This version of the form is not currently in use and is provided for reference only. Download this version of

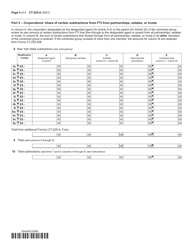

Form CT-225-A

for the current year.

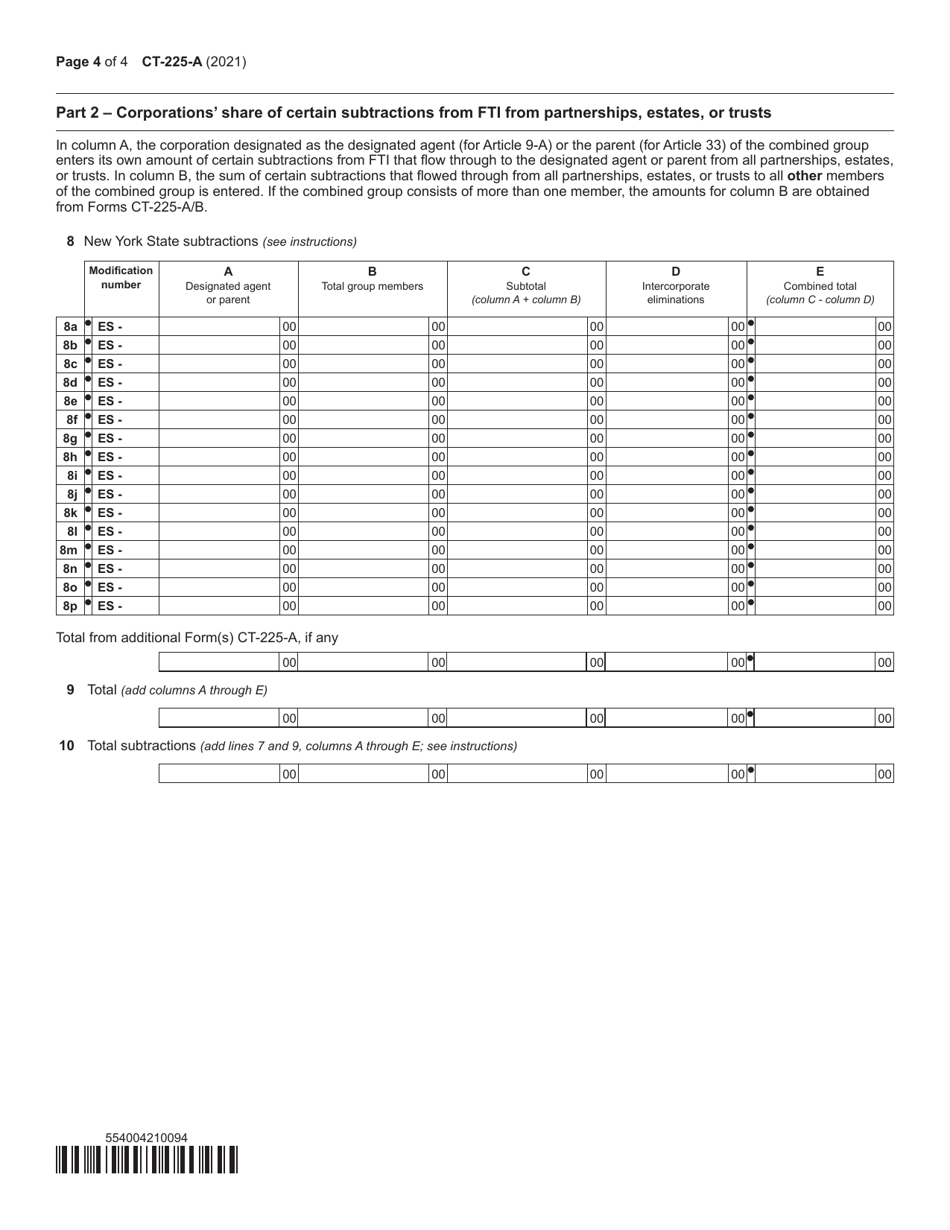

Form CT-225-A New York State Modifications (For Filers of Combined Franchise Tax Returns) - New York

What Is Form CT-225-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-225-A?

A: Form CT-225-A is a New York State form used by filers of combined franchise tax returns.

Q: Who needs to file Form CT-225-A?

A: Form CT-225-A needs to be filed by individuals or businesses who are filing combined franchise tax returns in New York State.

Q: What are New York State Modifications?

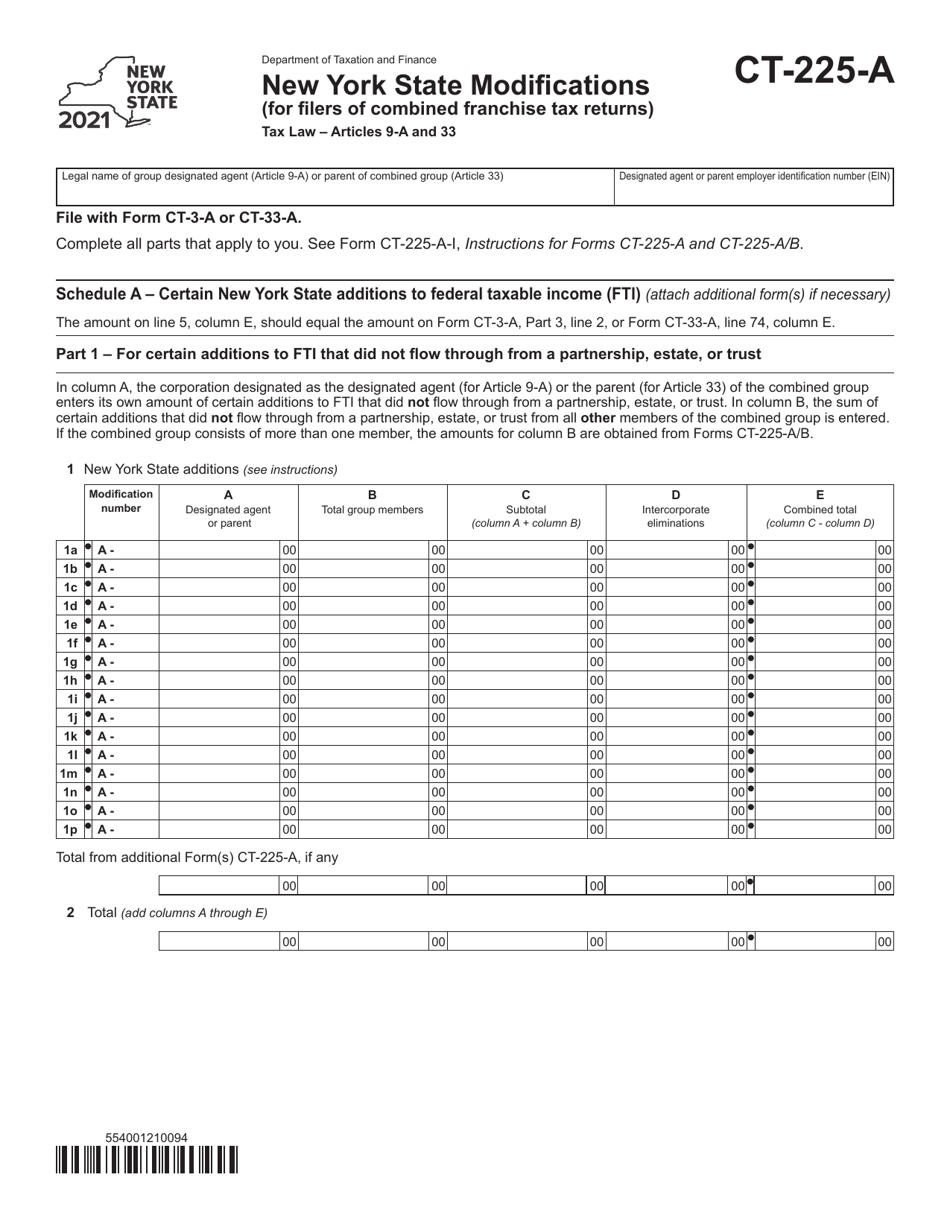

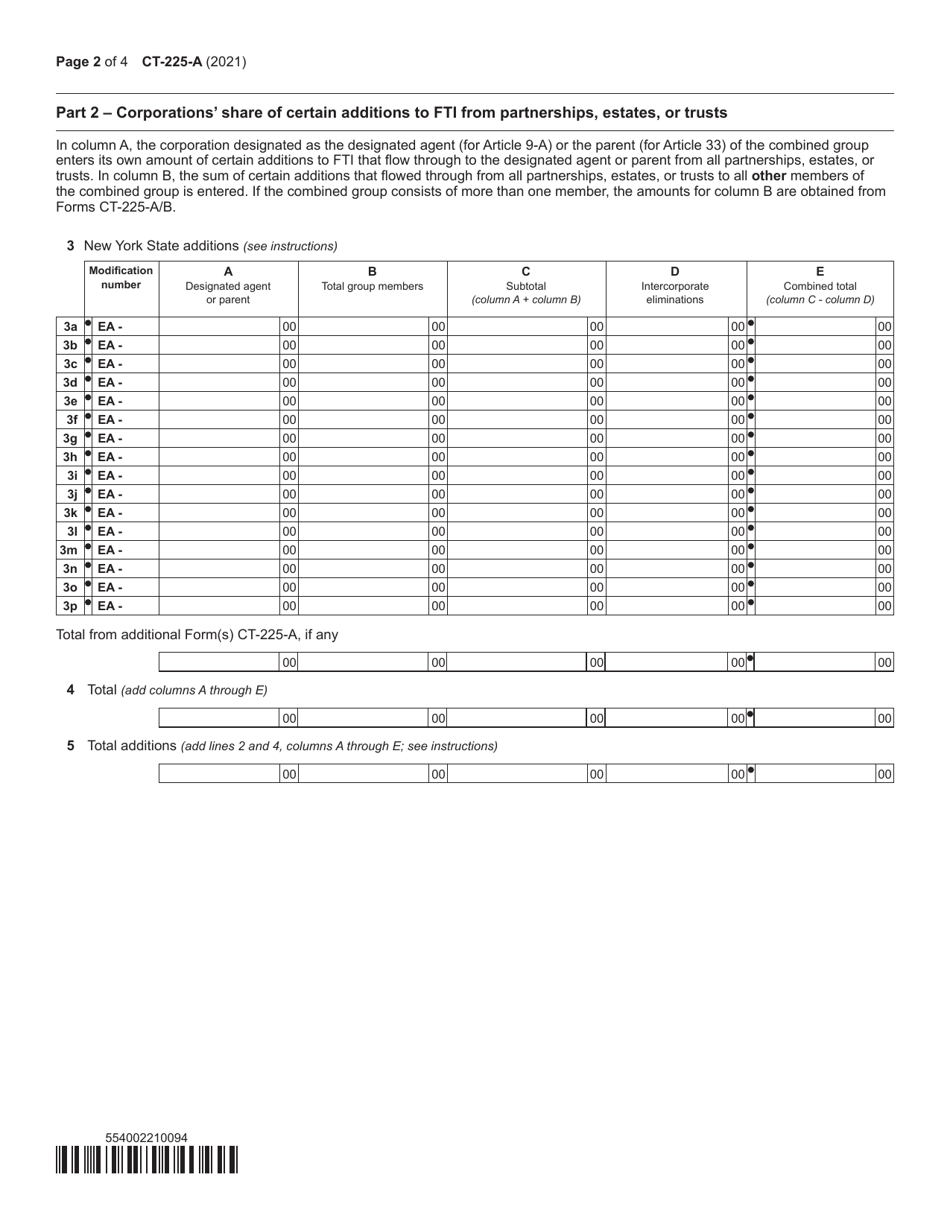

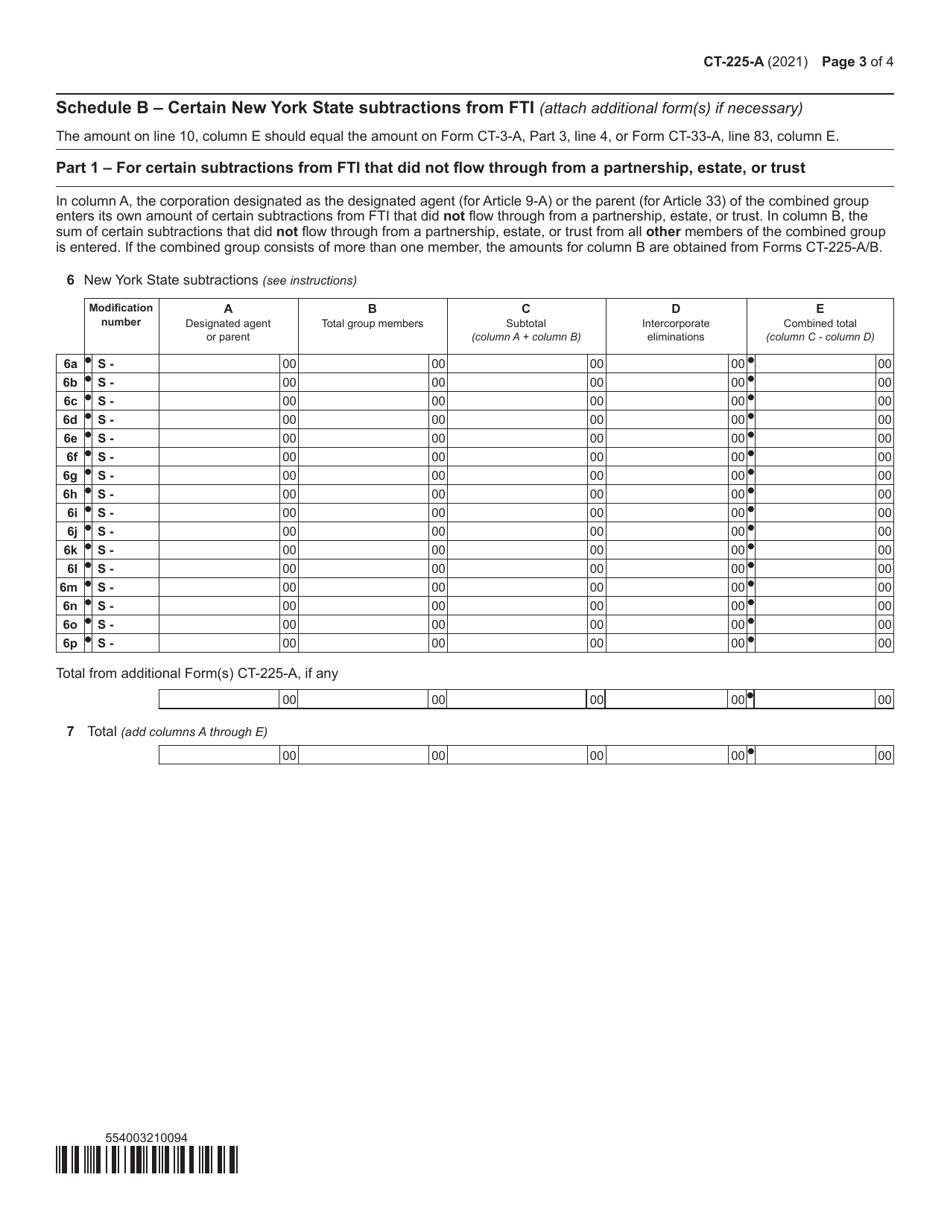

A: New York State Modifications refer to adjustments and additions that need to be made to the federal taxable income when calculating the New York State franchise tax.

Q: Why do I need to file Form CT-225-A?

A: You need to file Form CT-225-A to report any modifications to your federal taxable income that are required by New York State.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-225-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.