This version of the form is not currently in use and is provided for reference only. Download this version of

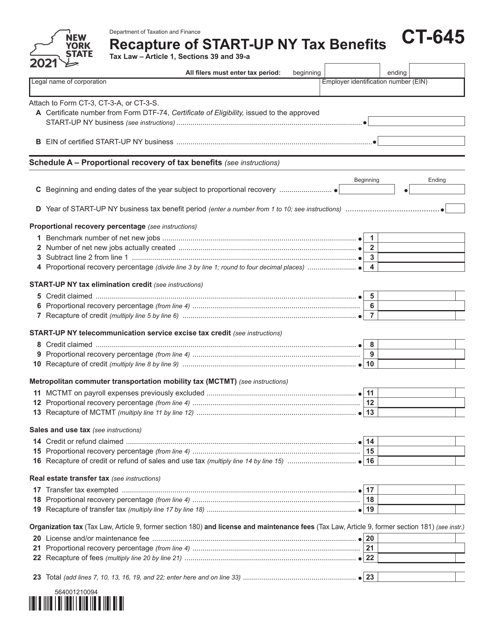

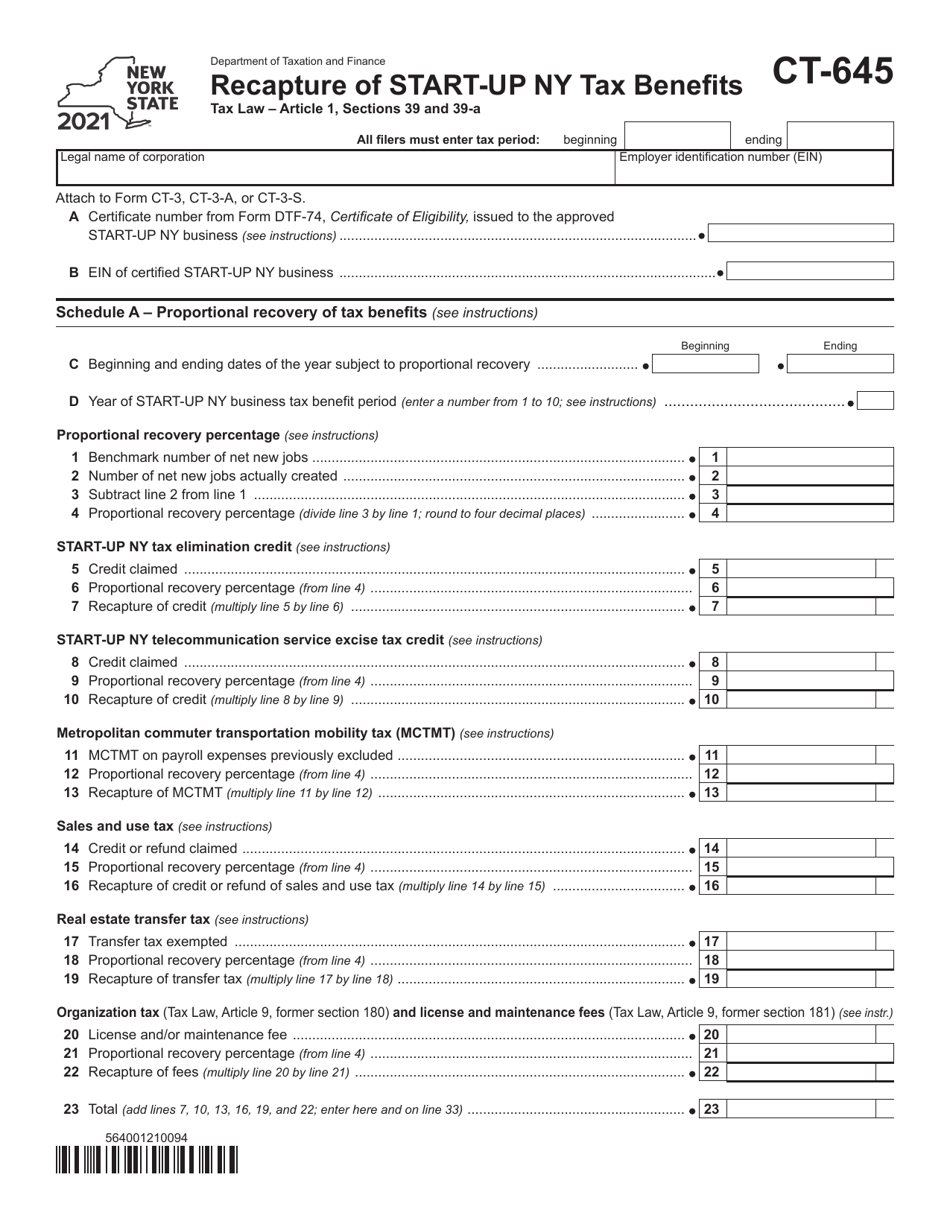

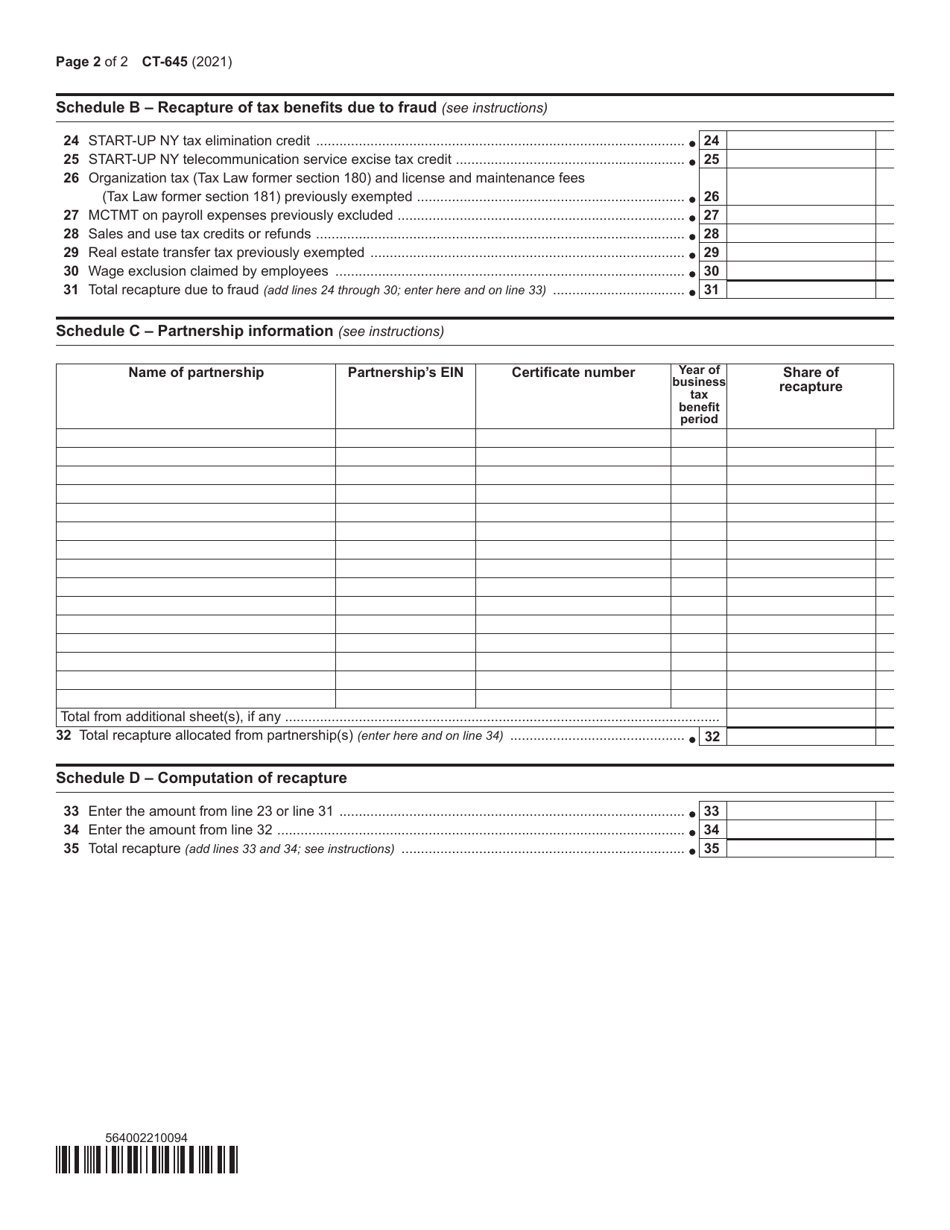

Form CT-645

for the current year.

Form CT-645 Recapture of Start-Up Ny Tax Benefits - New York

What Is Form CT-645?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-645?

A: Form CT-645 is a tax form used in New York to recapture the Start-Up NY tax benefits previously claimed.

Q: What are Start-Up NY tax benefits?

A: Start-Up NY tax benefits are incentives provided to eligible businesses that create new jobs in designated tax-free areas in New York.

Q: Who needs to file Form CT-645?

A: Businesses that have previously claimed Start-Up NY tax benefits and no longer meet the eligibility criteria need to file Form CT-645 to recapture those benefits.

Q: When is Form CT-645 due?

A: Form CT-645 is generally due on the same date as the business's New York State corporate tax return, which is usually March 15th for calendar year filers.

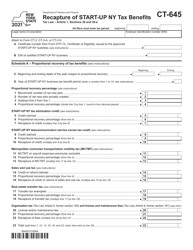

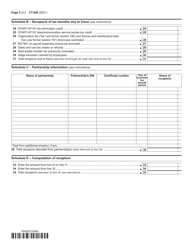

Q: How do I complete Form CT-645?

A: Form CT-645 requires information about the recapture calculation and the reason for recapture. Detailed instructions are provided with the form.

Q: Are there any penalties for not filing Form CT-645?

A: Failure to file Form CT-645 or recapture the Start-Up NY tax benefits as required may result in penalties and interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-645 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.