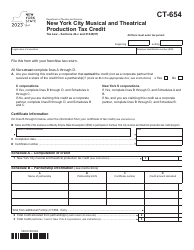

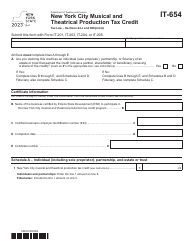

This version of the form is not currently in use and is provided for reference only. Download this version of

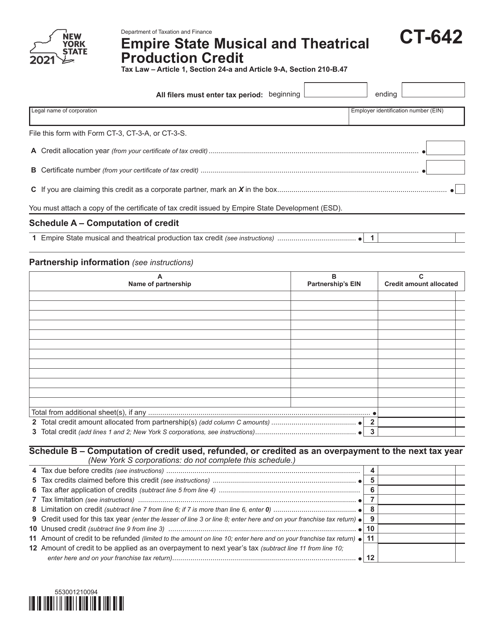

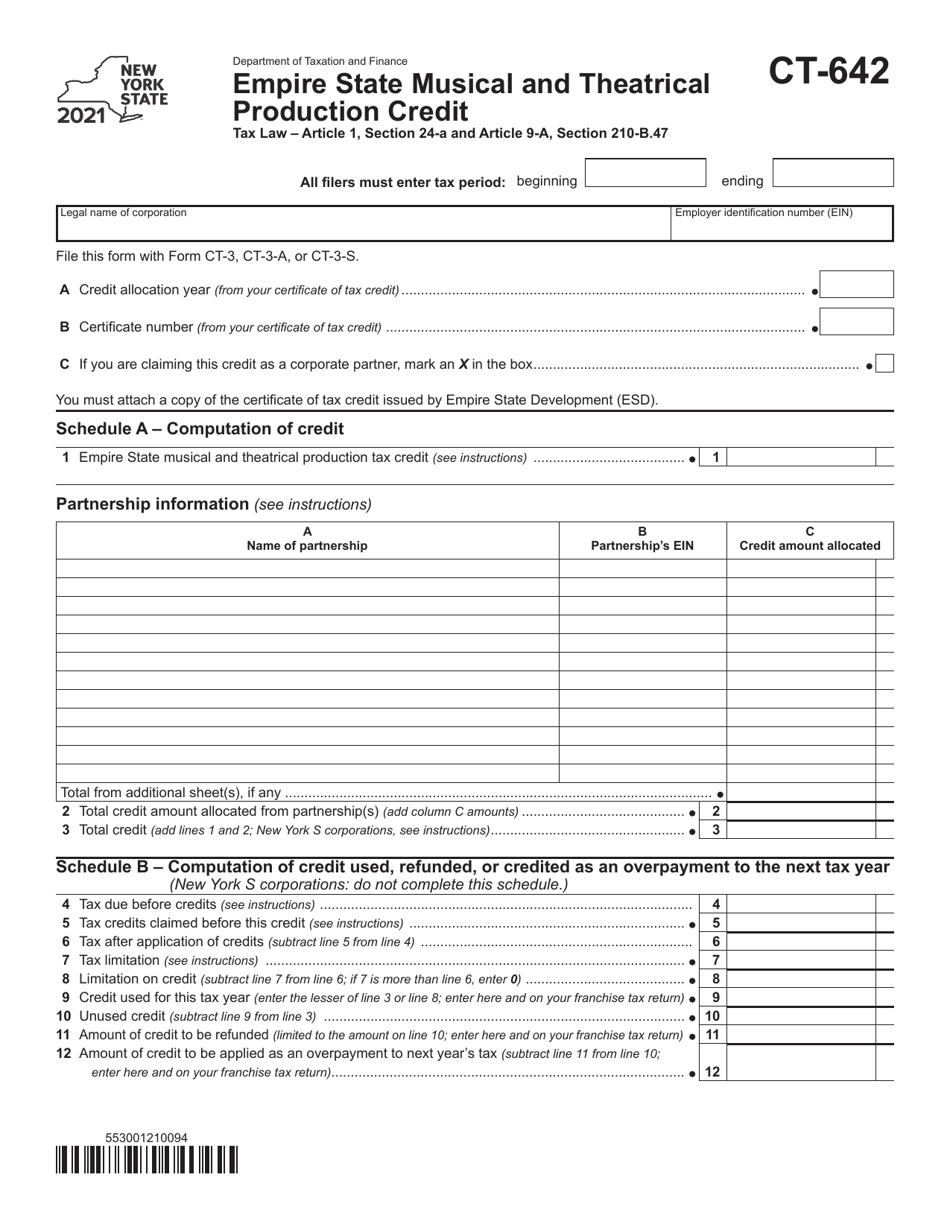

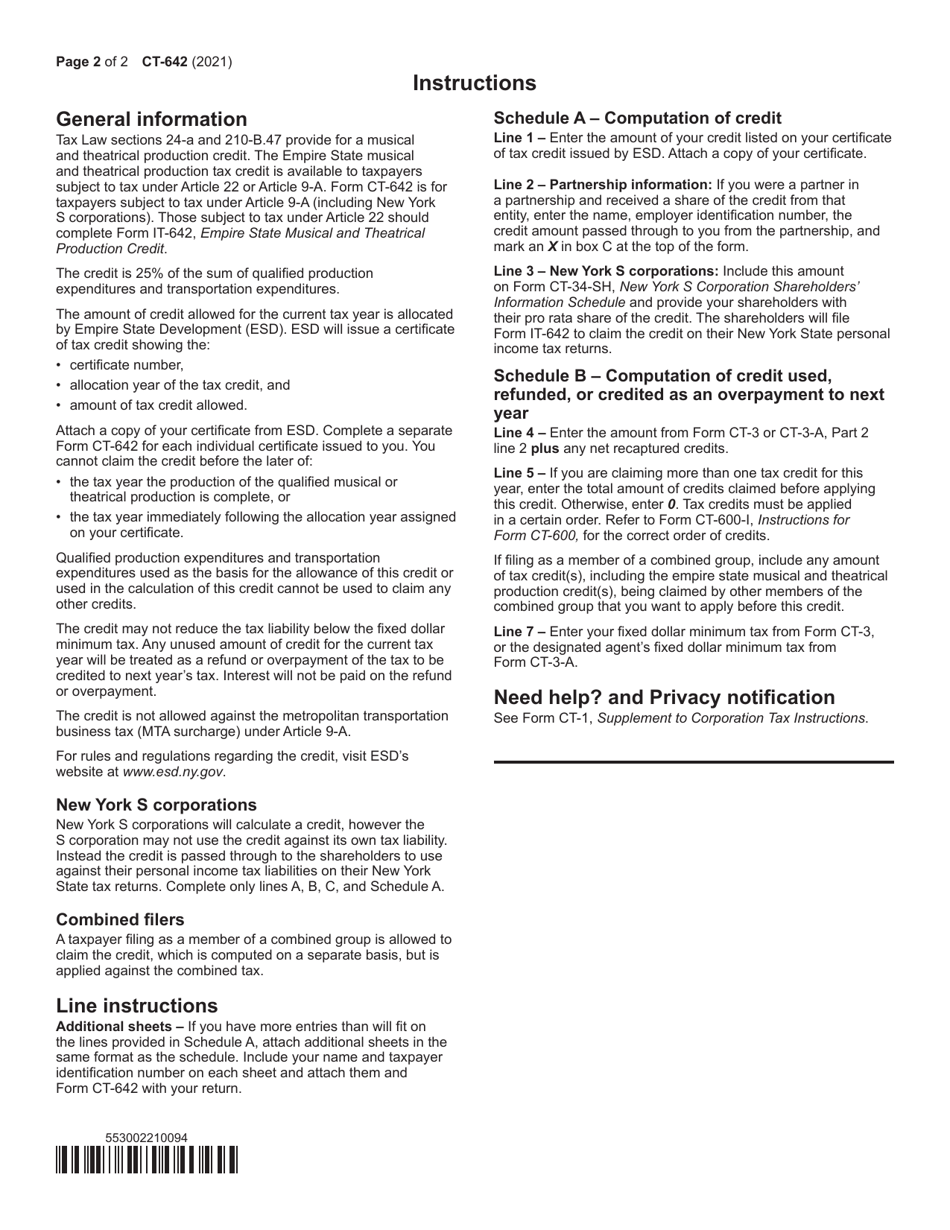

Form CT-642

for the current year.

Form CT-642 Empire State Musical and Theatrical Production Credit - New York

What Is Form CT-642?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-642?

A: Form CT-642 is the Empire State Musical and Theatrical Production Credit form for New York.

Q: What is the purpose of Form CT-642?

A: The purpose of Form CT-642 is to claim the Empire State Musical and Theatrical Production Credit in New York.

Q: Who can file Form CT-642?

A: Form CT-642 can be filed by eligible taxpayers who are engaged in musical and theatrical productions in the state of New York.

Q: What is the Empire State Musical and Theatrical Production Credit?

A: The Empire State Musical and Theatrical Production Credit is a tax credit available to eligible taxpayers engaged in musical and theatrical productions in New York.

Q: What expenses qualify for the Empire State Musical and Theatrical Production Credit?

A: Expenses related to the production of eligible musical and theatrical productions, such as production costs, labor costs, and certain qualified stage productions costs, may qualify for the credit.

Q: What is the deadline for filing Form CT-642?

A: The deadline for filing Form CT-642 is the same as the deadline for filing the taxpayer's income tax return for the tax year.

Q: Are there any limitations or restrictions for claiming the Empire State Musical and Theatrical Production Credit?

A: Yes, there are certain limitations and restrictions for claiming the credit. It is important to review the instructions and guidelines provided with Form CT-642 or consult a tax professional for more information.

Q: Can Form CT-642 be filed electronically?

A: Yes, Form CT-642 can be filed electronically using the New York State e-file system.

Q: Is the Empire State Musical and Theatrical Production Credit refundable?

A: No, the Empire State Musical and Theatrical Production Credit is not refundable. Any unused credit cannot be refunded, but it may be carried forward for future tax years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-642 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.