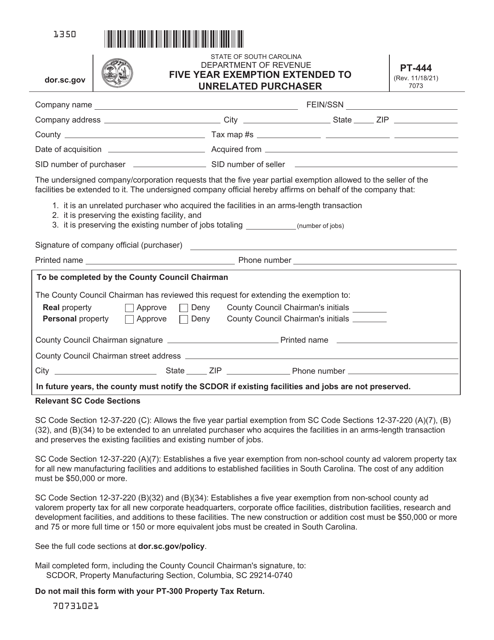

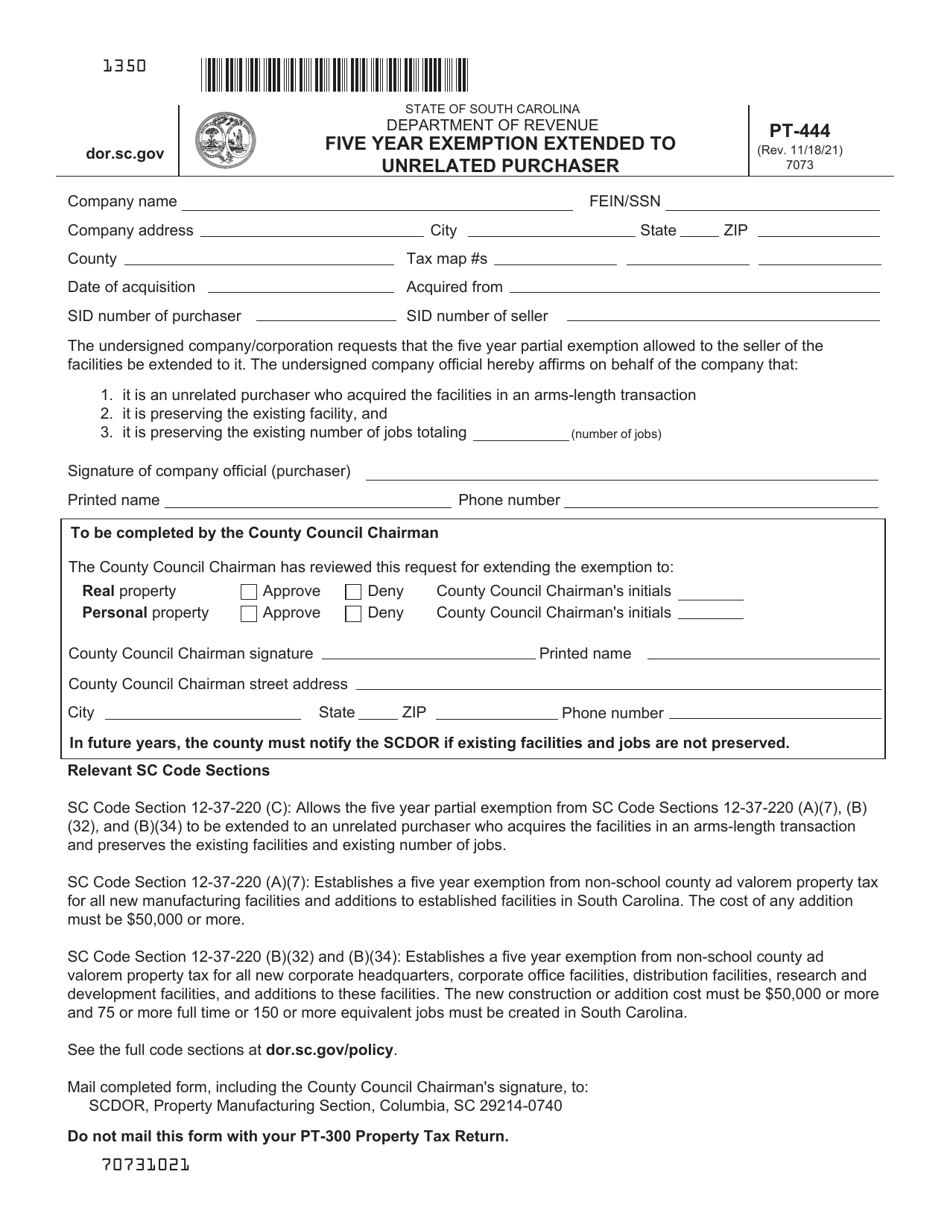

Form PT-444 Five Year Exemption Extended to Unrelated Purchaser - South Carolina

What Is Form PT-444?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-444?

A: Form PT-444 is a tax form in South Carolina.

Q: What does the Five Year Exemption refer to?

A: The Five Year Exemption refers to a tax exemption that lasts for five years.

Q: Who is eligible for the Five Year Exemption?

A: Unrelated purchasers in South Carolina are eligible for the Five Year Exemption.

Q: What is an unrelated purchaser?

A: An unrelated purchaser is someone who is not related to the seller or the property being purchased.

Q: What does it mean for the Five Year Exemption to be extended?

A: The Five Year Exemption has been extended beyond its original duration.

Q: What is the purpose of the Form PT-444?

A: The purpose of Form PT-444 is to claim the Five Year Exemption for an unrelated purchaser in South Carolina.

Q: Does the Form PT-444 need to be filed annually?

A: No, the Form PT-444 only needs to be filed once to claim the Five Year Exemption.

Q: Is the Five Year Exemption available in any other states?

A: The Five Year Exemption is specific to South Carolina.

Form Details:

- Released on November 18, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-444 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.