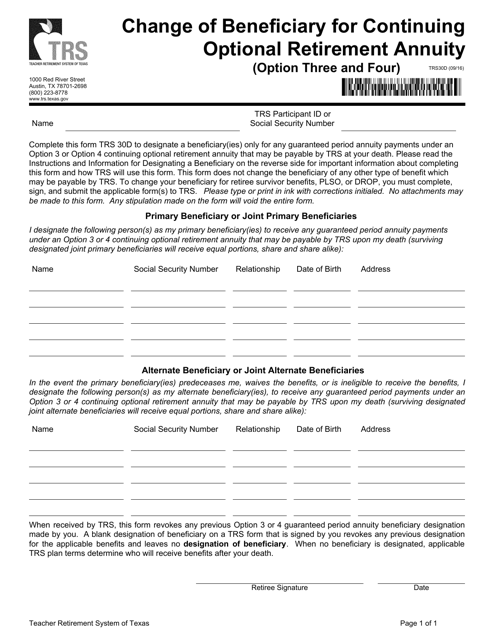

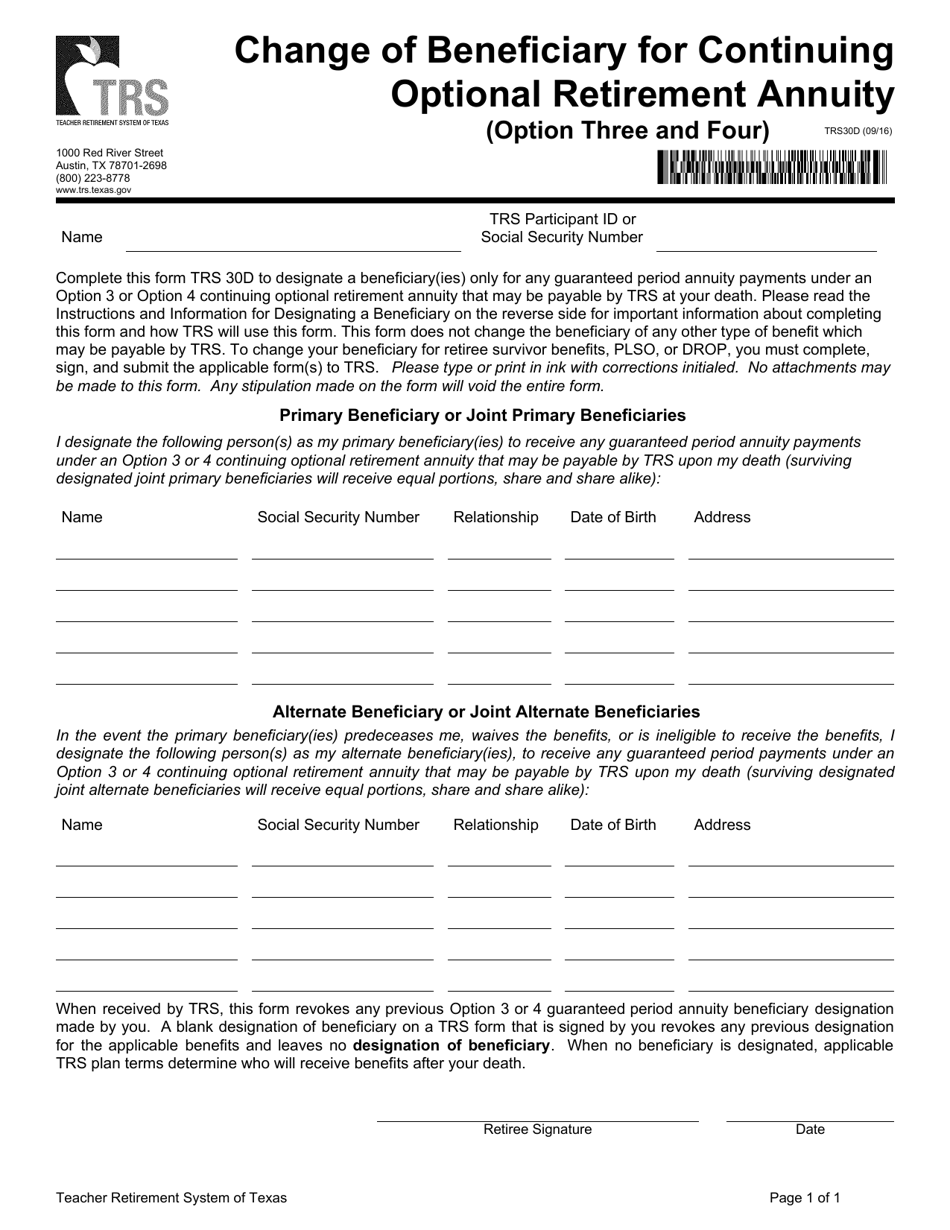

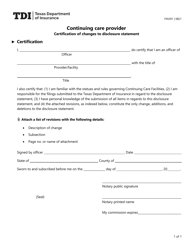

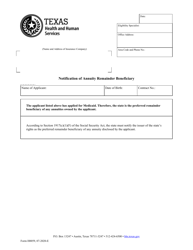

Form TRS30D Change of Beneficiary for Continuing Optional Retirement Annuity (Option Three and Four) - Texas

What Is Form TRS30D?

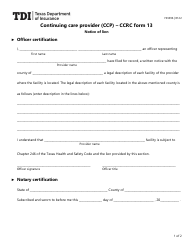

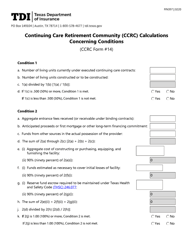

This is a legal form that was released by the Teacher Retirement System of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TRS30D?

A: Form TRS30D is the Change of Beneficiary form for the Continuing Optional Retirement Annuity (Option Three and Four) in Texas.

Q: What is the purpose of Form TRS30D?

A: The purpose of Form TRS30D is to change the beneficiary for the Continuing Optional Retirement Annuity (Option Three and Four) in Texas.

Q: Who can use Form TRS30D?

A: This form can be used by individuals who have a Continuing Optional Retirement Annuity (Option Three and Four) in Texas and want to change their beneficiary.

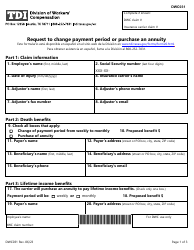

Q: How do I fill out Form TRS30D?

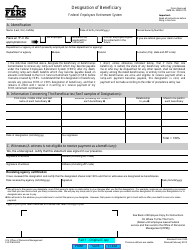

A: To fill out Form TRS30D, you need to provide your personal information, the current beneficiary information, and the new beneficiary information.

Q: Are there any fees associated with submitting Form TRS30D?

A: There are no fees associated with submitting Form TRS30D.

Q: What should I do after submitting Form TRS30D?

A: After submitting Form TRS30D, you should keep a copy for your records and notify your new beneficiary of the change.

Q: Is there a deadline for submitting Form TRS30D?

A: There is no specific deadline for submitting Form TRS30D, but it is recommended to submit it as soon as you want to change your beneficiary.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Teacher Retirement System of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TRS30D by clicking the link below or browse more documents and templates provided by the Teacher Retirement System of Texas.