This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-644

for the current year.

Form CT-644 Workers With Disabilities Tax Credit - New York

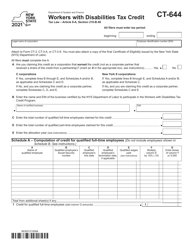

What Is Form CT-644?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-644?

A: Form CT-644 is the Workers With Disabilities Tax Credit form in New York.

Q: Who can use Form CT-644?

A: Employers in New York who have hired individuals with disabilities can use Form CT-644.

Q: What is the purpose of Form CT-644?

A: The purpose of Form CT-644 is to claim the tax credit for employing individuals with disabilities.

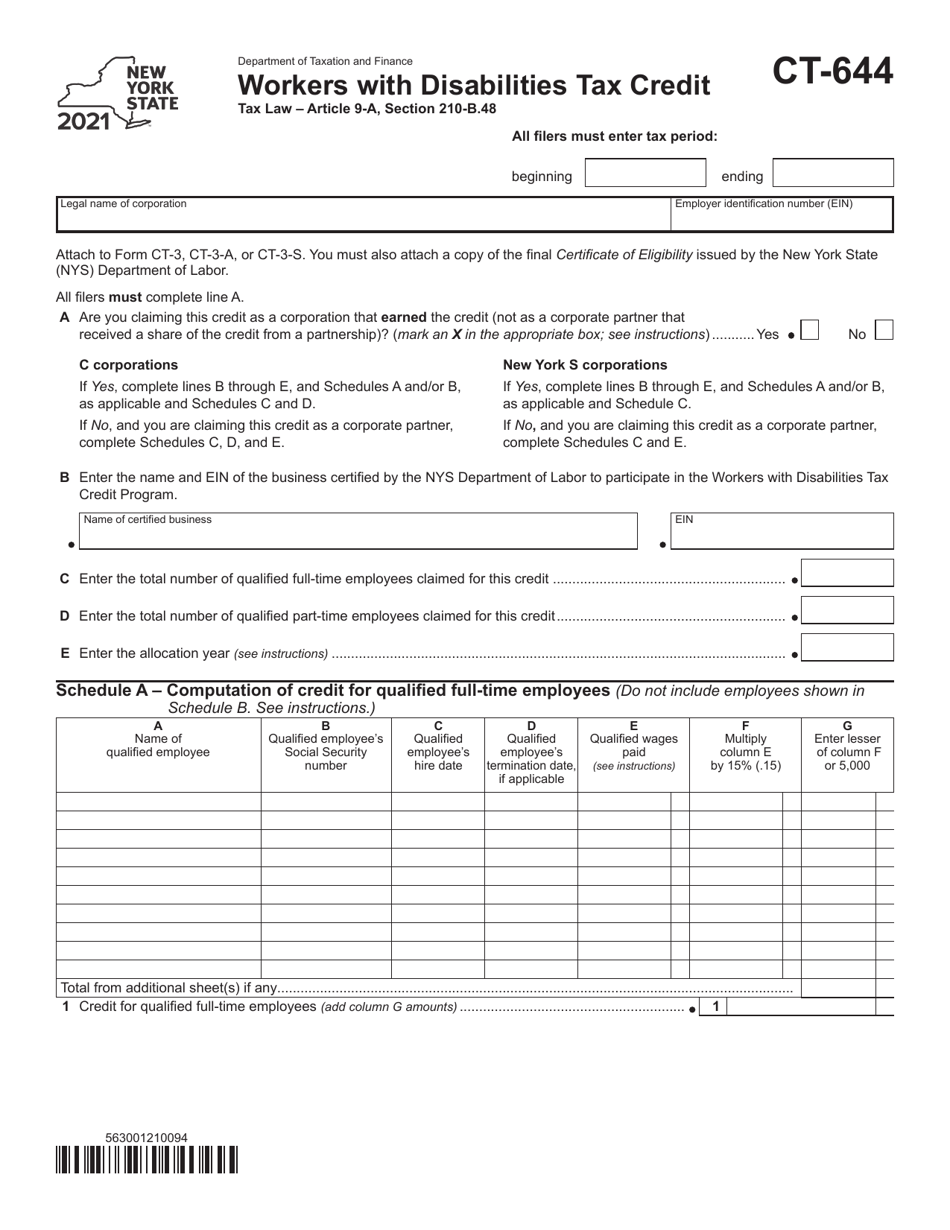

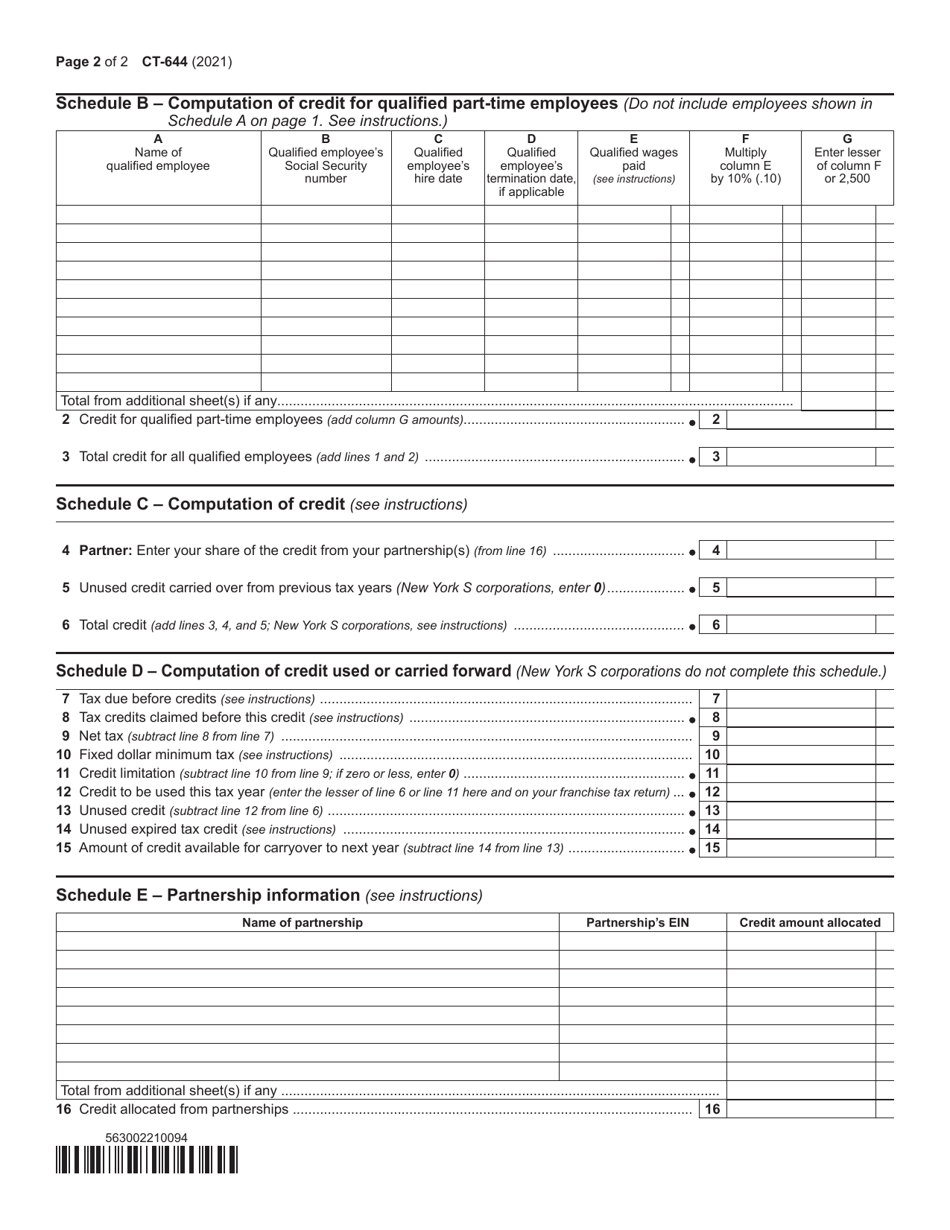

Q: What information is required on Form CT-644?

A: Form CT-644 requires information about the employer, the qualified employee with a disability, and the wages paid.

Q: When is the deadline to file Form CT-644?

A: Form CT-644 should be filed with the employer's annual franchise tax return for the same taxable year.

Q: Is Form CT-644 only applicable in New York?

A: Yes, Form CT-644 is specific to employers in New York.

Q: Is there a deadline for submitting Form CT-644?

A: Form CT-644 should be submitted along with the employer's annual franchise tax return for the same taxable year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-644 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.