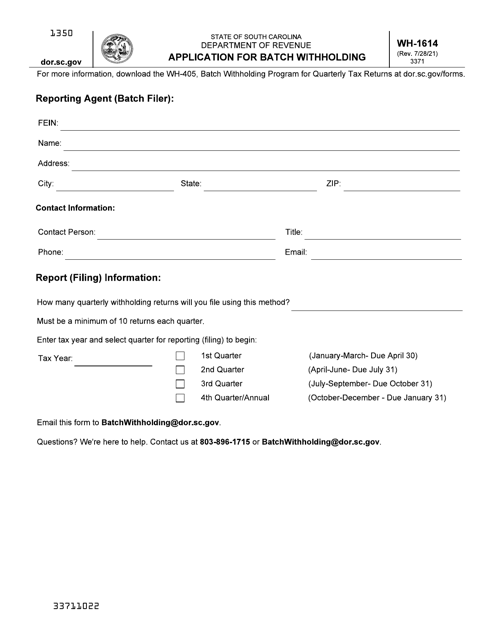

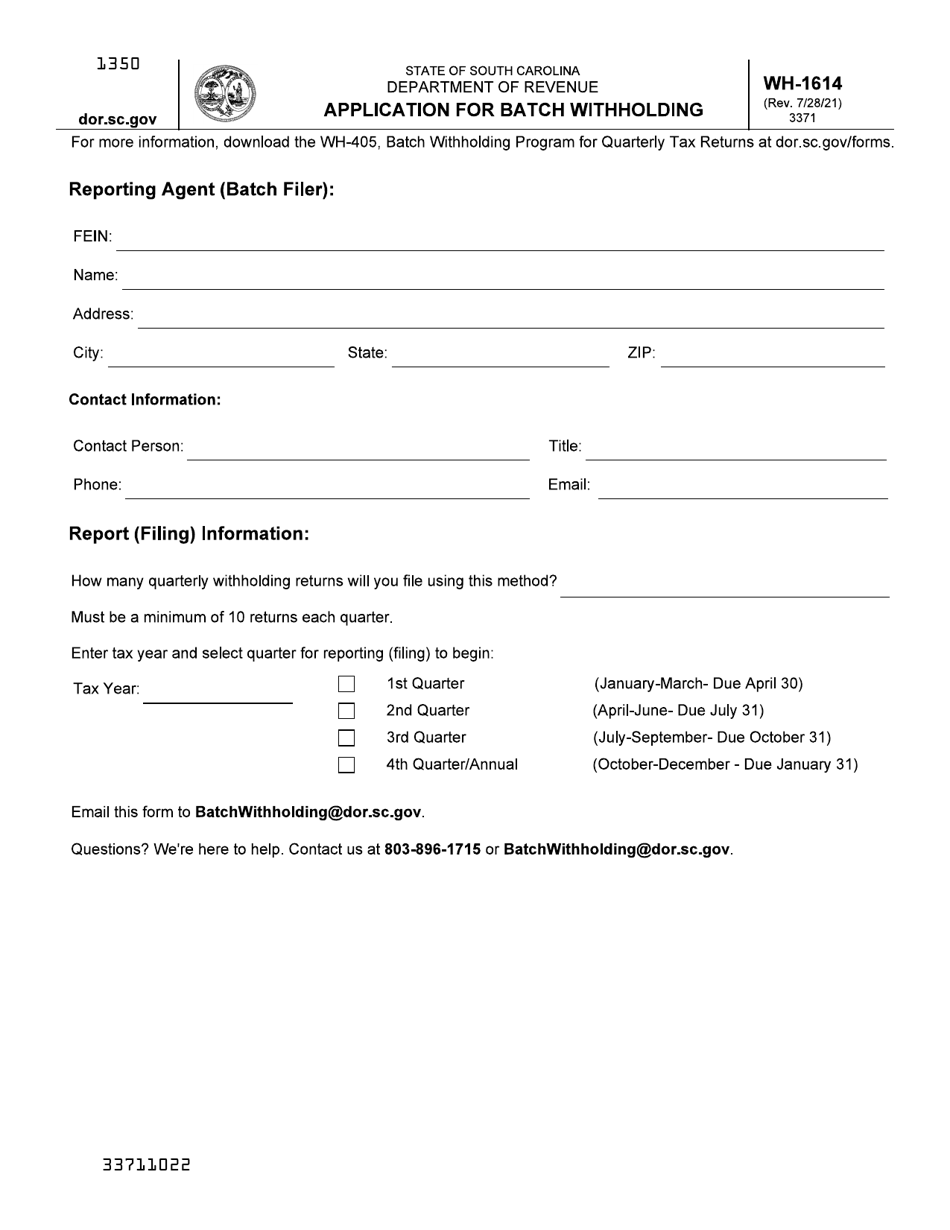

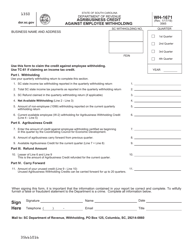

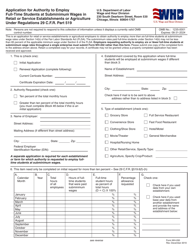

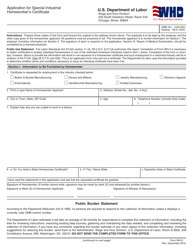

Form WH-1614 Application for Batch Withholding - South Carolina

What Is Form WH-1614?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WH-1614?

A: Form WH-1614 is the Application for Batch Withholding in South Carolina.

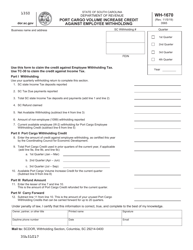

Q: What is the purpose of Form WH-1614?

A: The purpose of Form WH-1614 is to request a batch withholding account for employers in South Carolina.

Q: Who needs to file Form WH-1614?

A: Employers in South Carolina who want to set up a batch withholding account need to file Form WH-1614.

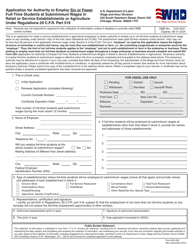

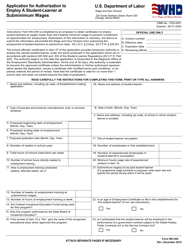

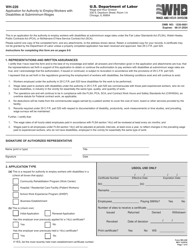

Q: What information is required on Form WH-1614?

A: Form WH-1614 requires information such as employer contact details, a brief description of the business, and estimated number of employees.

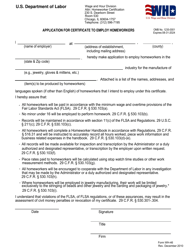

Q: Are there any fees associated with filing Form WH-1614?

A: No, there are no fees associated with filing Form WH-1614.

Q: What is the deadline for filing Form WH-1614?

A: There is no specific deadline for filing Form WH-1614 as it can be submitted at any time.

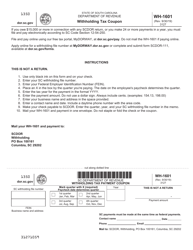

Q: What happens after Form WH-1614 is submitted?

A: After Form WH-1614 is submitted, the South Carolina Department of Revenue will review the application and notify the employer of their batch withholding account number.

Q: Is Form WH-1614 required for all employers in South Carolina?

A: No, Form WH-1614 is only required for employers who want to set up a batch withholding account.

Form Details:

- Released on July 28, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WH-1614 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.