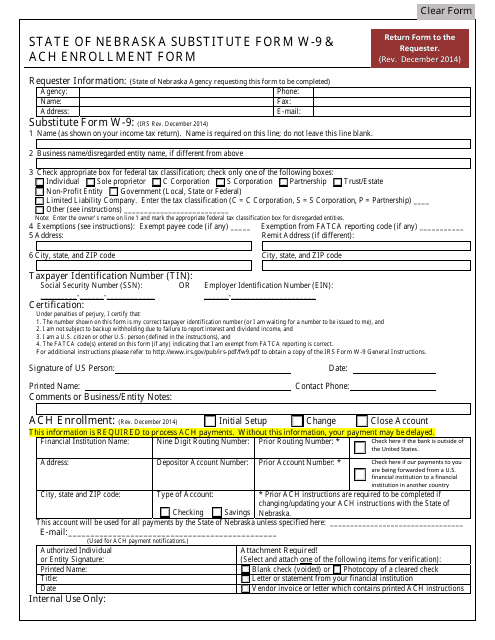

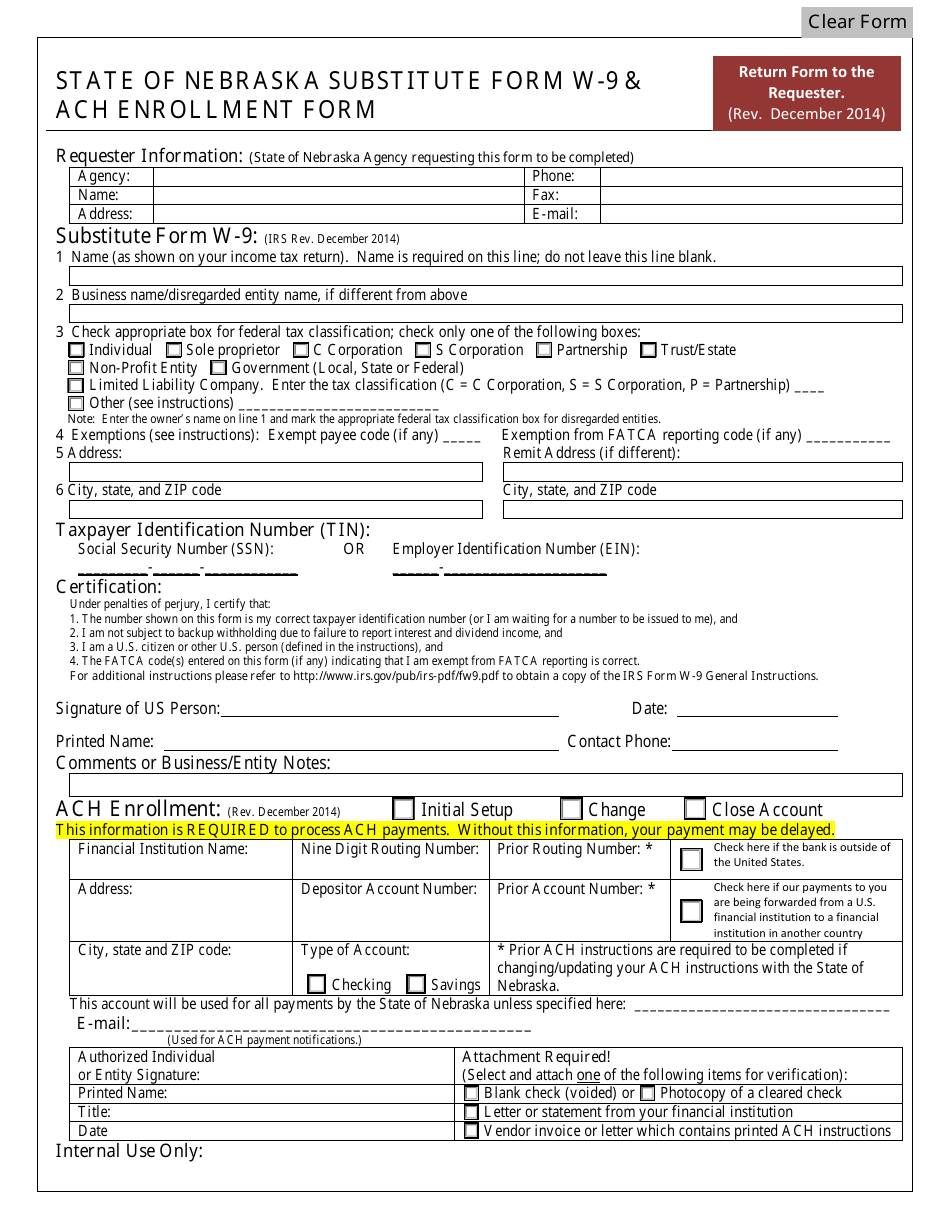

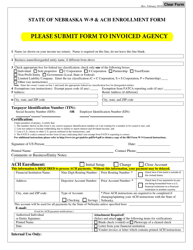

State of Nebraska Substitute Form W-9 & ACH Enrollment Form - Nebraska

State of Nebraska Substitute Form W-9 & ACH Enrollment Form is a legal document that was released by the Nebraska Department of Education - a government authority operating within Nebraska.

FAQ

Q: What is the State of Nebraska Substitute Form W-9?

A: The State of Nebraska Substitute Form W-9 is a form used by individuals or entities to provide their taxpayer identification number to the State of Nebraska for tax purposes.

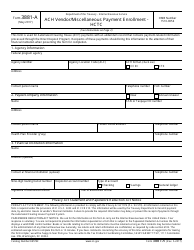

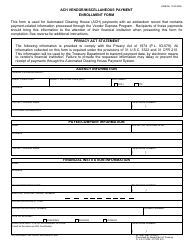

Q: What is the ACH Enrollment Form for Nebraska?

A: The ACH Enrollment Form for Nebraska is a form used to authorize the State of Nebraska to initiate electronic fund transfers from a bank account for tax payments or other financial transactions.

Q: How do I complete the State of Nebraska Substitute Form W-9?

A: To complete the State of Nebraska Substitute Form W-9, you will need to provide your name, taxpayer identification number, business name (if applicable), address, and other requested information.

Q: How do I complete the ACH Enrollment Form for Nebraska?

A: To complete the ACH Enrollment Form for Nebraska, you will need to provide your banking information, including your bank account number and routing number, as well as other requested information.

Q: Are these forms mandatory?

A: The State of Nebraska Substitute Form W-9 is required if you are conducting business with the State of Nebraska and need to provide your taxpayer identification number. The ACH Enrollment Form for Nebraska is optional, but it can be convenient for making electronic tax payments.

Q: Are there any fees for submitting these forms?

A: There are no fees for submitting the State of Nebraska Substitute Form W-9 or the ACH Enrollment Form for Nebraska.

Q: What is the purpose of the State of Nebraska Substitute Form W-9?

A: The purpose of the State of Nebraska Substitute Form W-9 is to collect taxpayer identification numbers for tax reporting and compliance with state laws.

Q: What is the purpose of the ACH Enrollment Form for Nebraska?

A: The purpose of the ACH Enrollment Form for Nebraska is to authorize the State of Nebraska to initiate electronic fund transfers from a bank account for tax payments or other financial transactions.

Form Details:

- Released on December 1, 2014;

- The latest edition currently provided by the Nebraska Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Education.