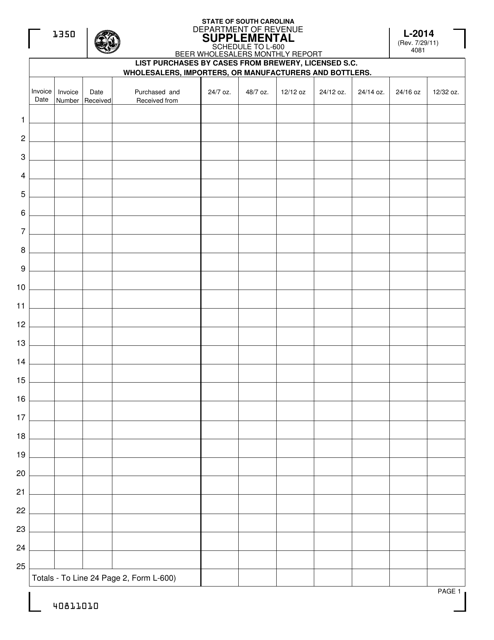

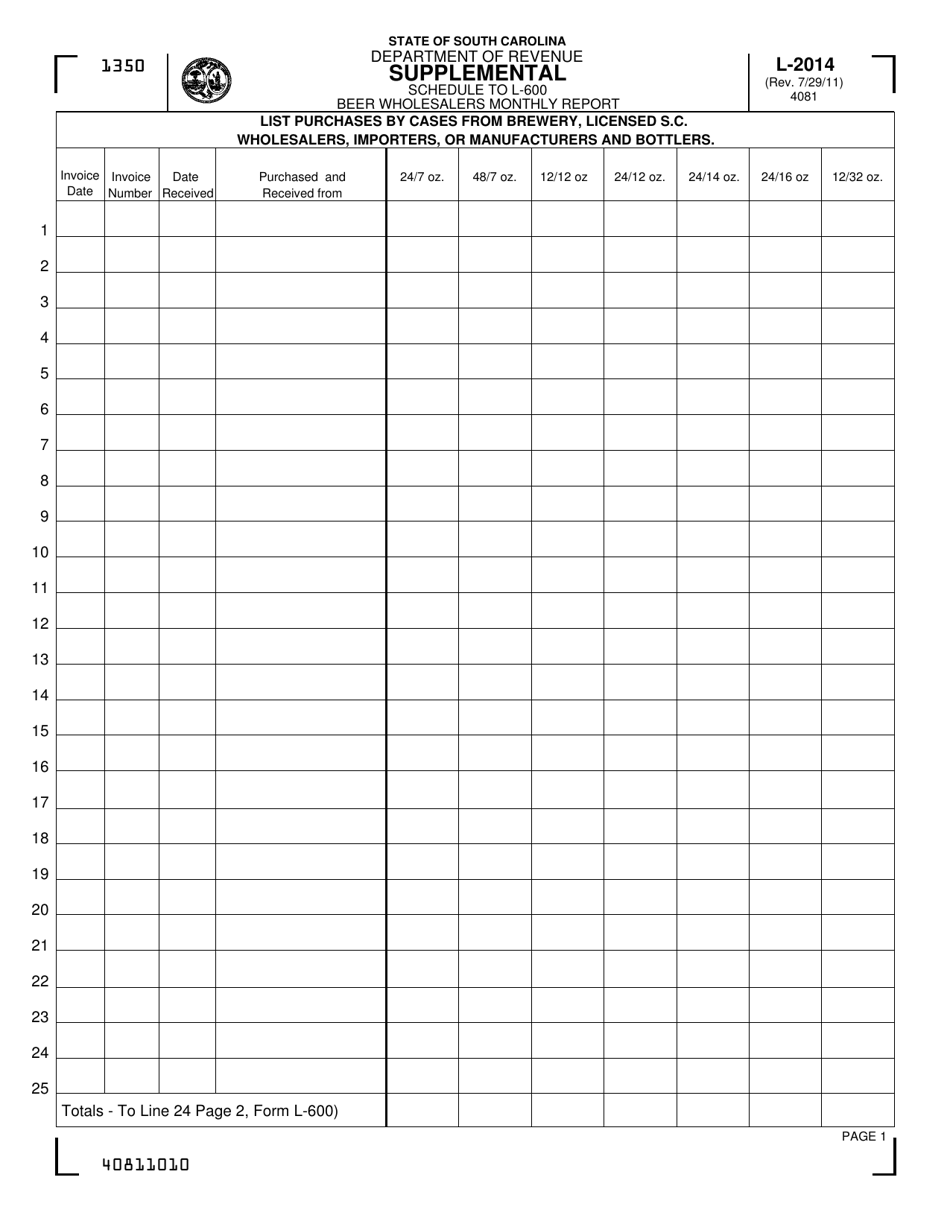

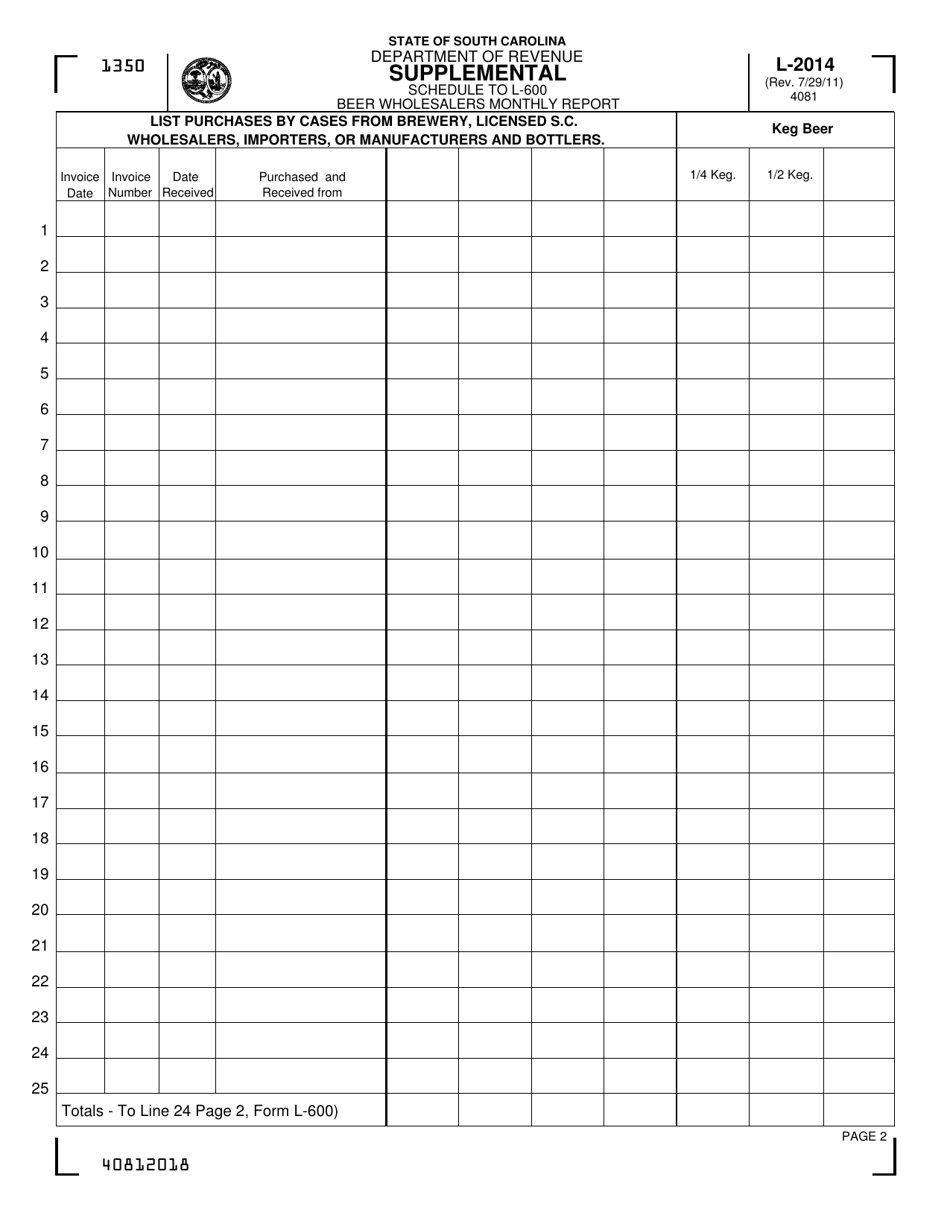

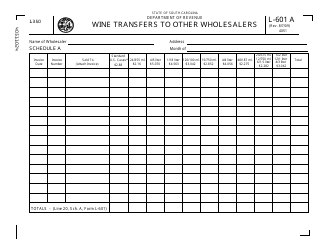

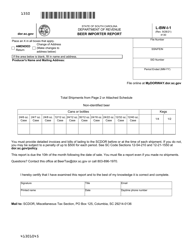

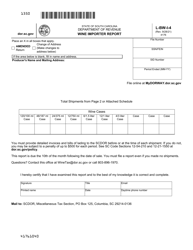

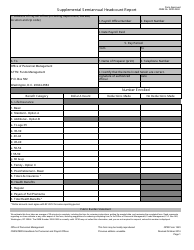

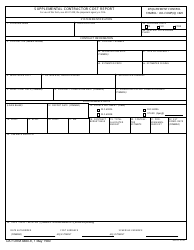

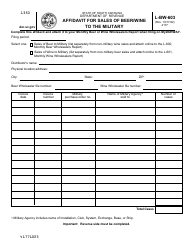

Form L-2014 Supplemental Schedule to L-600 - Beer Wholesalers Monthly Report - South Carolina

What Is Form L-2014?

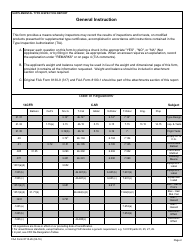

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2014?

A: Form L-2014 is the Supplemental Schedule to L-600 - Beer Wholesalers Monthly Report in South Carolina.

Q: What is the purpose of Form L-2014?

A: The purpose of Form L-2014 is to provide supplemental information to the Beer Wholesalers Monthly Report (Form L-600) in South Carolina.

Q: Who is required to file Form L-2014?

A: Beer wholesalers in South Carolina are required to file Form L-2014.

Q: What information is reported on Form L-2014?

A: Form L-2014 includes information such as beer sales by brand, beer sales by type, and beer sales by container size.

Q: When is Form L-2014 due?

A: Form L-2014 is due on or before the 20th day of the month following the month being reported.

Q: Are there any penalties for late or non-filing of Form L-2014?

A: Yes, there are penalties for late or non-filing of Form L-2014. It is important to file the form on time to avoid penalties and potential legal consequences.

Form Details:

- Released on July 29, 2011;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2014 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.