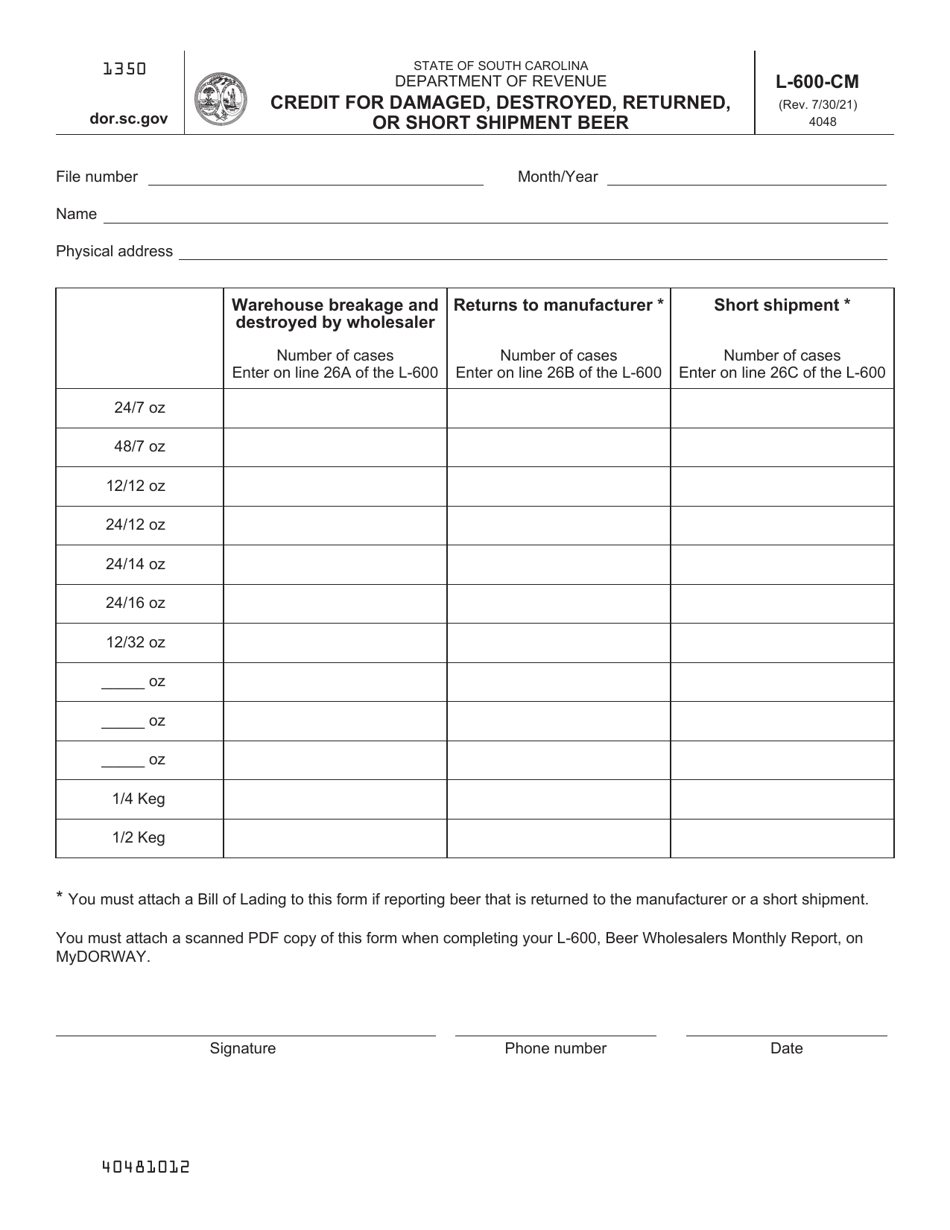

Form L-600-CM Credit for Damaged, Destroyed, Returned, or Short Shipment Beer - South Carolina

What Is Form L-600-CM?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-600-CM?

A: Form L-600-CM is a tax form used in South Carolina to claim a credit for damaged, destroyed, returned, or short shipment beer.

Q: What is the purpose of Form L-600-CM?

A: The purpose of Form L-600-CM is to allow businesses to claim a tax credit for beer that has been damaged, destroyed, returned, or not received in full.

Q: Who can use Form L-600-CM?

A: Businesses that sell beer in South Carolina can use Form L-600-CM to claim a tax credit.

Q: What qualifies as damaged, destroyed, returned, or short shipment beer?

A: Beer that is spoiled, broken, unsellable, returned by customers, or not delivered in full by suppliers qualifies for the credit.

Q: What information is required on Form L-600-CM?

A: Form L-600-CM requires information such as the quantity and value of the damaged, destroyed, returned, or short shipment beer, as well as supporting documentation.

Q: When is Form L-600-CM due?

A: Form L-600-CM is generally due on the 20th day of the month following the end of the quarter in which the beer was damaged, destroyed, returned, or short shipped.

Q: Is there a fee to file Form L-600-CM?

A: No, there is no fee to file Form L-600-CM.

Q: What should I do if I have questions about Form L-600-CM?

A: If you have questions about Form L-600-CM, you should contact the South Carolina Department of Revenue for assistance.

Form Details:

- Released on July 30, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-600-CM by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.