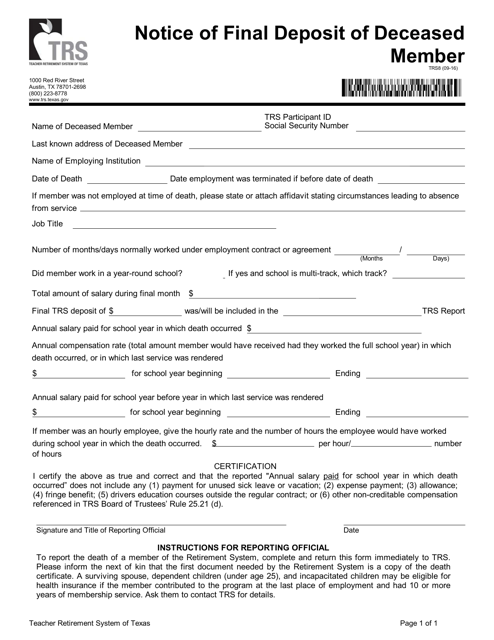

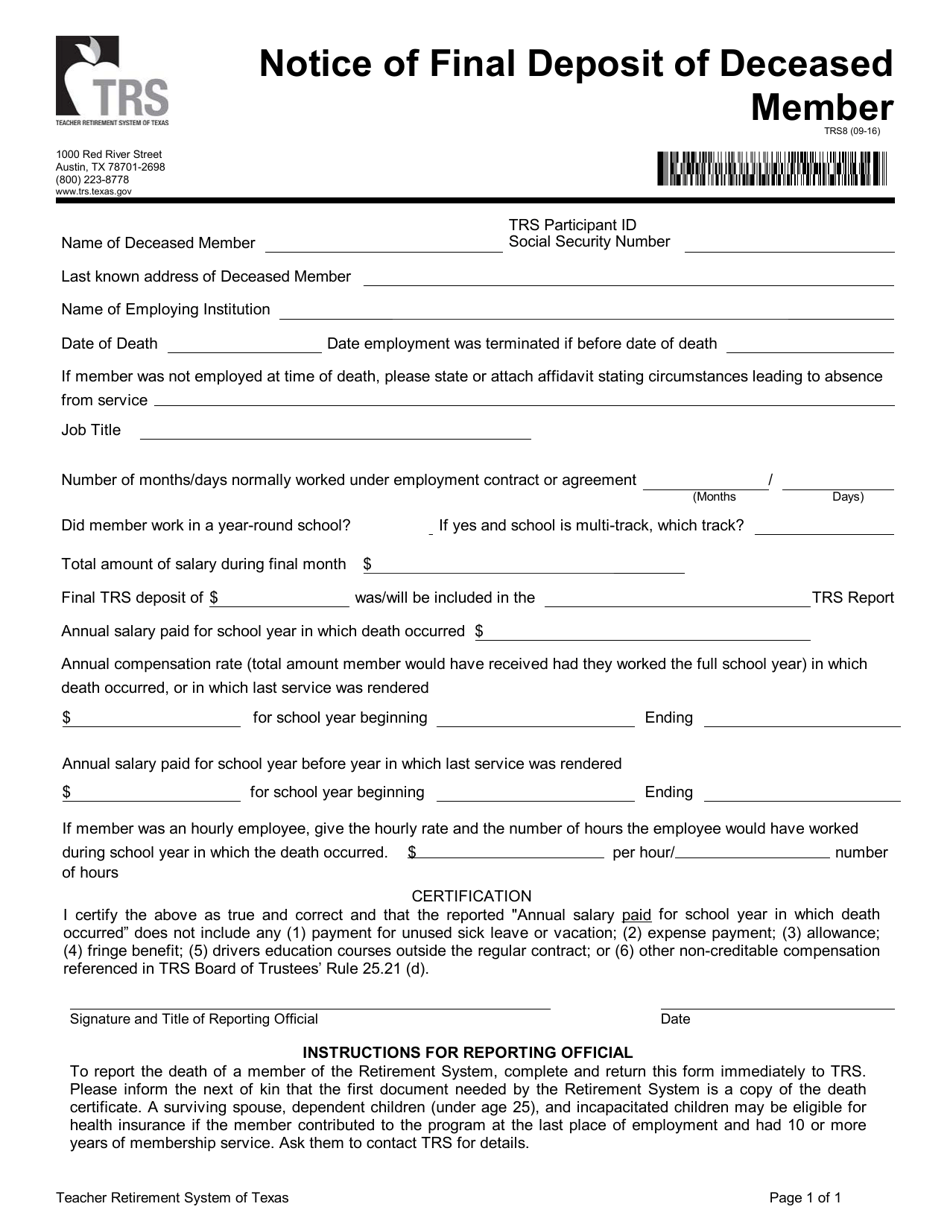

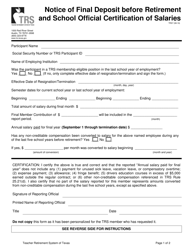

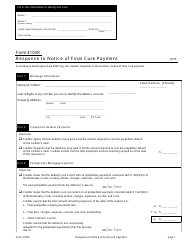

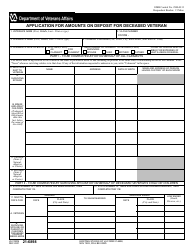

Form TRS8 Notice of Final Deposit of Deceased Member - Texas

What Is Form TRS8?

This is a legal form that was released by the Teacher Retirement System of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a TRS8 Notice of Final Deposit of Deceased Member?

A: The TRS8 Notice of Final Deposit of Deceased Member is a form used in Texas to report the final deposit of a deceased member's retirement account with the Teacher Retirement System (TRS).

Q: Who needs to file a TRS8 Notice of Final Deposit of Deceased Member?

A: The person responsible for handling the deceased member's affairs, such as an executor or administrator of the estate, needs to file the TRS8 form.

Q: What information is required on the TRS8 form?

A: The TRS8 form requires information such as the deceased member's name, TRS ID number, date of death, and details of the final deposit.

Q: When should the TRS8 form be filed?

A: The TRS8 form should be filed as soon as possible after the death of the TRS member, typically within 90 days.

Q: Is there a fee to file the TRS8 form?

A: No, there is no fee to file the TRS8 form.

Q: What happens after the TRS8 form is filed?

A: After the TRS8 form is filed and processed, the final deposit from the deceased member's retirement account will be issued to the designated beneficiary or estate.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Teacher Retirement System of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TRS8 by clicking the link below or browse more documents and templates provided by the Teacher Retirement System of Texas.