This version of the form is not currently in use and is provided for reference only. Download this version of

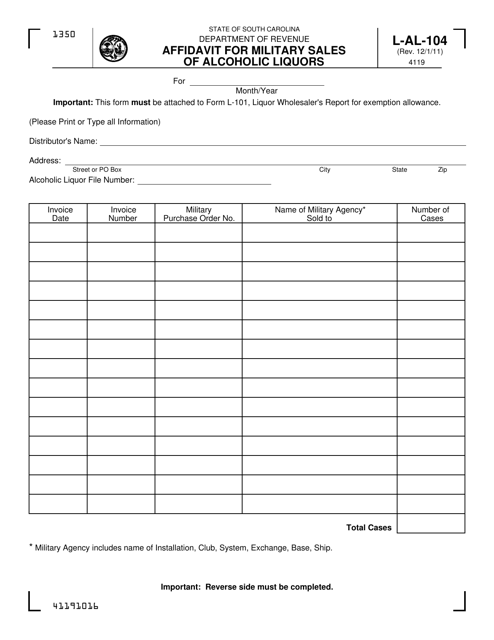

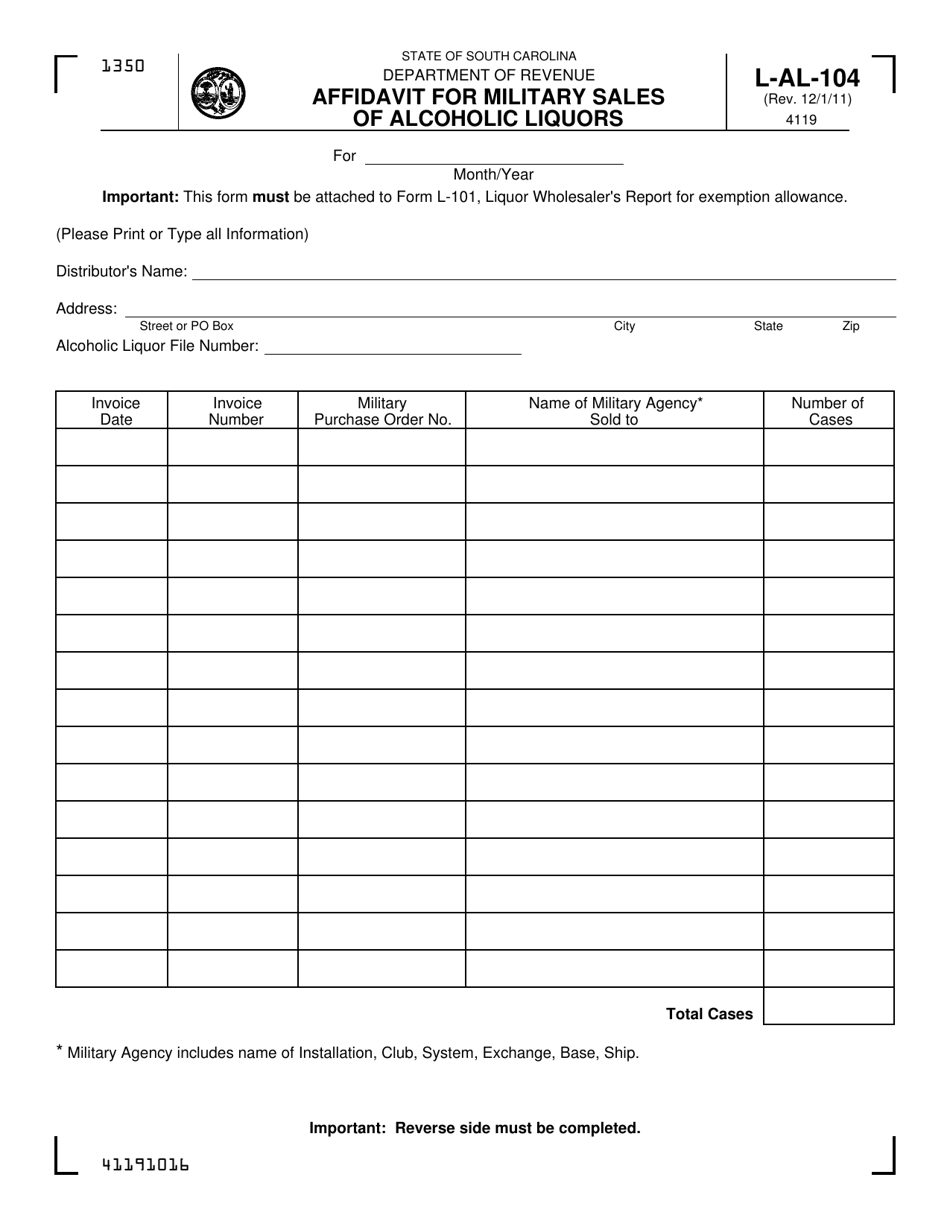

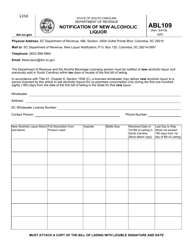

Form L-AL-104

for the current year.

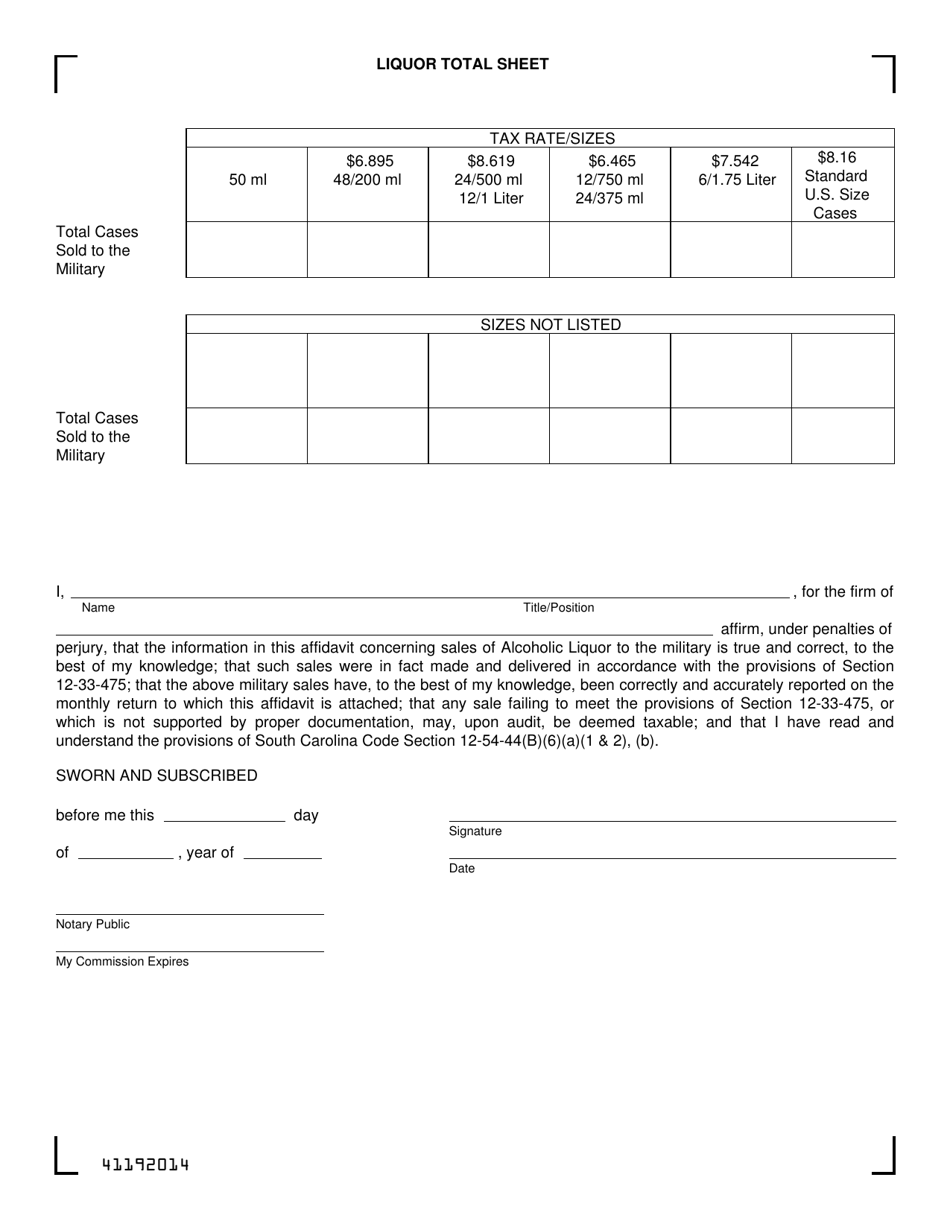

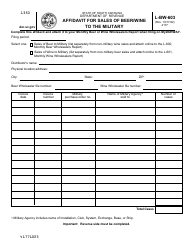

Form L-AL-104 Affidavit for Military Sales of Alcoholic Liquors - South Carolina

What Is Form L-AL-104?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-AL-104?

A: Form L-AL-104 is the Affidavit for Military Sales of Alcoholic Liquors in South Carolina.

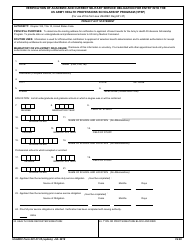

Q: Who needs to file Form L-AL-104?

A: This form needs to be filed by military personnel or their spouses who want to purchase alcoholic beverages at military installations in South Carolina.

Q: What is the purpose of Form L-AL-104?

A: The purpose of this form is to certify that the person filing it is a military member or their spouse and is eligible to purchase alcoholic beverages at military sales outlets in South Carolina.

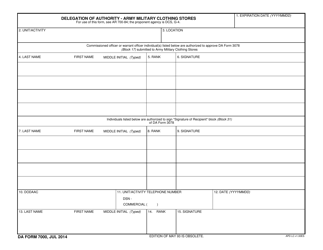

Q: How do I fill out Form L-AL-104?

A: The form requires you to provide your personal information, including your name, address, military status, and information about the military installation where you plan to make the purchase.

Q: Is there a fee to file Form L-AL-104?

A: No, there is no fee to file this form.

Q: When should I file Form L-AL-104?

A: You should file this form at least 30 days before your planned purchase of alcoholic beverages.

Q: Can I use Form L-AL-104 for purchases in states other than South Carolina?

A: No, this form is specific to the state of South Carolina. You should check with the military sales outlet in other states for the appropriate forms.

Q: What happens after I file Form L-AL-104?

A: After you file this form, it will be reviewed by the military sales outlet, and if approved, you will be issued a temporary permit allowing you to purchase alcoholic beverages at the designated military installation in South Carolina.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-AL-104 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.