This version of the form is not currently in use and is provided for reference only. Download this version of

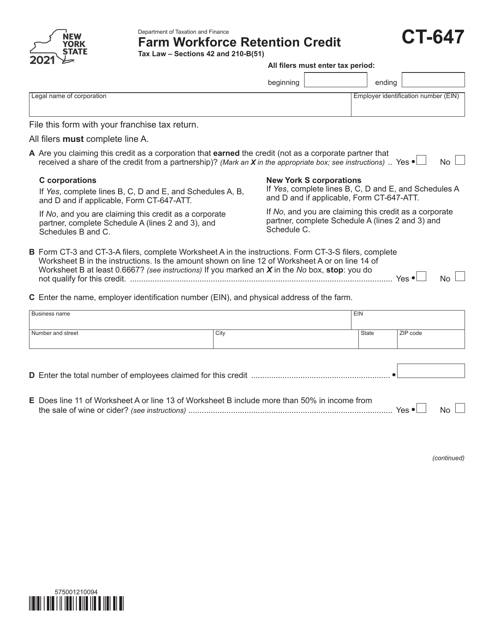

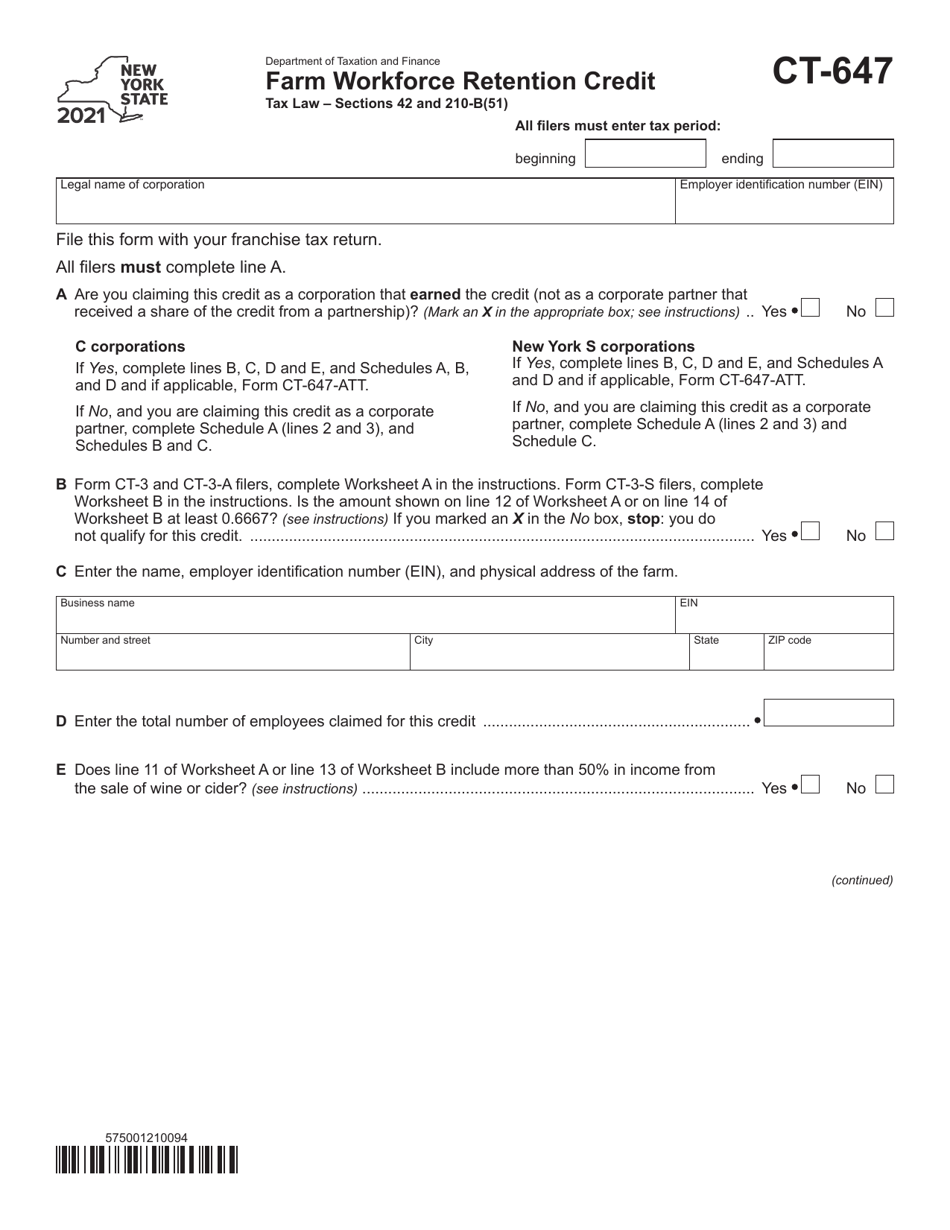

Form CT-647

for the current year.

Form CT-647 Farm Workforce Retention Credit - New York

What Is Form CT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-647?

A: Form CT-647 is the Farm Workforce Retention Credit form for the state of New York.

Q: What is the Farm Workforce Retention Credit?

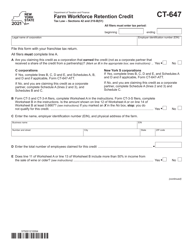

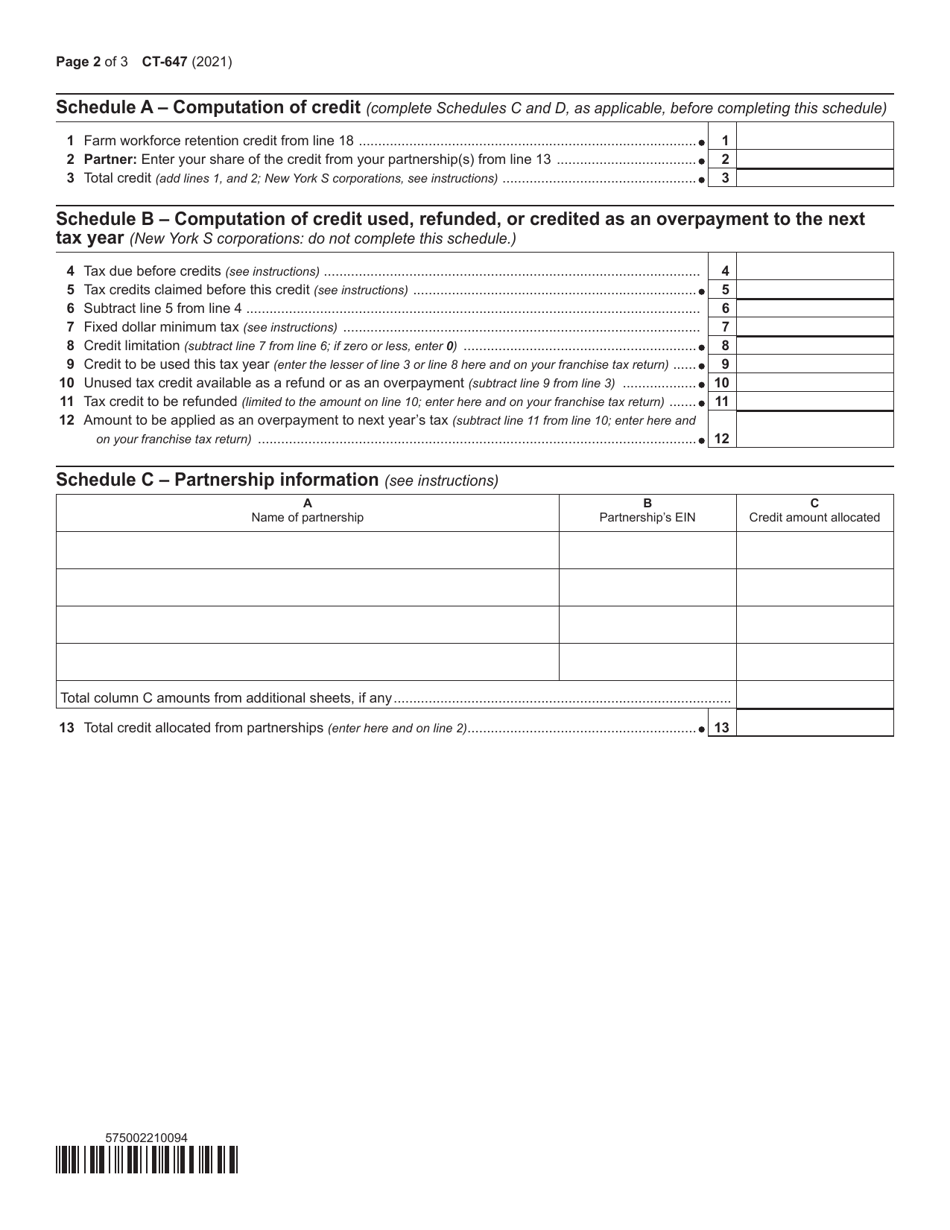

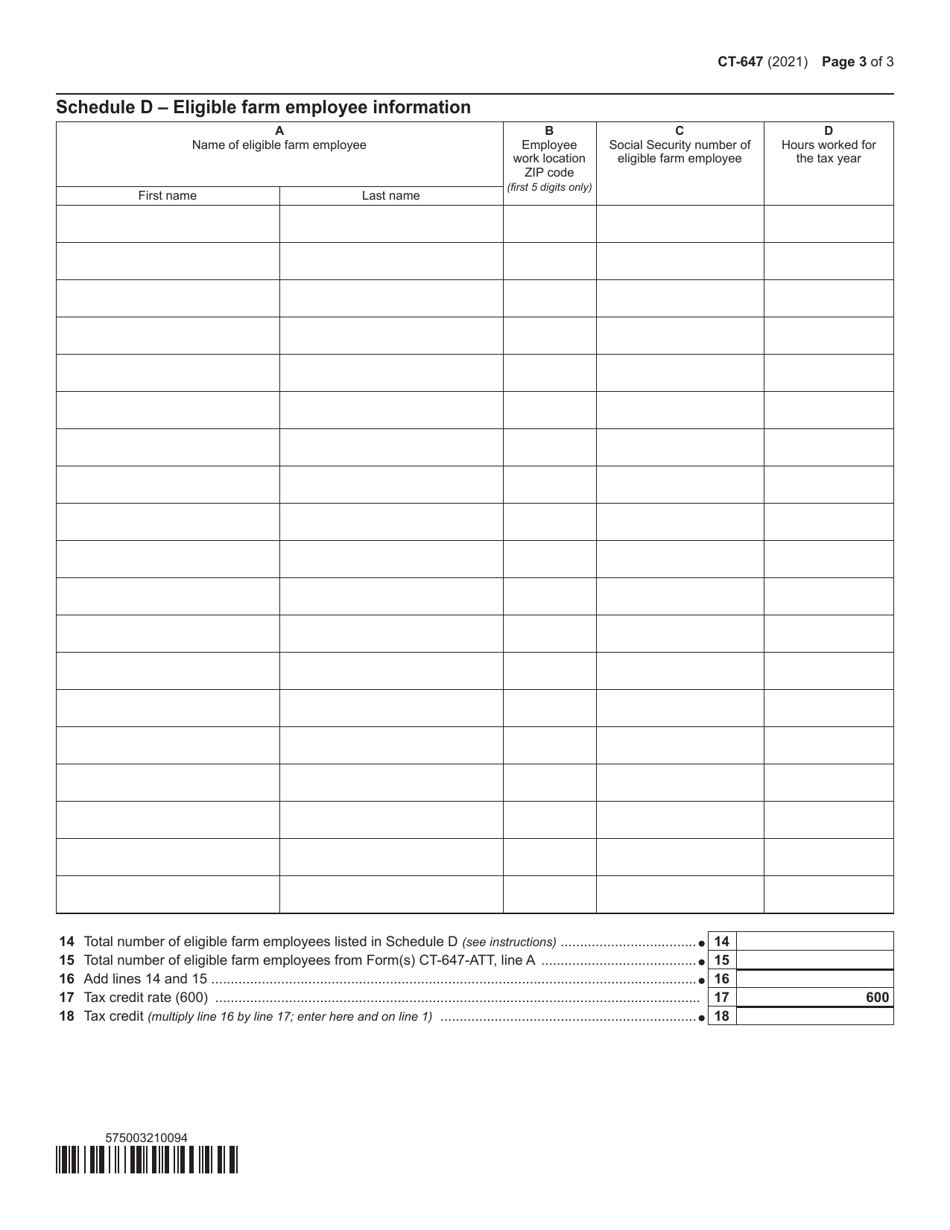

A: The Farm Workforce Retention Credit is a tax credit available to eligible farmers in New York to help offset the costs of retaining eligible employees.

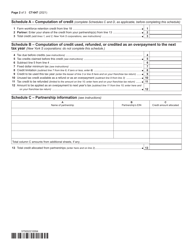

Q: Who is eligible for the Farm Workforce Retention Credit?

A: Farmers in the state of New York who meet certain criteria are eligible for the Farm Workforce Retention Credit.

Q: What are the criteria for eligibility?

A: To be eligible for the Farm Workforce Retention Credit, farmers must meet specific requirements regarding the number of eligible employees, their wages, and the number of hours worked.

Q: What is the purpose of the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is designed to support and incentivize farmers in New York to retain qualified and skilled workers.

Q: How can farmers claim the Farm Workforce Retention Credit?

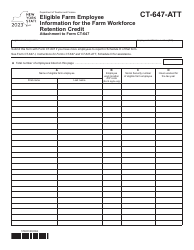

A: Farmers can claim the Farm Workforce Retention Credit by filing Form CT-647 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for filing Form CT-647?

A: Yes, farmers must file Form CT-647 by the due date of their New York State income tax return, including extensions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.