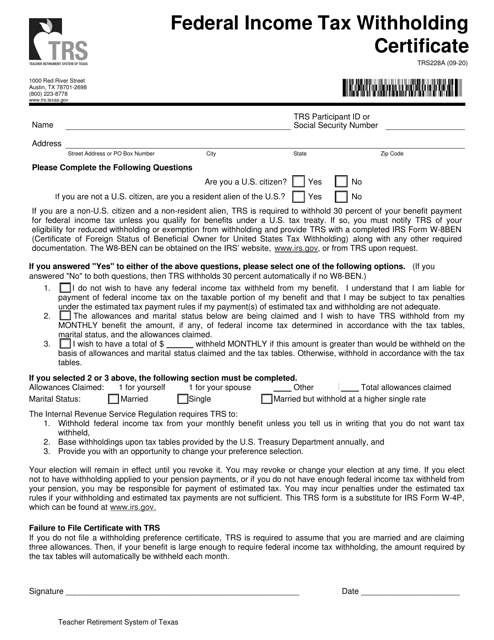

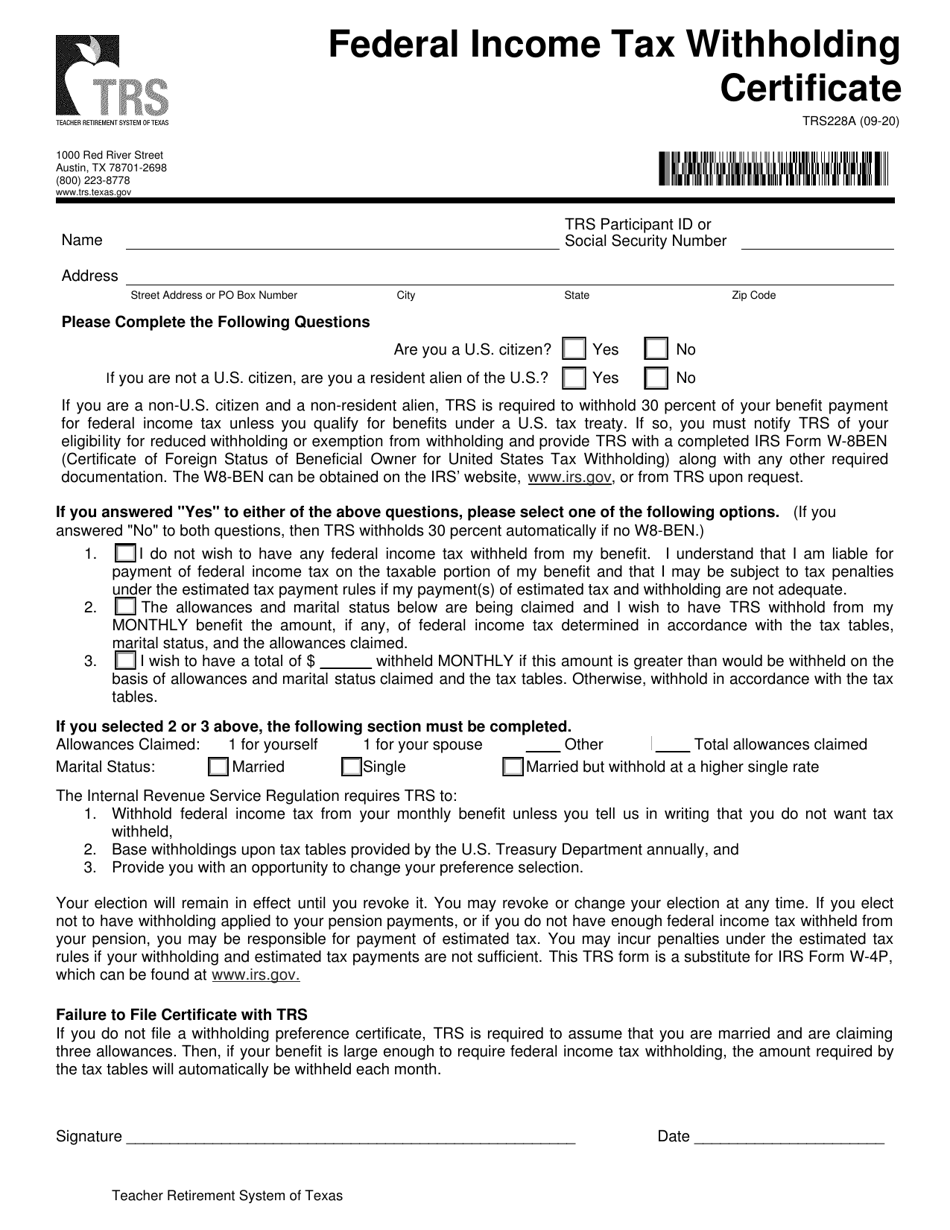

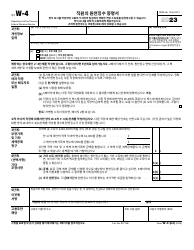

Form TRS228A Federal Income Tax Withholding Certificate - Texas

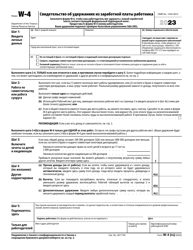

What Is Form TRS228A?

This is a legal form that was released by the Teacher Retirement System of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TRS228A?

A: Form TRS228A is the Federal Income Tax Withholding Certificate specific to Texas.

Q: Who needs to use Form TRS228A?

A: Employees living and working in Texas who want to adjust their federal incometax withholding should use Form TRS228A.

Q: How do I fill out Form TRS228A?

A: You need to provide your personal information, calculate your allowances, and sign the form to complete it.

Q: What is the purpose of Form TRS228A?

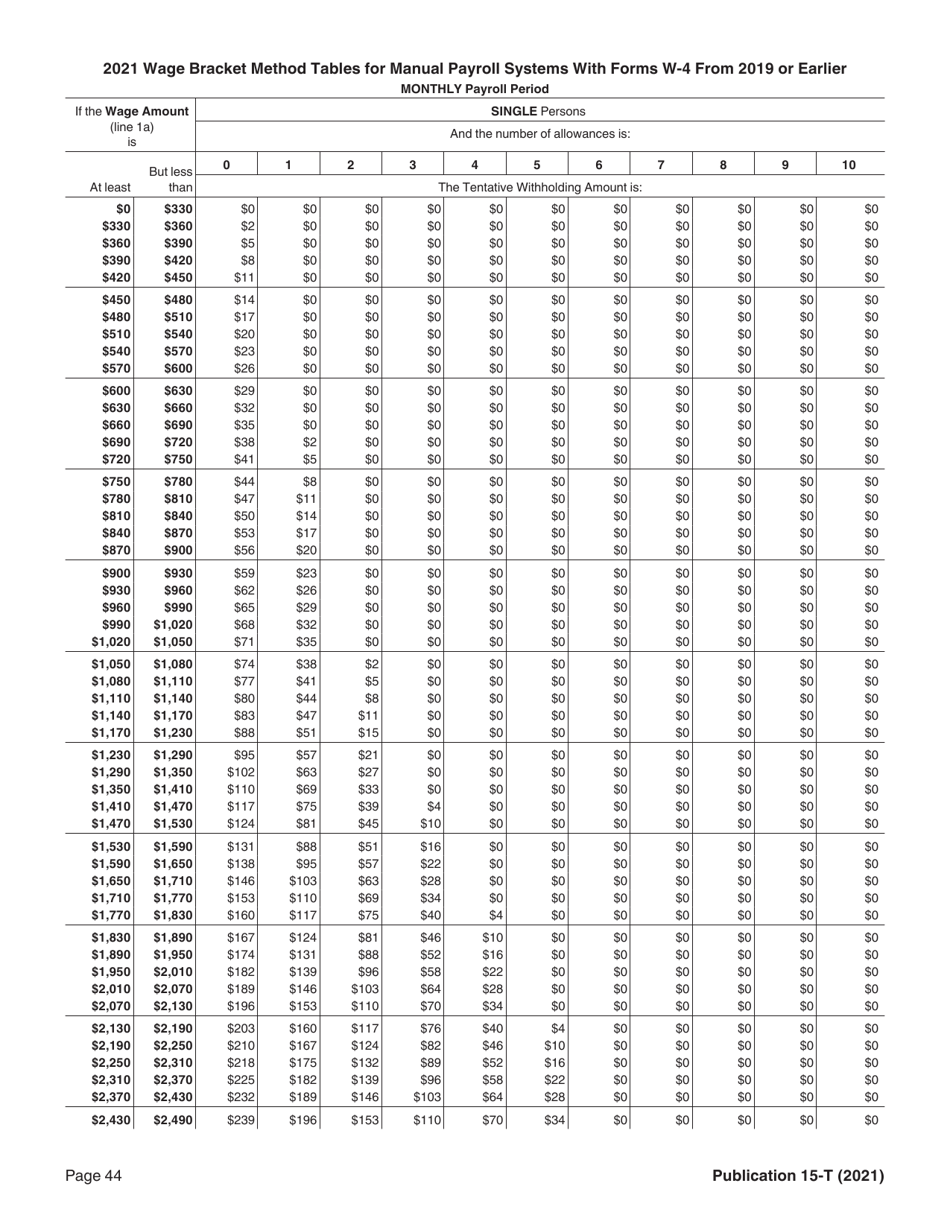

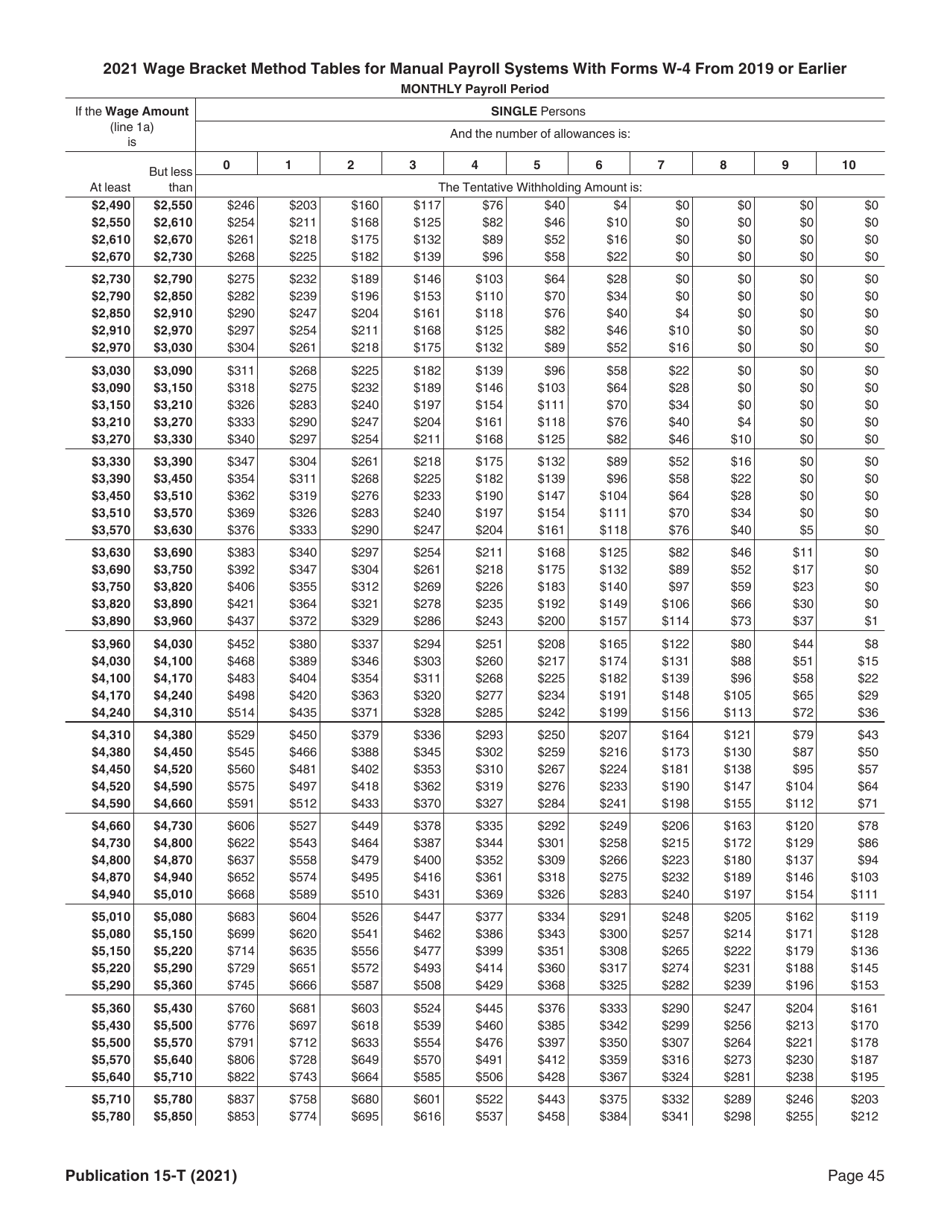

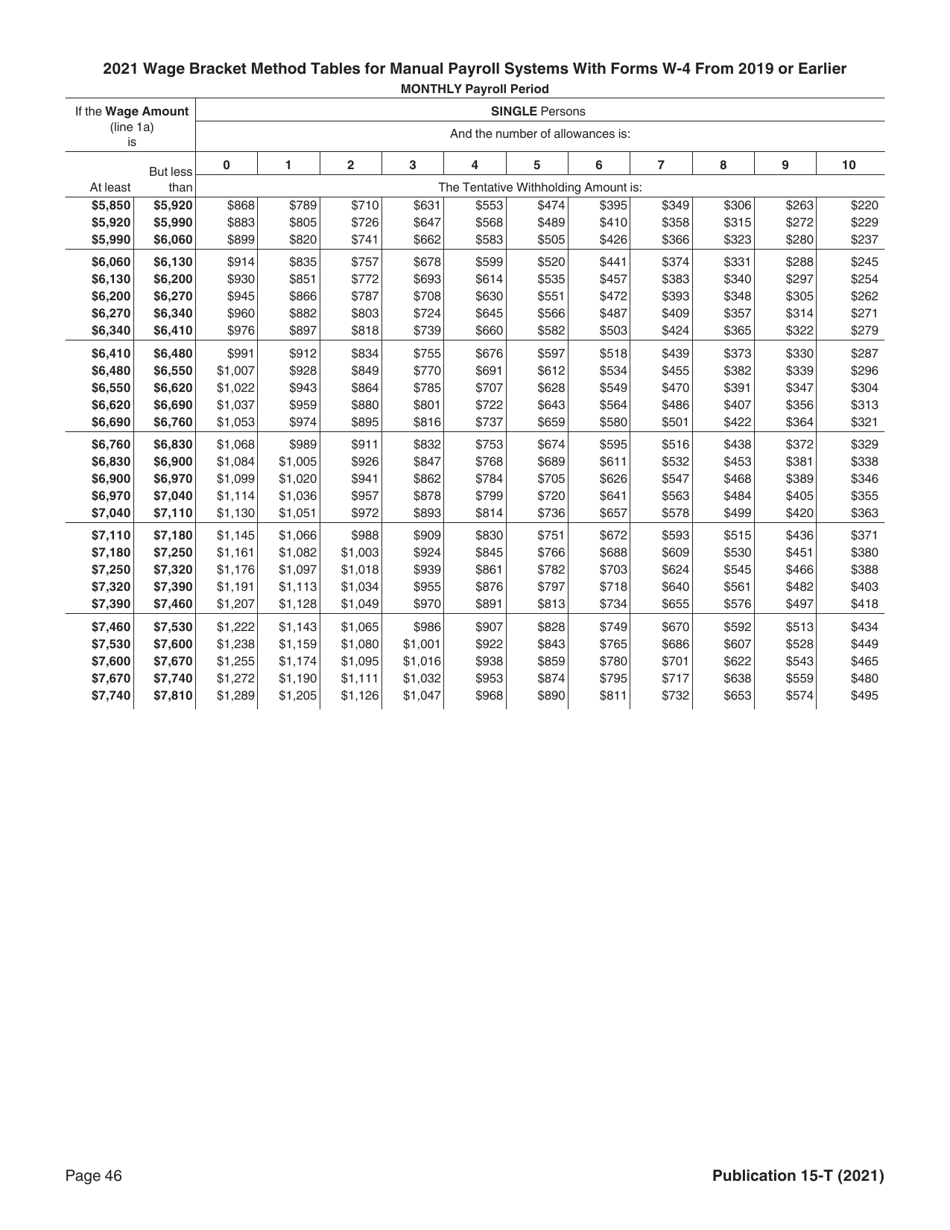

A: Form TRS228A is used to determine the appropriate amount of federal income tax to withhold from your wages based on your individual circumstances.

Q: Do I need to submit Form TRS228A every year?

A: It is recommended to review and update your federal income tax withholding each year, so you may need to submit a new Form TRS228A if your circumstances change.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Teacher Retirement System of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TRS228A by clicking the link below or browse more documents and templates provided by the Teacher Retirement System of Texas.