This version of the form is not currently in use and is provided for reference only. Download this version of

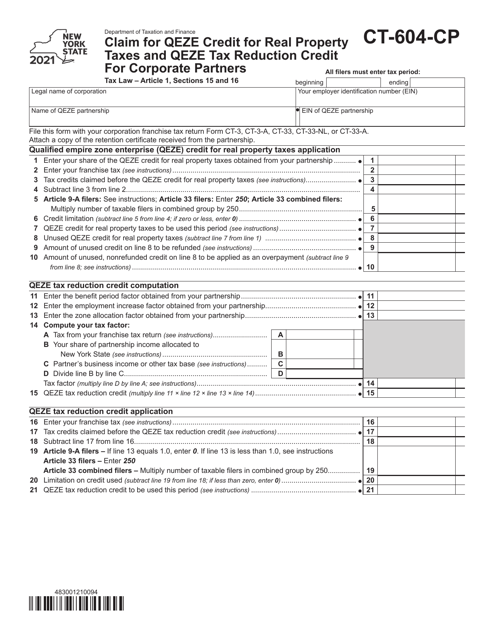

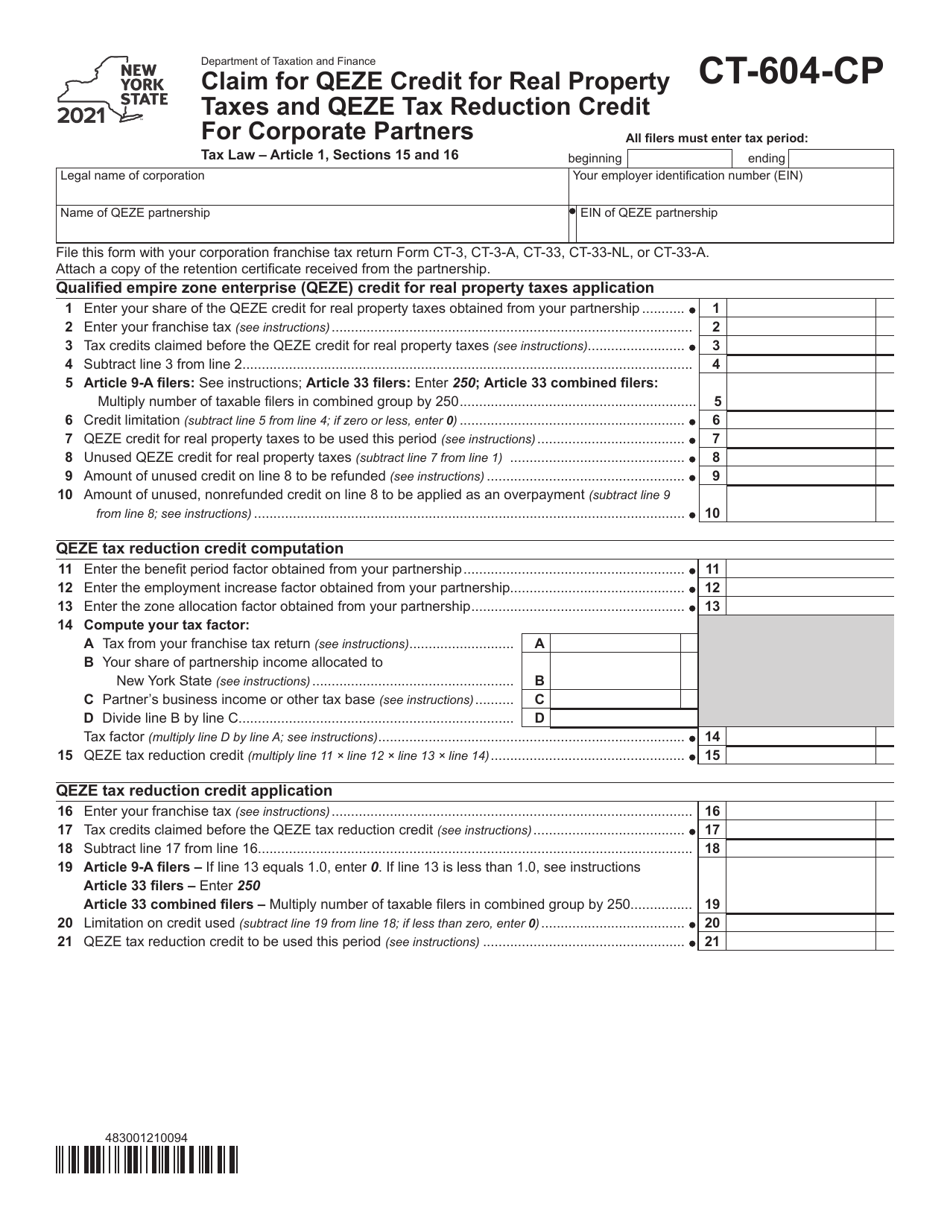

Form CT-604-CP

for the current year.

Form CT-604-CP Claim for Qeze Credit for Real Property Taxes and Qeze Tax Reduction Credit for Corporate Partners - New York

What Is Form CT-604-CP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-604-CP?

A: Form CT-604-CP is a form used in New York to claim the Qeze Credit for Real Property Taxes and Qeze Tax Reduction Credit for Corporate Partners.

Q: What is the Qeze Credit for Real Property Taxes?

A: The Qeze Credit for Real Property Taxes is a credit available to businesses in New York that operate in a Qualified Empire Zone (QEZ) and pay real property taxes.

Q: Who can claim the Qeze Credit for Real Property Taxes?

A: Businesses operating in a Qualified Empire Zone (QEZ) in New York can claim the Qeze Credit for Real Property Taxes.

Q: What is the Qeze Tax Reduction Credit for Corporate Partners?

A: The Qeze Tax Reduction Credit for Corporate Partners is a credit available to corporate partners of a partnership that operates in a Qualified Empire Zone (QEZ) in New York.

Q: Who can claim the Qeze Tax Reduction Credit for Corporate Partners?

A: Corporate partners of a partnership operating in a Qualified Empire Zone (QEZ) in New York can claim the Qeze Tax Reduction Credit for Corporate Partners.

Q: How do I claim the Qeze credits?

A: You can claim the Qeze credits by completing Form CT-604-CP and attaching it to your New York State tax return.

Q: Are there any deadlines for claiming the Qeze credits?

A: Yes, the deadlines for claiming the Qeze credits may vary and it's important to check with the New York State Department of Taxation and Finance for specific deadlines.

Q: Are there any other requirements to claim the Qeze credits?

A: Yes, there may be additional requirements to claim the Qeze credits, such as being in compliance with all tax laws and regulations.

Q: Can I claim both the Qeze Credit for Real Property Taxes and the Qeze Tax Reduction Credit for Corporate Partners?

A: Yes, eligible businesses can claim both the Qeze Credit for Real Property Taxes and the Qeze Tax Reduction Credit for Corporate Partners if they meet the requirements.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-604-CP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.