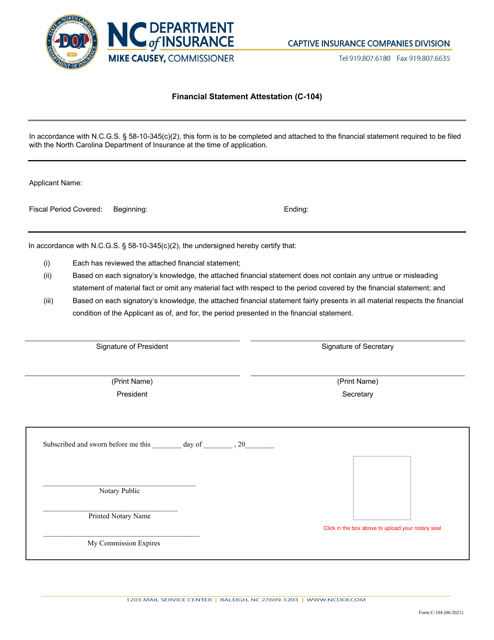

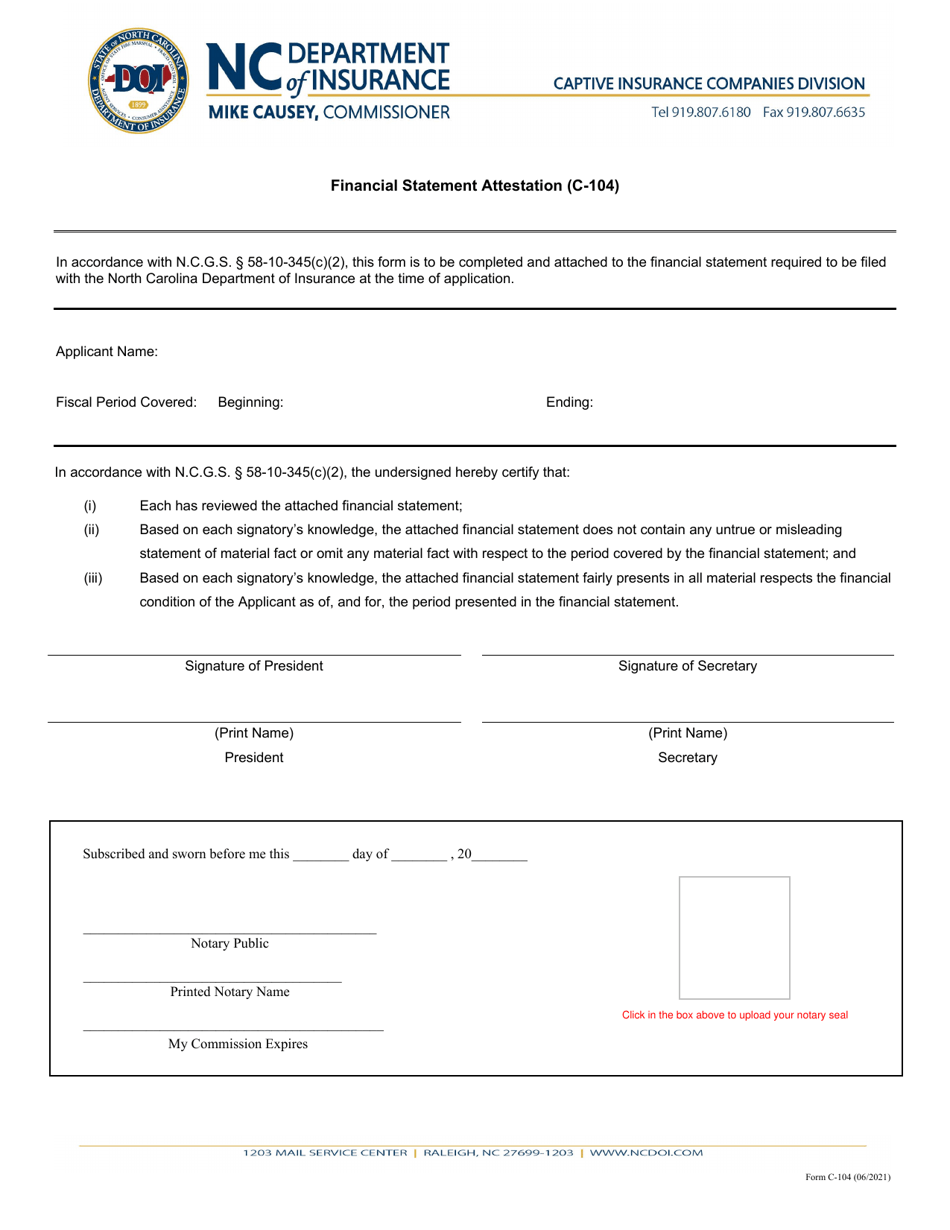

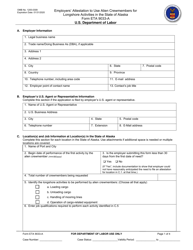

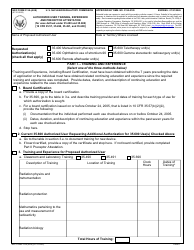

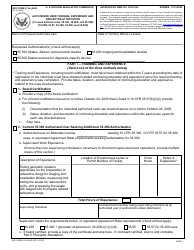

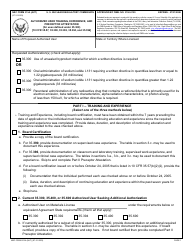

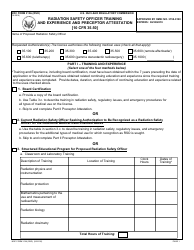

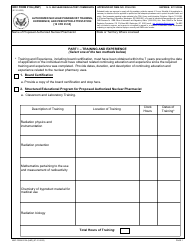

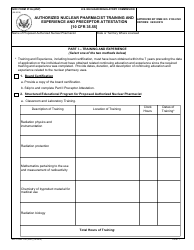

Form C-104 Financial Statement Attestation - North Carolina

What Is Form C-104?

This is a legal form that was released by the North Carolina Department of Insurance - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

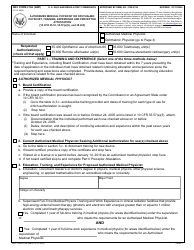

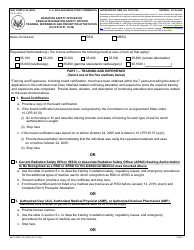

Q: What is Form C-104 Financial Statement Attestation?

A: Form C-104 is a document used in North Carolina to attest to the accuracy and completeness of financial statements submitted by a business entity.

Q: Who needs to file Form C-104 Financial Statement Attestation?

A: Certain business entities in North Carolina, such as corporations, partnerships, and LLCs, are required to file Form C-104 along with their annual report.

Q: When is Form C-104 Financial Statement Attestation due?

A: Form C-104 must be filed annually along with the business entity's annual report, which is typically due by the fifteenth day of the fourth month after the close of the fiscal year.

Q: Are there any fees associated with filing Form C-104 Financial Statement Attestation?

A: Yes, there is a filing fee for submitting Form C-104 and the annual report. The amount varies depending on the type of business entity and its authorized shares or owners.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the North Carolina Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-104 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Insurance.