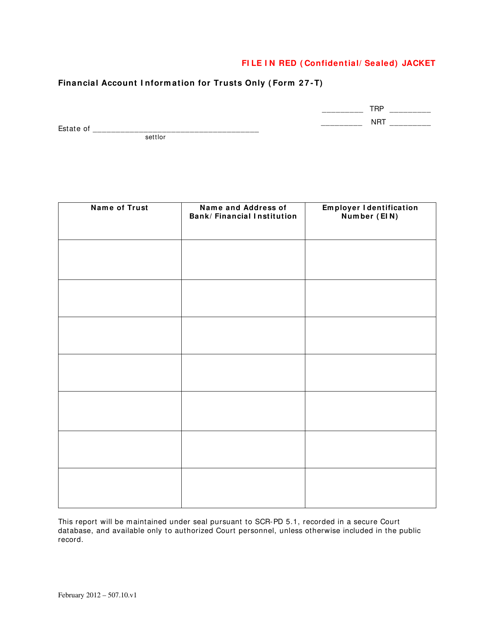

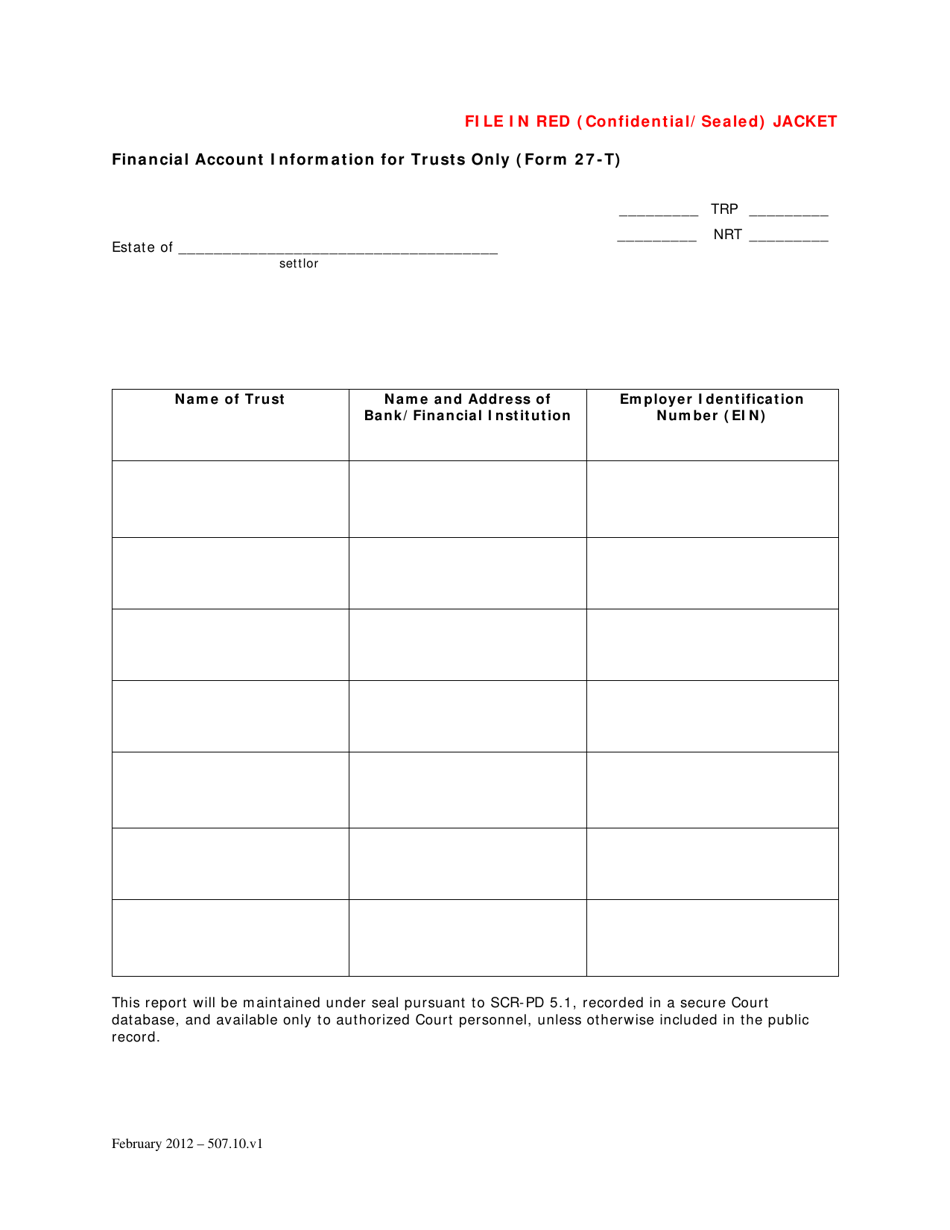

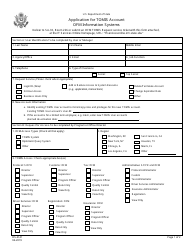

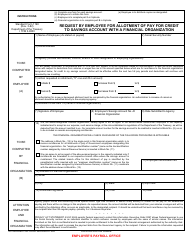

Form 27-T Financial Account Information for Trusts Only - Washington, D.C.

What Is Form 27-T?

This is a legal form that was released by the District of Columbia Courts - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 27-T?

A: Form 27-T is a tax form used to provide financial account information for trusts in Washington, D.C.

Q: Who is required to file Form 27-T?

A: Only trusts in Washington, D.C. are required to file Form 27-T.

Q: What kind of information is required on Form 27-T?

A: Form 27-T requires financial account information for trusts, including details about each account held by the trust.

Q: When is the deadline for filing Form 27-T?

A: The deadline for filing Form 27-T is typically April 15th, unless that day falls on a weekend or holiday, in which case the deadline is the next business day.

Q: What happens if I don't file Form 27-T?

A: Failure to file Form 27-T or filing it late may result in penalties or interest charges.

Q: Can I file Form 27-T electronically?

A: Yes, Form 27-T can be filed electronically using the District of Columbia's eTSC system.

Q: Are there any exemptions from filing Form 27-T?

A: There may be certain exemptions from filing Form 27-T, such as for certain small trusts or those who meet specific criteria. It is best to consult the instructions or seek professional advice.

Q: What supporting documents do I need to submit with Form 27-T?

A: You may be required to submit supporting documents, such as bank statements or other financial records, along with Form 27-T. Check the instructions for specific requirements.

Q: Can I request an extension to file Form 27-T?

A: Yes, you can request an extension to file Form 27-T by submitting Form FR-164 with the District of Columbia Office of Tax and Revenue.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the District of Columbia Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 27-T by clicking the link below or browse more documents and templates provided by the District of Columbia Courts.