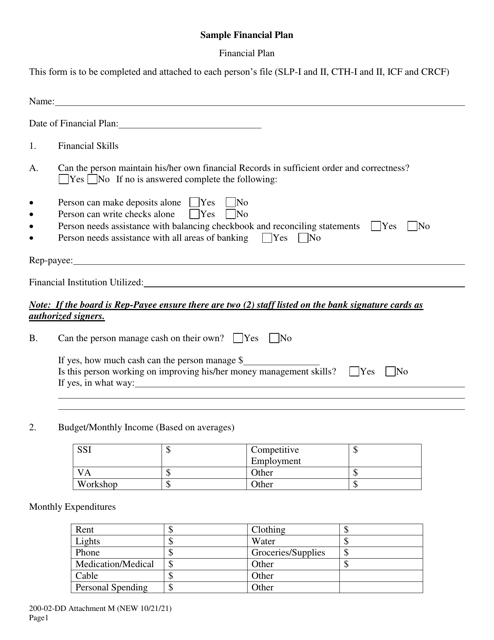

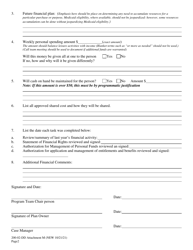

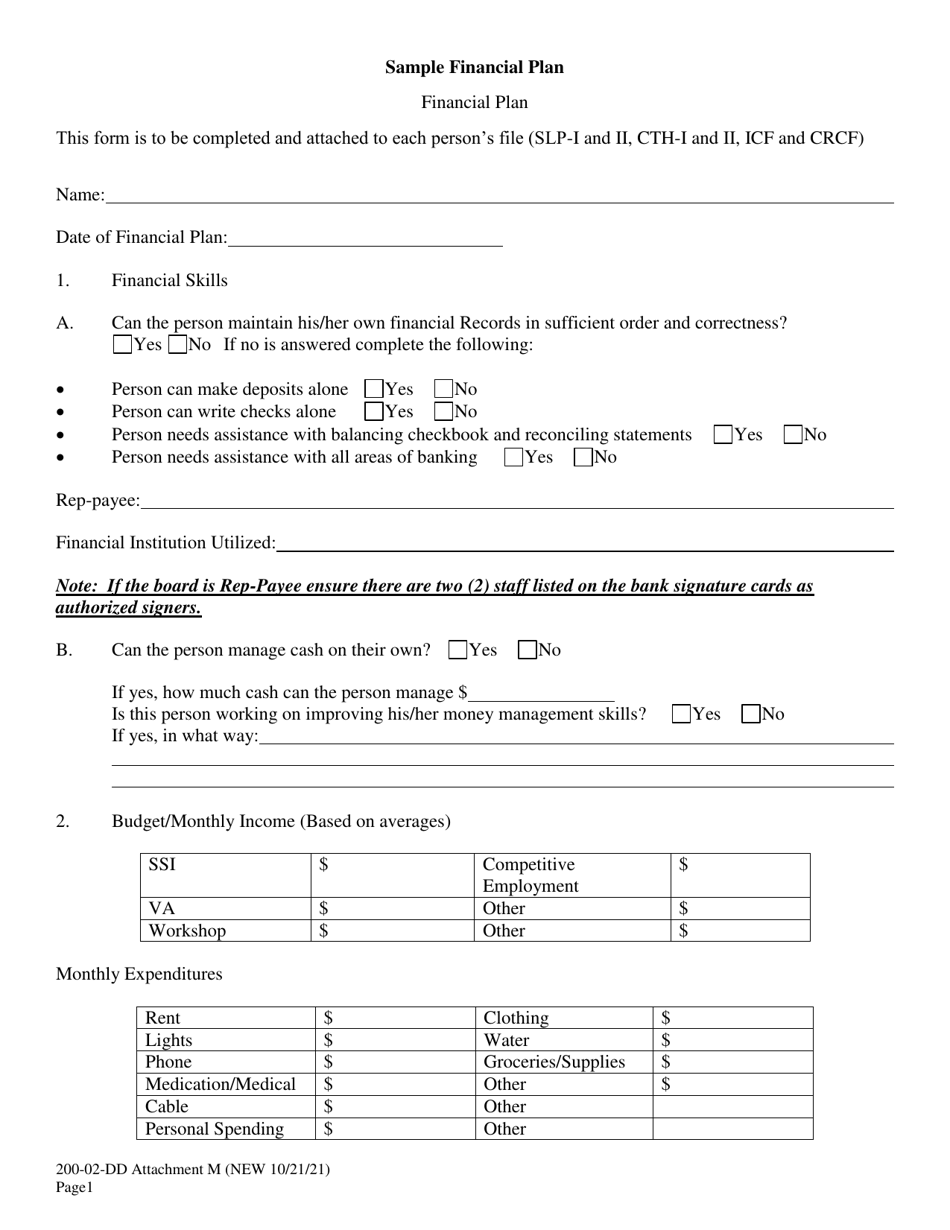

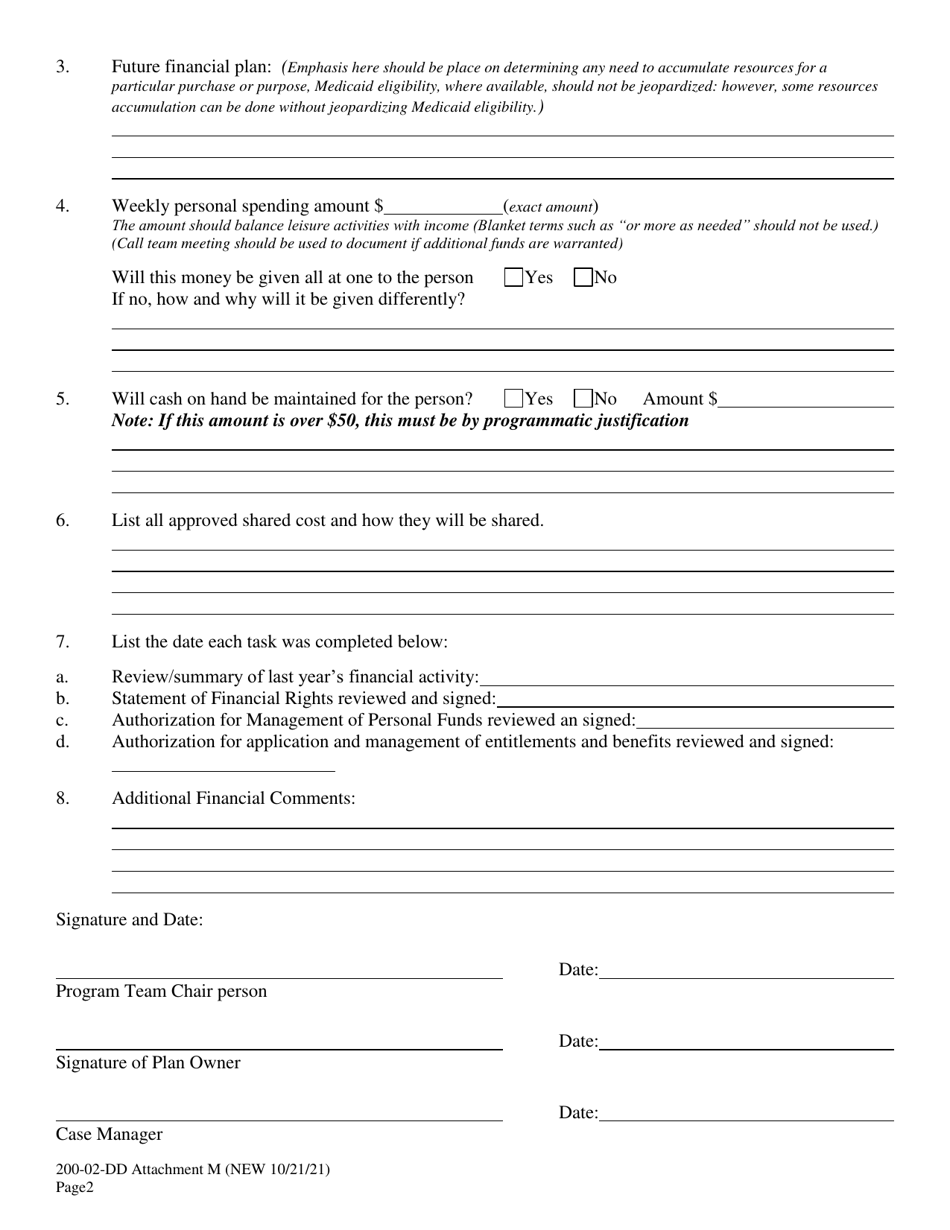

Attachment M Sample Financial Plan - South Carolina

What Is Attachment M?

This is a legal form that was released by the South Carolina Department of Disabilities and Special Needs - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a financial plan?

A: A financial plan is a comprehensive document that outlines an individual's or organization's financial goals and strategies.

Q: Why is having a financial plan important?

A: Having a financial plan is important because it helps individuals and organizations make informed decisions about their financial future and work towards achieving their goals.

Q: What does a financial plan typically include?

A: A financial plan typically includes information about income, expenses, savings, investments, debts, and goals.

Q: How can I create a financial plan?

A: To create a financial plan, you can start by setting financial goals, analyzing your current financial situation, and identifying strategies to achieve those goals.

Q: Do I need professional help to create a financial plan?

A: It is not necessary to seek professional help to create a financial plan, but a financial advisor can provide guidance and expertise in developing a plan tailored to your specific needs.

Q: What are the benefits of having a financial plan?

A: Having a financial plan can help you track your progress towards your goals, make better financial decisions, and provide a roadmap for your financial future.

Q: How often should I review and update my financial plan?

A: It is recommended to review and update your financial plan at least once a year or whenever there are significant life changes like marriage, having children, or changing jobs.

Q: Can a financial plan help me save money?

A: Yes, a financial plan can help you identify areas where you can save money, set savings goals, and develop strategies to achieve those goals.

Q: Is it too late to create a financial plan if I am already in debt?

A: No, it is never too late to create a financial plan, even if you are in debt. A financial plan can help you develop a strategy to pay off your debts and work towards a better financial future.

Form Details:

- Released on October 21, 2021;

- The latest edition provided by the South Carolina Department of Disabilities and Special Needs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Attachment M by clicking the link below or browse more documents and templates provided by the South Carolina Department of Disabilities and Special Needs.