This version of the form is not currently in use and is provided for reference only. Download this version of

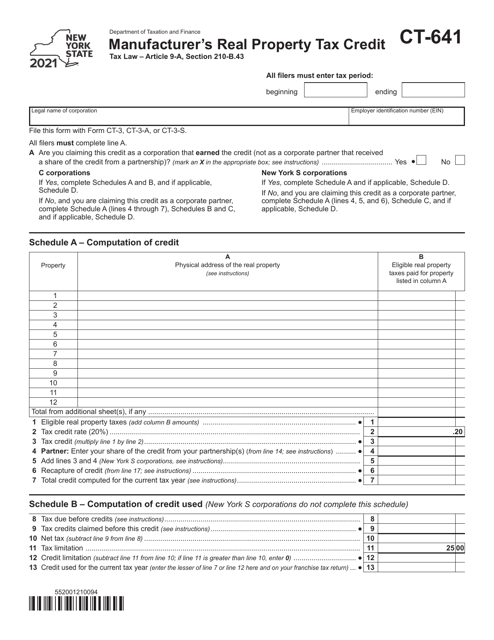

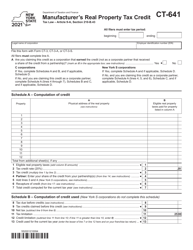

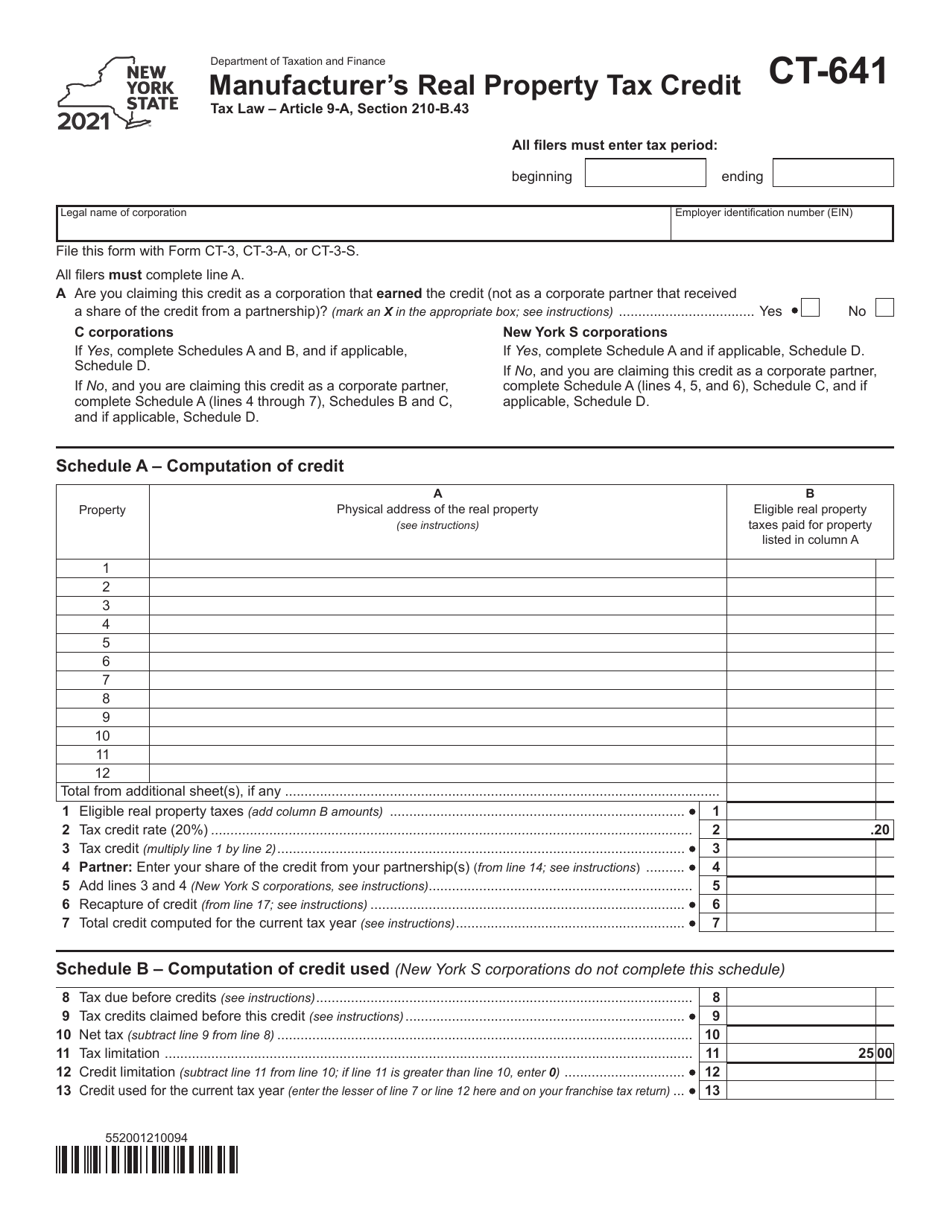

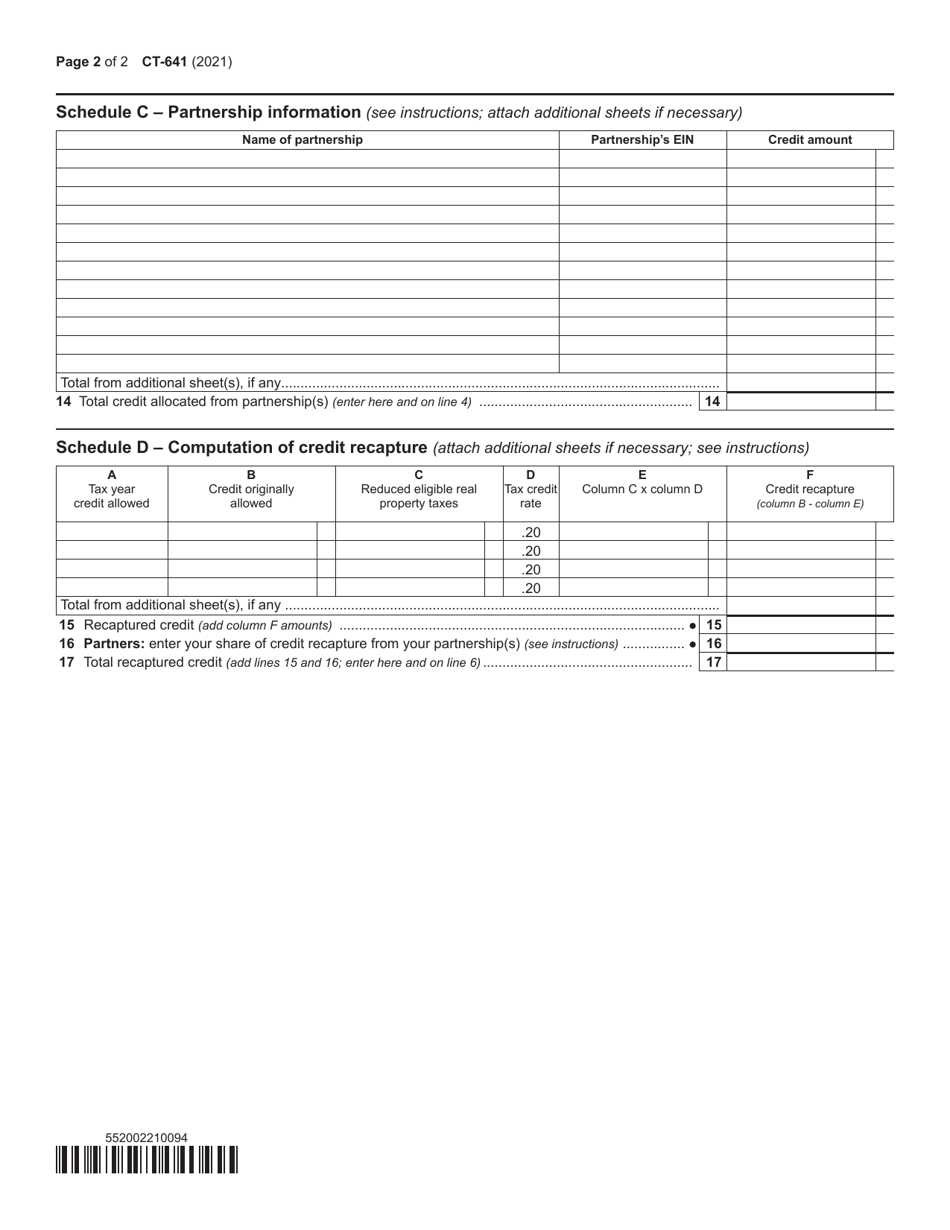

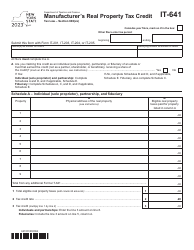

Form CT-641

for the current year.

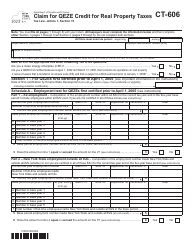

Form CT-641 Manufacturer's Real Property Tax Credit - New York

What Is Form CT-641?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-641?

A: Form CT-641 is a tax form used in the state of New York.

Q: What is the Manufacturer's Real Property Tax Credit?

A: The Manufacturer's Real Property Tax Credit is a credit available to eligible manufacturers in New York.

Q: Who is eligible for the Manufacturer's Real Property Tax Credit?

A: Eligible manufacturers in New York are eligible for the credit.

Q: What is the purpose of Form CT-641?

A: Form CT-641 is used to claim the Manufacturer's Real Property Tax Credit.

Q: Are there any specific requirements for claiming the credit?

A: Yes, there are specific requirements that manufacturers must meet in order to claim the credit.

Q: Can the Manufacturer's Real Property Tax Credit be carried forward?

A: Yes, the credit can be carried forward for up to 15 years.

Q: Is there a deadline for filing Form CT-641?

A: Yes, Form CT-641 must be filed by the due date of the corporation tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-641 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.