This version of the form is not currently in use and is provided for reference only. Download this version of

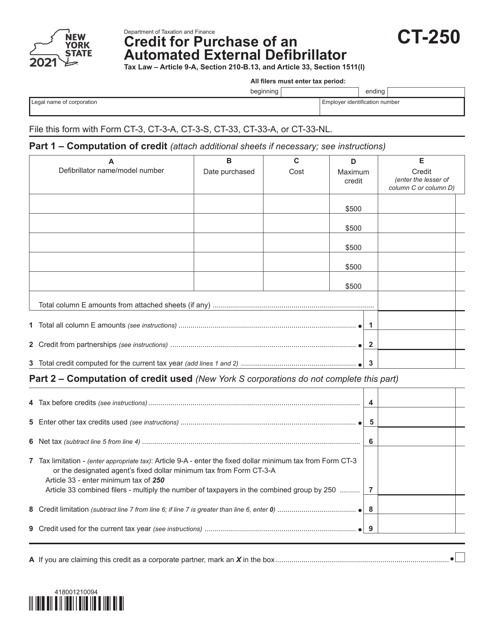

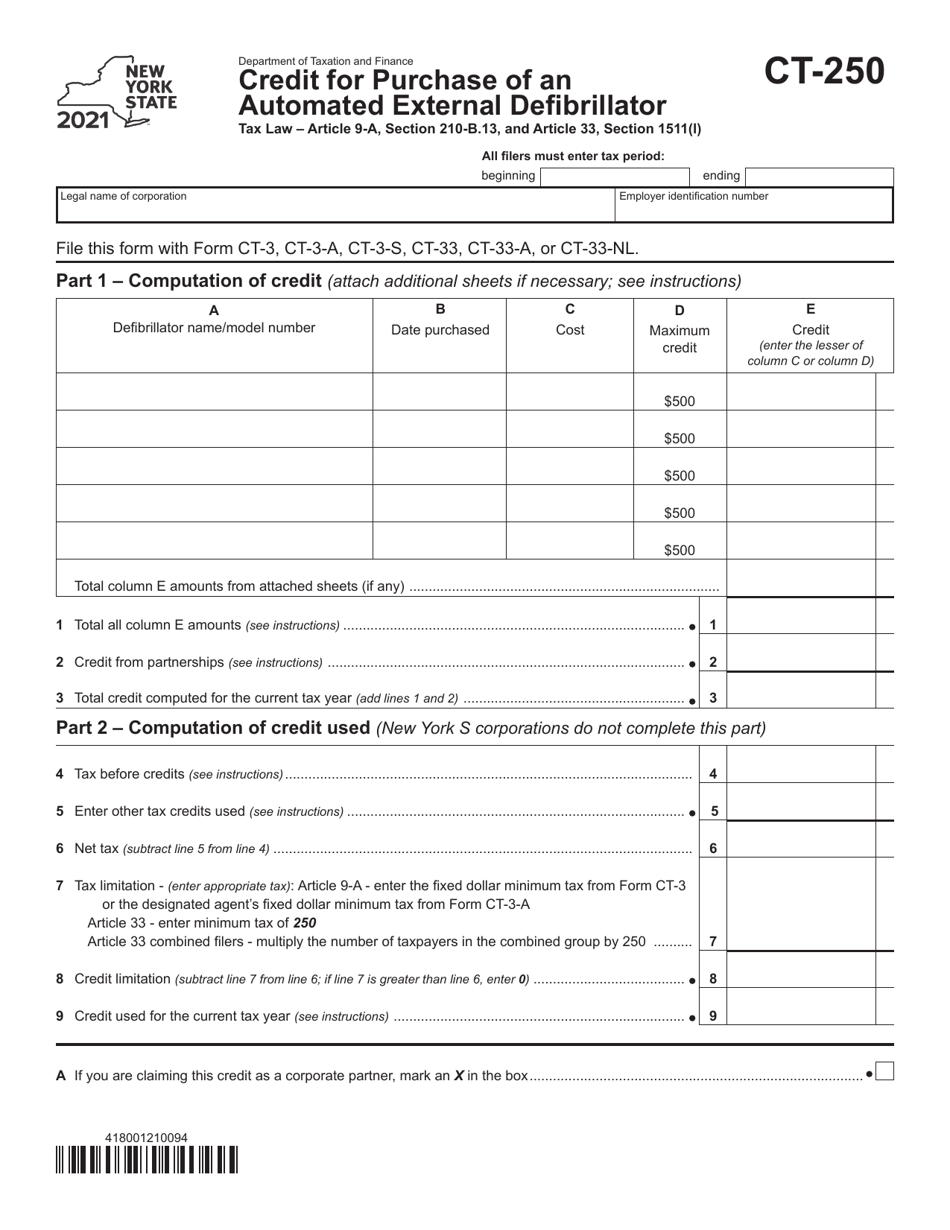

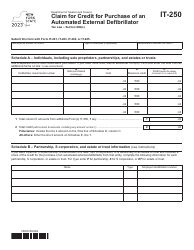

Form CT-250

for the current year.

Form CT-250 Credit for Purchase of an Automated External Defibrillator - New York

What Is Form CT-250?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-250?

A: Form CT-250 is a tax form in New York for claiming a credit for the purchase of an Automated External Defibrillator (AED).

Q: What is an Automated External Defibrillator (AED)?

A: An Automated External Defibrillator (AED) is a portable device that can deliver an electric shock to the heart to help restore normal rhythm in the event of sudden cardiac arrest.

Q: Who is eligible to claim the credit?

A: Eligible taxpayers in New York who have purchased an AED for their business or property can claim the credit.

Q: How much is the credit?

A: The credit is equal to 50% of the purchase price of the AED, up to a maximum credit of $500.

Q: What documentation is required to claim the credit?

A: Taxpayers must include proof of purchase, such as an invoice or receipt, along with Form CT-250 when claiming the credit.

Q: How do I file Form CT-250?

A: Form CT-250 can be filed as an attachment to the taxpayer's New York State personal income tax return.

Q: Is there a deadline for claiming the credit?

A: Yes, the credit must be claimed in the year in which the AED was purchased.

Q: Can the credit be carried forward or transferred?

A: No, the credit cannot be carried forward to future years or transferred to another taxpayer.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-250 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.