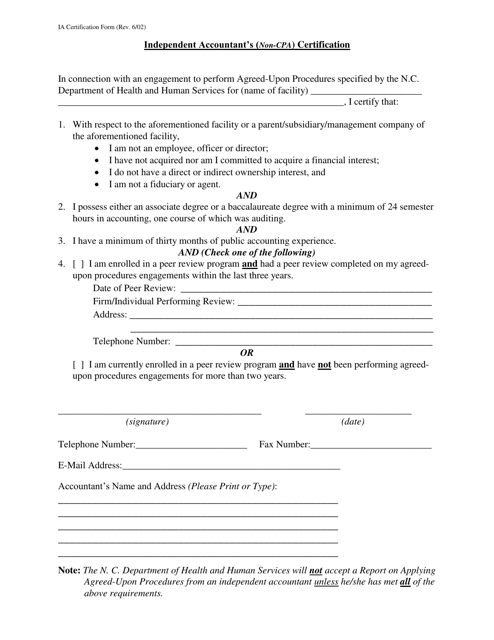

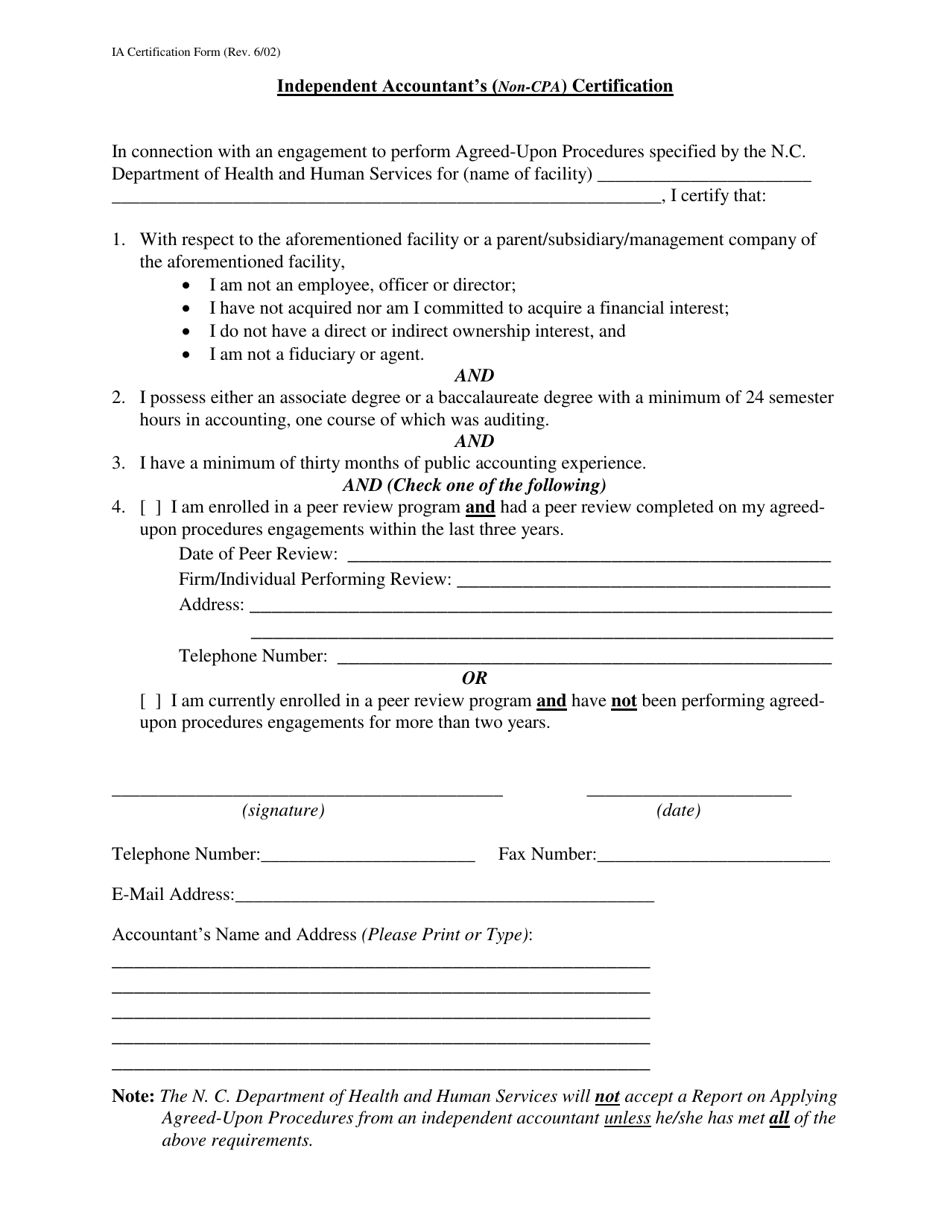

Independent Accountant's (Non-CPA) Certification - North Carolina

Independent Accountant's (Non-CPA) Certification is a legal document that was released by the North Carolina Department of Health and Human Services - a government authority operating within North Carolina.

FAQ

Q: What is an Independent Accountant's (Non-CPA) Certification?

A: An Independent Accountant's (Non-CPA) Certification is a certification that allows individuals who are not licensed Certified Public Accountants (CPAs) to provide accounting services in North Carolina.

Q: Who can obtain an Independent Accountant's (Non-CPA) Certification in North Carolina?

A: Anyone who meets the requirements set by the North Carolina State Board of CPA Examiners can obtain an Independent Accountant's (Non-CPA) Certification.

Q: What services can individuals with an Independent Accountant's (Non-CPA) Certification provide?

A: Individuals with an Independent Accountant's (Non-CPA) Certification can provide services such as bookkeeping, tax preparation, and financial statement preparation.

Q: What are the requirements for obtaining an Independent Accountant's (Non-CPA) Certification in North Carolina?

A: The requirements for obtaining an Independent Accountant's (Non-CPA) Certification in North Carolina include a minimum of a bachelor's degree in accounting or a related field, completion of specific accounting coursework, and passing an examination.

Q: Is an Independent Accountant's (Non-CPA) Certification equivalent to a CPA license?

A: No, an Independent Accountant's (Non-CPA) Certification is not equivalent to a CPA license. It is a separate certification that allows individuals without a CPA license to provide accounting services.

Form Details:

- Released on June 1, 2002;

- The latest edition currently provided by the North Carolina Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Health and Human Services.