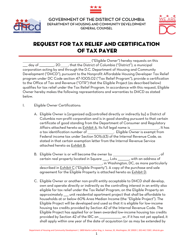

Tax Relief Certification - Washington, D.C.

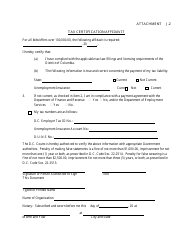

Tax Relief Certification is a legal document that was released by the Washington DC Department of Housing and Community Development - a government authority operating within Washington, D.C..

FAQ

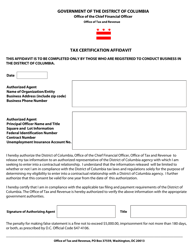

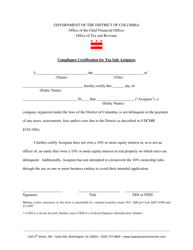

Q: What is Tax Relief Certification?

A: Tax Relief Certification is a program offered in Washington, D.C. that provides certain tax benefits to eligible residents.

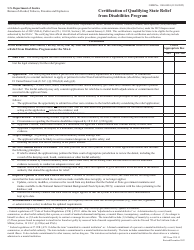

Q: Who is eligible for Tax Relief Certification in Washington, D.C.?

A: Eligible residents in Washington, D.C. who are elderly, disabled, or have limited income may qualify for Tax Relief Certification.

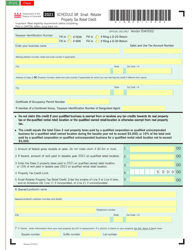

Q: What are the tax benefits of Tax Relief Certification in Washington, D.C.?

A: Tax Relief Certification in Washington, D.C. provides benefits such as exemption or reduction of property taxes.

Q: How can I apply for Tax Relief Certification in Washington, D.C.?

A: To apply for Tax Relief Certification in Washington, D.C., you need to complete an application form and provide supporting documentation. The application can be obtained from the Office of Tax and Revenue.

Q: Is there an income limit for Tax Relief Certification in Washington, D.C.?

A: Yes, there is an income limit for Tax Relief Certification in Washington, D.C. The specific limit may vary and is based on the size of the household.

Q: Can I apply for Tax Relief Certification if I'm not a resident of Washington, D.C.?

A: No, Tax Relief Certification is only available to eligible residents of Washington, D.C.

Q: What is the purpose of Tax Relief Certification in Washington, D.C.?

A: The purpose of Tax Relief Certification in Washington, D.C. is to provide financial assistance to eligible residents who may have difficulty affording their property taxes due to age, disability, or limited income.

Form Details:

- Released on July 1, 2015;

- The latest edition currently provided by the Washington DC Department of Housing and Community Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Department of Housing and Community Development.