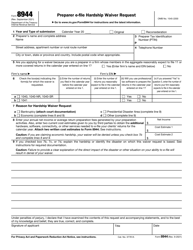

This version of the form is not currently in use and is provided for reference only. Download this version of

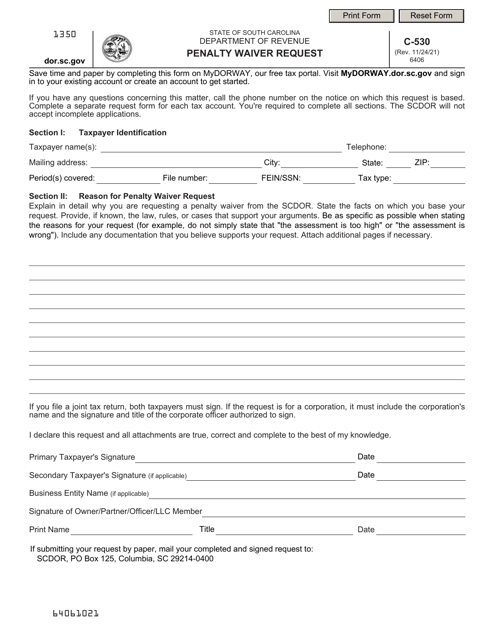

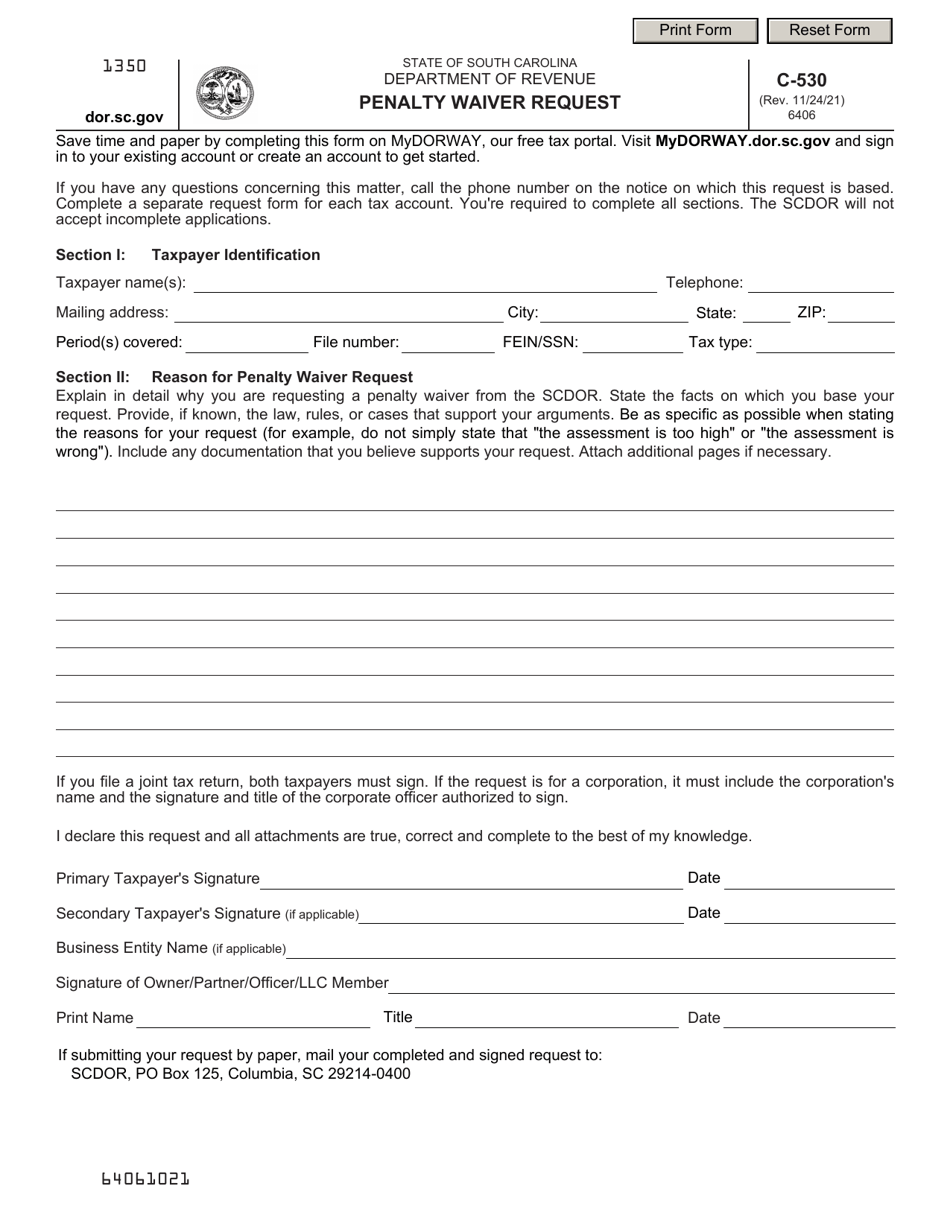

Form C-530

for the current year.

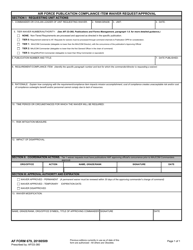

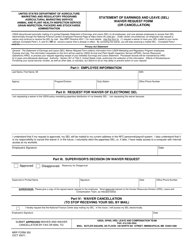

Form C-530 Penalty Waiver Request - South Carolina

What Is Form C-530?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-530 Penalty Waiver Request?

A: Form C-530 Penalty Waiver Request is a form used in South Carolina to request a waiver of penalties for late or delinquent tax payments.

Q: When should I use Form C-530 Penalty Waiver Request?

A: You should use Form C-530 Penalty Waiver Request when you have a reasonable cause for the late or delinquent tax payment and want to request a waiver of the associated penalties.

Q: What information do I need to provide on Form C-530 Penalty Waiver Request?

A: On Form C-530 Penalty Waiver Request, you will need to provide your personal information, details about the tax payment in question, and the reason for your request for penalty waiver.

Q: Is there a deadline for submitting Form C-530 Penalty Waiver Request?

A: Yes, there is a deadline for submitting Form C-530 Penalty Waiver Request. The form should be submitted within 180 days from the date of the penalty assessment notice.

Q: How long does it take to process Form C-530 Penalty Waiver Request?

A: The processing time for Form C-530 Penalty Waiver Request may vary, but it generally takes a few weeks for the South Carolina Department of Revenue to review and make a decision on the request.

Form Details:

- Released on November 24, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-530 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.