This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-8A

for the current year.

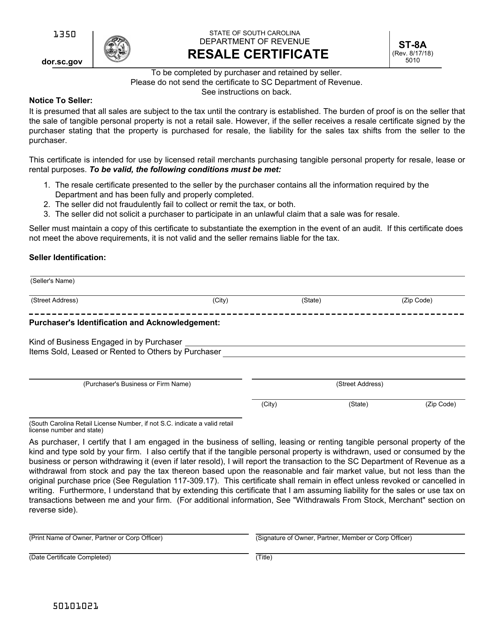

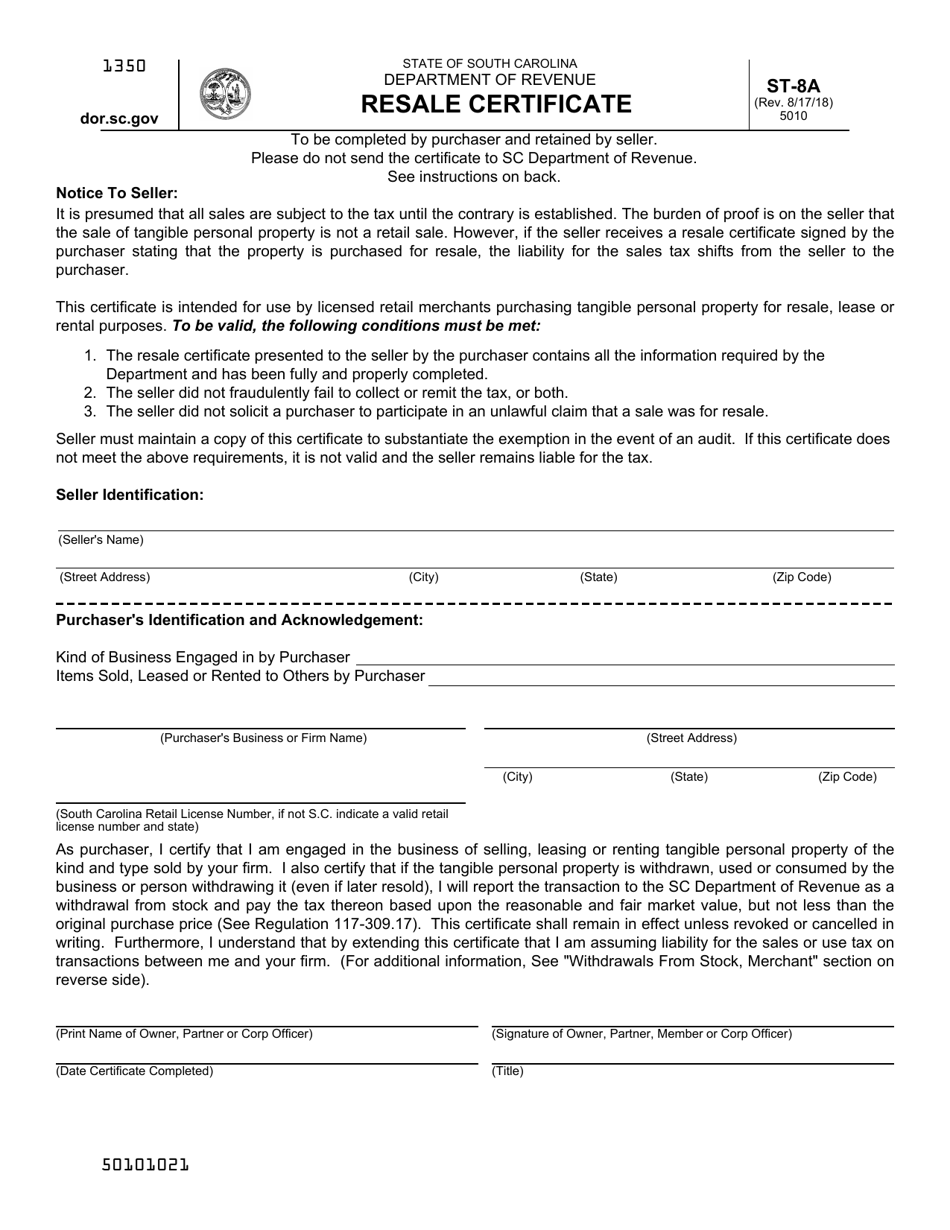

Form ST-8A Resale Certificate - South Carolina

What Is Form ST-8A?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

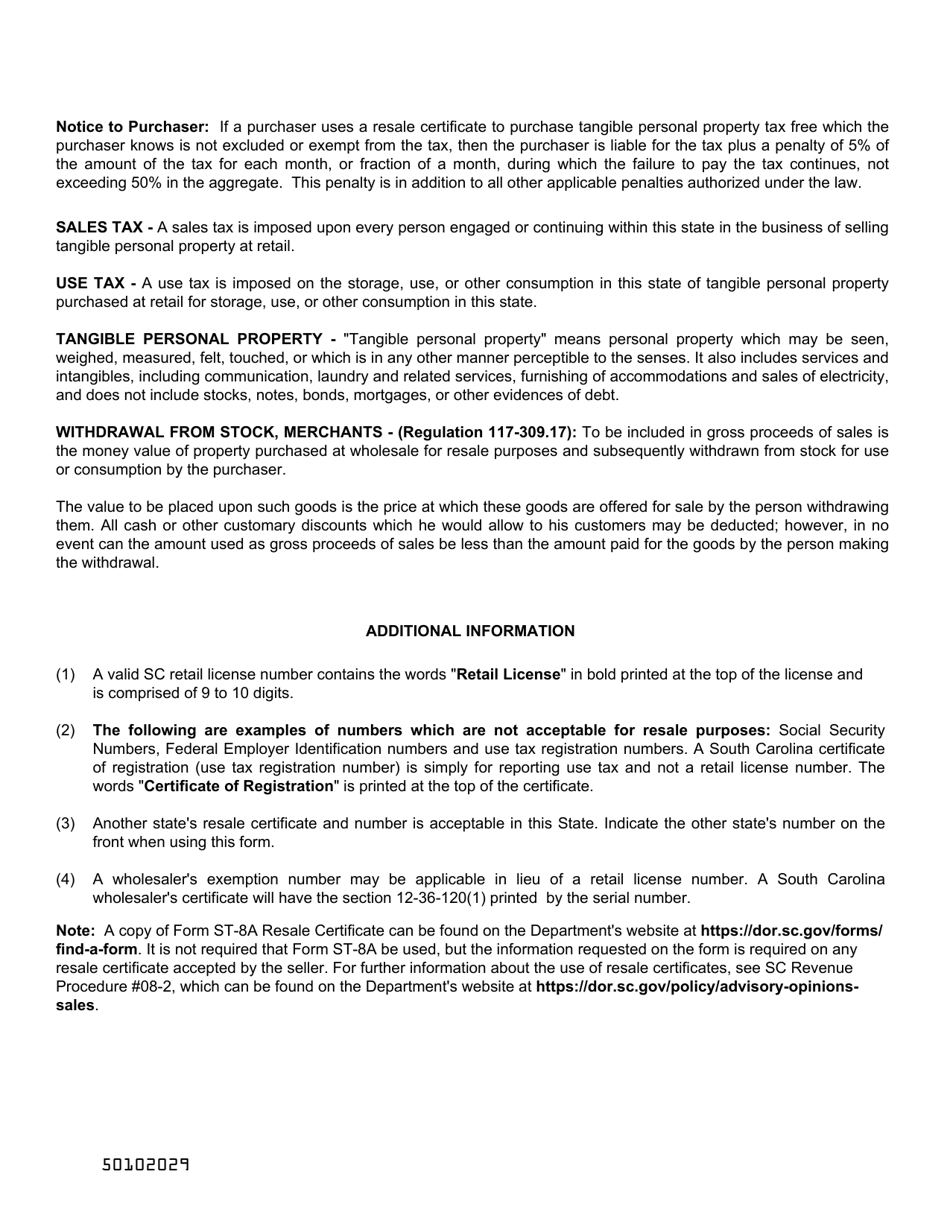

Q: What is the Form ST-8A Resale Certificate?

A: The Form ST-8A Resale Certificate is a document used in South Carolina to certify that a purchase is for resale.

Q: Who can use the Form ST-8A Resale Certificate?

A: Businesses registered for sales tax in South Carolina and engaged in selling tangible personal property can use the Form ST-8A Resale Certificate.

Q: What is the purpose of the Form ST-8A Resale Certificate?

A: The Form ST-8A Resale Certificate is used to exempt businesses from paying sales tax on items they plan to resell.

Q: When should the Form ST-8A Resale Certificate be used?

A: The Form ST-8A Resale Certificate should be used at the time of purchase when the intention is to resell the items.

Q: Is the Form ST-8A Resale Certificate specific to South Carolina?

A: Yes, the Form ST-8A Resale Certificate is specific to South Carolina and cannot be used in other states.

Q: Is the Form ST-8A Resale Certificate mandatory?

A: No, the use of the Form ST-8A Resale Certificate is not mandatory, but it can help businesses avoid paying sales tax on items intended for resale.

Q: How long is the Form ST-8A Resale Certificate valid?

A: The Form ST-8A Resale Certificate is valid until it is revoked or cancelled by the South Carolina Department of Revenue.

Form Details:

- Released on August 17, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-8A by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.