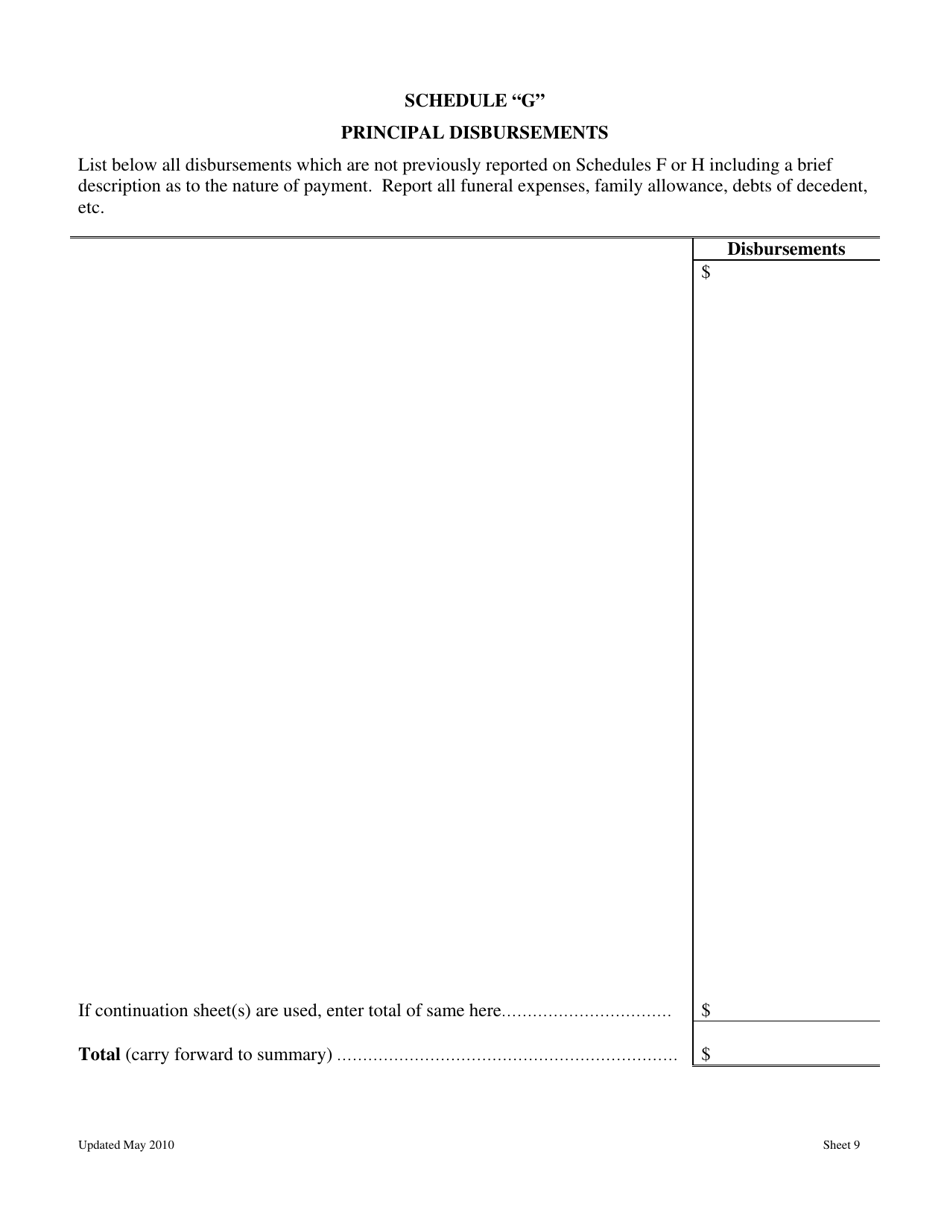

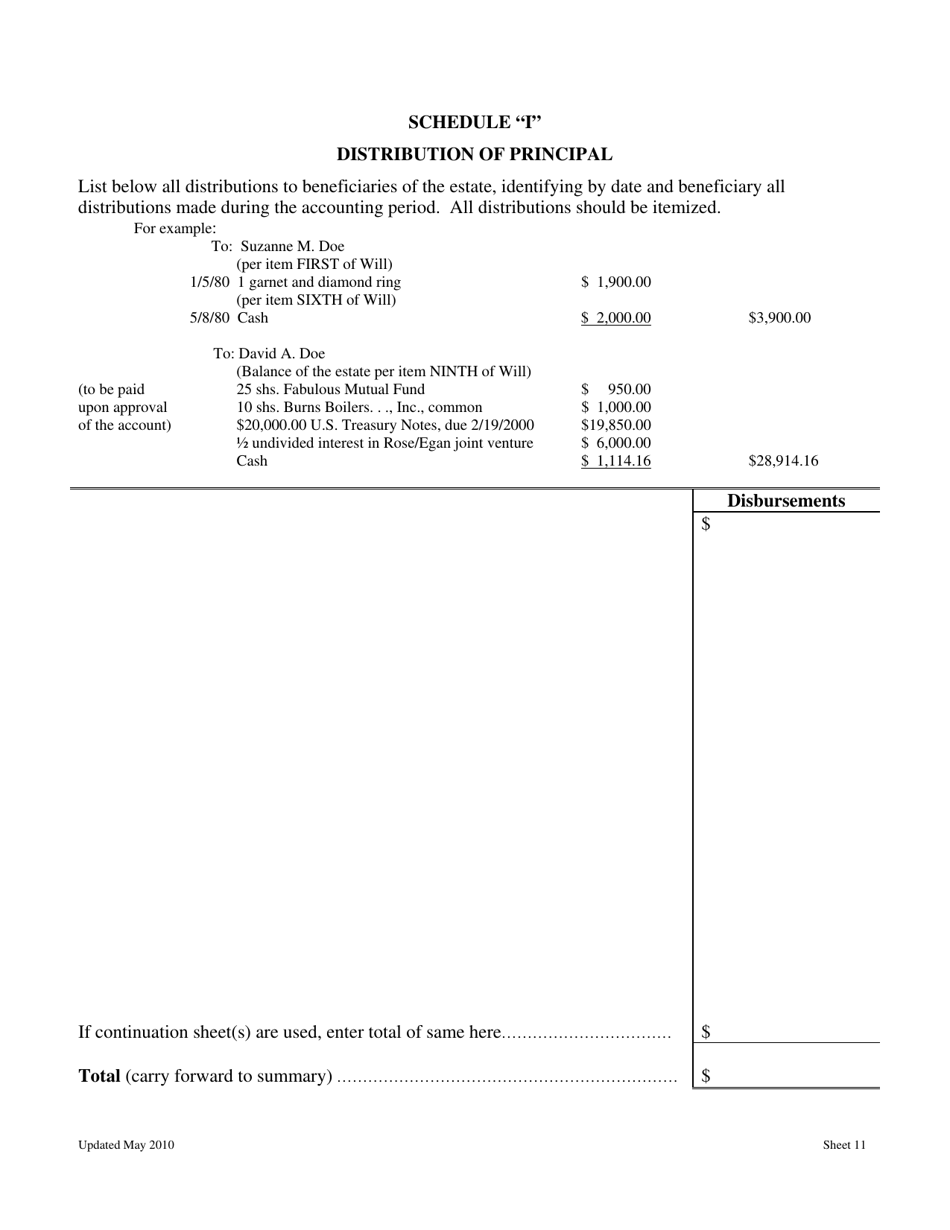

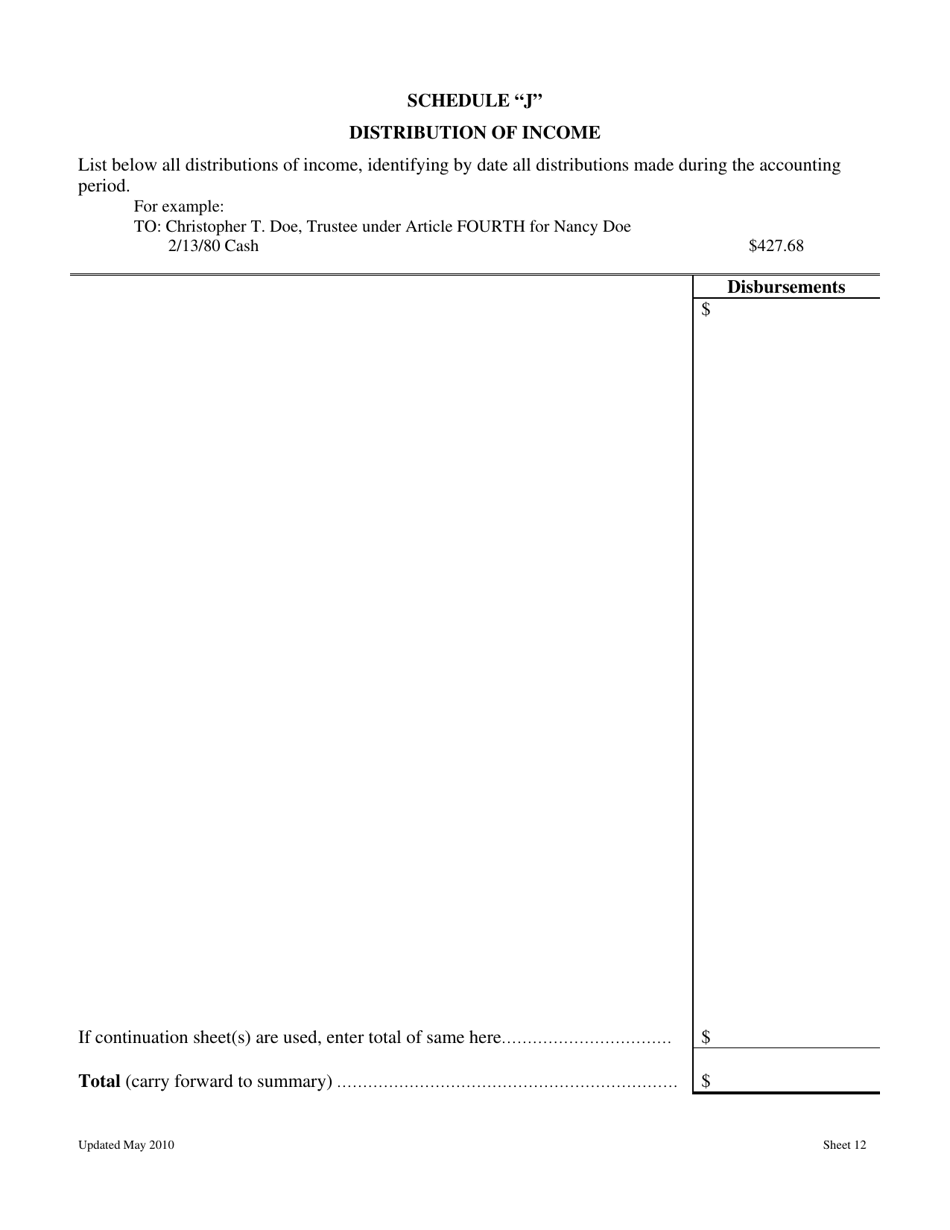

A: A Statement of Account for Estates of Decedents includes information about the assets, liabilities, income, expenses, distributions, and any other financial transactions related to the estate.

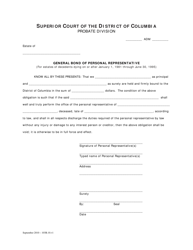

Q: Why is a Statement of Account for Estates of Decedents important?

A: A Statement of Account for Estates of Decedents is important as it provides transparency and accountability regarding the financial matters of the estate, ensuring that the proper distribution of assets is carried out.

Q: Is a Statement of Account for Estates of Decedents required for all estates in Washington, D.C.?

A: Yes, a Statement of Account for Estates of Decedents is required for all estates in Washington, D.C. for individuals who passed away on or after July 1, 1995.

Form Details:

- Released on May 1, 2010;

- The latest edition currently provided by the District of Columbia Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the District of Columbia Courts.