This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-635

for the current year.

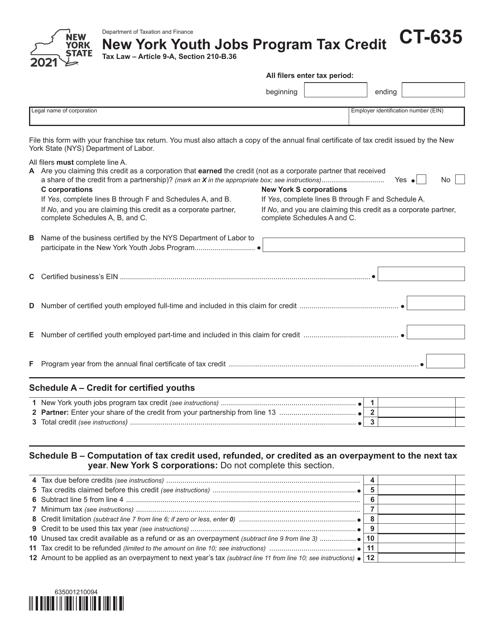

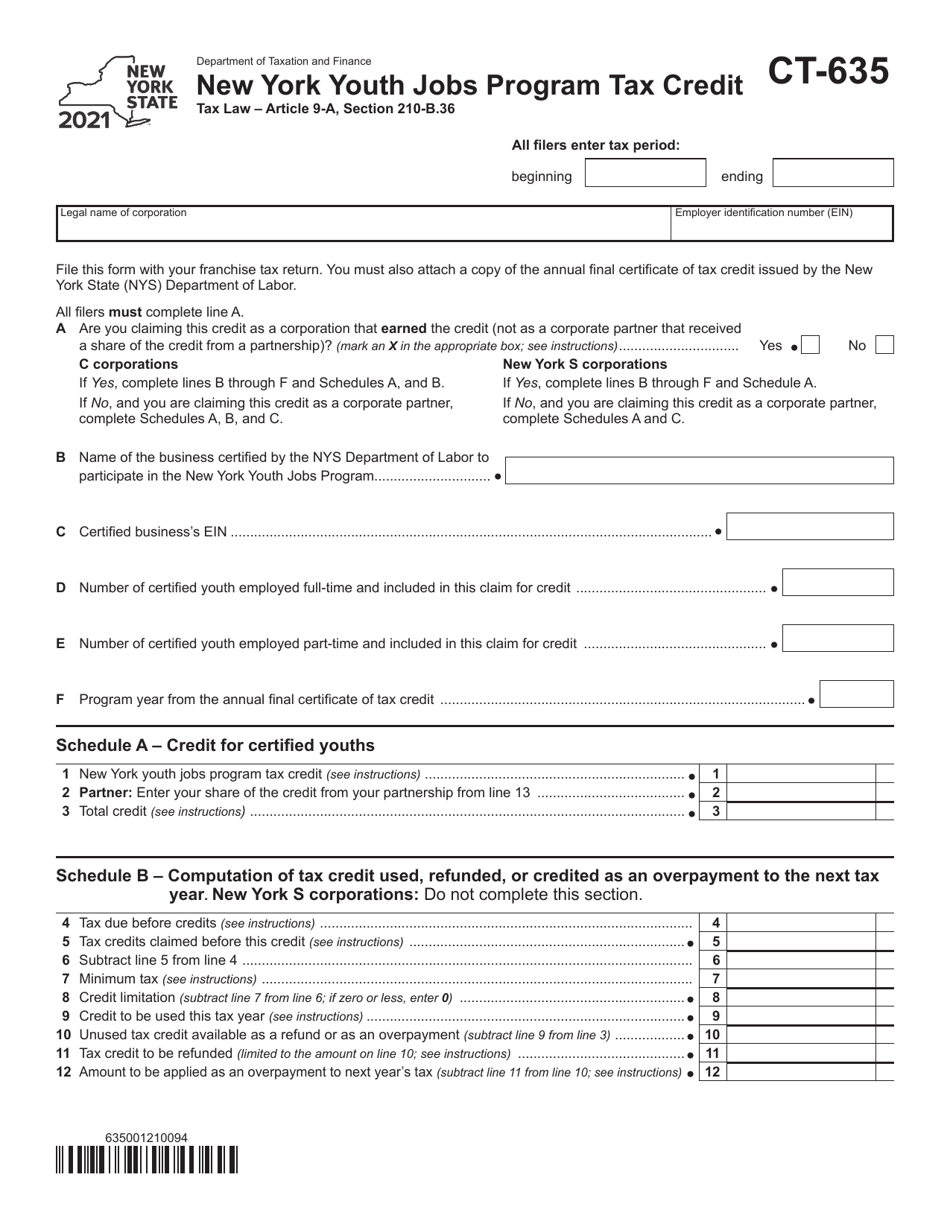

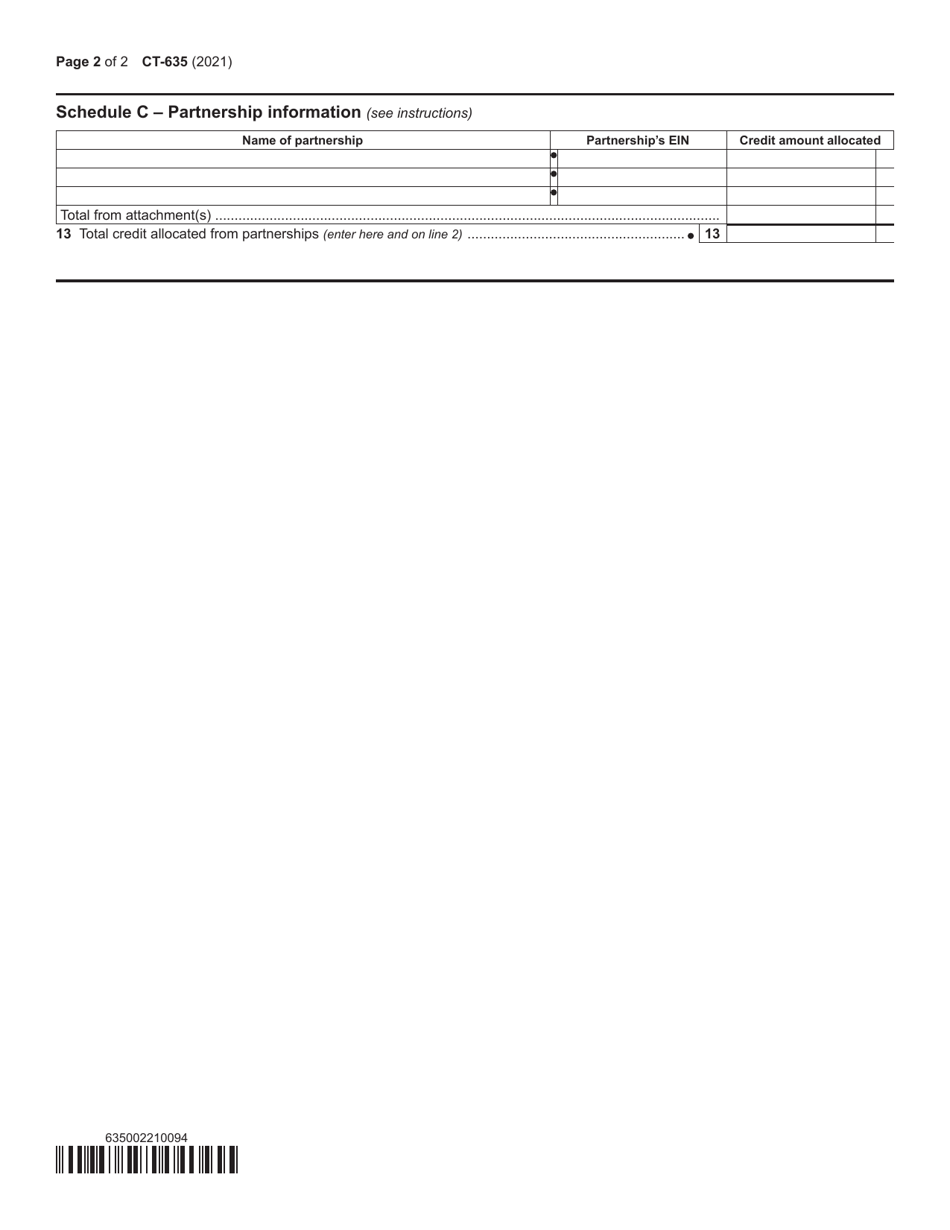

Form CT-635 New York Youth Jobs Program Tax Credit - New York

What Is Form CT-635?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-635?

A: Form CT-635 is a tax form used in New York to claim the New York Youth Jobs ProgramTax Credit.

Q: What is the New York Youth Jobs Program Tax Credit?

A: The New York Youth Jobs Program Tax Credit is a tax credit available to businesses that hire qualified at-risk youth in New York.

Q: Who is eligible for the New York Youth Jobs Program Tax Credit?

A: Businesses in New York that hire qualified at-risk youth between the ages of 16 and 24 are eligible for the tax credit.

Q: How much is the New York Youth Jobs Program Tax Credit?

A: The tax credit amount is based on the wages paid to eligible employees and can range from $500 to $2,000 per employee.

Q: How do I claim the New York Youth Jobs Program Tax Credit?

A: To claim the tax credit, businesses must complete Form CT-635 and submit it with their annual tax return.

Q: Are there any deadlines for claiming the New York Youth Jobs Program Tax Credit?

A: Yes, businesses must submit Form CT-635 within three years from the end of the taxable year in which the credit is earned.

Q: Are there any other requirements for claiming the New York Youth Jobs Program Tax Credit?

A: Yes, businesses must meet certain criteria and follow specific guidelines outlined by the New York State Department of Taxation and Finance.

Q: Can individuals claim the New York Youth Jobs Program Tax Credit?

A: No, the tax credit is only available to businesses that hire qualified at-risk youth in New York.

Q: Is the New York Youth Jobs Program Tax Credit refundable?

A: No, the tax credit is not refundable, but any unused credit can be carried forward for up to five years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-635 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.