This version of the form is not currently in use and is provided for reference only. Download this version of

Form NPERS8000

for the current year.

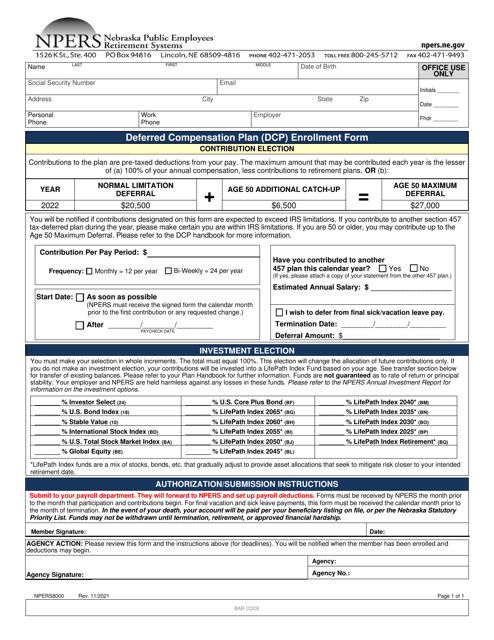

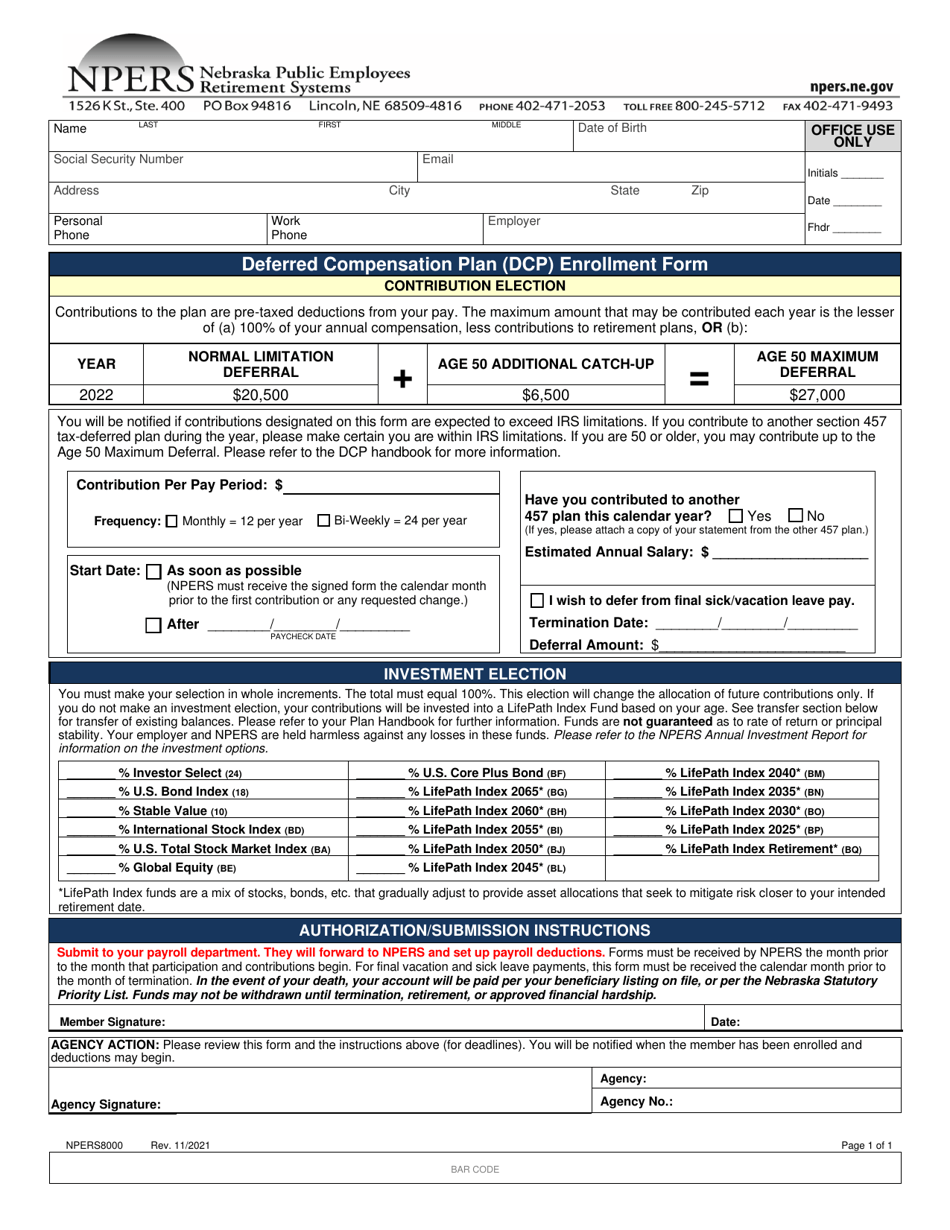

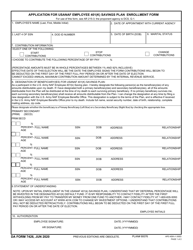

Form NPERS8000 Deferred Compensation Plan (Dcp) Enrollment Form - Nebraska

What Is Form NPERS8000?

This is a legal form that was released by the Nebraska Public Employees Retirement Systems - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

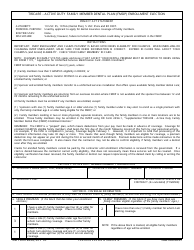

Q: What is the NPERS8000 Deferred Compensation Plan?

A: The NPERS8000 Deferred Compensation Plan is a retirement savings plan for Nebraska state employees.

Q: Who is eligible to enroll in the NPERS8000 Deferred Compensation Plan?

A: Nebraska state employees are eligible to enroll in the plan.

Q: What is the purpose of the NPERS8000 Deferred Compensation Plan?

A: The plan is designed to help employees save for retirement and supplement their pension benefits.

Q: How does enrollment in the NPERS8000 Deferred Compensation Plan work?

A: Employees can enroll in the plan by completing the enrollment form and selecting their contribution amount.

Q: Can employees change their contribution amount in the NPERS8000 Deferred Compensation Plan?

A: Yes, employees can make changes to their contribution amount at any time.

Q: Are there any tax advantages to participating in the NPERS8000 Deferred Compensation Plan?

A: Yes, contributions to the plan are made on a pre-tax basis, which may result in lower taxable income.

Q: What investment options are available in the NPERS8000 Deferred Compensation Plan?

A: The plan offers a variety of investment options, such as mutual funds and target date funds.

Q: Is there a maximum contribution limit for the NPERS8000 Deferred Compensation Plan?

A: Yes, the maximum annual contribution limit for the plan is set by the IRS and may change each year.

Q: Can employees make withdrawals from the NPERS8000 Deferred Compensation Plan before retirement?

A: Yes, employees may be able to make withdrawals in certain circumstances, such as financial hardship or separation from service.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Nebraska Public Employees Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NPERS8000 by clicking the link below or browse more documents and templates provided by the Nebraska Public Employees Retirement Systems.