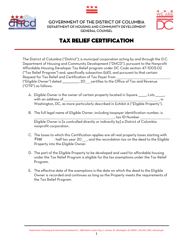

Request for Tax Relief and Certification of Tax Payer - Washington, D.C.

Request for Tax Relief and Certification of Tax Payer is a legal document that was released by the Washington DC Department of Housing and Community Development - a government authority operating within Washington, D.C..

FAQ

Q: What is the purpose of a request for tax relief?

A: A request for tax relief is made to seek relief from a tax liability or penalty.

Q: Who can submit a request for tax relief?

A: Any taxpayer can submit a request for tax relief.

Q: What is the certification of taxpayer?

A: Certification of taxpayer is a document that verifies the status of a taxpayer.

Q: Why would I need a certification of taxpayer?

A: You may need a certification of taxpayer to fulfill certain requirements or qualify for certain benefits.

Q: Can anyone request a certification of taxpayer?

A: Yes, any taxpayer can request a certification of taxpayer.

Q: How can I obtain a certification of taxpayer?

A: You can obtain a certification of taxpayer by submitting a request to the tax authority in Washington, D.C.

Form Details:

- The latest edition currently provided by the Washington DC Department of Housing and Community Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Department of Housing and Community Development.