This version of the form is not currently in use and is provided for reference only. Download this version of

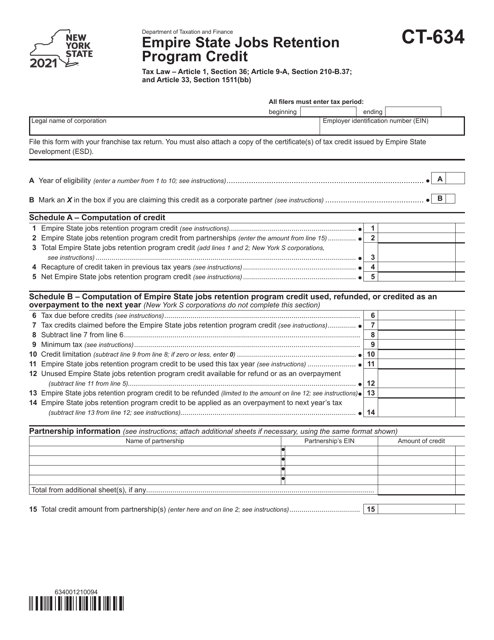

Form CT-634

for the current year.

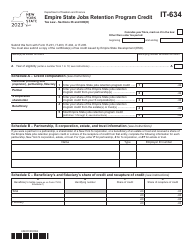

Form CT-634 Empire State Jobs Retention Program Credit - New York

What Is Form CT-634?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-634?

A: Form CT-634 is the Empire StateJobs Retention Program Credit form in New York.

Q: What is the Empire State Jobs Retention Program Credit?

A: The Empire State Jobs Retention Program Credit is a tax credit provided by the state of New York to businesses that create or retain jobs.

Q: Who can use Form CT-634?

A: Form CT-634 can be used by businesses in New York that are eligible for the Empire State Jobs Retention Program Credit.

Q: What is the purpose of Form CT-634?

A: The purpose of Form CT-634 is to calculate and claim the Empire State Jobs Retention Program Credit.

Q: Are there any deadlines for filing Form CT-634?

A: Yes, the deadlines for filing Form CT-634 vary depending on the tax year. It is important to check the instructions on the form for the specific deadlines.

Q: What information is required when completing Form CT-634?

A: When completing Form CT-634, you will need to provide information about the business, the number of jobs created or retained, and other details related to the Empire State Jobs Retention Program Credit.

Q: Can I file Form CT-634 electronically?

A: Yes, Form CT-634 can be filed electronically through the New York State Department of Taxation and Finance's e-file system.

Q: Is there a fee for filing Form CT-634?

A: No, there is no fee for filing Form CT-634.

Q: What should I do if I have questions or need assistance with Form CT-634?

A: If you have questions or need assistance with Form CT-634, you can contact the New York State Department of Taxation and Finance for help.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-634 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.