This version of the form is not currently in use and is provided for reference only. Download this version of

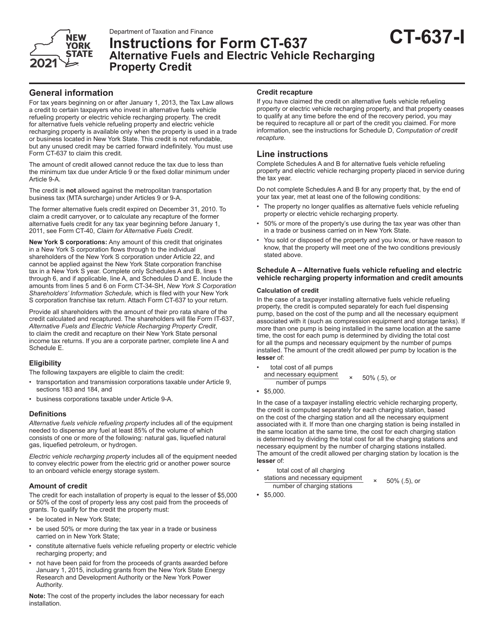

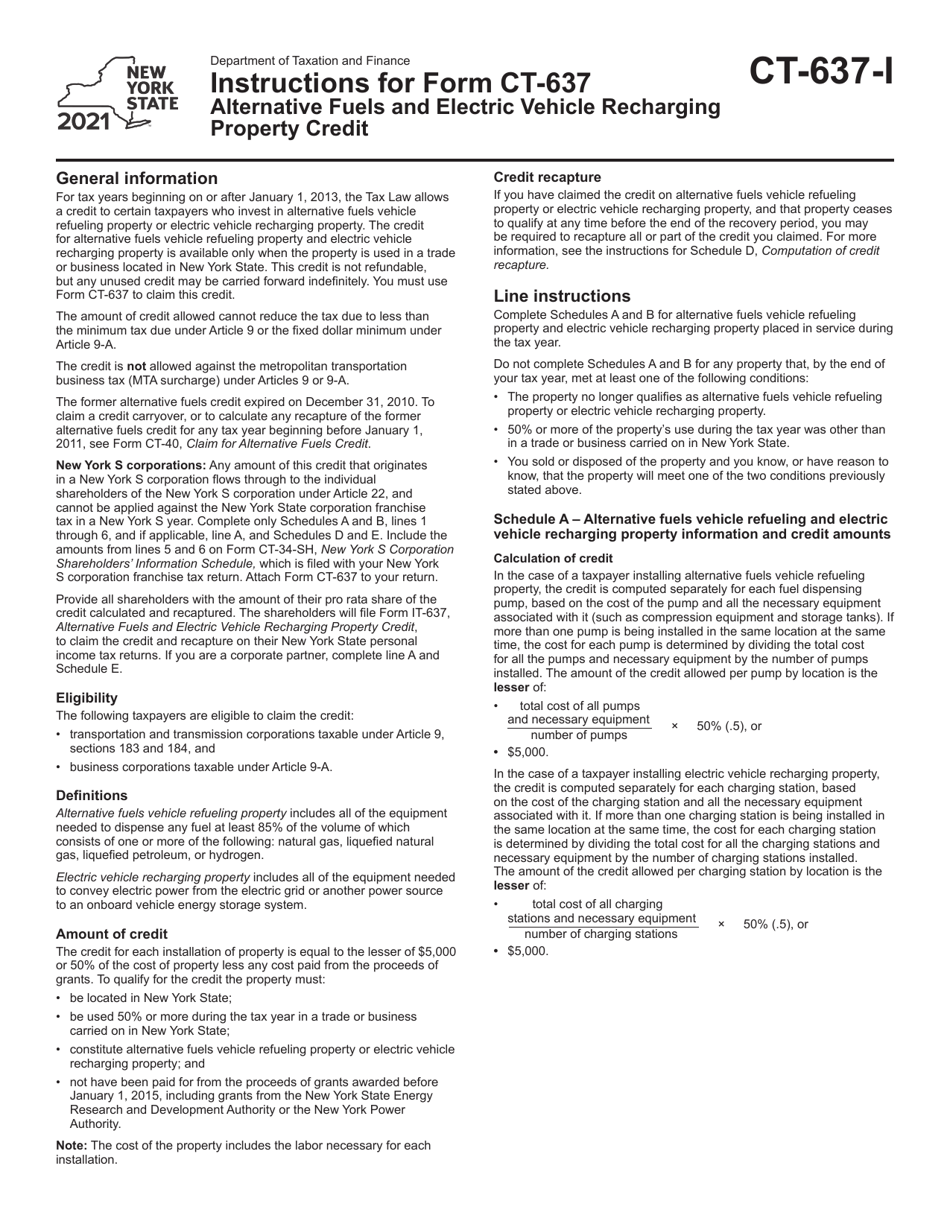

Instructions for Form CT-637

for the current year.

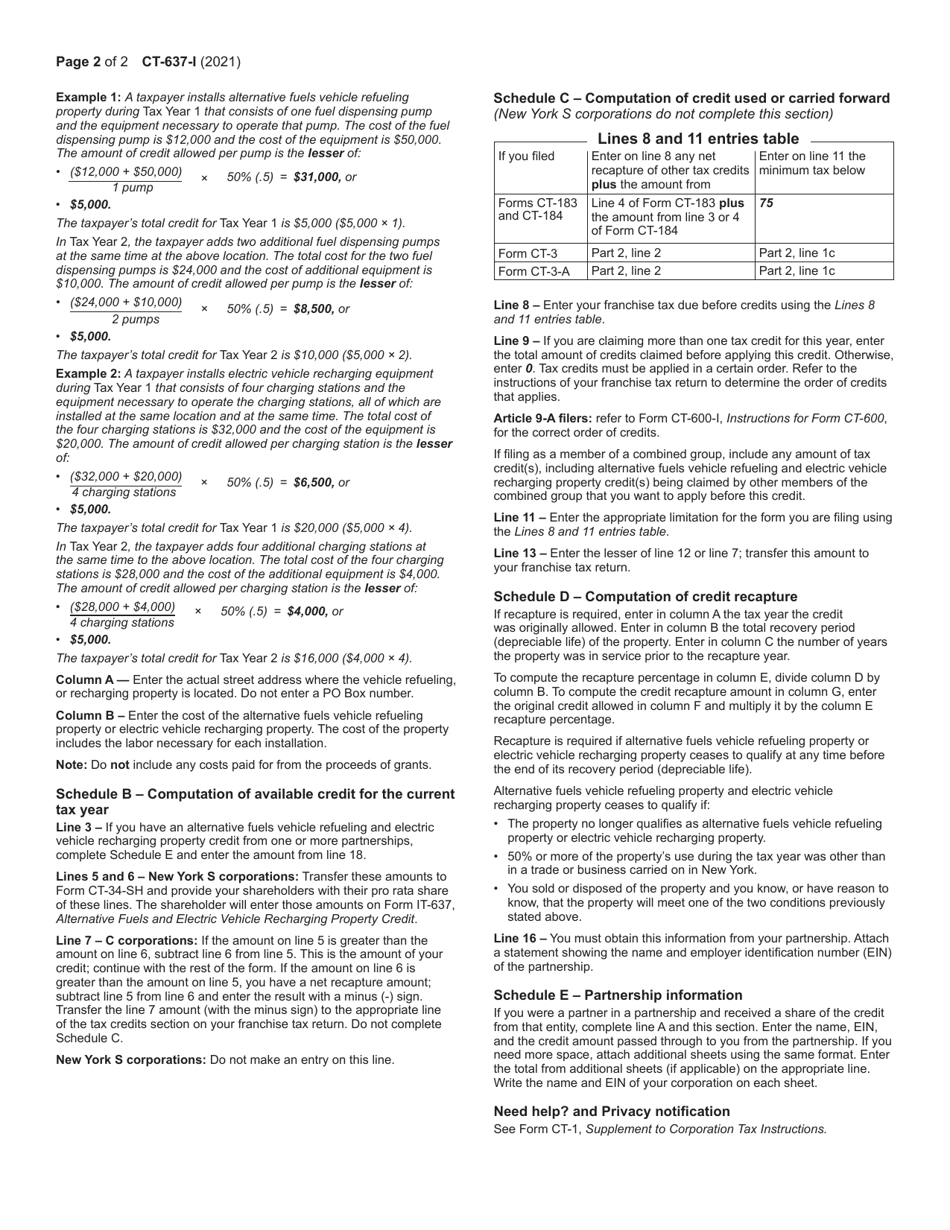

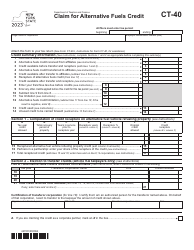

Instructions for Form CT-637 Alternative Fuels and Electric Vehicle Recharging Property Credit - New York

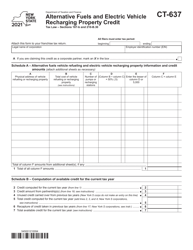

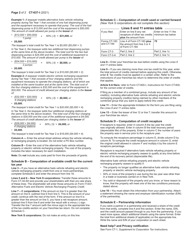

This document contains official instructions for Form CT-637 , Alternative Fuels and Electric Vehicle Recharging Property Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-637 is available for download through this link.

FAQ

Q: What is Form CT-637?

A: Form CT-637 is a form used in New York to claim the Alternative Fuels and Electric Vehicle Recharging Property Credit.

Q: What is the Alternative Fuels and Electric Vehicle Recharging Property Credit?

A: The Alternative Fuels and Electric Vehicle Recharging Property Credit is a credit available in New York for eligible costs related to alternative fuels and electric vehicle recharging property.

Q: Who is eligible to claim the credit?

A: Various entities, including individuals, corporations, and partnerships, may be eligible to claim the credit.

Q: What types of costs are eligible for the credit?

A: Eligible costs may include expenses related to the purchase, installation, and operation of alternative fuels and electric vehicle recharging property.

Q: What documentation do I need to include when filing Form CT-637?

A: You may need to include various supporting documents, such as invoices, receipts, and proof of payment, to substantiate your claim for the credit.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions, such as maximum credit amounts and eligibility requirements, that apply to the Alternative Fuels and Electric Vehicle Recharging Property Credit.

Q: When is the deadline for filing Form CT-637?

A: The deadline for filing Form CT-637 is typically the same as the deadline for filing your New York State income tax return, which is generally April 15th of each year.

Q: Can I claim the credit for expenses incurred in a previous year?

A: Yes, you may be able to claim the credit for eligible expenses incurred in a previous year, but you must file an amended return for that year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.