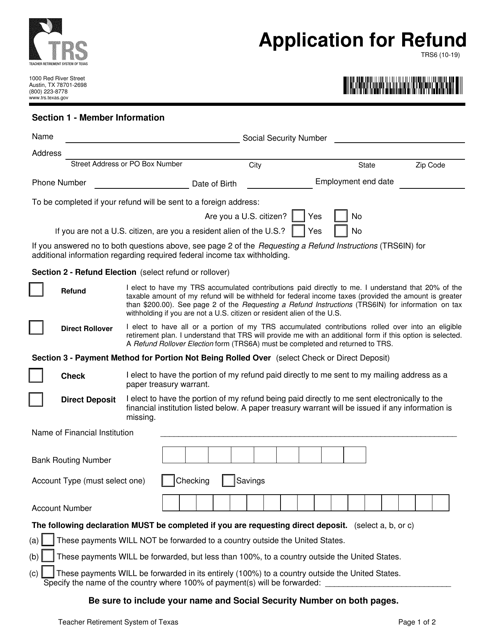

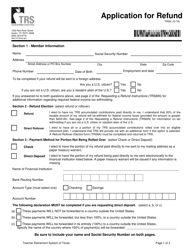

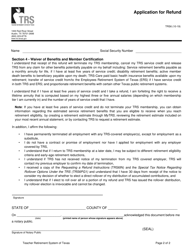

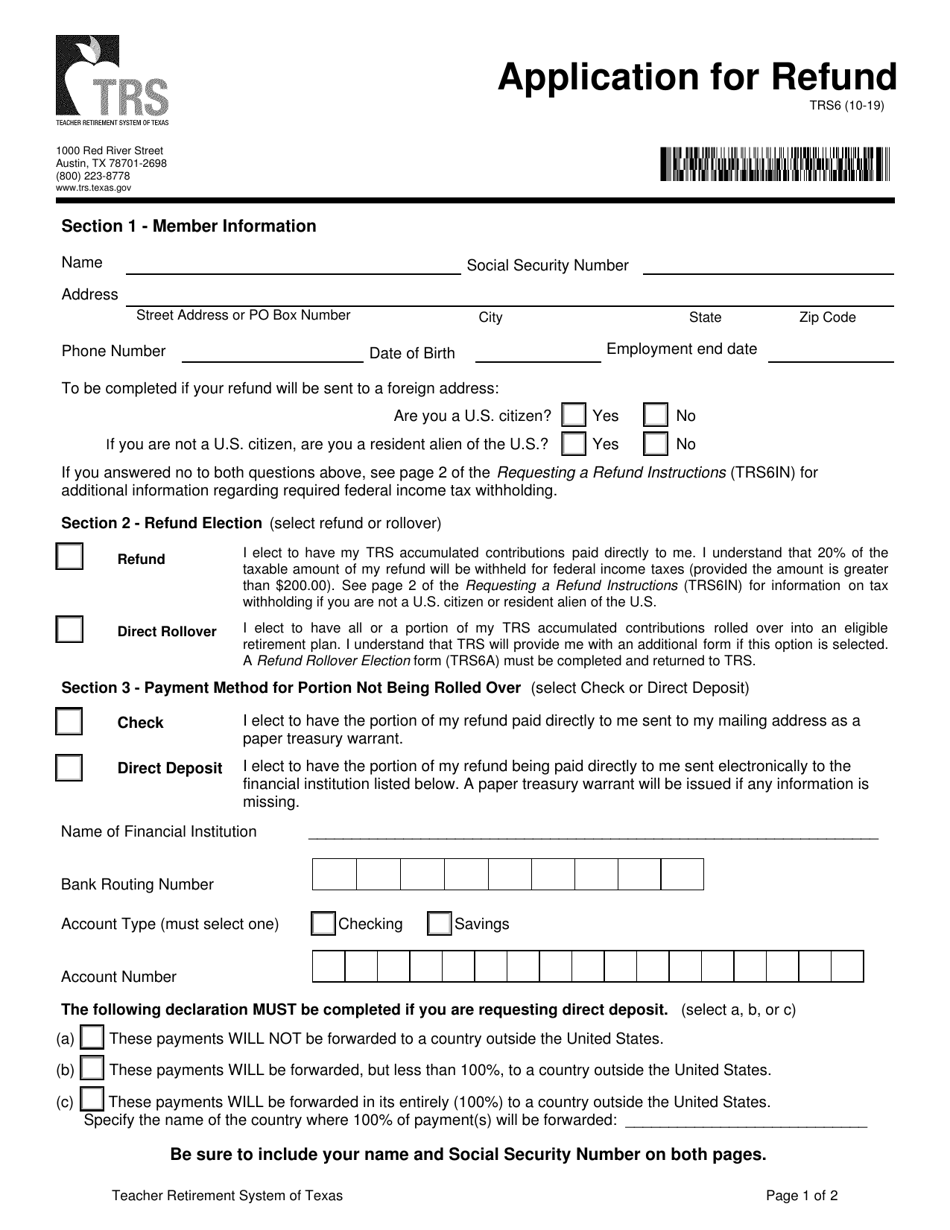

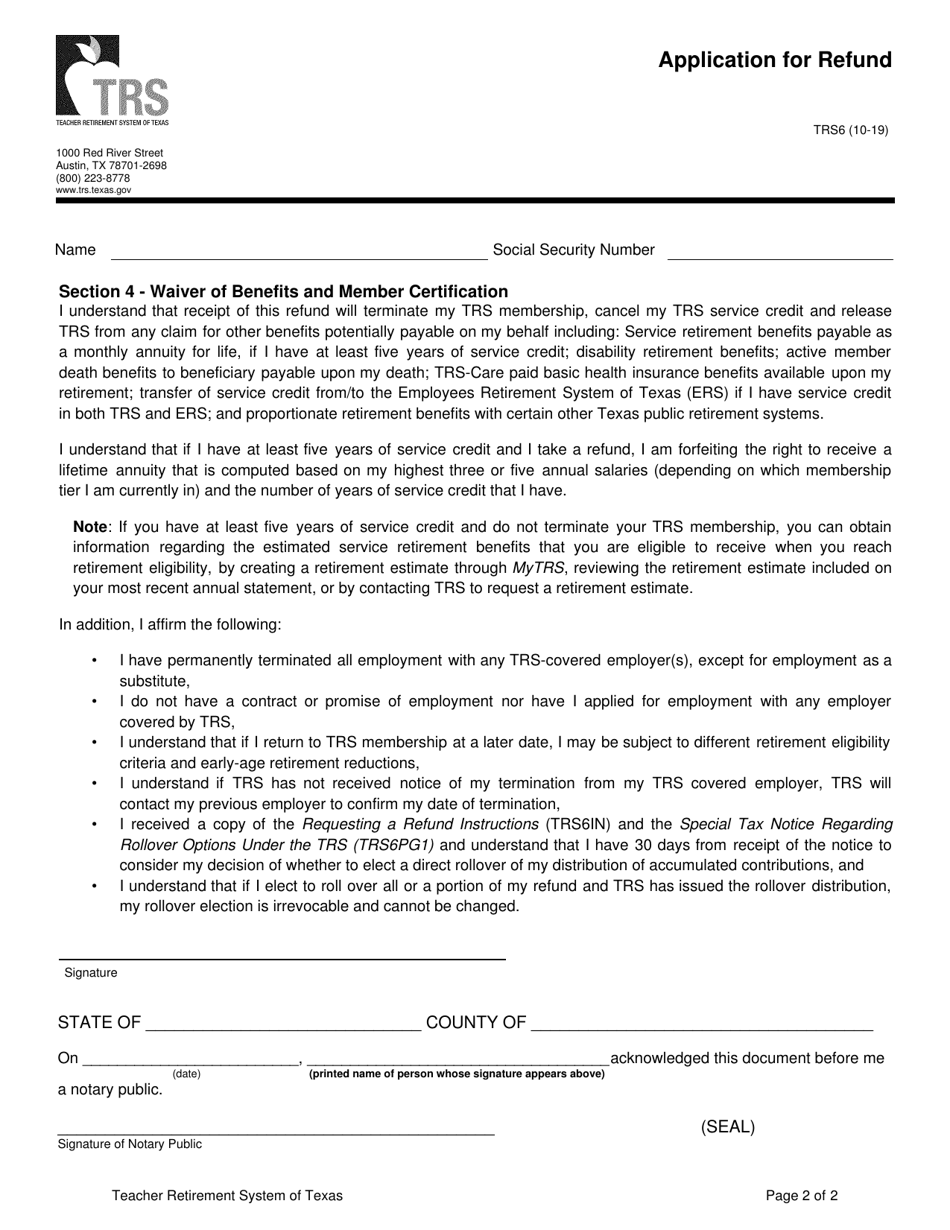

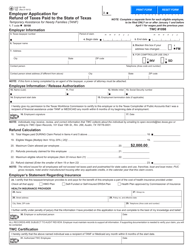

Form TRS6 Application for Refund - Texas

What Is Form TRS6?

This is a legal form that was released by the Teacher Retirement System of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

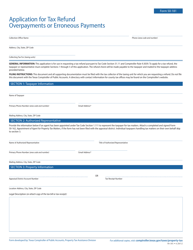

Q: What is the TRS6 Application for Refund?

A: The TRS6 Application for Refund is a form used in Texas to request a refund of sales tax paid on qualifying items.

Q: Who can use the TRS6 Application for Refund?

A: Any individual or business that has paid sales tax on qualifying items in Texas can use the TRS6 Application for Refund.

Q: What are qualifying items for a refund?

A: Qualifying items for a refund include certain items used in the production, processing, or fabrication of tangible personal property for sale.

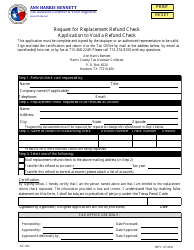

Q: How long does it take to receive a refund?

A: The processing time for a refund varies, but it typically takes several weeks.

Q: Are there any fees associated with filing the TRS6 Application for Refund?

A: No, there are no fees associated with filing the TRS6 Application for Refund.

Q: What documentation do I need to include with the TRS6 Application for Refund?

A: You will need to include copies of invoices or receipts showing the sales tax paid on the qualifying items.

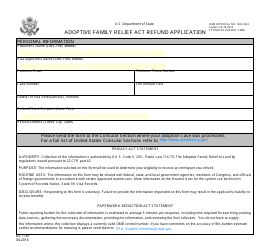

Q: Can I claim a refund for sales tax paid in previous years?

A: Yes, you can claim a refund for sales tax paid in previous years as long as it falls within the statute of limitations.

Q: What is the statute of limitations for filing a refund?

A: The statute of limitations for filing a refund varies depending on the specific circumstances, so it is best to check with the Texas Comptroller's office.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Teacher Retirement System of Texas;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TRS6 by clicking the link below or browse more documents and templates provided by the Teacher Retirement System of Texas.