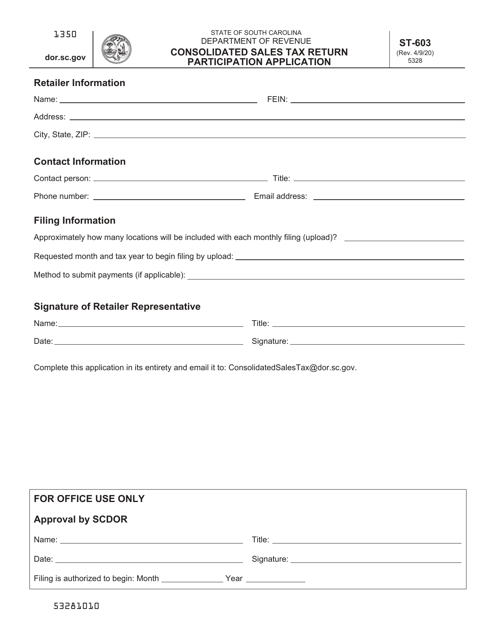

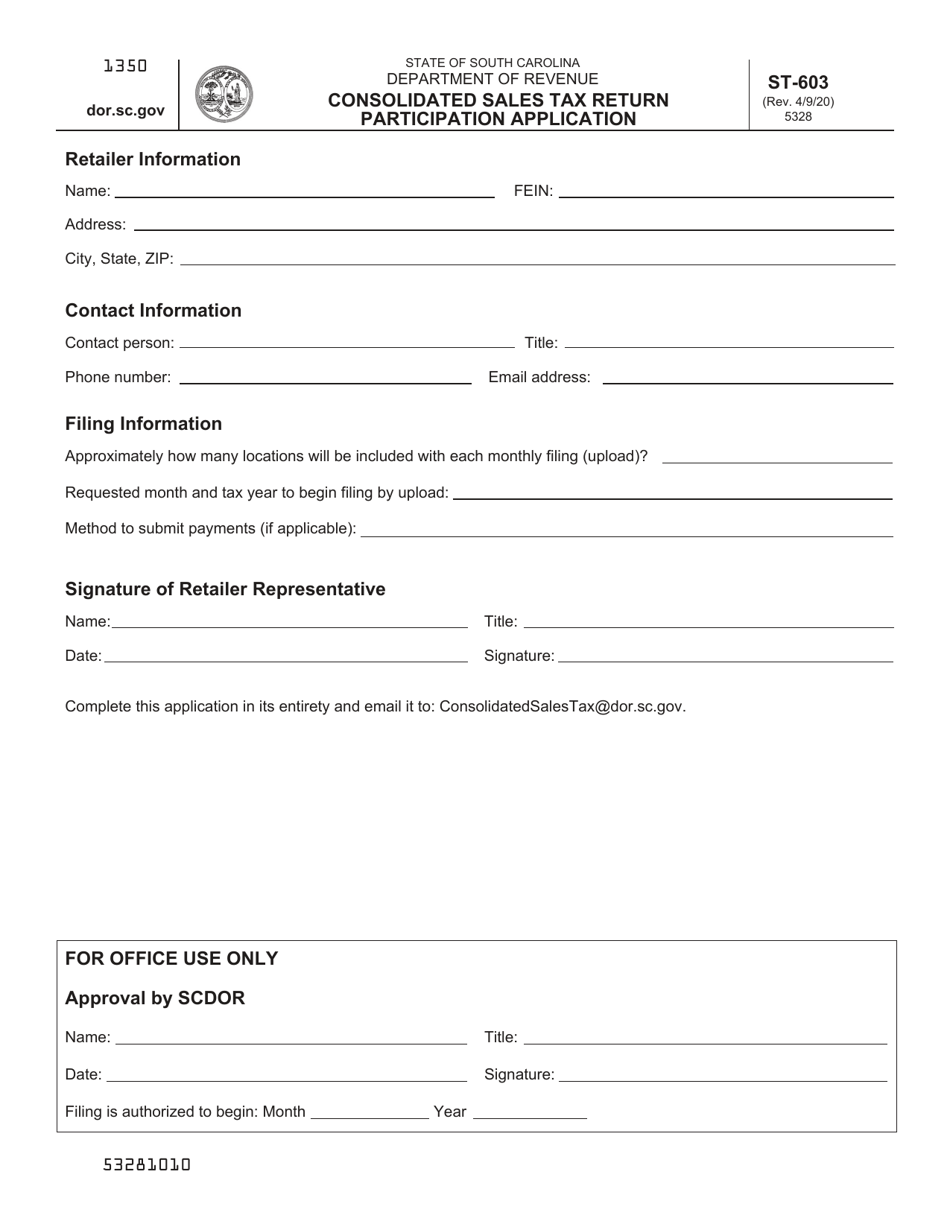

Form ST-603 Consolidated Sales Tax Return Participation Application - South Carolina

What Is Form ST-603?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-603?

A: Form ST-603 is the Consolidated Sales Tax Return Participation Application used in South Carolina.

Q: What is the purpose of Form ST-603?

A: The purpose of Form ST-603 is to apply for participation in the Consolidated Sales Tax Return program in South Carolina.

Q: Who needs to fill out Form ST-603?

A: Businesses in South Carolina who want to participate in the Consolidated Sales Tax Return program need to fill out Form ST-603.

Q: What is the Consolidated Sales Tax Return program?

A: The Consolidated Sales Tax Return program allows eligible businesses to report and remit sales tax on a consolidated basis for multiple locations or entities.

Q: Is there a deadline for submitting Form ST-603?

A: Yes, Form ST-603 must be submitted to the South Carolina Department of Revenue by the due date specified by the department.

Q: Are there any fees associated with Form ST-603?

A: There are no fees associated with Form ST-603.

Q: What supporting documents are required with Form ST-603?

A: Supporting documents such as a list of locations or entities, sales tax returns for each location or entity, and other required information may be required with Form ST-603.

Q: What should I do if I have questions about Form ST-603?

A: If you have questions about Form ST-603, you should contact the South Carolina Department of Revenue for assistance.

Form Details:

- Released on April 9, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-603 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.