This version of the form is not currently in use and is provided for reference only. Download this version of

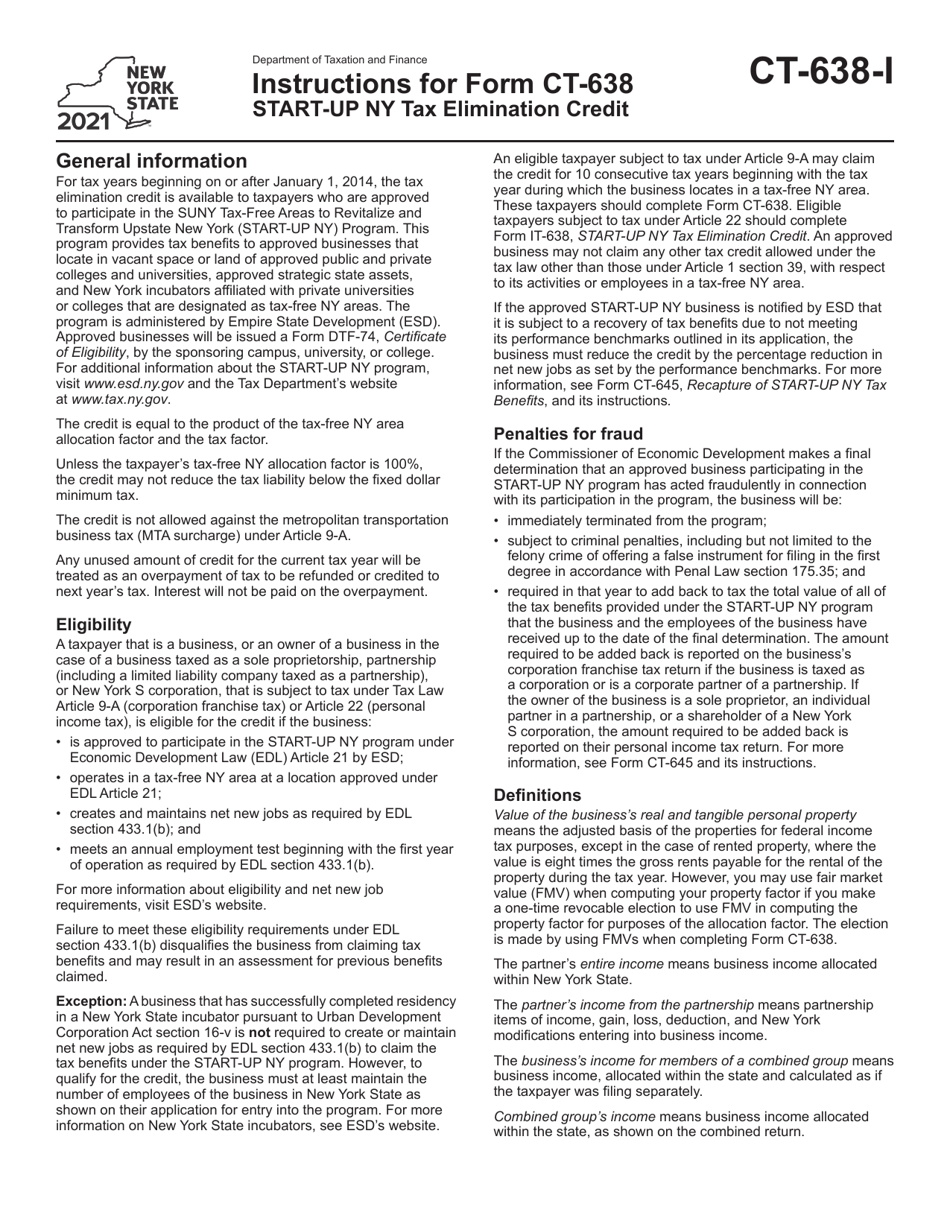

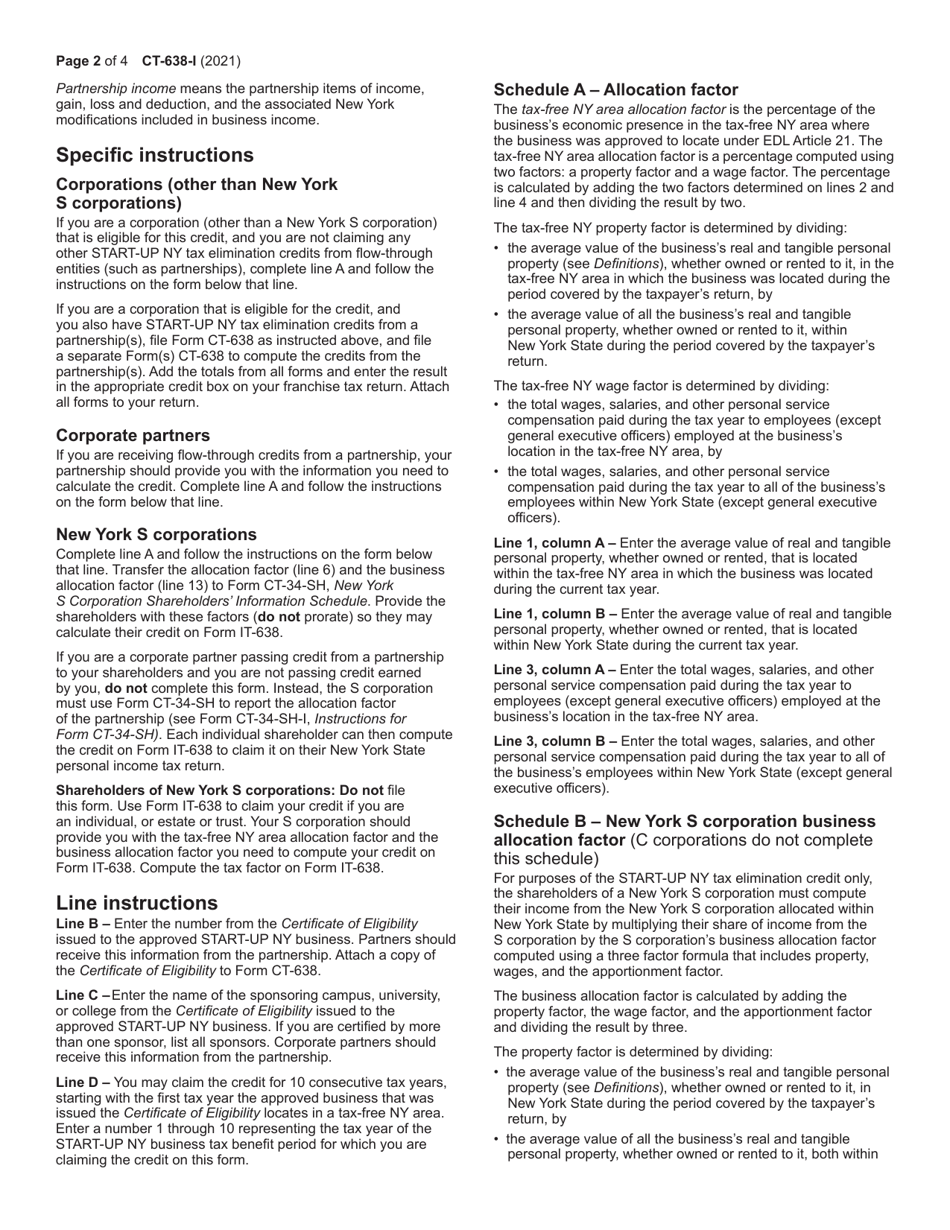

Instructions for Form CT-638

for the current year.

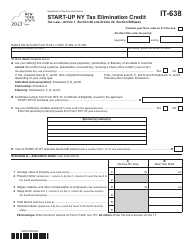

Instructions for Form CT-638 Start-Up Ny Tax Elimination Credit - New York

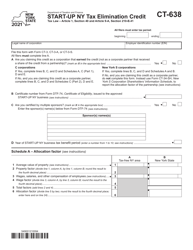

This document contains official instructions for Form CT-638 , Start-Up Ny Tax Elimination Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-638 is available for download through this link.

FAQ

Q: What is Form CT-638?

A: Form CT-638 is a tax form related to the Start-Up NY Tax Elimination Credit in New York.

Q: What is the Start-Up NY Tax Elimination Credit?

A: The Start-Up NY Tax Elimination Credit is a tax credit program in New York that provides incentives for new businesses.

Q: What is the purpose of Form CT-638?

A: Form CT-638 is used to calculate and claim the Start-Up NY Tax Elimination Credit.

Q: Who is eligible to claim the Start-Up NY Tax Elimination Credit?

A: Eligible businesses that are approved by the Start-Up NY program are eligible to claim the tax credit.

Q: How do I fill out Form CT-638?

A: You will need to provide information about your business, including the number of employees and the amount of wages paid. The form also requires you to provide detailed information about the tax year and the amount of tax credit claimed.

Q: When is the deadline to submit Form CT-638?

A: The deadline to submit Form CT-638 is determined by the tax year. It is typically due with your annual tax return.

Q: Are there any other requirements to claim the Start-Up NY Tax Elimination Credit?

A: Yes, there are additional requirements, such as being in compliance with all New York State tax laws and regulations.

Q: Can I claim the Start-Up NY Tax Elimination Credit for multiple tax years?

A: Yes, you can claim the tax credit for multiple tax years as long as you meet the eligibility criteria each year.

Q: What happens after I submit Form CT-638?

A: After submitting Form CT-638, it will be reviewed by the New York State Department of Taxation and Finance. If approved, you will receive the tax credit as a reduction of your tax liability or a refund.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.