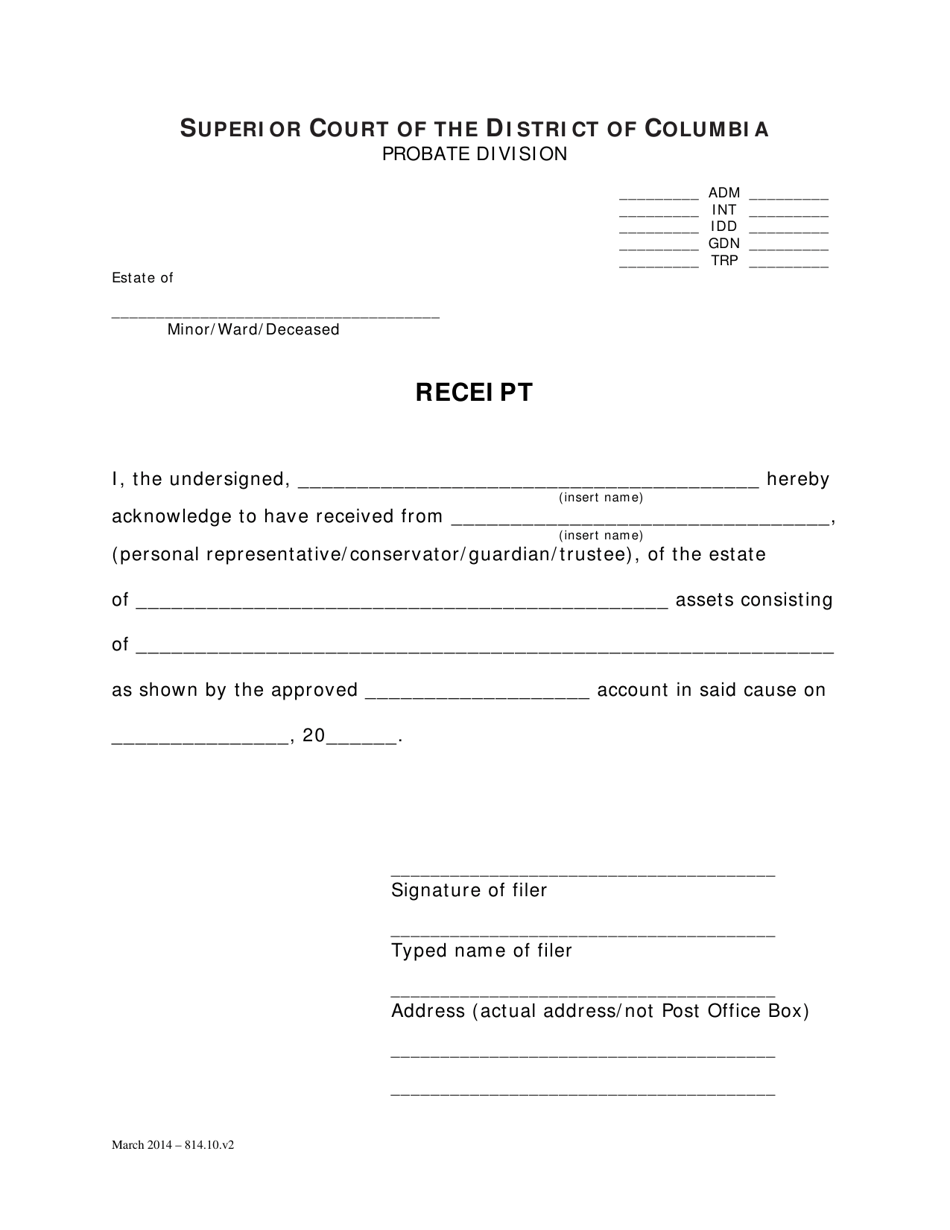

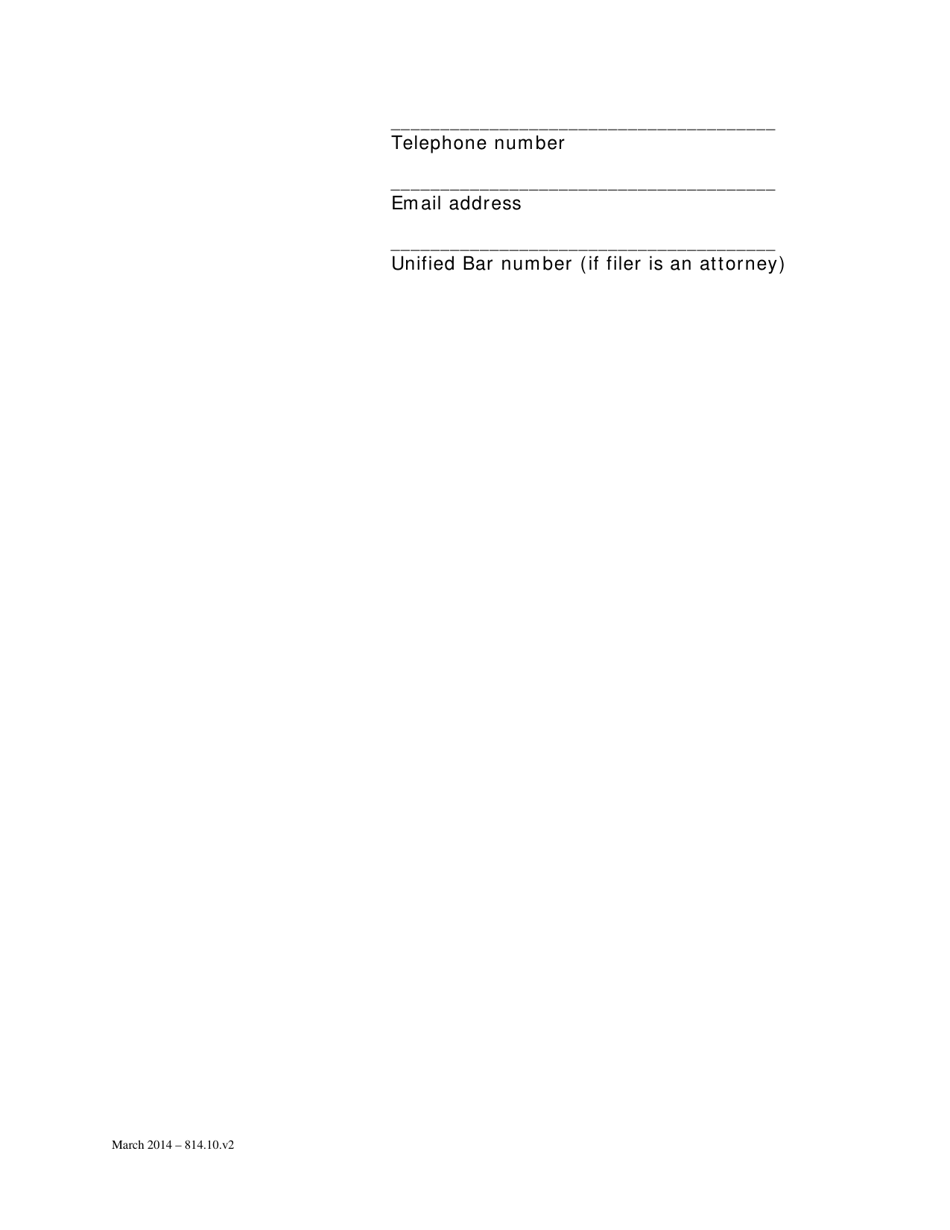

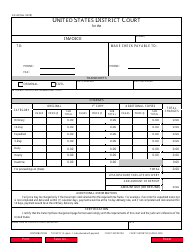

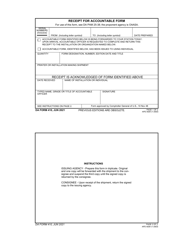

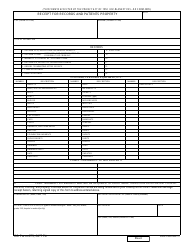

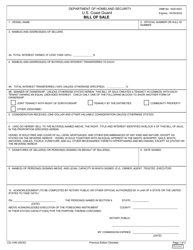

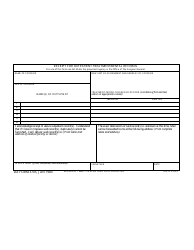

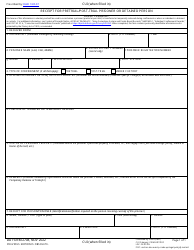

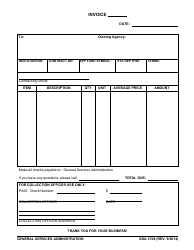

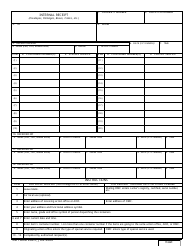

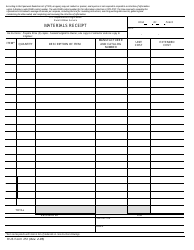

Receipt - Washington, D.C.

Receipt is a legal document that was released by the District of Columbia Courts - a government authority operating within Washington, D.C..

FAQ

Q: What is a receipt?

A: A receipt is a written record of a transaction that shows the items purchased and the amount paid.

Q: Why is a receipt important?

A: A receipt serves as proof of purchase and can be used for returns, exchanges, or to claim warranties.

Q: How long should I keep a receipt?

A: It is recommended to keep receipts for at least a year in case you need them for returns, warranties, or tax purposes.

Q: Can I get a receipt for a cash transaction?

A: Yes, you should always ask for a receipt when making a cash payment to keep a record of the transaction.

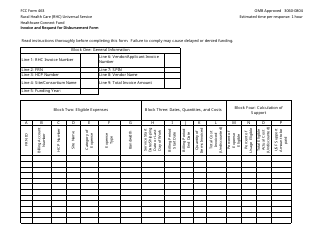

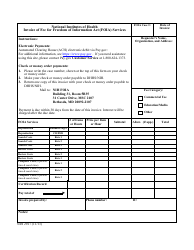

Q: What information should be on a receipt?

A: A receipt should include the date of the transaction, the items purchased, the price of each item, the total amount paid, and the method of payment.

Q: Can I get a duplicate receipt?

A: In most cases, you can request a duplicate receipt from the seller or business if you have lost or misplaced the original receipt.

Q: Do I need a receipt for tax purposes?

A: Having a receipt can be beneficial for tax purposes, especially if you plan to deduct certain expenses. It is recommended to keep receipts for tax-related transactions.

Q: What should I do if I receive an incorrect receipt?

A: If you receive an incorrect receipt, you should contact the seller or business and provide them with the necessary information to correct the error.

Q: Is a digital receipt acceptable?

A: Yes, in many cases, digital receipts are considered acceptable as proof of purchase. However, it is always a good idea to check with the specific retailer or business for their policy.

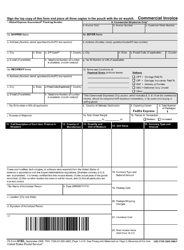

Form Details:

- Released on March 1, 2014;

- The latest edition currently provided by the District of Columbia Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the District of Columbia Courts.