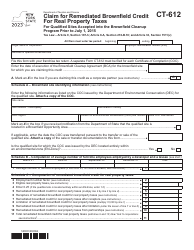

This version of the form is not currently in use and is provided for reference only. Download this version of

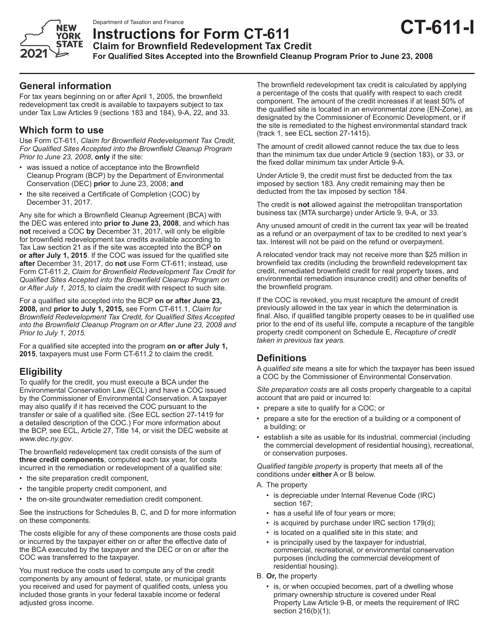

Instructions for Form CT-611

for the current year.

Instructions for Form CT-611 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

This document contains official instructions for Form CT-611 , Claim for Brownfield Cleanup Program Prior to June 23, 2008 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-611 is available for download through this link.

FAQ

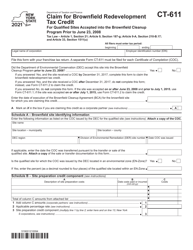

Q: What is Form CT-611?

A: Form CT-611 is a tax form used in New York to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program.

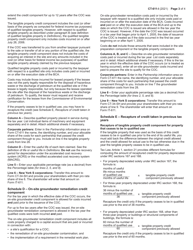

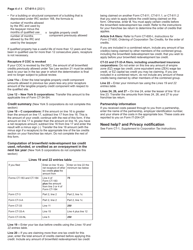

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax credit provided by the state of New York to encourage the cleanup and redevelopment of contaminated sites.

Q: Who can claim the Brownfield Redevelopment Tax Credit?

A: Property owners or developers who have qualified sites accepted into the Brownfield Cleanup Program prior to June 23, 2008, can claim the tax credit.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a New York State program that provides incentives and support for the cleanup and redevelopment of contaminated properties.

Q: When should Form CT-611 be filed?

A: Form CT-611 should be filed with your New York State income tax return within one year from the date of completion of the brownfield site's remedial program.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.