This version of the form is not currently in use and is provided for reference only. Download this version of

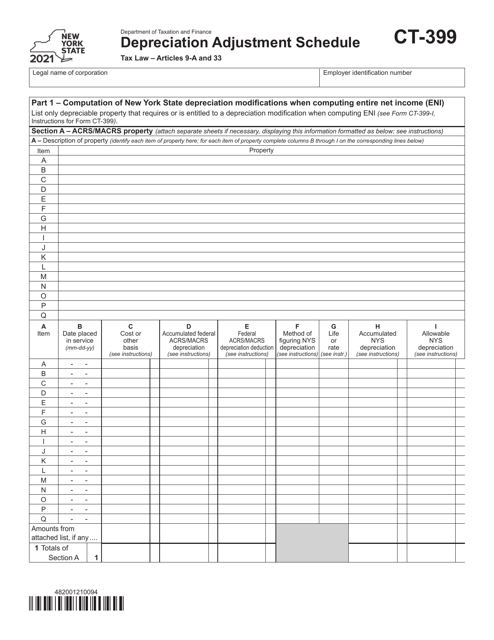

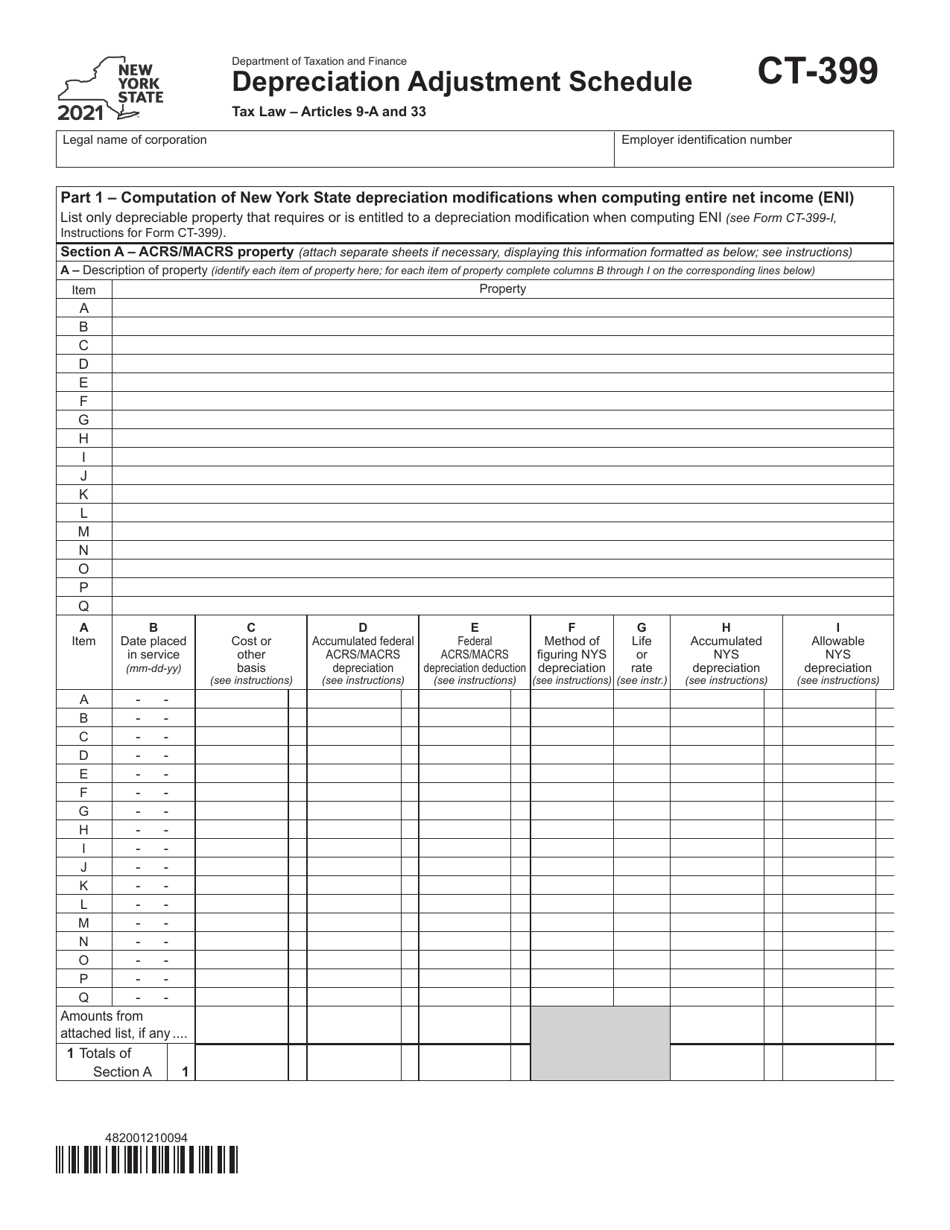

Form CT-399

for the current year.

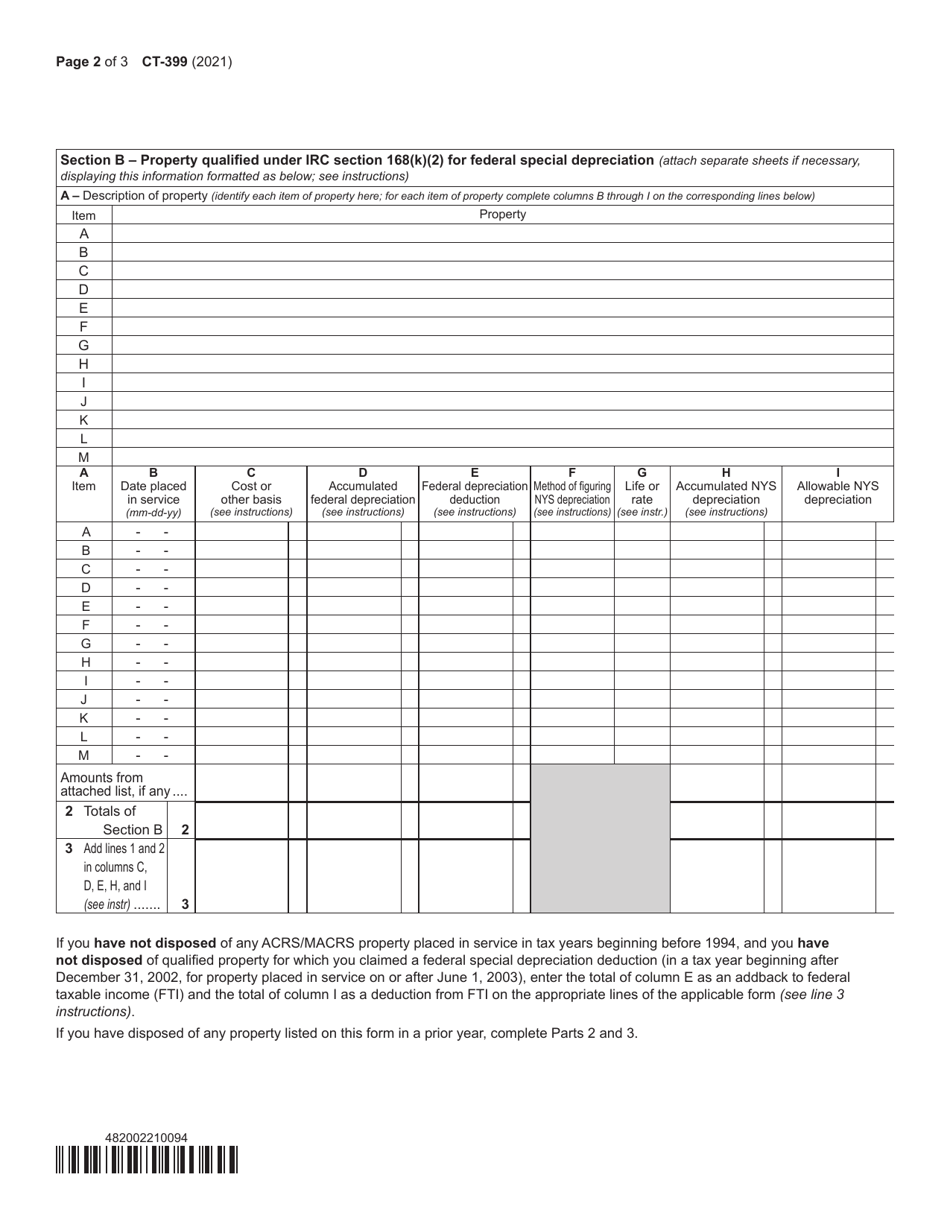

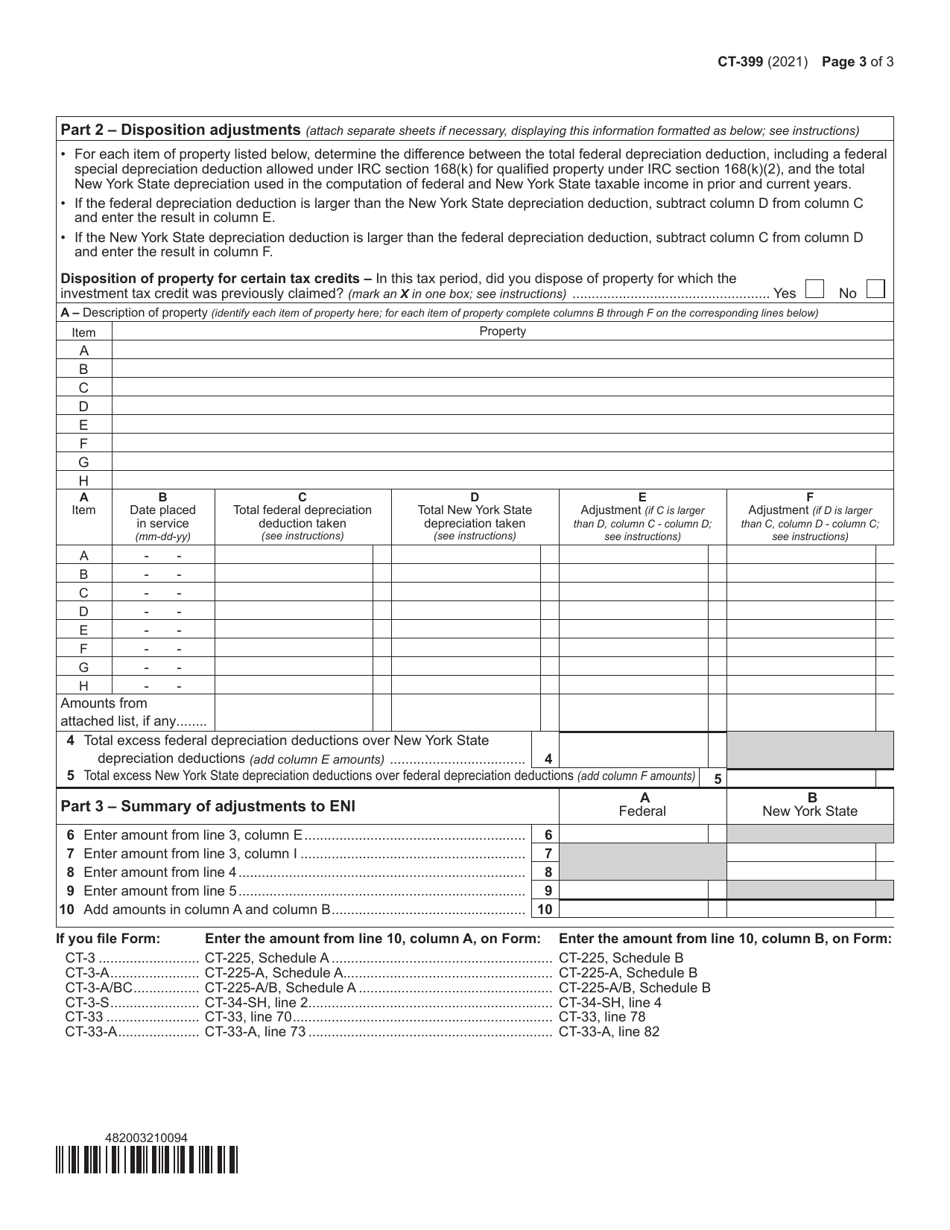

Form CT-399 Depreciation Adjustment Schedule - New York

What Is Form CT-399?

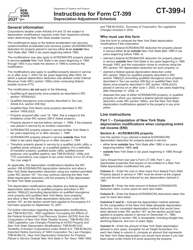

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-399?

A: Form CT-399 is the Depreciation Adjustment Schedule used in New York.

Q: Who needs to file Form CT-399?

A: Taxpayers in New York who have claimed depreciation deductions for federal tax purposes on property used in New York need to file Form CT-399.

Q: What is the purpose of Form CT-399?

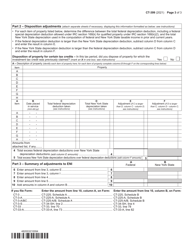

A: Form CT-399 is used to reconcile the depreciation claimed on federal tax returns with the depreciation allowed for New York State tax purposes.

Q: When is Form CT-399 due?

A: Form CT-399 is due on the same date as your New York State income tax return, typically on April 15th.

Q: Is Form CT-399 required for individuals?

A: No, Form CT-399 is not required for individuals. It is typically used by corporations, partnerships, and fiduciaries.

Q: What information do I need to complete Form CT-399?

A: To complete Form CT-399, you will need your federal depreciation schedules, New York State depreciation schedules, and other supporting documentation.

Q: Are there any penalties for failing to file Form CT-399?

A: Yes, there may be penalties for failing to file Form CT-399 or for filing it late. It is important to file the form accurately and on time.

Q: Who should I contact if I have questions about Form CT-399?

A: If you have questions about Form CT-399 or need assistance with completing the form, you can contact the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.