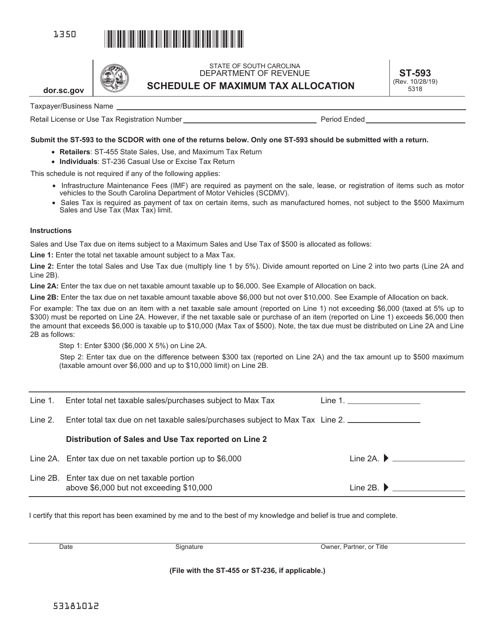

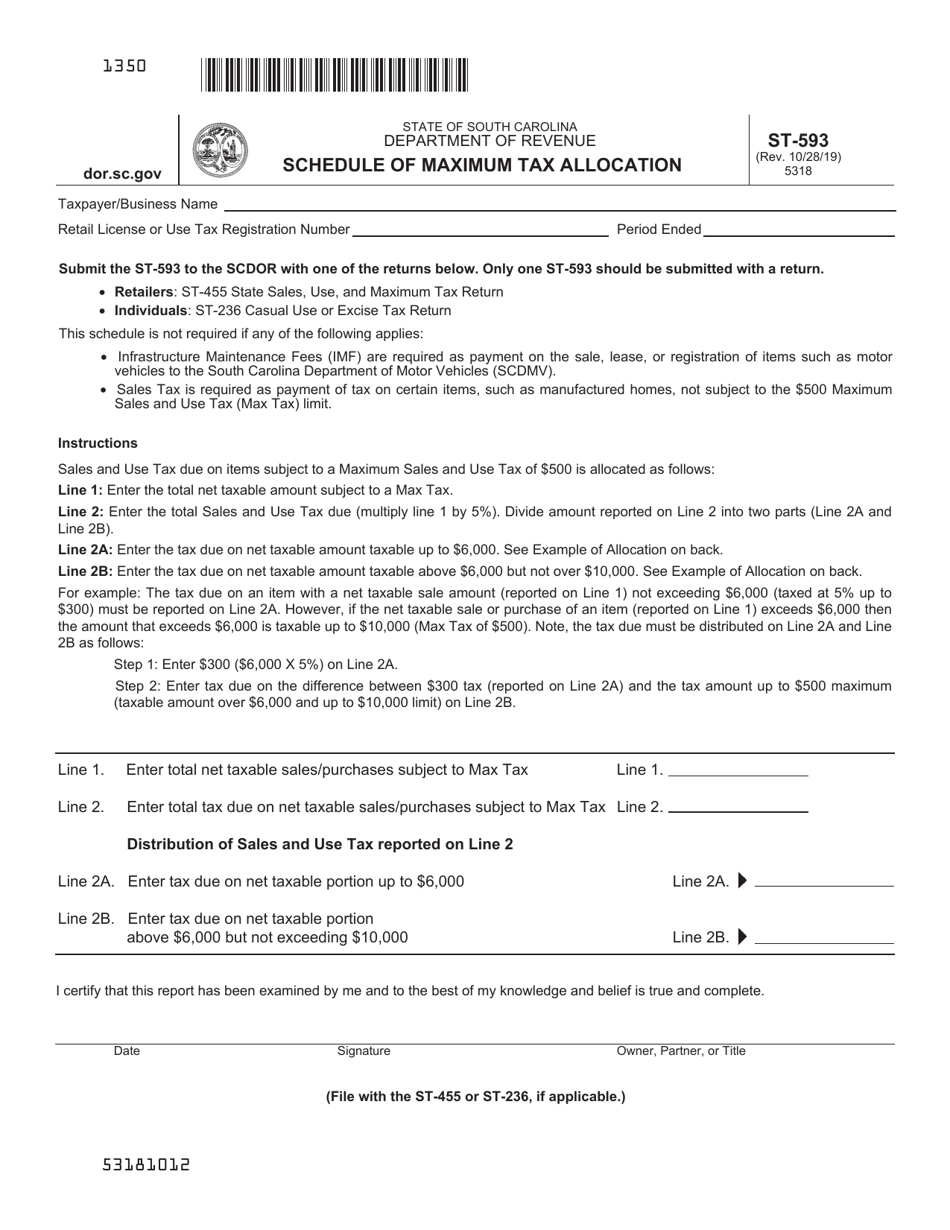

Form ST-593 Schedule of Maximum Tax Allocation - South Carolina

What Is Form ST-593?

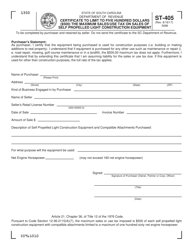

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-593?

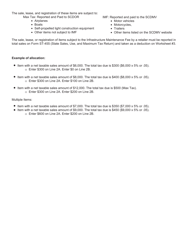

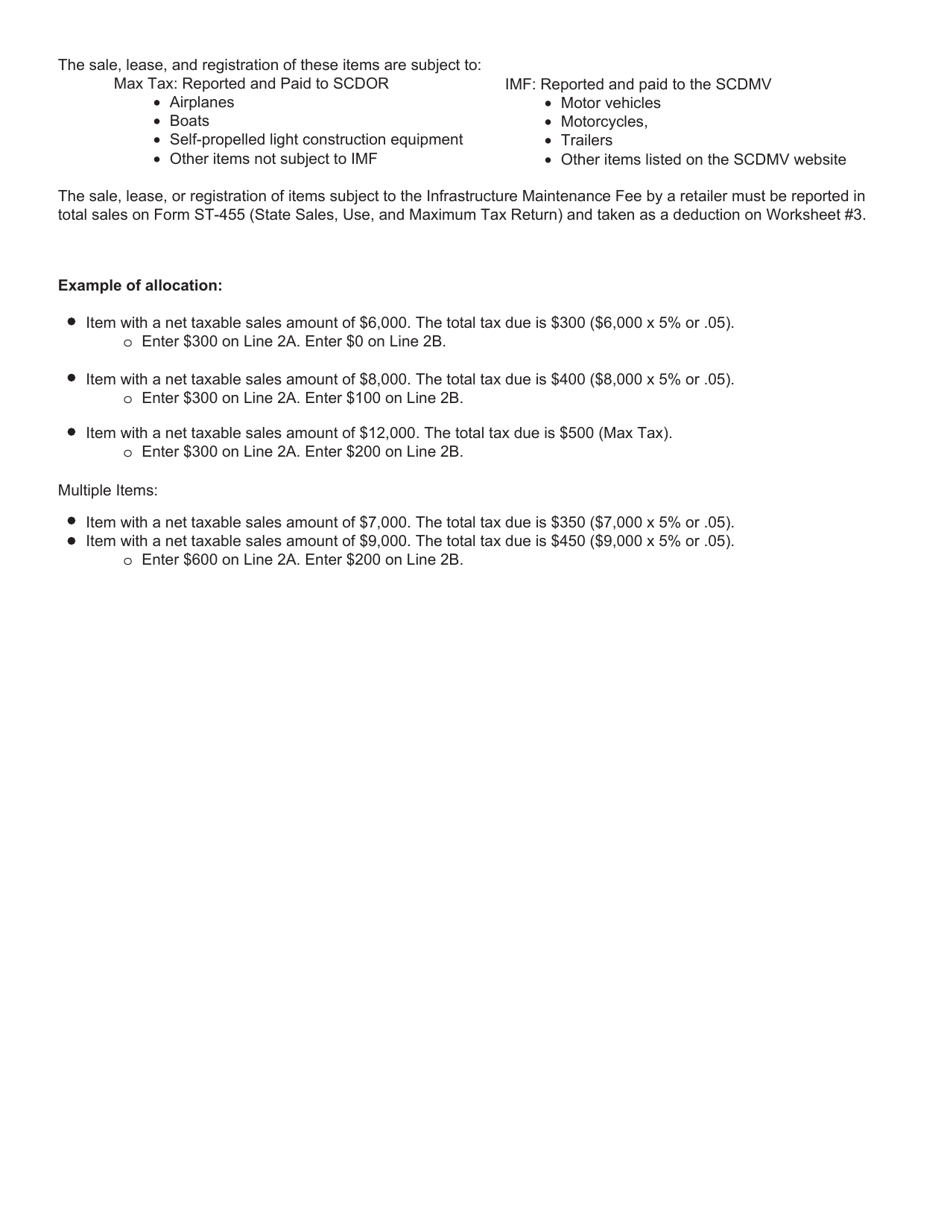

A: Form ST-593 is a tax form used in South Carolina to report the maximum tax allocation for businesses.

Q: What is the purpose of Form ST-593?

A: The purpose of Form ST-593 is to allocate taxes to the appropriate local jurisdictions in South Carolina.

Q: Who needs to file Form ST-593?

A: Businesses operating in South Carolina are required to file Form ST-593 if they have tax liabilities that need to be allocated to specific local jurisdictions.

Q: How often is Form ST-593 filed?

A: Form ST-593 is typically filed on an annual basis.

Q: What information is needed to complete Form ST-593?

A: To complete Form ST-593, businesses need to provide information about their tax liabilities and the jurisdictions to which the taxes should be allocated.

Q: Are there any penalties for not filing Form ST-593?

A: Yes, there may be penalties for failure to file Form ST-593 or for filing it late. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on October 28, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-593 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.