This version of the form is not currently in use and is provided for reference only. Download this version of

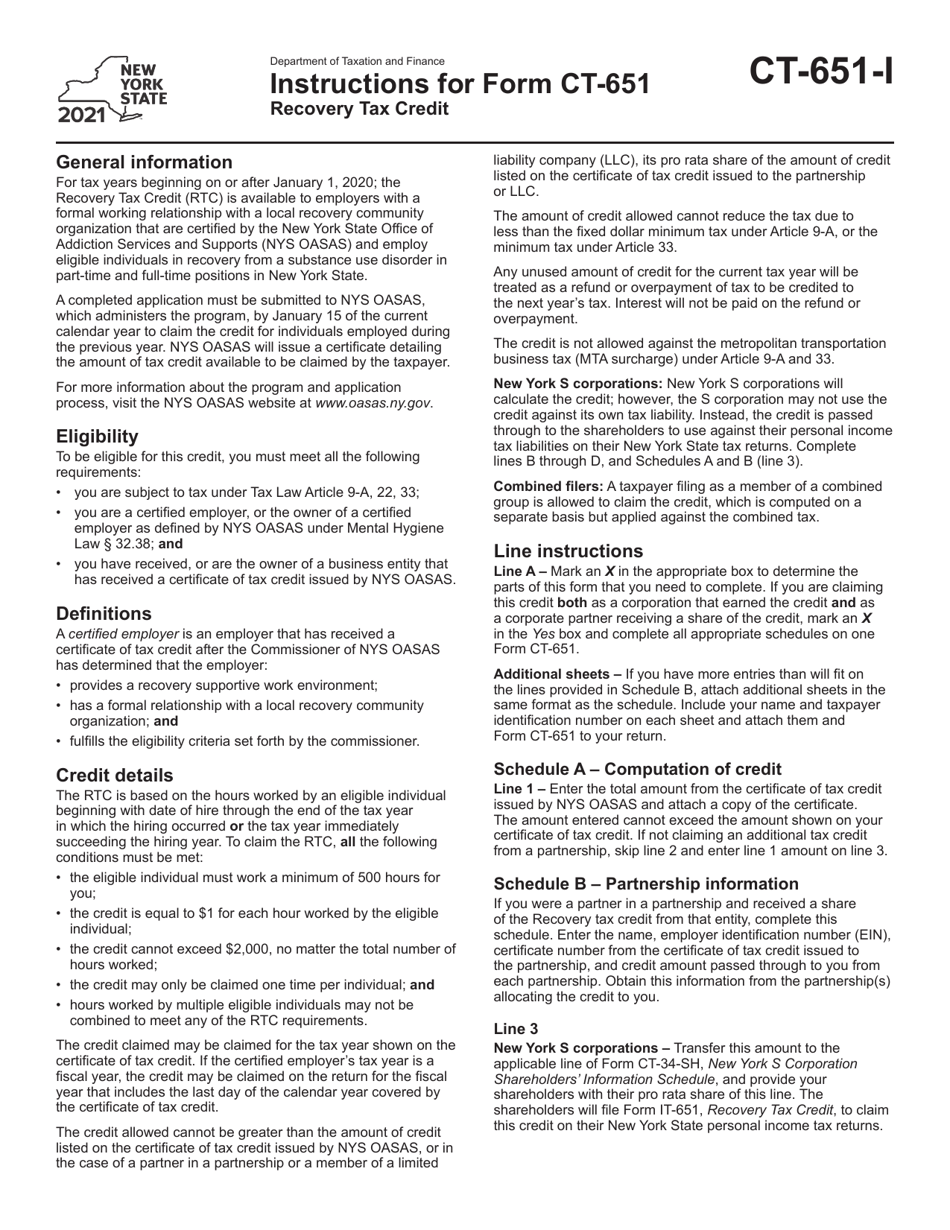

Instructions for Form CT-651

for the current year.

Instructions for Form CT-651 Recovery Tax Credit - New York

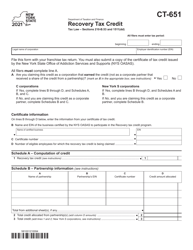

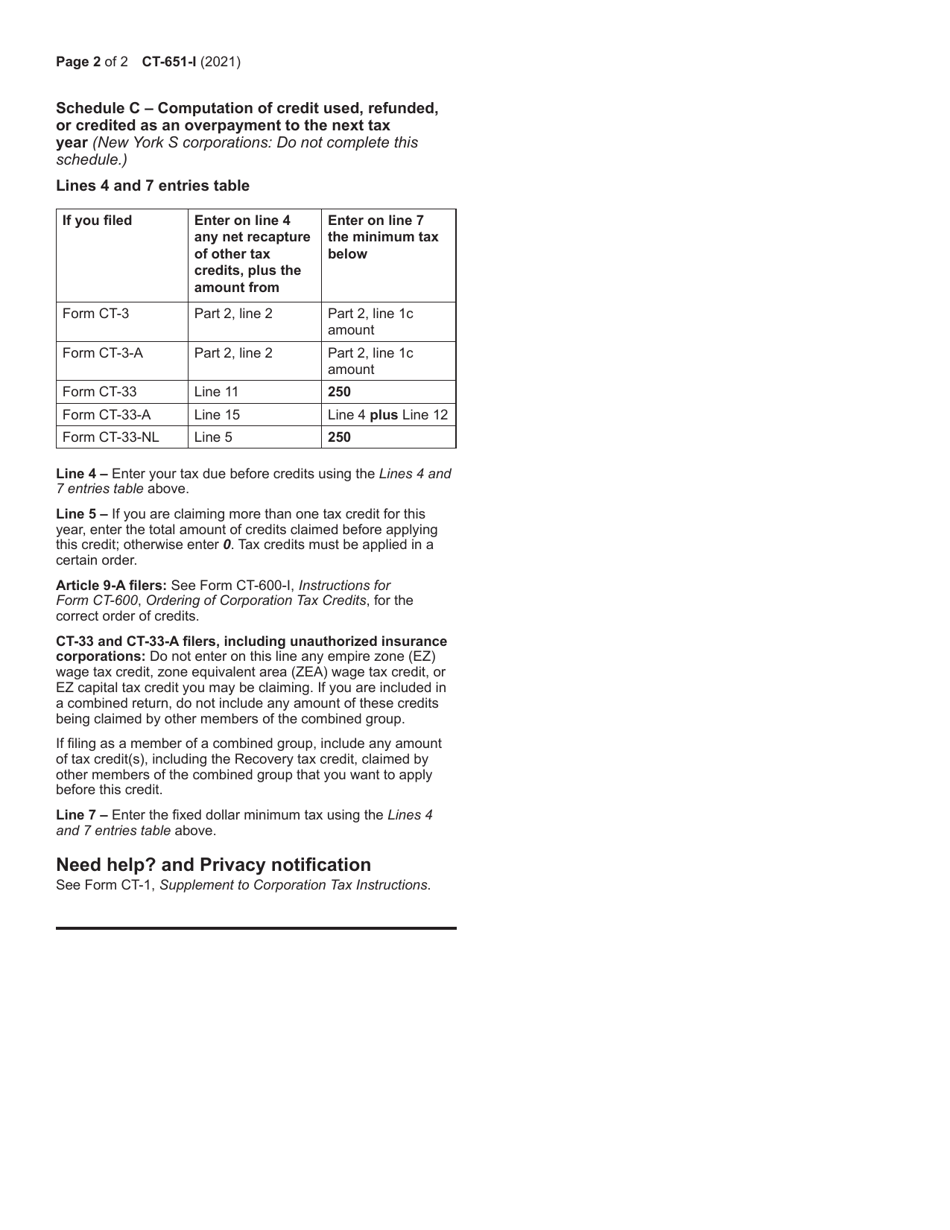

This document contains official instructions for Form CT-651 , Recovery Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-651 is available for download through this link.

FAQ

Q: What is Form CT-651?

A: Form CT-651 is a tax form used in New York to claim the Recovery Tax Credit.

Q: What is the Recovery Tax Credit?

A: The Recovery Tax Credit is a tax credit available to individuals and businesses in New York to help recover from natural disasters or other emergencies.

Q: Who is eligible to claim the Recovery Tax Credit?

A: Individuals and businesses in New York who have experienced a loss due to a natural disaster or emergency may be eligible to claim the Recovery Tax Credit.

Q: What information is required to fill out Form CT-651?

A: To fill out Form CT-651, you will need information about the disaster or emergency, the losses you suffered, and any insurance proceeds or other reimbursements you received.

Q: When is the deadline to file Form CT-651?

A: The deadline to file Form CT-651 is generally the same as the deadline for filing your New York state income tax return, which is typically April 15th.

Q: Can I claim the Recovery Tax Credit for losses in previous years?

A: No, the Recovery Tax Credit can only be claimed for losses incurred in the current tax year.

Q: Do I need to attach any supporting documentation to Form CT-651?

A: Yes, you will need to attach documentation supporting your claim, such as receipts, invoices, or other proof of loss.

Q: Can I e-file Form CT-651?

A: No, Form CT-651 cannot be e-filed. It must be filed by mail.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.