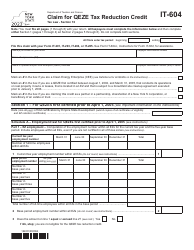

This version of the form is not currently in use and is provided for reference only. Download this version of

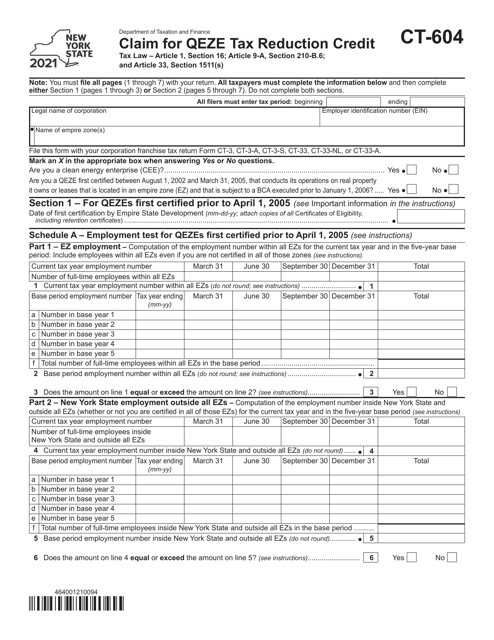

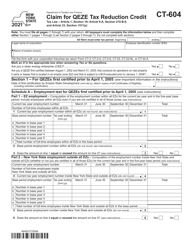

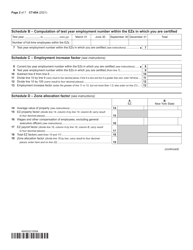

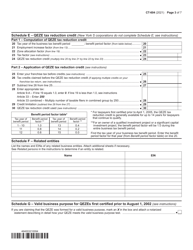

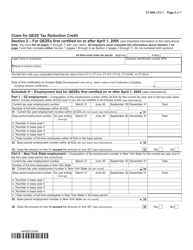

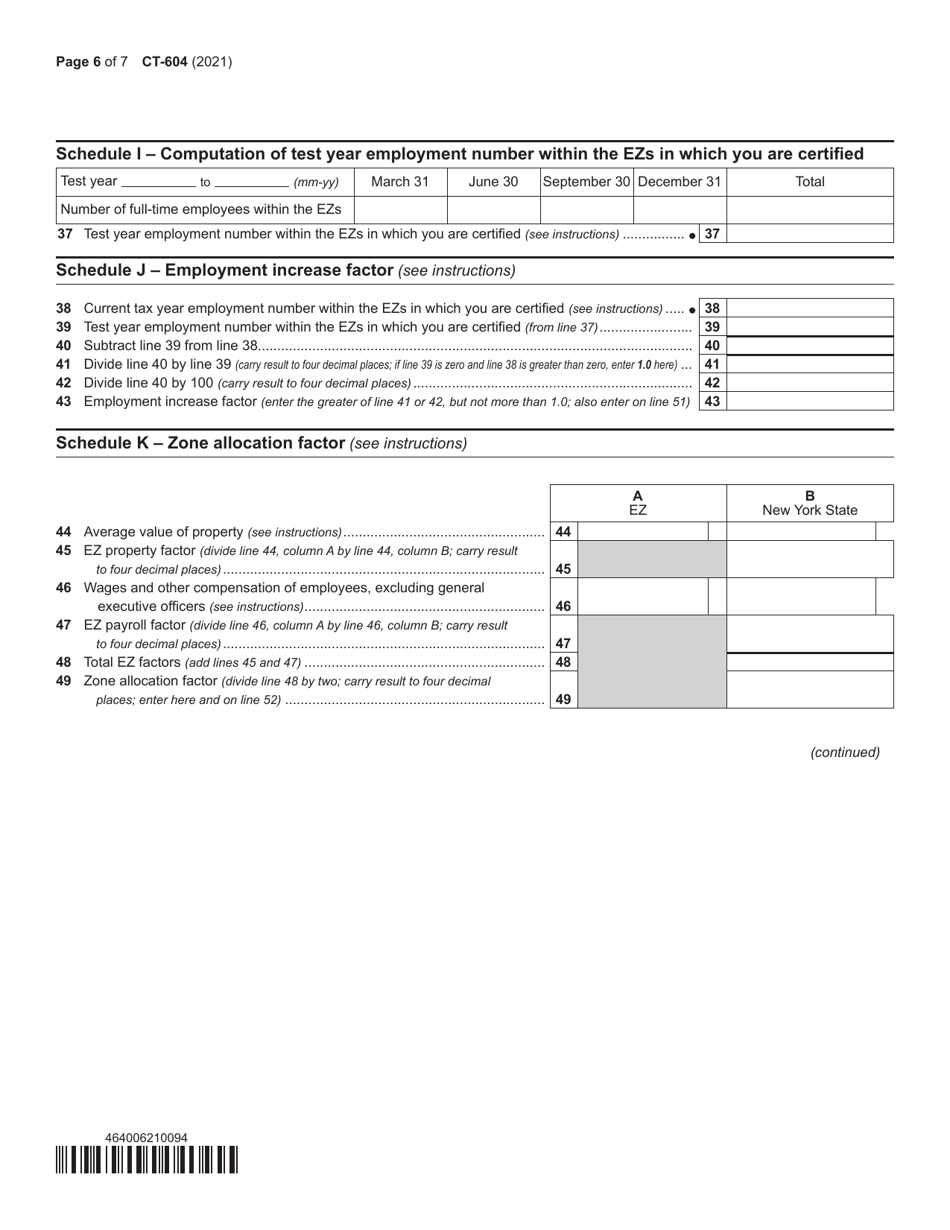

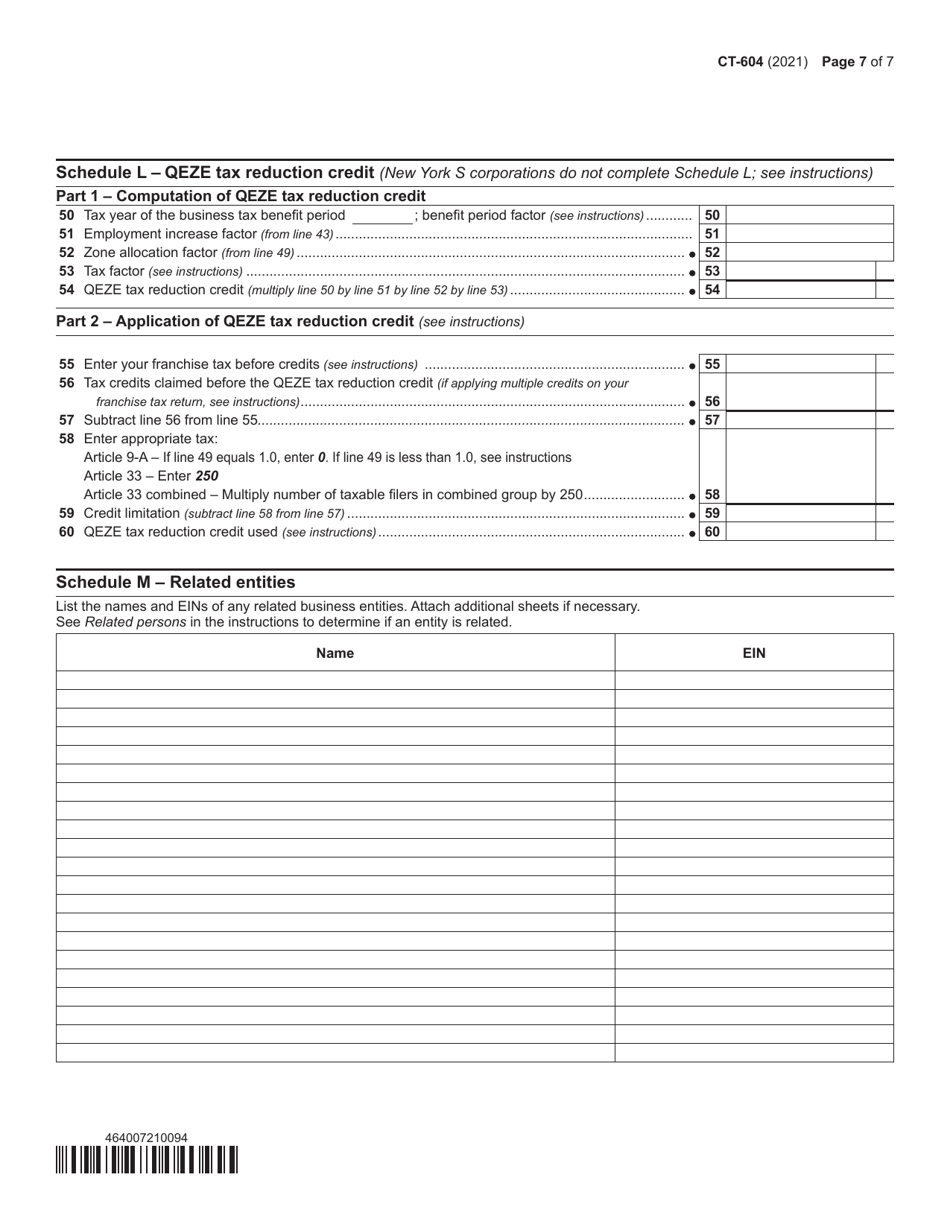

Form CT-604

for the current year.

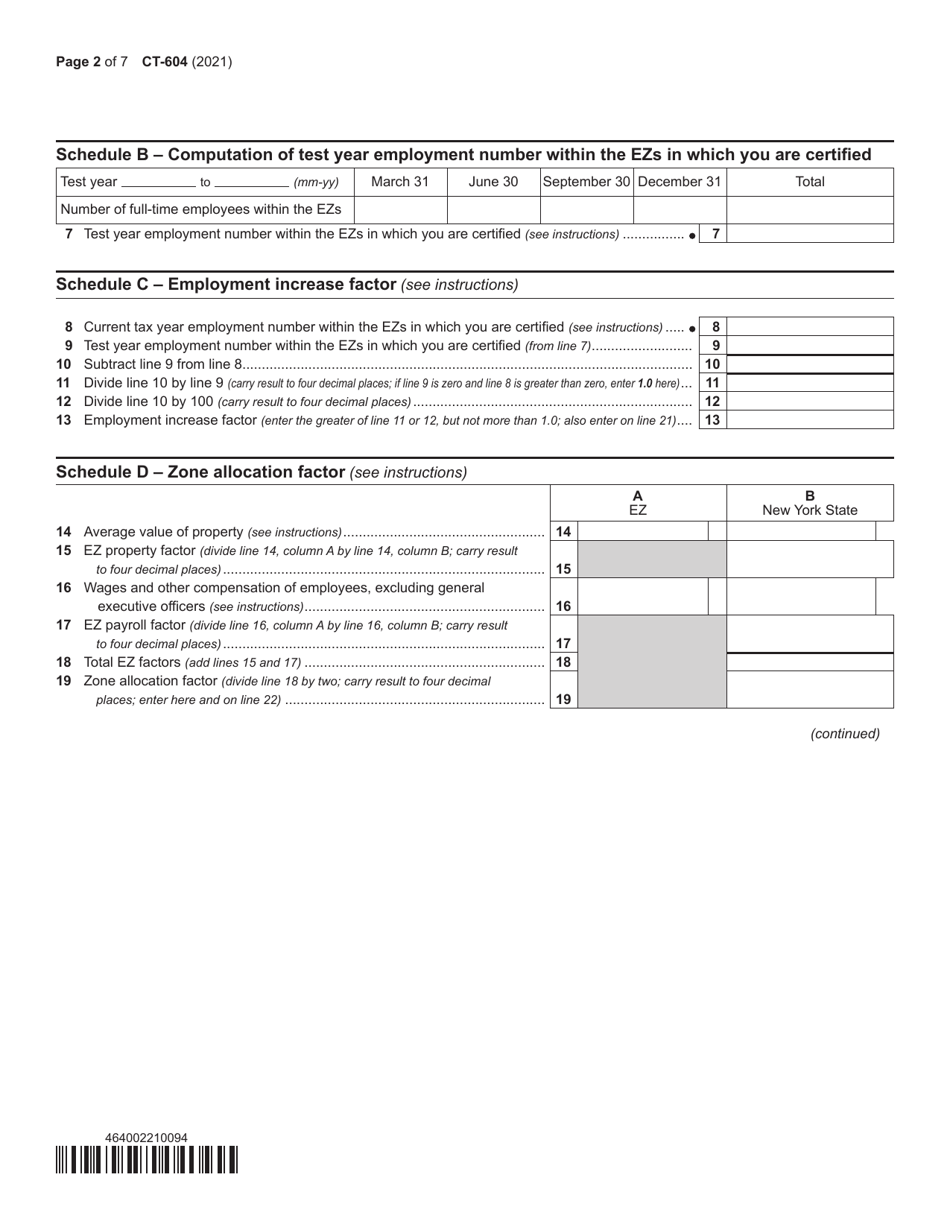

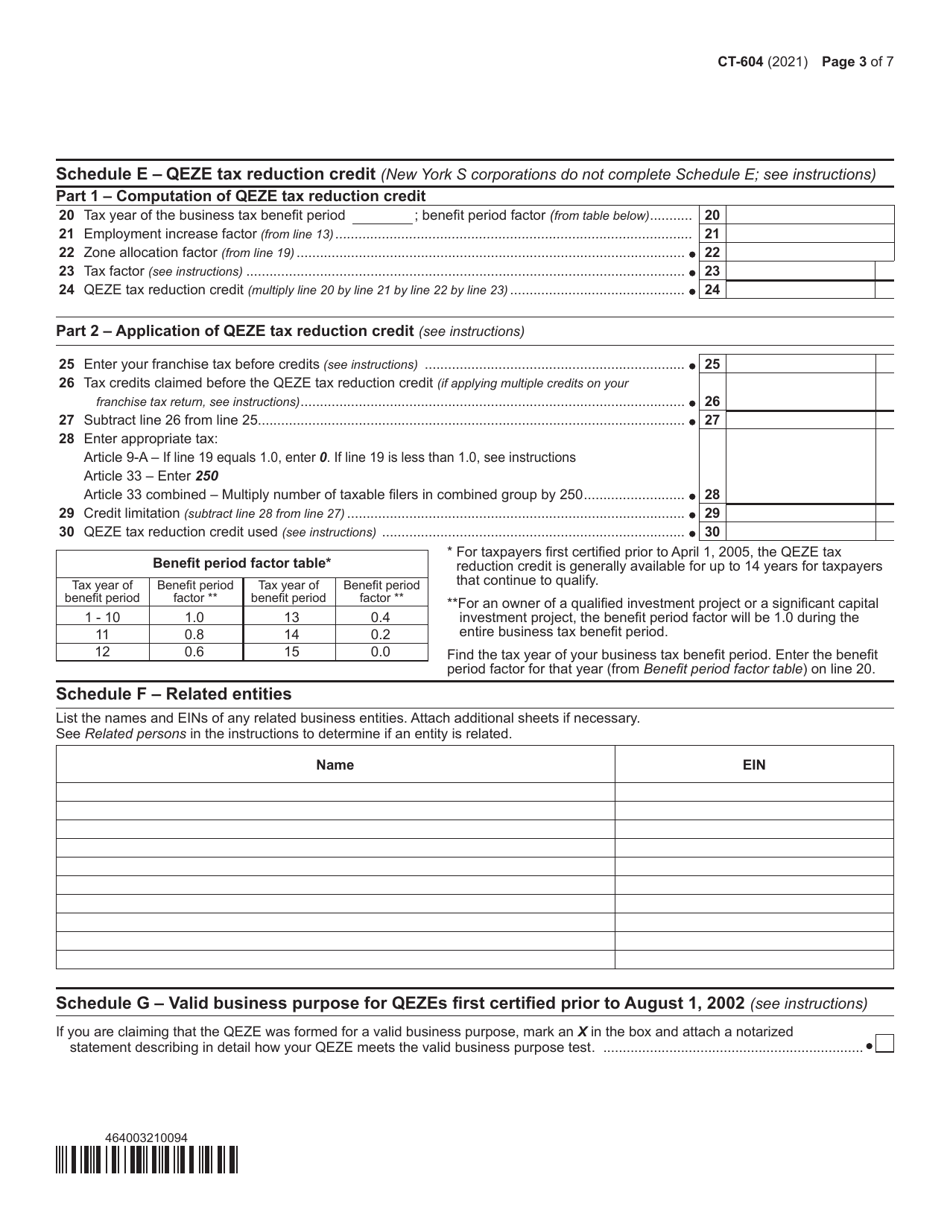

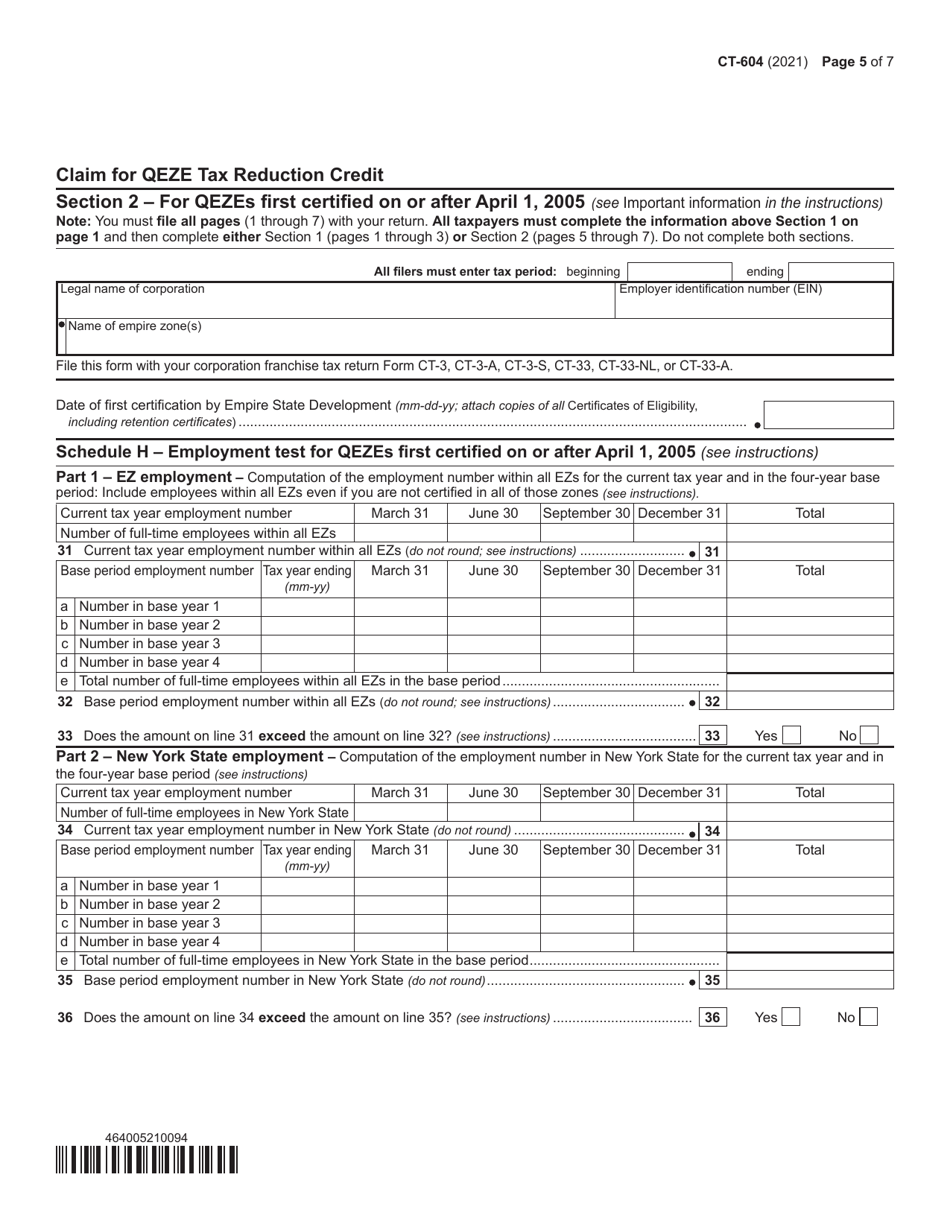

Form CT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form CT-604?

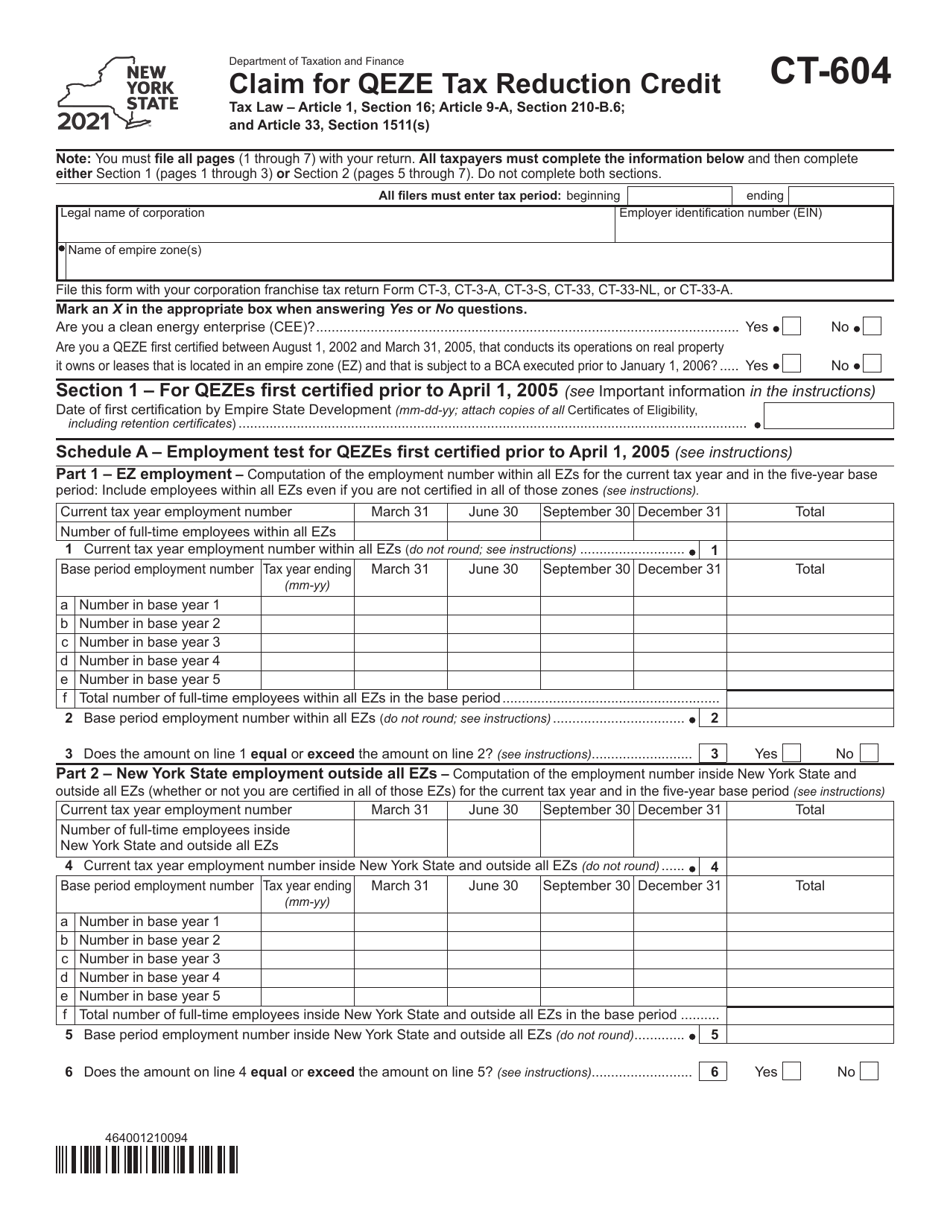

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-604?

A: Form CT-604 is a tax form used to claim the Qeze Tax Reduction Credit in New York.

Q: What is the Qeze Tax Reduction Credit?

A: The Qeze Tax Reduction Credit is a credit available to taxpayers in New York who invest in qualified emerging technology companies.

Q: Who is eligible to claim the Qeze Tax Reduction Credit?

A: Taxpayers who invest in qualified emerging technology companies in New York are eligible to claim the Qeze Tax Reduction Credit.

Q: What is the purpose of the Qeze Tax Reduction Credit?

A: The purpose of the Qeze Tax Reduction Credit is to promote investment in emerging technology companies and stimulate economic growth in New York.

Q: What expenses can be claimed using Form CT-604?

A: Form CT-604 can be used to claim expenses related to investments in qualified emerging technology companies.

Q: When is the deadline for filing Form CT-604?

A: The deadline for filing Form CT-604 is determined by the tax year in which the investment was made. It is important to consult the instructions provided with the form for the specific deadline.

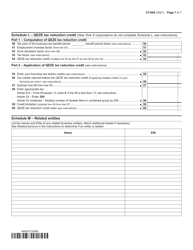

Q: Can the Qeze Tax Reduction Credit be carried forward or refunded?

A: Yes, any unused portion of the Qeze Tax Reduction Credit can be carried forward for up to 5 years. However, it cannot be refunded.

Q: Is there a limit on the total amount of Qeze Tax Reduction Credit that can be claimed?

A: Yes, there is a $500,000 annual cap on the total amount of Qeze Tax Reduction Credit that can be claimed by an individual or a business entity in New York.

Q: Are there any additional requirements or documentation needed to claim the Qeze Tax Reduction Credit?

A: Yes, taxpayers need to provide certain information and documentation related to their investment in qualified emerging technology companies. It is important to review the instructions provided with Form CT-604 for the specific requirements.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.