This version of the form is not currently in use and is provided for reference only. Download this version of

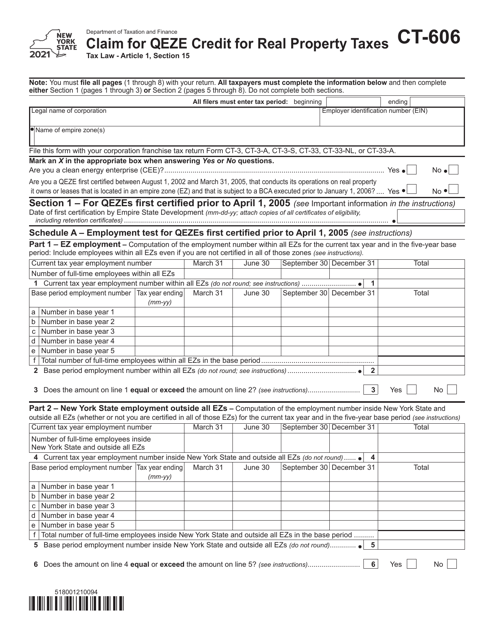

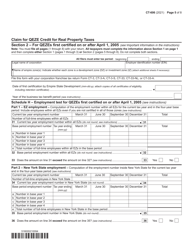

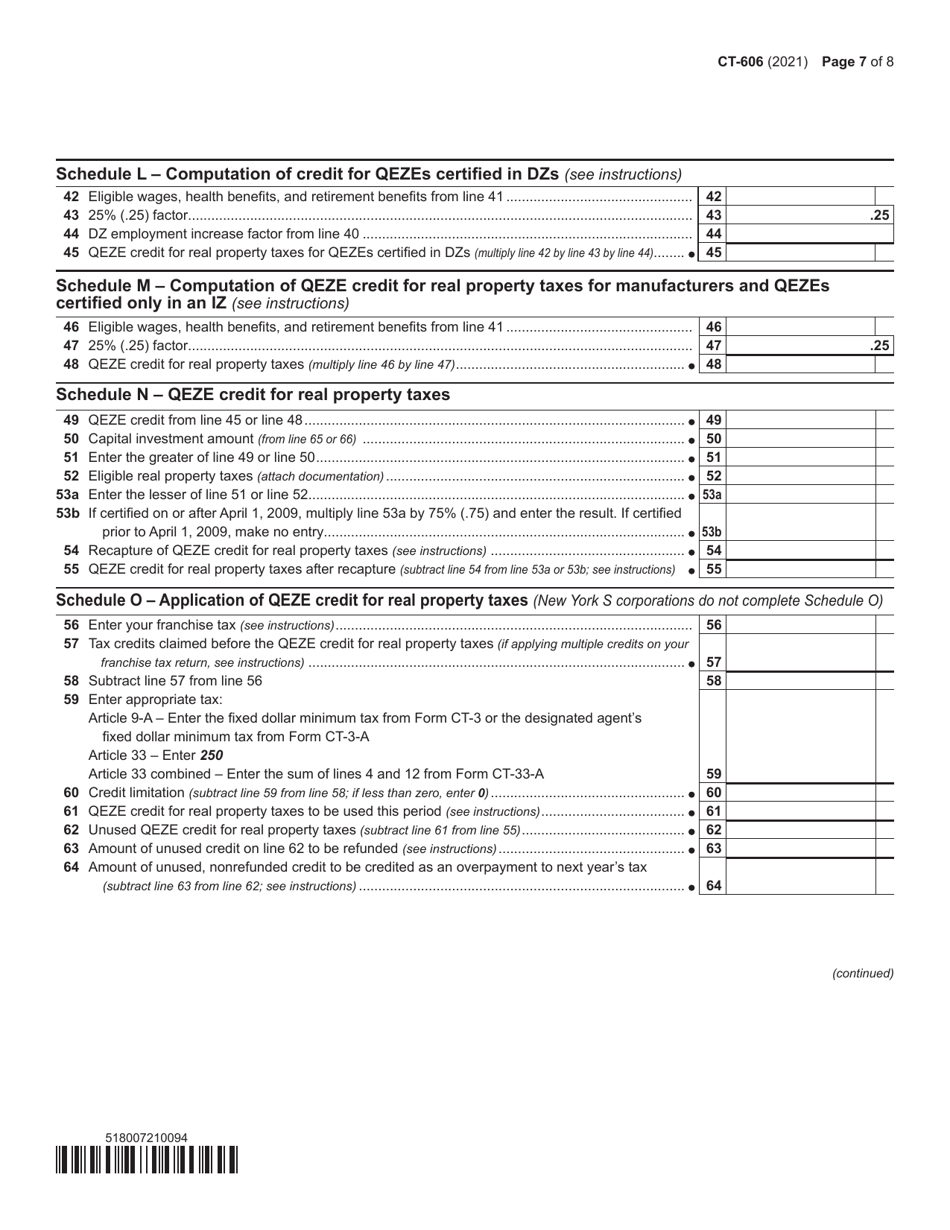

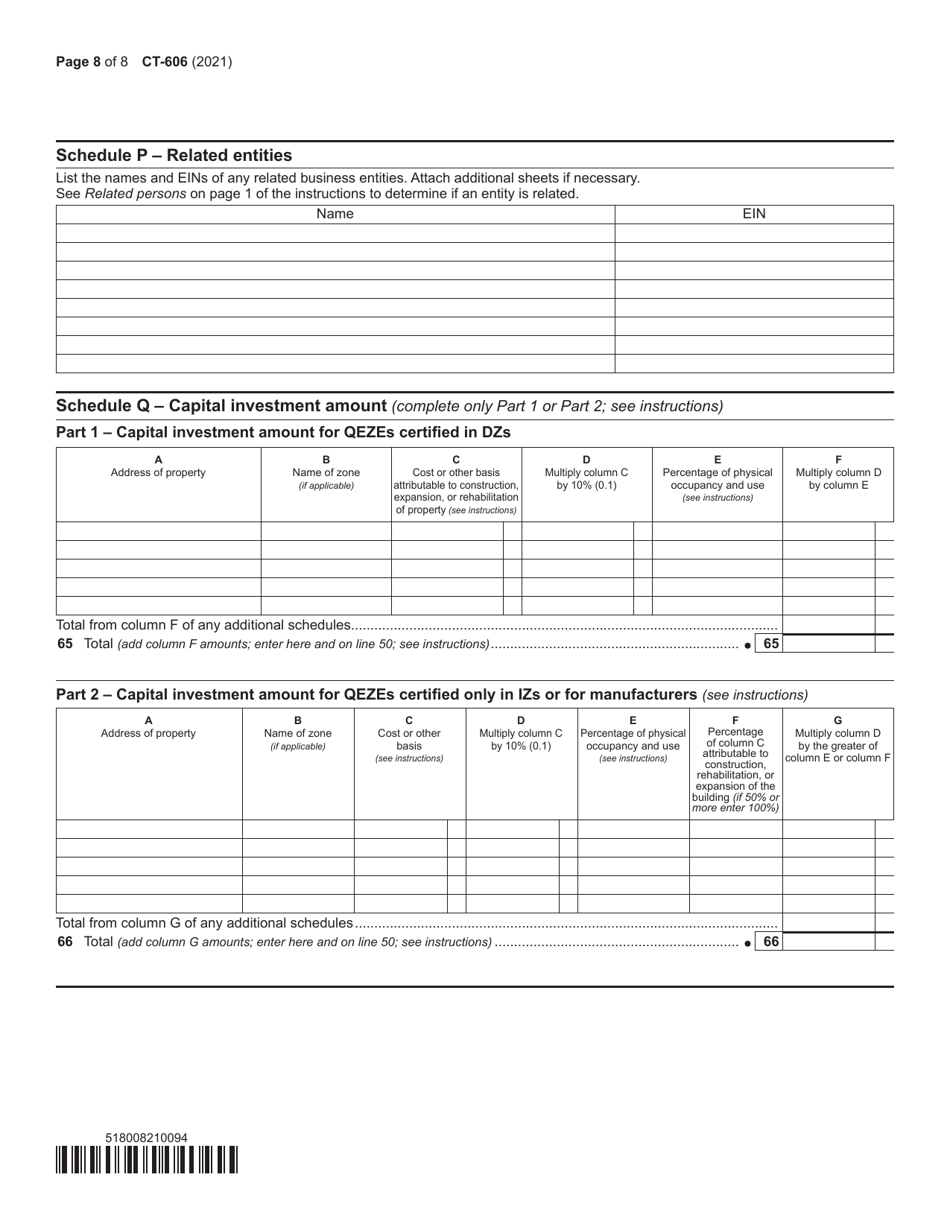

Form CT-606

for the current year.

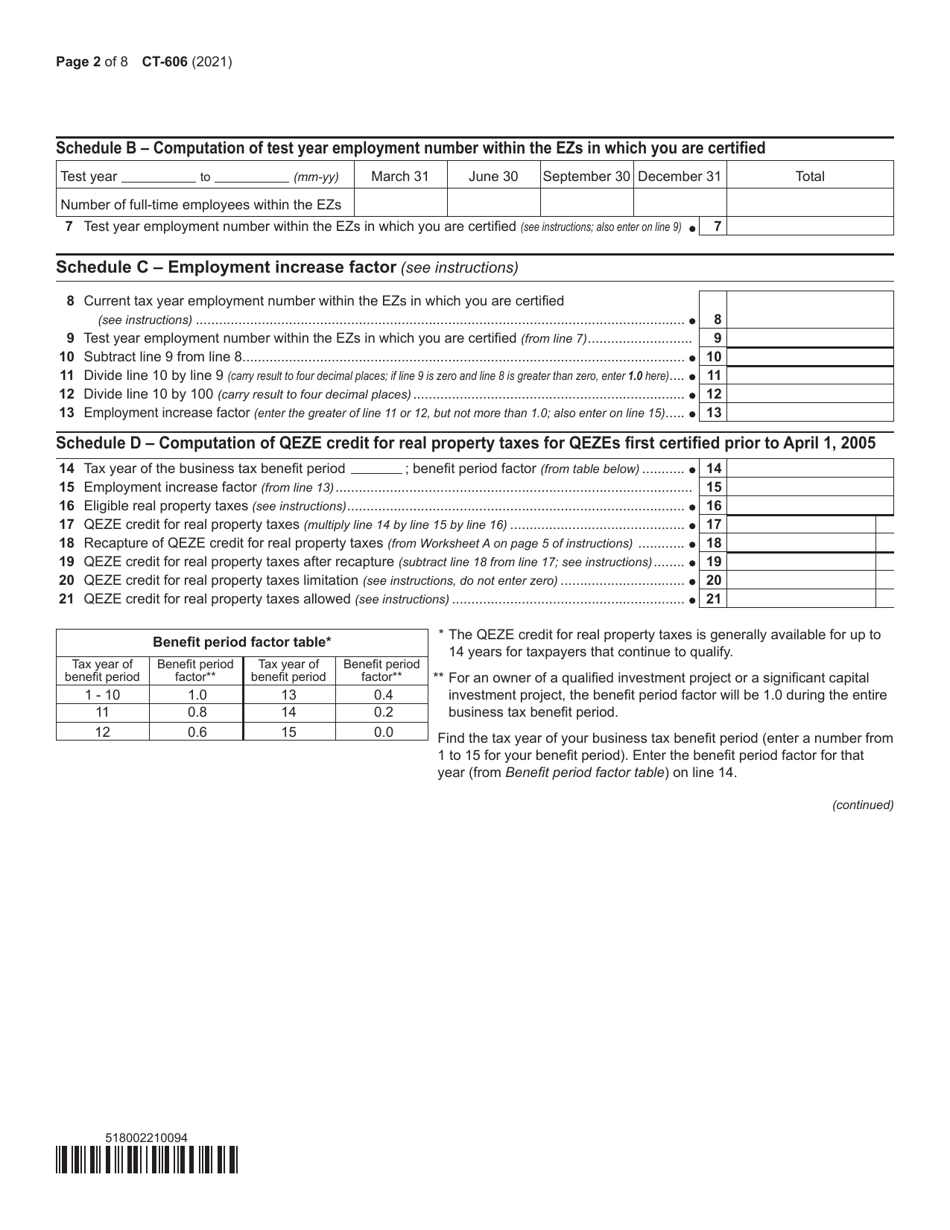

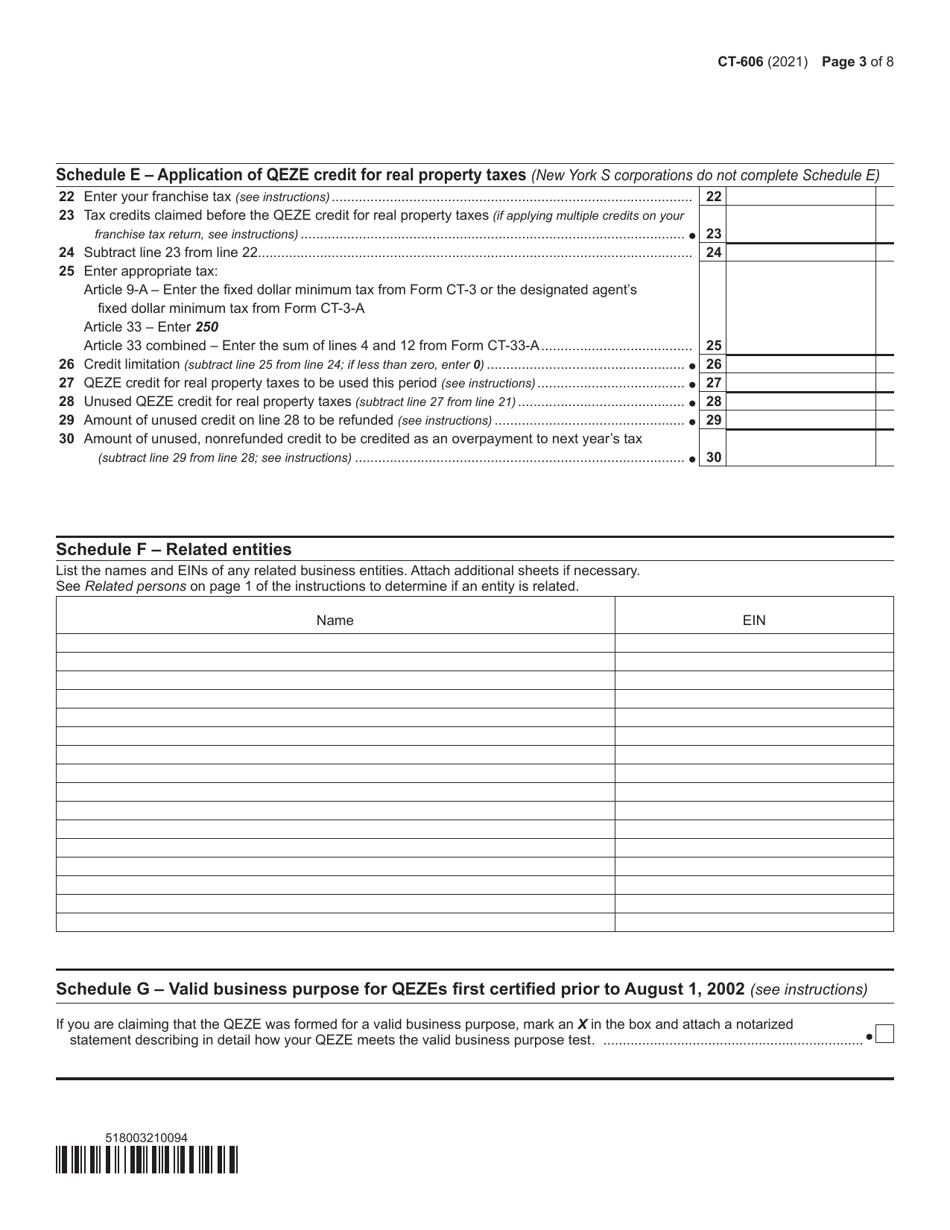

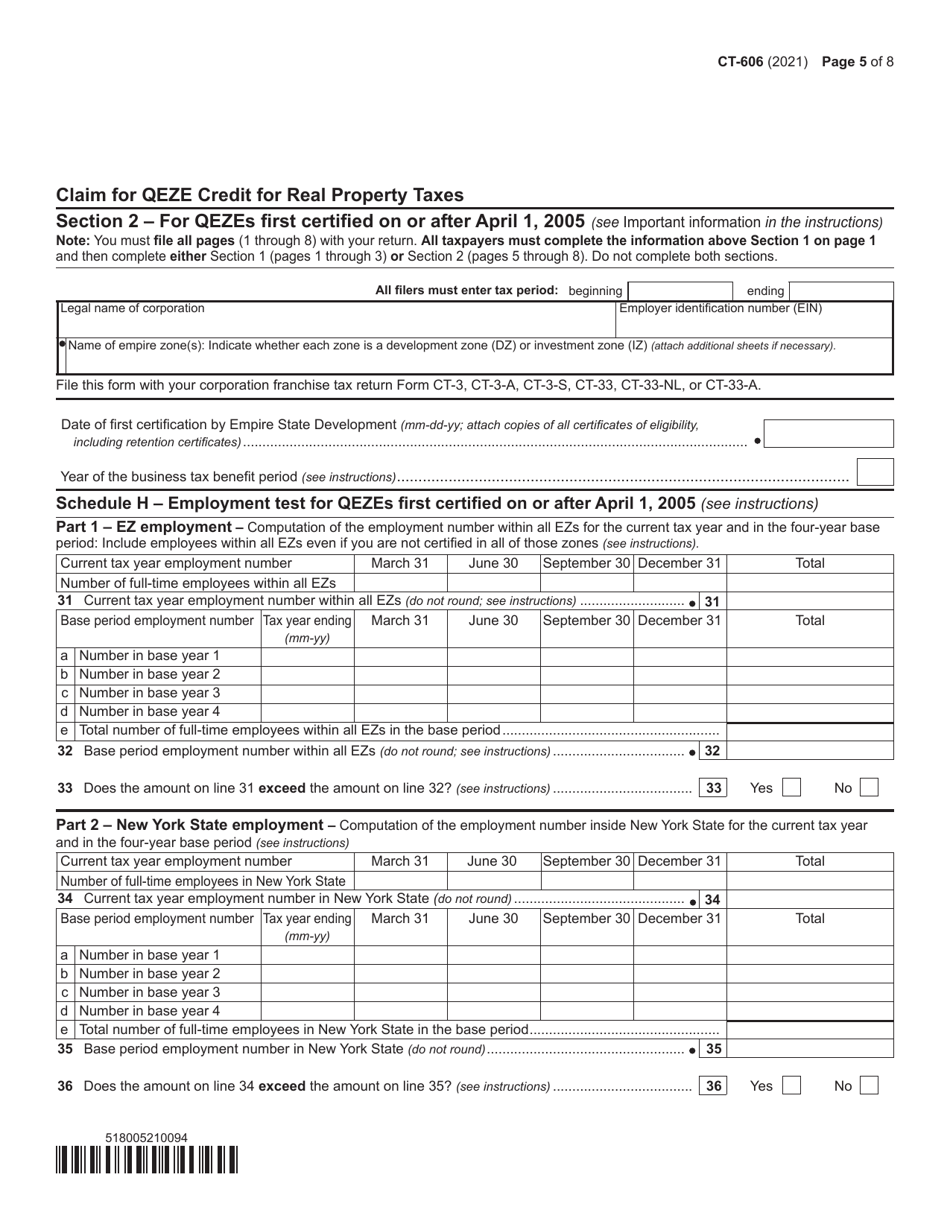

Form CT-606 Claim for Qeze Credit for Real Property Taxes - New York

What Is Form CT-606?

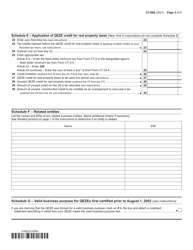

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-606?

A: Form CT-606 is the Claim for Qeze Credit for Real Property Taxes.

Q: Who should use Form CT-606?

A: New York taxpayers who want to claim the Qeze Credit for Real Property Taxes should use Form CT-606.

Q: What is the Qeze Credit for Real Property Taxes?

A: The Qeze Credit for Real Property Taxes is a credit available to eligible businesses in New York that make qualified environmental remediation expenditures.

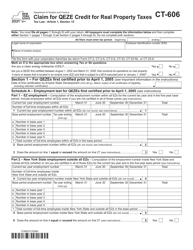

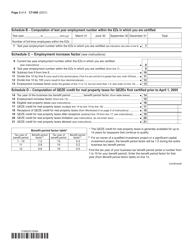

Q: How do I fill out Form CT-606?

A: To fill out Form CT-606, you will need to provide information about your business, the Qeze Credits you are claiming, and the qualified environmental remediation expenditures you have made.

Q: When is the deadline to file Form CT-606?

A: The deadline to file Form CT-606 is generally on or before the due date of your business tax return for the year in which you are claiming the credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-606 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.