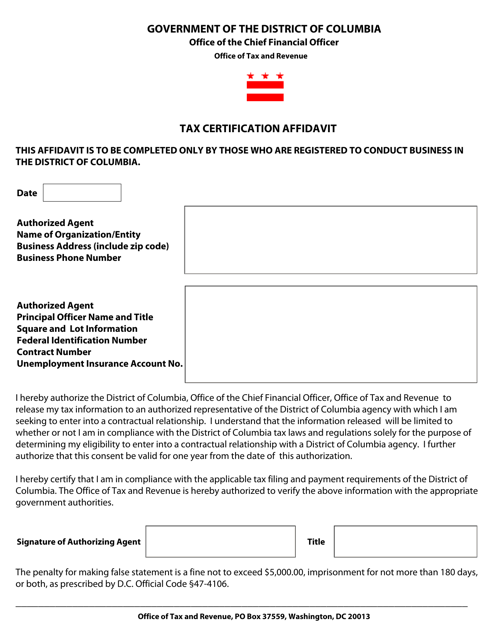

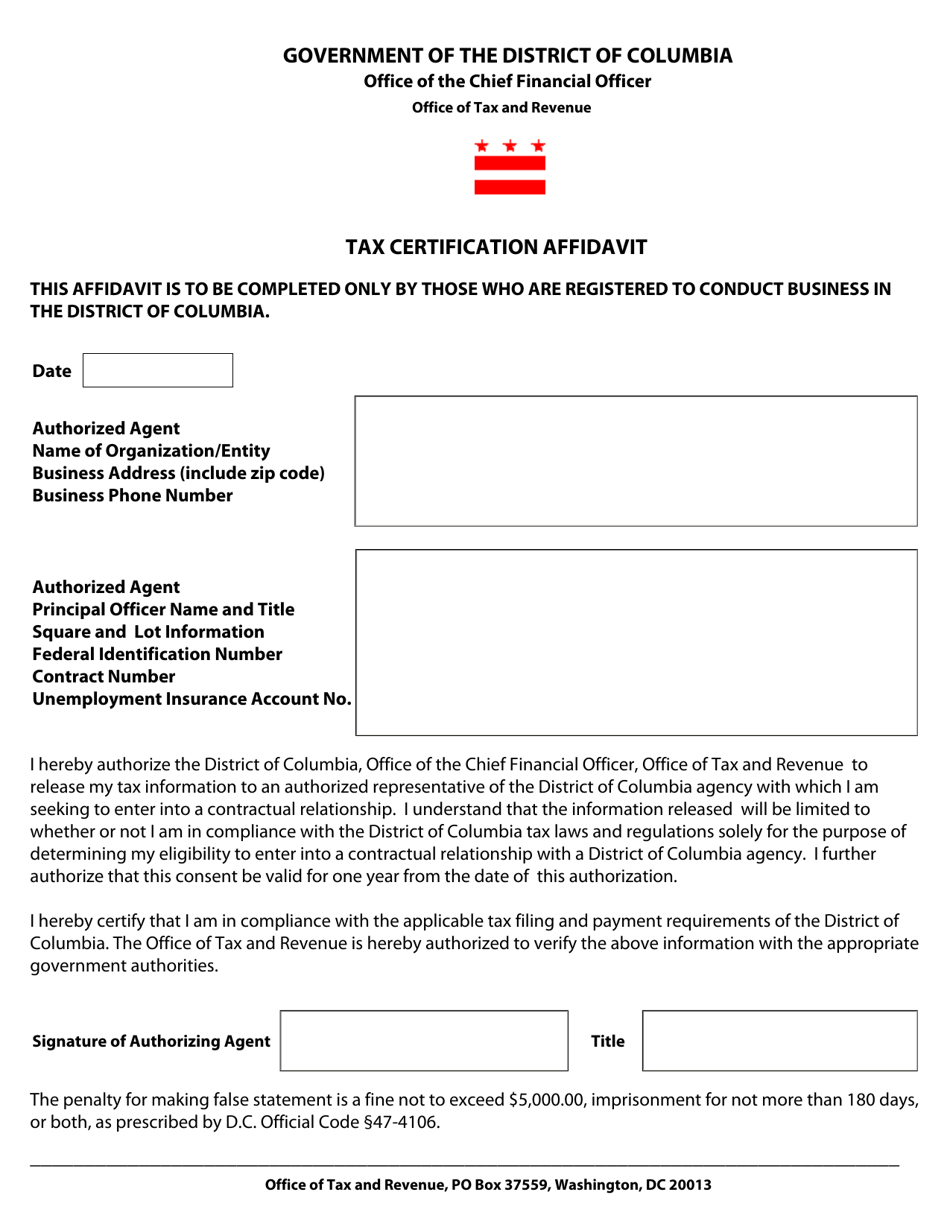

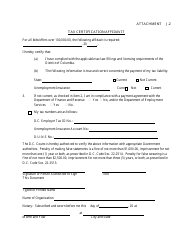

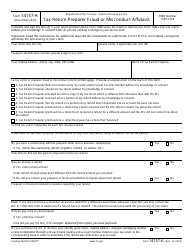

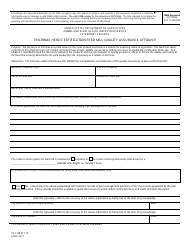

Tax Certification Affidavit - Washington, D.C.

Tax Certification Affidavit is a legal document that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C..

FAQ

Q: What is a Tax Certification Affidavit?

A: A Tax Certification Affidavit is a document used to certify the taxpayer's compliance with tax laws.

Q: When is a Tax Certification Affidavit required?

A: A Tax Certification Affidavit is typically required when applying for certain licenses or permits.

Q: What is the purpose of a Tax Certification Affidavit?

A: The purpose of a Tax Certification Affidavit is to ensure that the taxpayer is up to date with their tax obligations.

Q: Who needs to complete a Tax Certification Affidavit?

A: Individuals or businesses applying for licenses or permits in Washington, D.C. may need to complete a Tax Certification Affidavit.

Q: How can I obtain a Tax Certification Affidavit?

A: You can obtain a Tax Certification Affidavit from the Washington, D.C. Department of Consumer and Regulatory Affairs.

Q: What information is required in a Tax Certification Affidavit?

A: A Tax Certification Affidavit typically requires information such as the taxpayer's name, address, social security number or taxpayer identification number, and a statement affirming tax compliance.

Q: Are there any fees associated with a Tax Certification Affidavit?

A: There may be fees associated with obtaining a Tax Certification Affidavit. Contact the Department of Consumer and Regulatory Affairs for more information.

Q: What happens if I don't submit a Tax Certification Affidavit?

A: Failure to submit a Tax Certification Affidavit when required may result in the denial of a license or permit application.

Q: How long is a Tax Certification Affidavit valid?

A: The validity period of a Tax Certification Affidavit may vary depending on the specific license or permit being applied for. Check with the relevant licensing authority for more information.

Form Details:

- The latest edition currently provided by the Washington DC Office of Tax and Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.