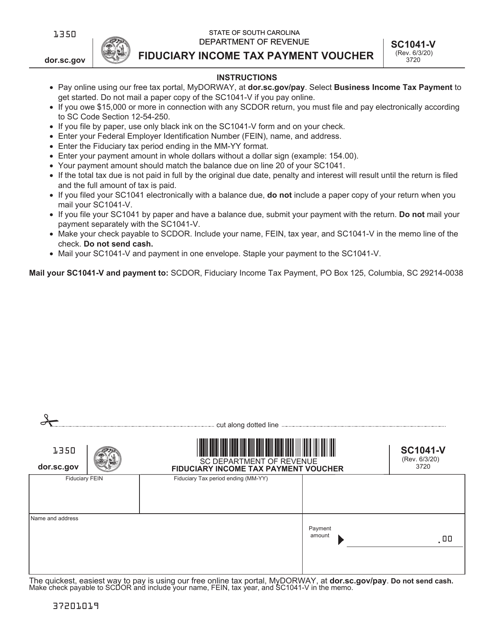

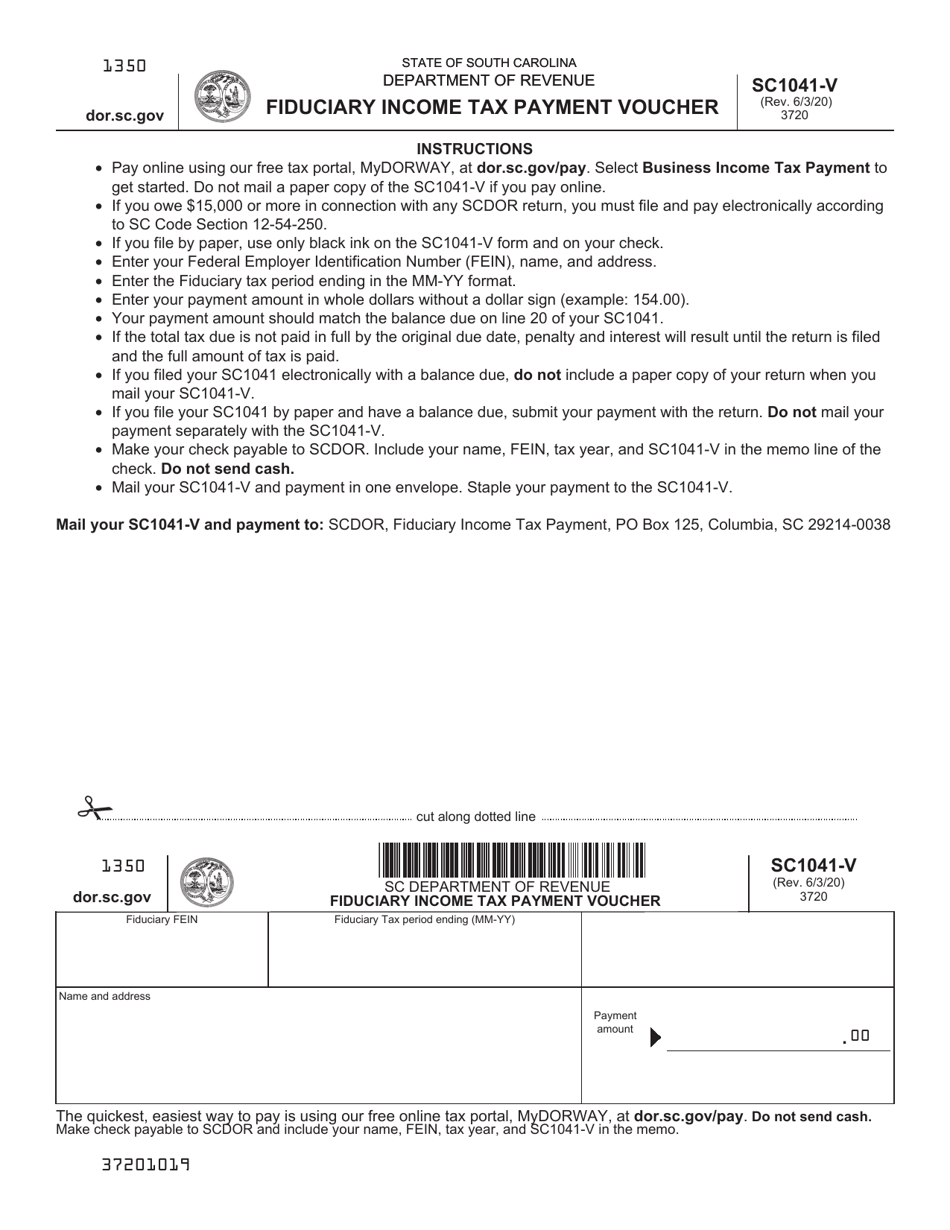

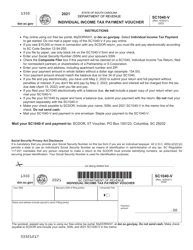

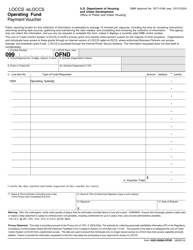

Form SC1041-V Fiduciary Income Tax Payment Voucher - South Carolina

What Is Form SC1041-V?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC1041-V?

A: Form SC1041-V is the Fiduciary Income Tax Payment Voucher used in South Carolina.

Q: What is a fiduciary income tax payment voucher?

A: A fiduciary income tax payment voucher is a document used to submit tax payments for fiduciaries in South Carolina.

Q: Who needs to use Form SC1041-V?

A: Form SC1041-V is used by fiduciaries who need to make income tax payments in South Carolina.

Q: What information is required on Form SC1041-V?

A: Form SC1041-V requires information such as the taxpayer's name, address, taxpayer identification number, tax year, and payment amount.

Q: When is the due date for submitting Form SC1041-V?

A: The due date for submitting Form SC1041-V and making the tax payment is typically April 15th, unless otherwise specified by the South Carolina Department of Revenue.

Form Details:

- Released on June 3, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1041-V by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.