This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

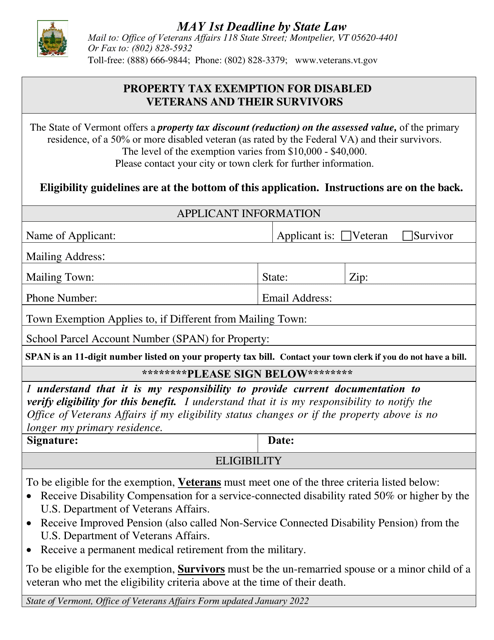

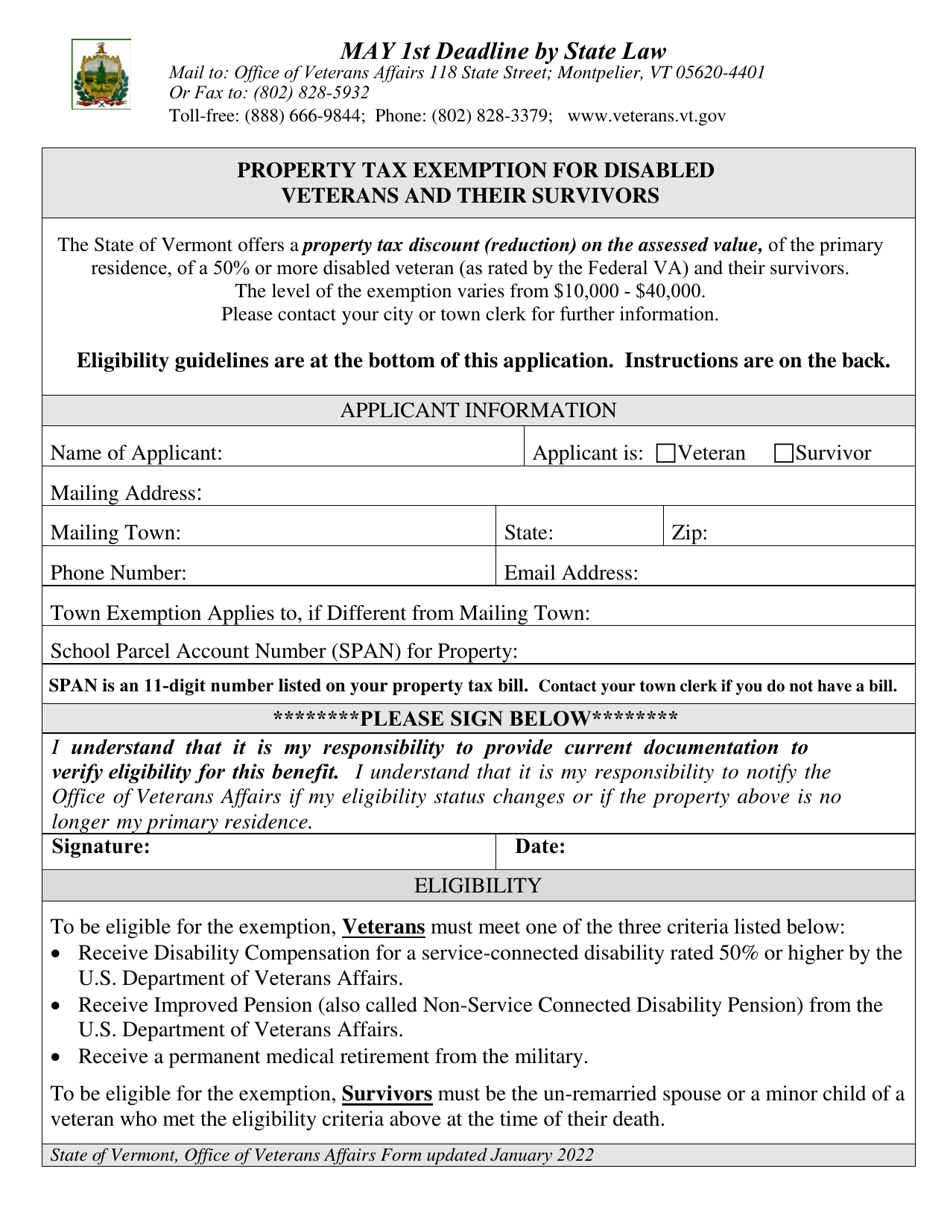

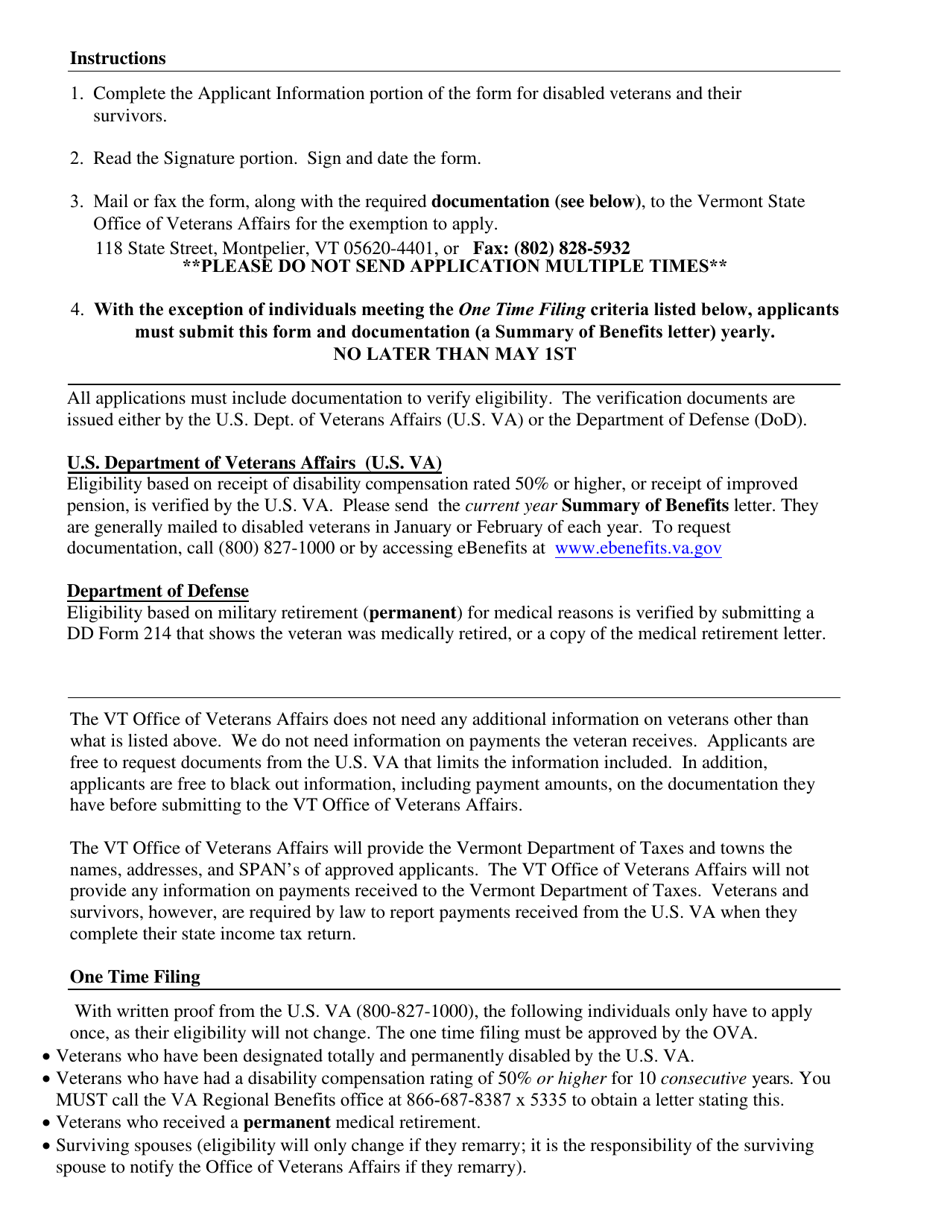

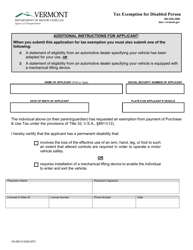

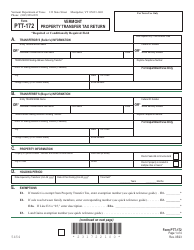

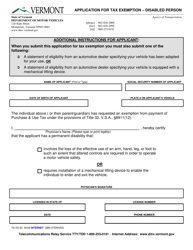

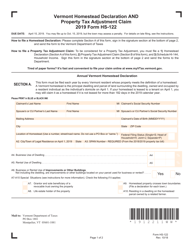

Property Tax Exemption for Disabled Veterans and Their Survivors - Vermont

Property Tax Exemption for Disabled Veterans and Their Survivors is a legal document that was released by the Vermont Department of Veterans Affairs - a government authority operating within Vermont.

FAQ

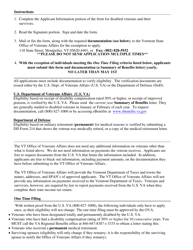

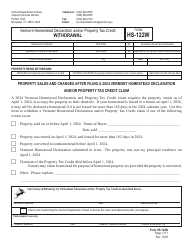

Q: Who is eligible for property tax exemption for disabled veterans and their survivors in Vermont?

A: Disabled veterans and their surviving spouses or parents may be eligible for property tax exemption in Vermont.

Q: What is the requirement for property tax exemption for disabled veterans and their survivors in Vermont?

A: The veteran must have a service-connected disability rated at 50% or higher to qualify for the property tax exemption in Vermont.

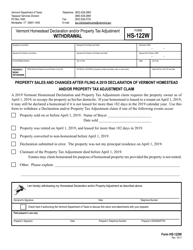

Q: What is the benefit of property tax exemption for disabled veterans and their survivors in Vermont?

A: The property tax exemption provides a reduction or complete waiver of property taxes for eligible disabled veterans and their survivors in Vermont.

Q: How can disabled veterans and their survivors apply for property tax exemption in Vermont?

A: Disabled veterans and their survivors can apply for property tax exemption by filing an application with their local town assessor's office in Vermont.

Q: Is there a deadline for applying for property tax exemption for disabled veterans and their survivors in Vermont?

A: Yes, the application for property tax exemption must be filed by April 1st each year in Vermont.

Form Details:

- The latest edition currently provided by the Vermont Department of Veterans Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Veterans Affairs.