This version of the form is not currently in use and is provided for reference only. Download this version of

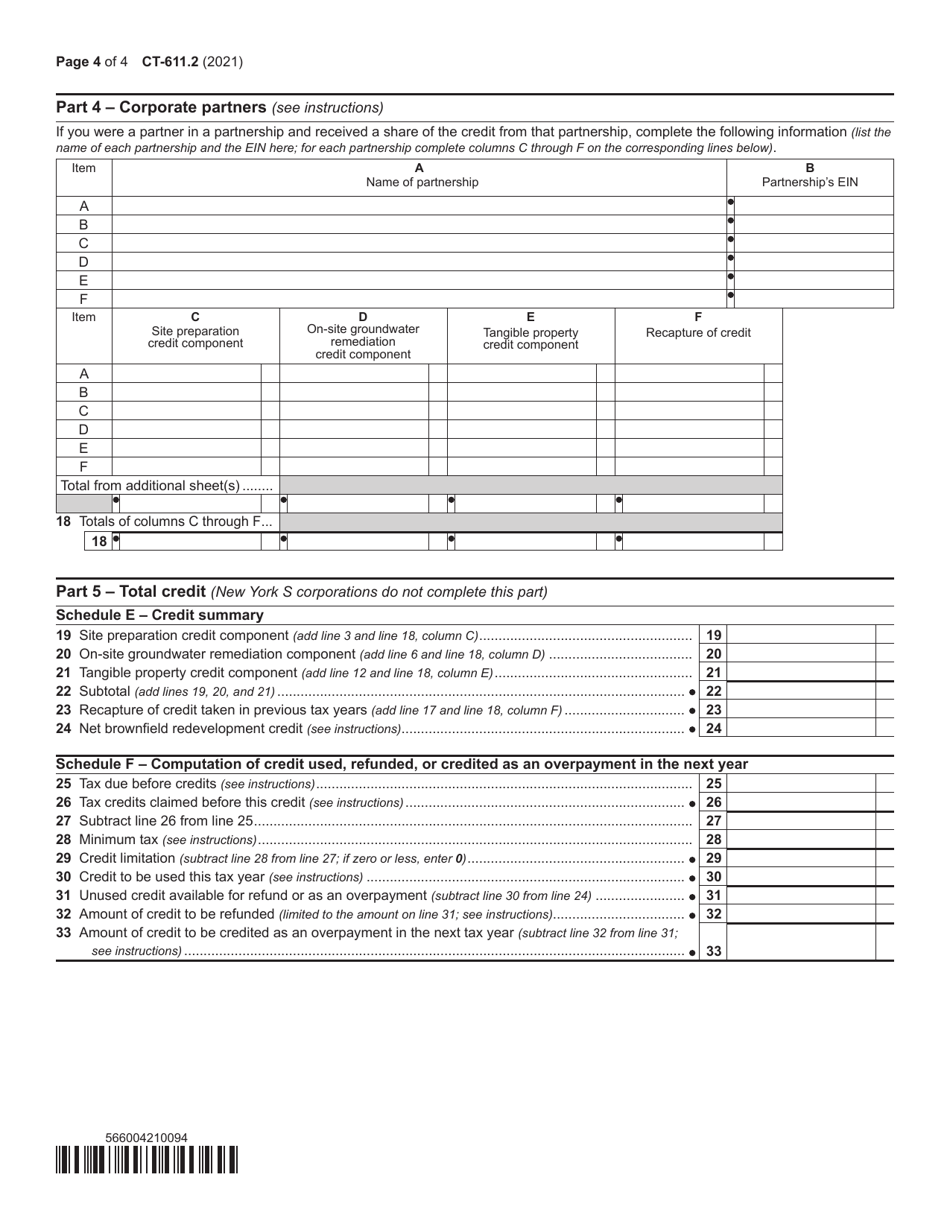

Form CT-611.2

for the current year.

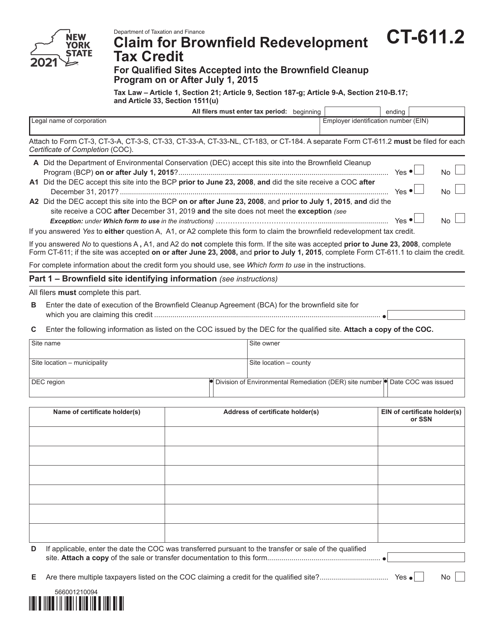

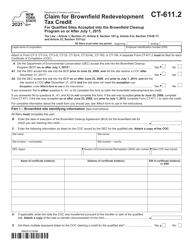

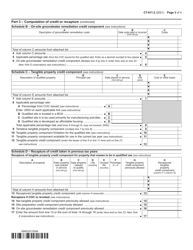

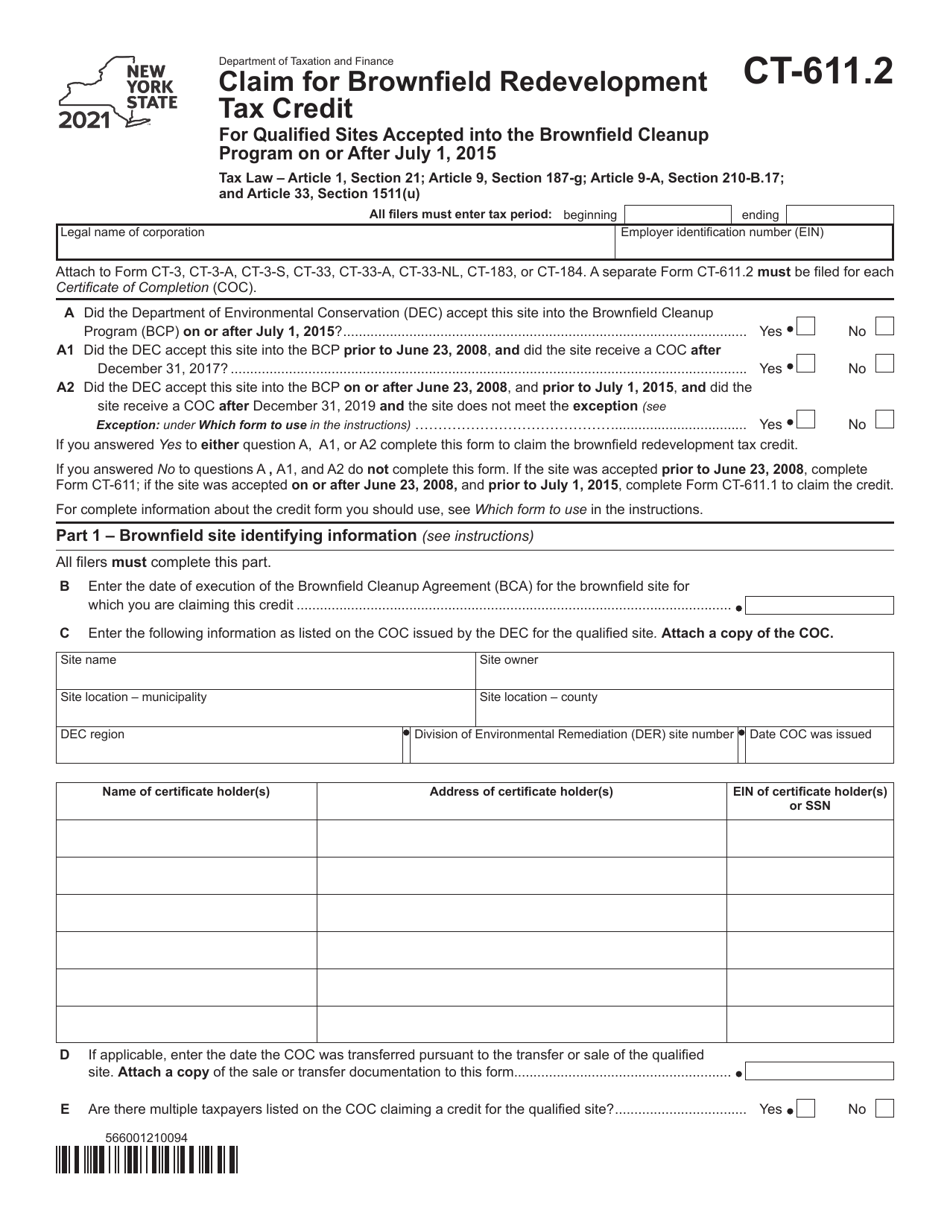

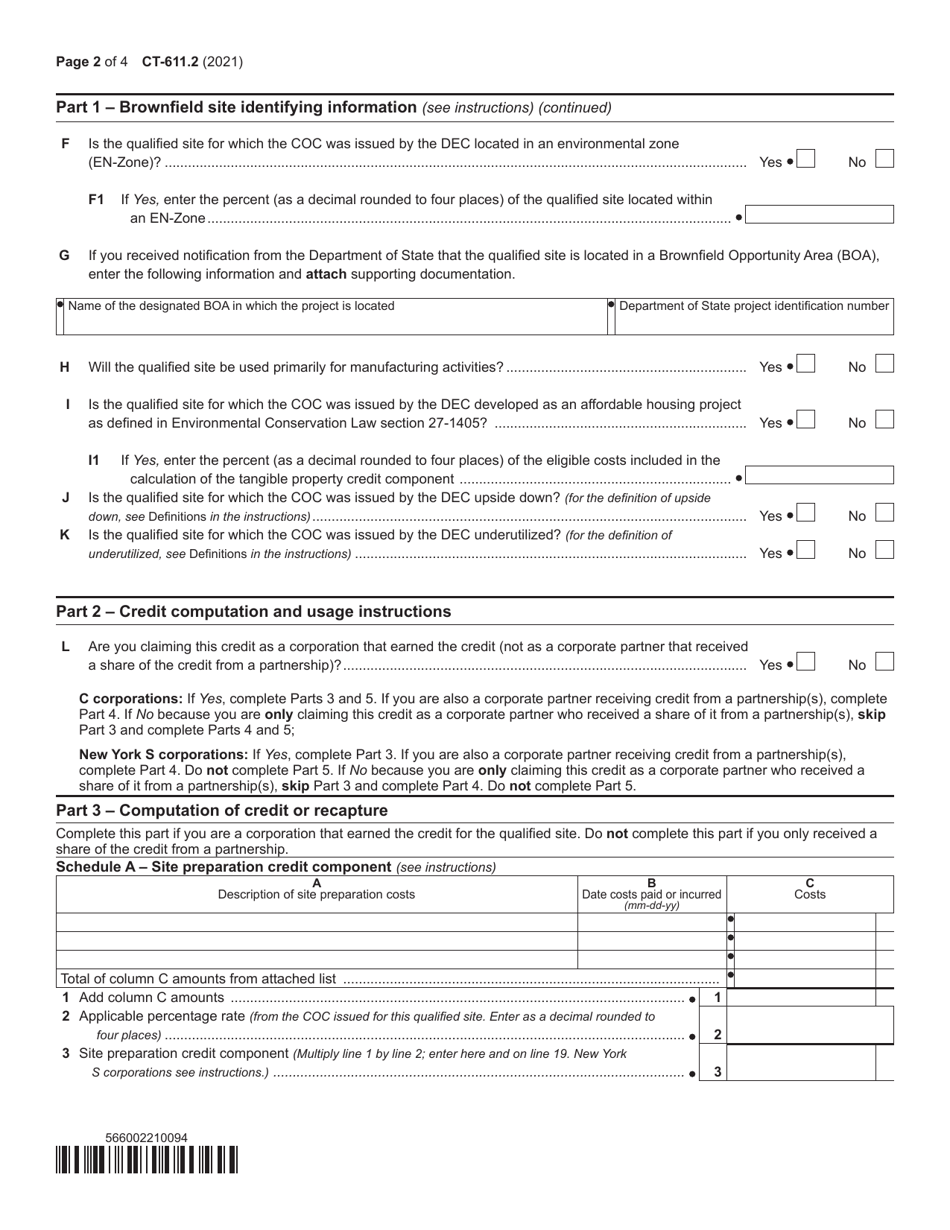

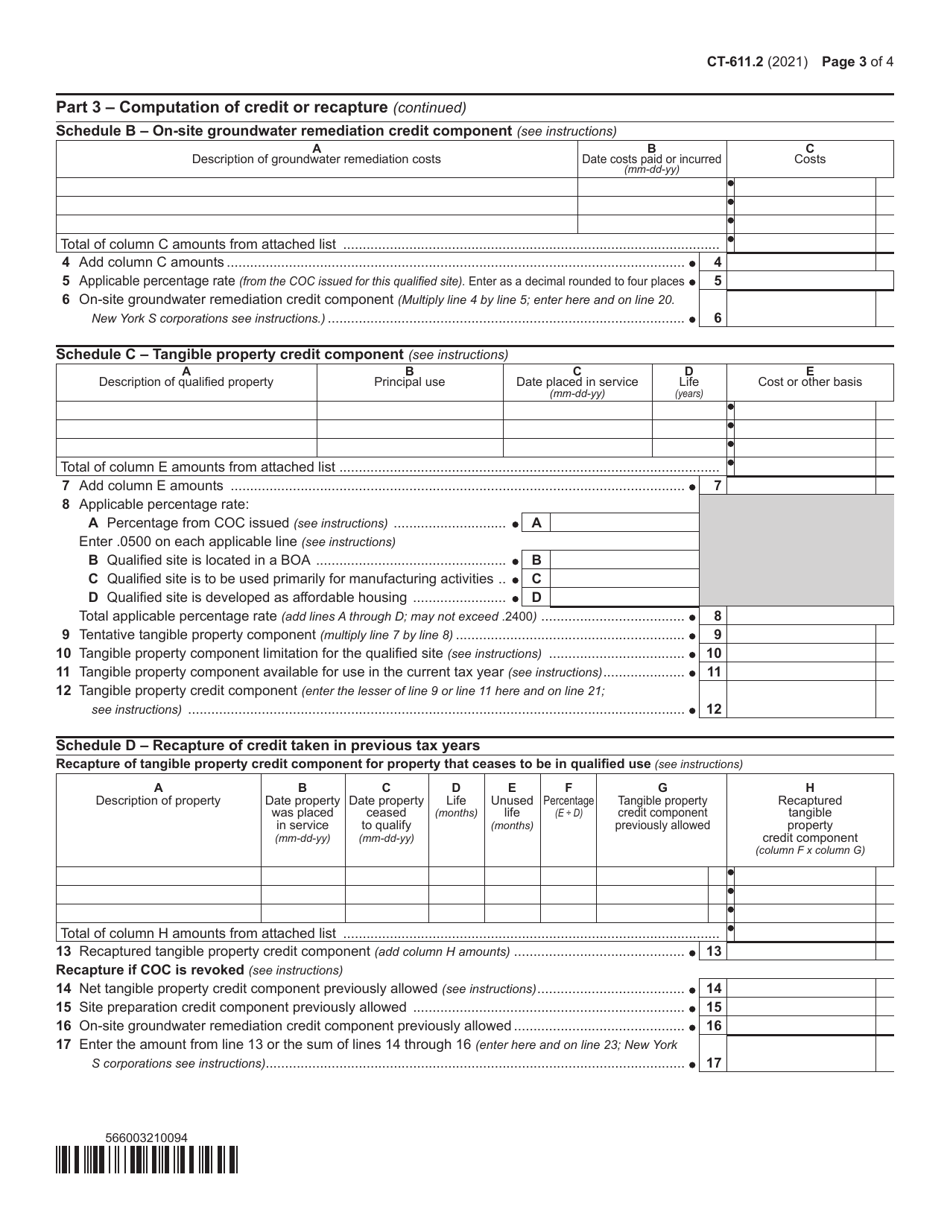

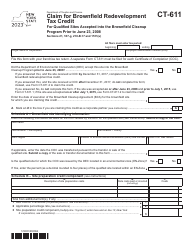

Form CT-611.2 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 - New York

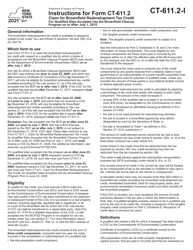

What Is Form CT-611.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-611.2?

A: Form CT-611.2 is a claim for Brownfield RedevelopmentTax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 in New York.

Q: Who can use Form CT-611.2?

A: Anyone who has qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York can use Form CT-611.2.

Q: What is the purpose of Form CT-611.2?

A: The purpose of Form CT-611.2 is to claim the Brownfield Redevelopment Tax Credit for qualified sites in New York.

Q: When was Form CT-611.2 introduced?

A: Form CT-611.2 was introduced for qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York.

Q: Is there a deadline for filing Form CT-611.2?

A: Yes, there is a deadline for filing Form CT-611.2. You should refer to the instructions provided with the form for specific deadlines.

Q: What is the Brownfield Redevelopment Tax Credit?

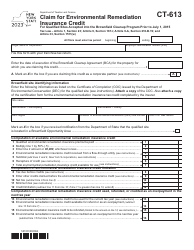

A: The Brownfield Redevelopment Tax Credit is a tax incentive provided to individuals or entities who redevelop contaminated sites in New York.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that encourages the voluntary cleanup and redevelopment of contaminated sites.

Q: What are qualified sites?

A: Qualified sites are contaminated sites that have been accepted into the Brownfield Cleanup Program in New York.

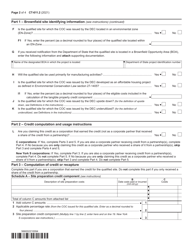

Q: What expenses are eligible for the Brownfield Redevelopment Tax Credit?

A: Expenses related to remediation, site preparation, and construction that are necessary for the redevelopment of qualified sites may be eligible for the Brownfield Redevelopment Tax Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-611.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.