This version of the form is not currently in use and is provided for reference only. Download this version of

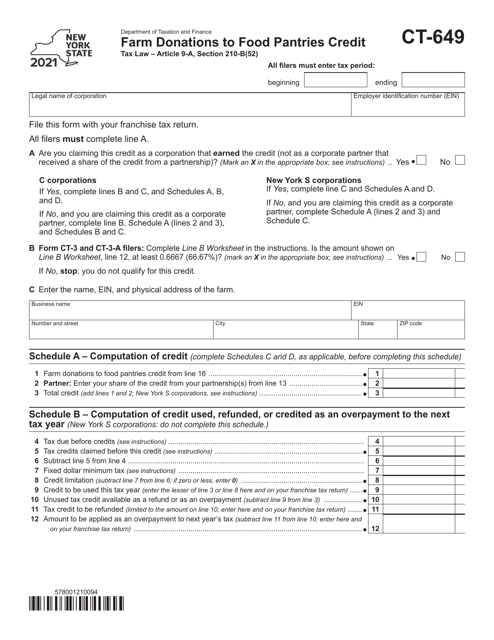

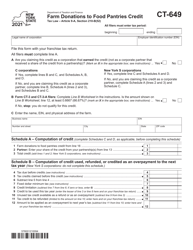

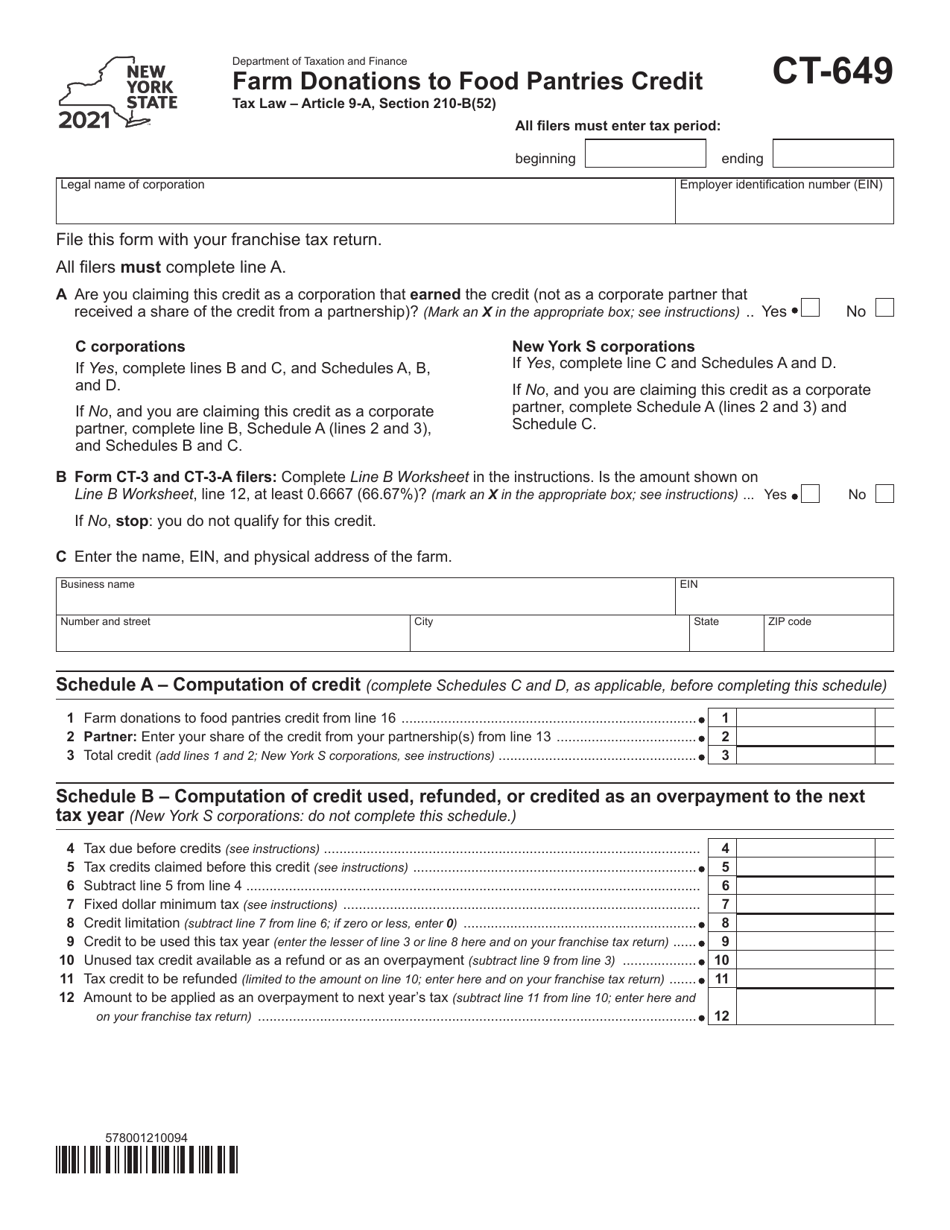

Form CT-649

for the current year.

Form CT-649 Farm Donations to Food Pantries Credit - New York

What Is Form CT-649?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-649?

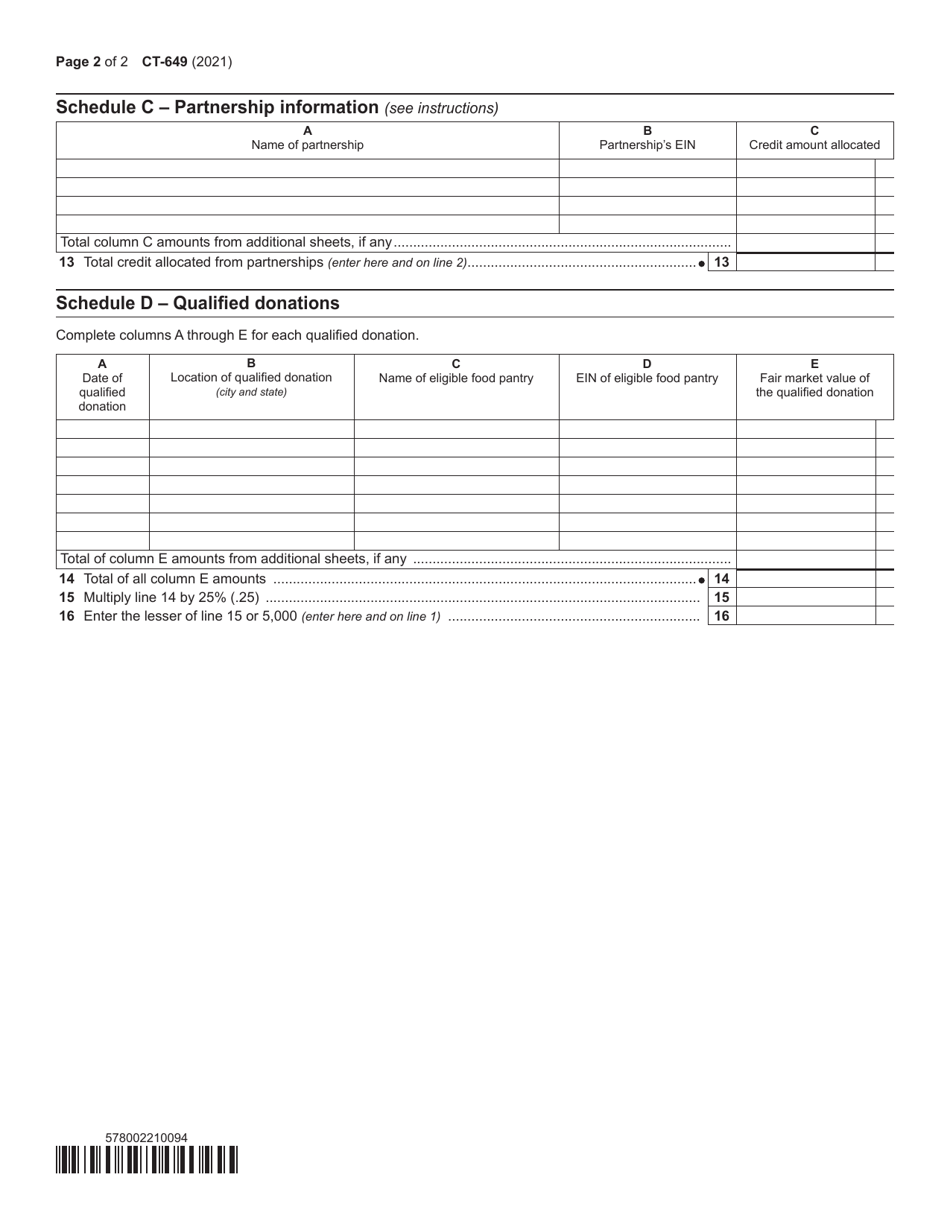

A: Form CT-649 is a tax form used in New York to claim the Farm Donations to Food Pantries Credit.

Q: What is the purpose of the Farm Donations to Food Pantries Credit?

A: The purpose of the Farm Donations to Food Pantries Credit is to provide a tax credit for farmers who make eligible donations of food to food pantries in New York.

Q: Who is eligible to claim the Farm Donations to Food Pantries Credit?

A: Farmers in New York who make eligible donations of food to food pantries are eligible to claim the credit.

Q: What is considered an eligible donation of food?

A: To be considered eligible, the donated food must be of agricultural origin, such as fresh produce or dairy products.

Q: How much is the credit?

A: The credit is equal to 25% of the fair market value of the eligible food donated.

Q: What is the maximum credit that can be claimed?

A: The maximum credit that can be claimed is $5,000 per taxpayer.

Q: How do I claim the Farm Donations to Food Pantries Credit?

A: To claim the credit, you must complete and file Form CT-649 with your New York State tax return.

Q: Are there any other requirements or limitations for claiming the credit?

A: Yes, there are certain requirements and limitations, such as keeping proper records of the donated food and obtaining written acknowledgement from the food pantry.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-649 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.